Index struggles at 6100, Westpac report a good set of numbers (STO, WBC, ORI)

WHAT MATTERED TODAY

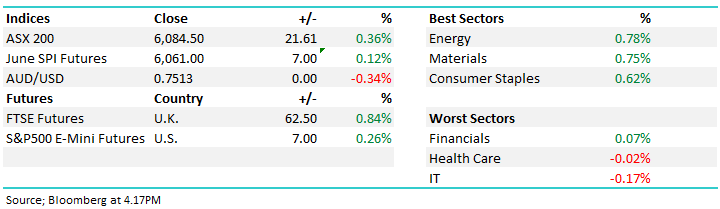

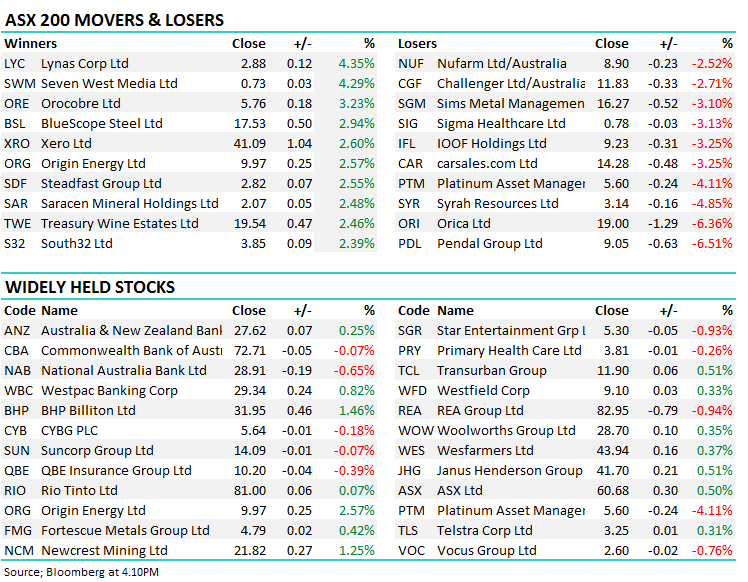

The market pushed higher once again today, toying with a close above 6100 for the first time since early February before the early strength was sold into finishing ~15pts shy of the target. Energy was the standout as Oil reached near 3 year highs this morning. The banks were mixed, Westpac performed well though after their 1st half report was released this morning. The Diversified Financials were soft following the downgrade of IOOF and AMP by UBS, and the announcement that ANZ would scrap product-linked bonuses for their Financial planners. Although not affecting other planners directly, the move will put pressure on their earnings models – Pendal Group, the new name for BT Financial, was the worst on the market today falling 6.5%. Orica was weaker after the explosives provider missed 1st half estimates – more on this later.

Overall the bourse clawed back most of Friday’s losses, finishing up 21pts, or 0.36% to 6084.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

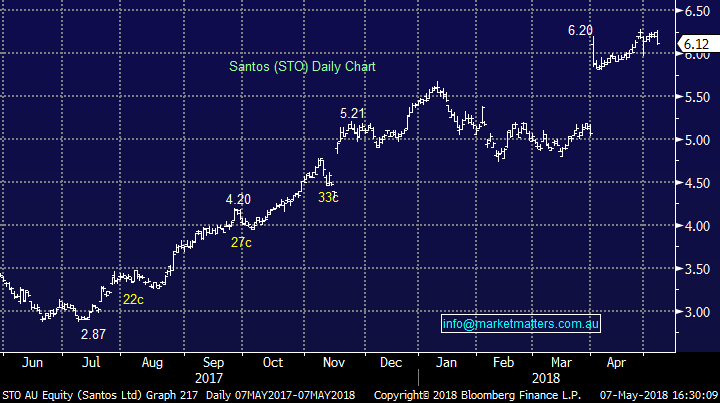

Broker Moves; IOOF was downgraded today by UBS with a neutral rating while they also slapped a sell on AMP. The Bank effectively saying that the sector will take a long time to recover from the Royal Commission – 2 to 3 years before some semblance of stability returns. Elsewhere, Macquarie are saying that the Santos bid from Harbour has an 80% chance of getting across the line despite FIRB concerns…the stock hit a high of $6.24 today – we originally suggested that if we held, a SELL above $6.20 makes sense even though the bid is at $6.50 given the chance the deal may stumble – Gas is a political issue at the moment…

Santos (STO) Chart

ELSEWHERE…

· Ainsworth Game Downgraded to Sell at Canaccord; PT A$1

· WiseTech Upgraded to Buy at Citi; PT A$14.12

· IOOF Holdings Downgraded to Neutral at UBS; PT A$10

· AMP Downgraded to Sell at UBS; PT A$3.80

· ARB Downgraded to Hold at Wilsons; PT A$22.40

· iSelect Downgraded to Neutral at Credit Suisse; PT A$0.58

· SkyCity Entertainment Cut to Neutral at Goldman; PT NZ$4.30

· GrainCorp Downgraded to Hold at Morgans Financial; PT A$8

· Ainsworth Game Downgraded to Hold at Baillieu Holst; PT A$1.40

· Village Roadshow Upgraded to Overweight at JPMorgan; PT A$2.74

· BHP Upgraded to Overweight at Barclays; PT 18 Pounds

· Rio Tinto Downgraded to Equal-weight at Barclays; PT 44 Pounds

Westpac (WBC) Result $29.34 / +0.82%; WBC reported 1H results this morning beating expectations by around 2%, a reduction in bad debts the key driver again however other metrics were also strong. Revenue beat by +0.5% with a good NIM figure, the result of re-pricing across their existing loan book BUT not discounting the front end as the rest of them are doing, therefore margins expanded in aggregate. Expenses were slightly above management guidance at 3.4% (guidance of 2-3%) and we’d expect that theme to continue, largely on the back of increased compliance spend. The dividend of 94cps was 1c below Bloomberg consensus but in-line with prior period – all up, a good result from WBC.

Westpac (WBC) Chart

Orica (ORI) Result $19.00 /-6.36%; a poor result from Orica + the stock had run fairly hard into it so we saw some selling post their 1H numbers this morning. I like to look at Orica in terms of demand for their products (explosives) geographically. Divisionally Australasia did better with 10% volume growth however EMEA and LATAM were both worse than expected and Nth America was inline. They maintained full year guidance however given the share price gain in recent times, it seemed the whisper was for a potential upgrade….stock to trade lower from here it would seem.

Orica (ORI) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/05/2018. 4.35PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here