Banks the shining light today (ANZ, CBA, IGO, MQG)

WHAT MATTERED TODAY

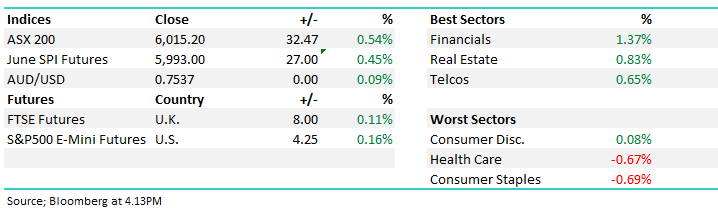

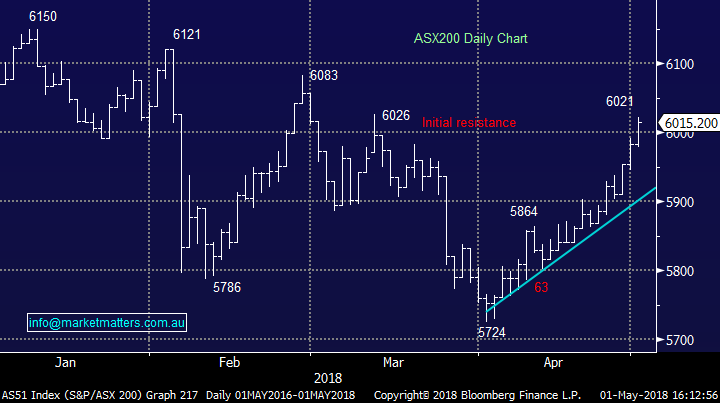

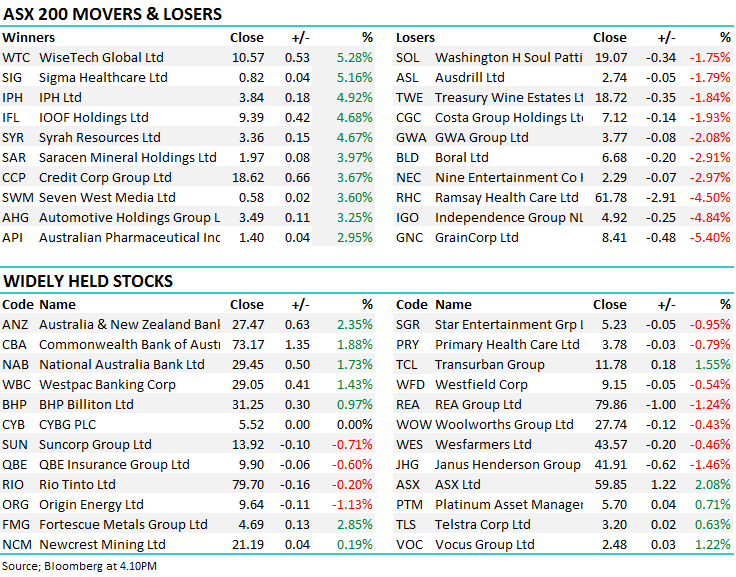

Another solid performance from local stocks today bucking the negative overseas lead – the Dow Jones down -146pts / 0.61% overnight yet we rallied +0.54% today continuing our recent period of outperformance. The banks the main driver which would have come as a surprise to some (not MM) with the big 4 contributing +22 index points today. The headlines were negative this morning with Scott Morrison targeting CBA following APRAs move to increase their capital requirements by $1bn – a big number on face value however for CBA it means an increase in capital requirements of around 0.30% at a time when they are well capitalised – not huge although it made for some good headlines this morning.

I discussed the banks on Sky Biz this morning as the news was dropping around CBA….click to view

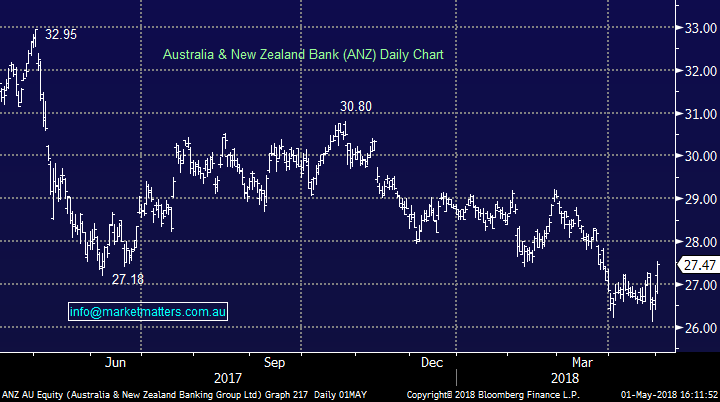

CBA actually ended the day higher by 1.88% to $73.17 while ANZ was also strong, rallying 2.35% to close at $27.47 after reporting an inline first half result – more on that later, however it clearly highlights the current bearish positioning towards the banks, where expectation ‘meets’ equate to strong share price gains.

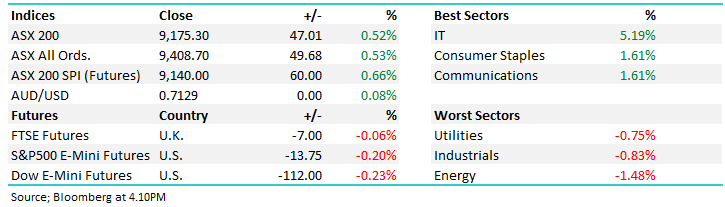

Overall, the ASX put on +32points or +0.54% today to close at 6015, the Financials the strongest link – 6250 clearly in our sights!

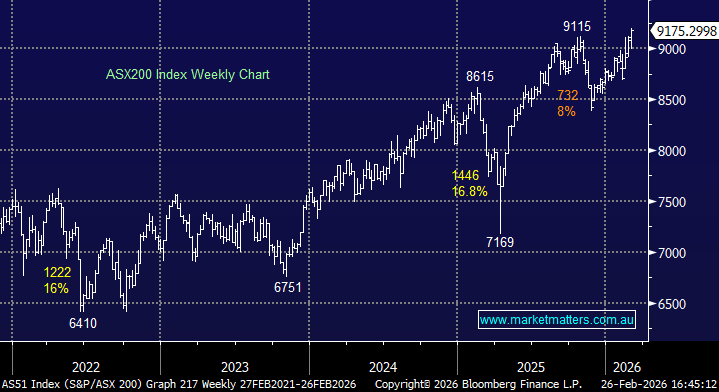

ASX 200 Chart

ASX 200 Chart

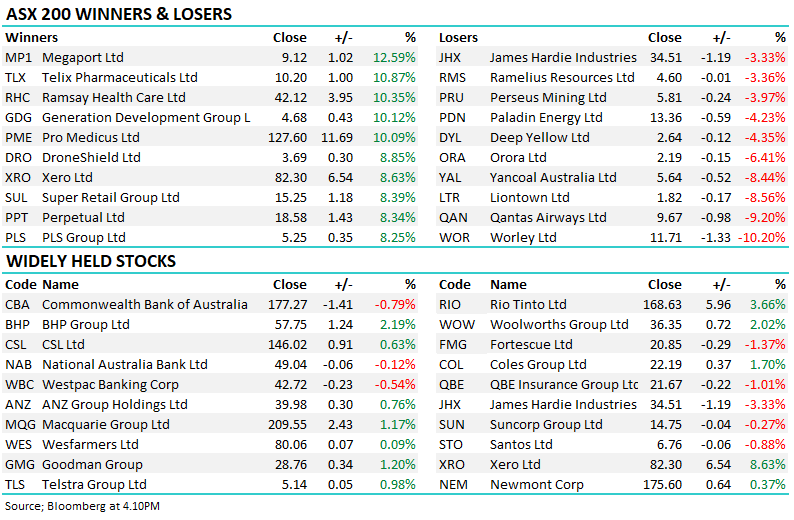

CATCHING OUR EYE

Broker Moves; Macquarie Group was in the sights of two brokers overnight with both Bells and Evans downgrading the stock into recent strength. Not surprisingly the stock took a hit this morning however recovered well late in trade. We have Macquarie in the Growth Portfolio targeting $110 – the stock closed today at $107.72, down 0.89% after trading as low as $106.31 in early trade.

· Macquarie Group Cut to Hold at Bell Potter; Price Target A$111

· Macquarie Group Cut to Neutral at Evans and Partners; PT A$107

· Syrah Upgraded to Speculative Buy at Canaccord; PT A$4.20

· Southern Cross Media Downgraded to Hold at Morningstar

· GrainCorp Cut to Neutral at Credit Suisse; Price Target A$9.06

Staying on Macquarie for a moment, the investment bank has good momentum however a couple of points reinforcing our appetite to SELL around $110. MQG is cheaper than the market, trading on 14.3 times with many sighting that as the reason / along with good growth to own it. MQG though usually trades around 13.5x so it’s starting to get a bit expensive based on current earnings forecasts – as the PE graph shows below. Trading on 13.5x to stock is worth $102.95. In bullish times MQG should trade at a premium and in weak times a discount. Right now the mkt is doing okay justifying the premium, however Macquarie is a high beta stock and will turn sharply if / when the market does.

Macquarie (MQG) – look at valuations

Also worth looking at valuations to overseas comparables below. MQG screens slightly expensive. While we like the stock, selling into strength makes sense.

Macquarie (MQG) Chart

ANZ Bank (ANZ) $27.47 / +2.35%; ANZ announced their half year result before the market opened this morning with numbers coming in broadly inline. Underlying profit of $3.3bil, which excludes any contribution from the pending business sales, while bad and doubtful debts remained at historical lows helping cash earnings rise to $3.5bil. The dividends remained unchanged at 80cents for the half, which was in line with consensus. ANZ remains a turnaround story, and will be a capital return player in the near future by the look of their current balance sheet - teir-1 capital at 11%, and expected to be closer to 12% by the time asset sales are completed.

We reckon ANZ will look to pay higher or special dividends, or launch a buy back later in the year. Clearly ANZ, like the rest of the banks are stuck in what everyone is saying as a low growth phase but they still managed to show loan growth in Australia of 4%. The move in ANZ today, and the banks alike, highlights how cheap they are, and how little the market is expecting from them.

ANZ Bank (ANZ) Chart

Banks – Relative valuations – the market hates them, even the Treasurer seems to hate them and probably rightly so, however from an investment standpoint, the vortex of negativity surely creates a buying opportunity??

Independence Group (IGO) $4.92 / -4.84%; The nickel miner released their 3Q update last night (sneaky) which notably missed guidance / market expectations in key areas, despite growing significantly on the previous quarter. To reach the consensus EBITDA number for the year, 40% of the final figure will have to come from the fourth quarter – which is massive. Operationally, IGO is tracking ok as the Nova production continues to ramp up, and costs continue to fall – although neither seem to be changing at a fast enough rate to beat expectations for the year - just meeting guidance might be a big ask!!!

Positives from the update include the continued deleveraging story – debt now down to a measly $73mil – while nickel and gold prices track higher than most market expectations. While it is entirely possible that IGO manage a huge 4Q to make up some ground, and commodity prices do their part in bridging the gap in earnings, the 3rd quarter wasn’t up to the market’s lofty standards and the stock was hit. All in all, Independence Group is a good story, with high quality assets and now MM are back on the buy side if today’s selling continues. We thought about pulling the trigger this morning, however the stocks had already moved once I got off the conference call that started at 10am. Market expectations will now be rebased overnight and we may see selling tomorrow – a buy around $4.75 would look attractive.

Independence Group (IGO) Chart

OUR CALLS

No changes to either portfolio today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/05/2018. 5.01PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here