UBS reignite the bank sell off (WBC, HSO)

WHAT MATTERED TODAY

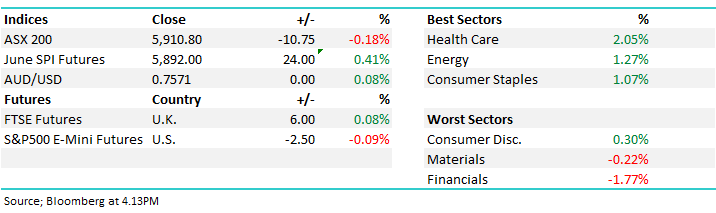

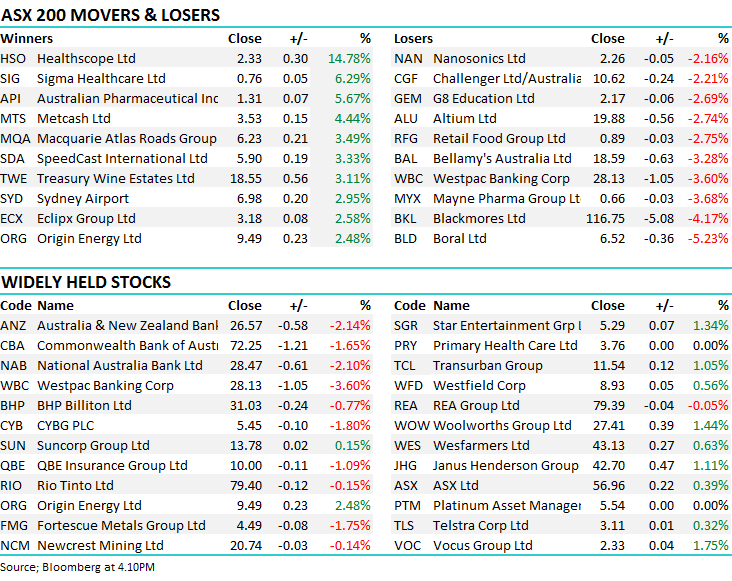

After yesterday’s day off the market was choppy through the morning before selling kicked in - particularly in the banks today. Westpac in particular was sold off hard as UBS heavily reduced their target price and outlook for the bank – more on this later. Healthcare got a boost with the proposed acquisition of Healthscope, while energy did it’s best to offset the poor performance in financials.

Overall the market fell 10pts or -0.18% to 5910 – not a bad effort considering the banks took 29points off the market, Westpac alone falling 11.5 index points!

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker Moves; Westpac was the stand out move today, with UBS heavily impacting the market. Regis Resources performed well despite the downgrade.

- Beach Energy (BPT AU): Upgraded to Neutral at Macquarie; PT A$1.20

- Regis Resources (RRL AU): Downgraded to Hold at Bell Potter; PT A$4.70

- Western Areas (WSA AU): Upgraded to Hold at Argonaut Securities; PT A$3.30; Cut to Sell at Canaccord; Price Target A$3.10

- Westpac (WBC:AU): Downgraded to Sell at UBS; PT reduced from A$31.00 to A$26.50

Westpac (WBC) $28.13 / -3.6%; A scathing note from UBS today clearly put the sprinklers on any optimism that was returning to the banking sector. As the Royal Commission rolls on, UBS took to pouring over the documents that had been released as part of the review including a number of internal documents and board papers. The analysts found significant shortfalls in lending standards at the bank, in particular the standards within its $400bil mortgage book. ‘Liar Loans’ where customers financial details were misrepresented to improve their borrowing ability, along with poor background and income checks were just a few of the issues UBS found within the loan book.

Realistically, this is not new news – for those that have been keeping track of the various reviews into the banks in recent times and now the commission, these problems have been noted for some time. What the report does note is the sheer scale of the issues with responsible lending practices within the banks – and how significant changes in the short term could lead to a squeeze in the availability of credit, weighing on house prices, and growth and inflation in the economy – not great for the share market either.

On the flip side for the banks today, APRA will remove the 10% investor loan growth restriction on lenders as long as proper lending standards are met by 1 July. Theoretically this will drive some credit growth and may work to offset the fears raised by UBS today. Shaw & Partners analyst Brett Le Mesurier was more cautious on this announcement today, noting “it probably signals that there has been a weakening in credit growth this month. The timing of the announcement is interesting because the monthly credit growth numbers are due to be released in the next few days. They will probably indicate a further slowing in credit growth.” It seems regulators are working to drive some credit growth despite the headwinds.

Westpac (WBC) Chart

Healthscope (HSO) $2.33 / +14.78%; a consortium of investors calling themselves the BGH – AustralianSuper Consortium has launched an all-cash takeover bid at $2.36/share – a healthy but not excessive premium of 16% to Tuesday’s close. This gap has since closed to just a 1.3% premium after money followed the bid in. The offer for one of Australia’s largest hospital operators was led by private equity firm BGH Capital, and AustralianSuper which own 14% of the stock, along with a number of smaller players. It is still early days in the event of any takeover happening which is conditional to due-diligence, financing and unanimous board recommendations. For these reasons, this is unlikely to be the only offer for Healthscope we see and the deal will be vastly different if any takeover was to happen.

Healthscope (HSO) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/04/2018. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here