Aussie bourse flat despite decent sell off in US Futures

WHAT MATTERED TODAY

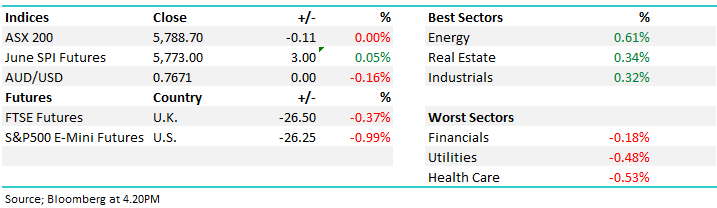

A reasonable day for Aussie stocks given US Futures came under a raft of selling early on the back of reports that Trump is stepping up his tariff talk targeting another $100bn of Chinese product – although it does feel like traders are acclimatising to the posturing given we didn’t see the usual Friday weakness on the mkt today + the Australian markets was incredibly resilient climbing back up from early weakness. Asian markets were also strong with Hong Kong up +1.23% even though US Futures were down ~1% for much of our session – right now DOW FUTURES are off -254pts.

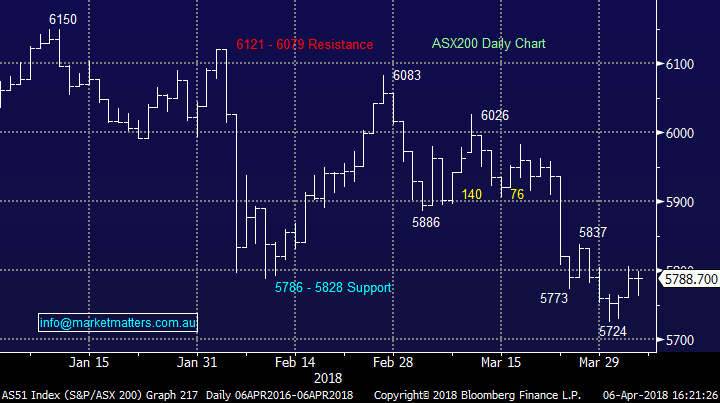

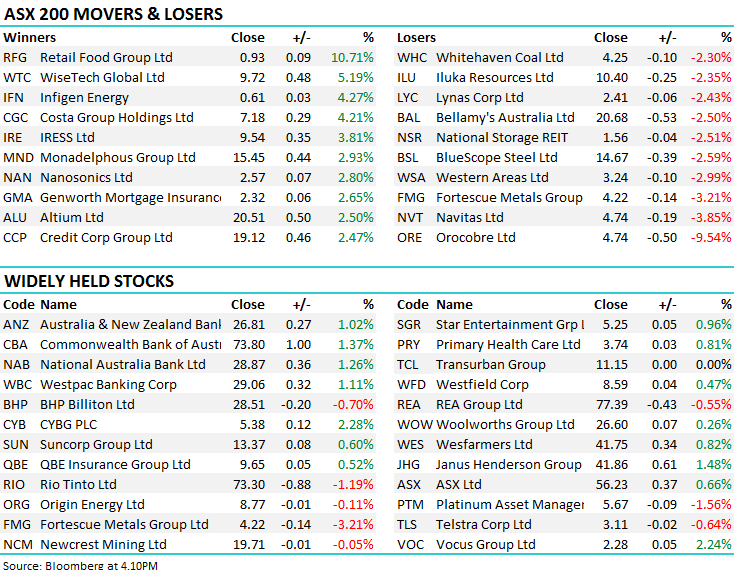

Overall, the ASX 200 ended flat for the day closing just shy of the 5800 level at 5788.

ASX 200 Chart

ASX 200 Chart

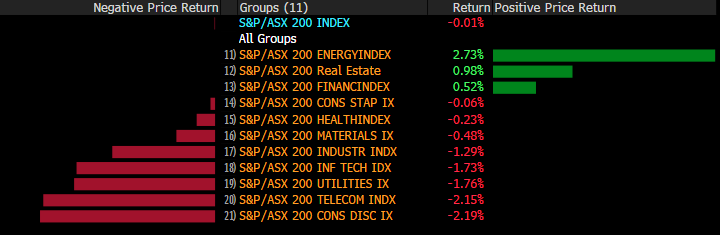

For the week , the market was flat in aggregate with the bid for Santos putting a bid tone under the Energy Sector. Interestingly, Financials actually finished the week in the black.

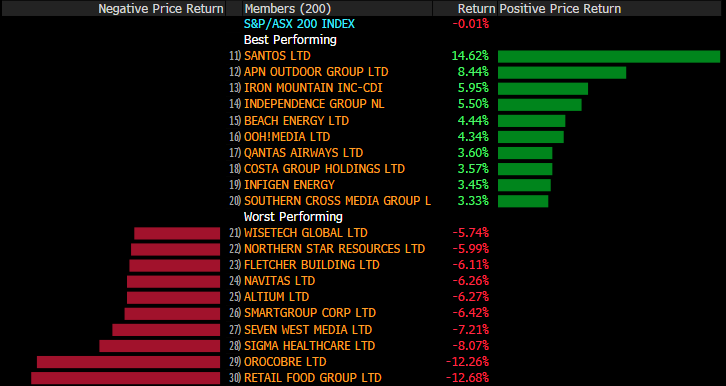

While on a stock specific level….Some of the higher PE names were in the sights of sellers…

CATCHING OUR EYE

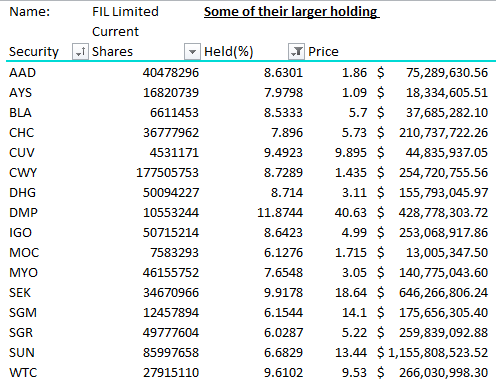

Some Big Lines; There’s a seller of some big lines of stock in the market today and some (unsubstantiated) rumours that it’s Fidelity looking to fund a raft of redemptions, no doubt a consequence of a few poor picks in recent times (assuming there is substance to the rumours) BlueSky obviously the latest of their woes – they hold around 7m shares after spending another $33m in the recent $100m share placement at $11.50 per share (stocks now trading around $5.70).

This is not new ground for Fidelity though after they bought 13.6 million GetSwift shares at $4 in December - now trading at just 46¢) and they also held 23.5 million Quintis shares – which are now worthless. Quintis were the previous target of Short Seller Glaucus before ultimately administrators were appointed early this year.

Fidelity are massive, the numbers here might sound large but they have a significant invested in Australia from what I can see and the issues they’ve had in recent times will have a bigger bearing from a reputational perspective, rather than a big hit to performance, however it’s still a negative. Anyway, it makes sense to understand what they are holding – and the list is long. We’ve pulled their holdings from IRESS and we’ve included a small list here of the stocks over 5% and of reasonable size.

Some of their larger holdings (over 5% and of reasonable size)

Source; IRESS

OUR CALLS

We added the USD ETF to the MM Growth Portfolio Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here