Myer takes a big impairment at 1H result (MYR, MOC)

WHAT MATTERED TODAY

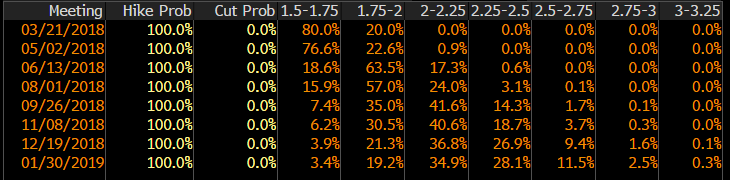

A rise in the Oil price overnight helped to support that sector today with Santos and Oil Search both up more than 1% while Woodside edged +0.35% higher. BHP opened with a bang however sellers came in and pushed the stock lower throughout the session – sell strength still clearly the play in the resource sector for now. The banks were interesting today – still not a lot of good news floating about however they’ve started to brush off the negative sentiment and push up from recent lows…

For the month (March) the ASX is now down around 1% which is weak from a seasonal perspective however we are starting to recover from the lows – basically the mkt will now be dictated by the fate of the banks in the short term and March / April is (still) the most bullish period of the year. The Bank Royal Commission has clearly had an impact in 2018 however it remains too premature to lose faith in our view.

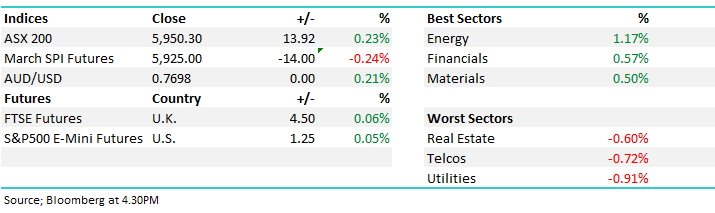

The market added+13points today or +0.23% to close smack on 5950

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

A lot of focus on the Fed Reserve in the US tonight around interest rates. The market is positioned for a hike (as per below) however commentary plus the DOT PLOT the important aspect.

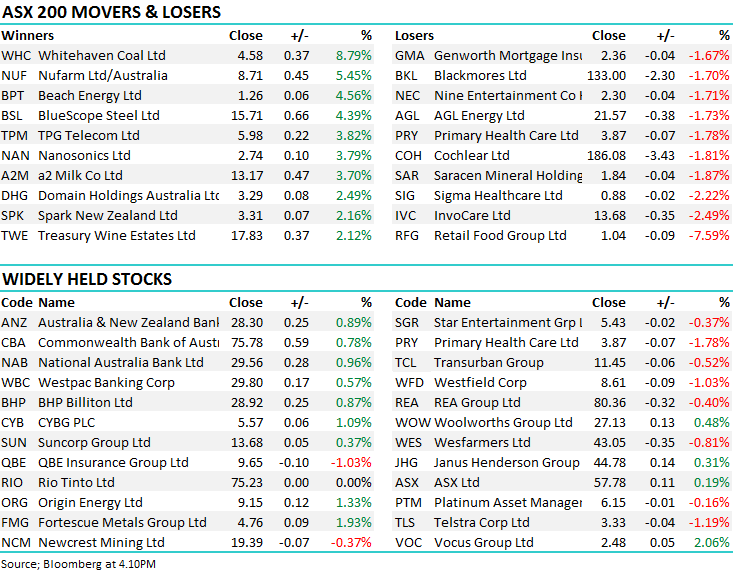

Myer (MYR) 41.5c / -3.49%; Reported half year results this morning with the underlying profit number already guided to in early February – at the same time they had their 3rd consecutive profit downgrade. At that time they said NPAT for the half would be between $37- 41m and they printed around ~$40m today however they also took some large non-cash impairments which they had flagged in February – the magnitude though was the variable component. The market had feared that the level of impairments may impact banking covenants but that wasn’t the case – the stock seeing a relief rally early but then those who bought saw sense - reality set in and the stock got pummelled into the close – which was the right reaction. Banking covenants or not the only issue here - this is a retailer in trouble and bottom feeding is simply too hard in MYR….

Myer (MYR) Chart

Mortgage Choice (MOC) -1.32 /.$1.875; We had a good question about this stock today and we haven’t looked at it for some time. Obviously the Banking Royal Commission and focus on mortgage brokers has this stock feeling some pain so I dug around to look at what we wrote last time we covered it. This was before the Royal Commission was announced about 8 months ago however the views are still relevant today. We have no interest in MOC.

26/7/2017 Mortgage Choice (MOC) Forecast P/E of 14.5x Yield of 6.3% FF

MOC is a mortgage broker that looks attractive from an historical valuation perspective trading on a discount of ~15% to its long term PE – currently around 14.5x. with a yield of 6.3%, paying a forecasted half year dividend of 7.5c FF. Mortgage Choice would seemingly be a great choice for the income portfolio, however the company is facing considerable headwinds. The mortgage broking industry has been facing scrutiny around unethical practices and many are pushing for reform that would shake up the commission based fees. Even the most basic of reforms, such as a push to pivot commissions where broker compensation is increased as the LVR falls, would significantly hit Mortgage Choice’s profits and valuation. Clearly this is an income opportunity that carries too high a risk to capital for the income portfolio. https://www.marketmatters.com.au/blog/post/income-report-staring-down-the-bear-buy-harvey-norman/

Mortgage Choice (MOC) Daily Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here . Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/03/2018. 5.11PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here