ASX 200 hits 6250 then retreats… US markets are close to providing a sell signal (CBA, MTS)

WHAT MATTERED TODAY

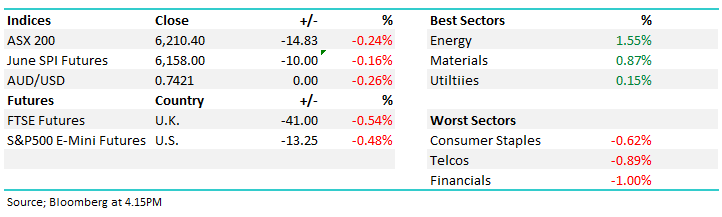

A sell off amongst the banks after a strong rally last week + weakness in US Futures on more trade war concerns put pressure on our market today, with the ASX 200 seeing its best levels in the first 15 mins of trade hitting a high of 6250, before sustained selling saw the market edge lower all day. It will be very interesting to see US trade tonight – the NASDAQ is very close to giving a SELL signal if futures are a guide as I type away this afternoon – a potentially key night ahead for US stocks. If they do close at or below levels being indicated by Futures now, expect some activity on the portfolios tomorrow, specifically around buying a negative facing ETF on the US market such as the Betshares US Equities Strong Bear Hedge Fund which trades under the code of (BBUS). This is a currency hedged play (unfortunately) however it’s the simplest way (in our view) of gaining short US equity market exposure.

Here is a quick discussion on the potential use of a bearish ETF – click here to listen.

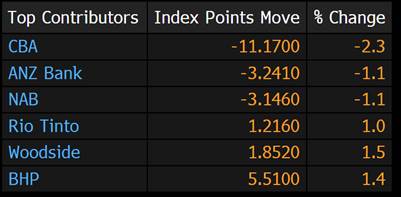

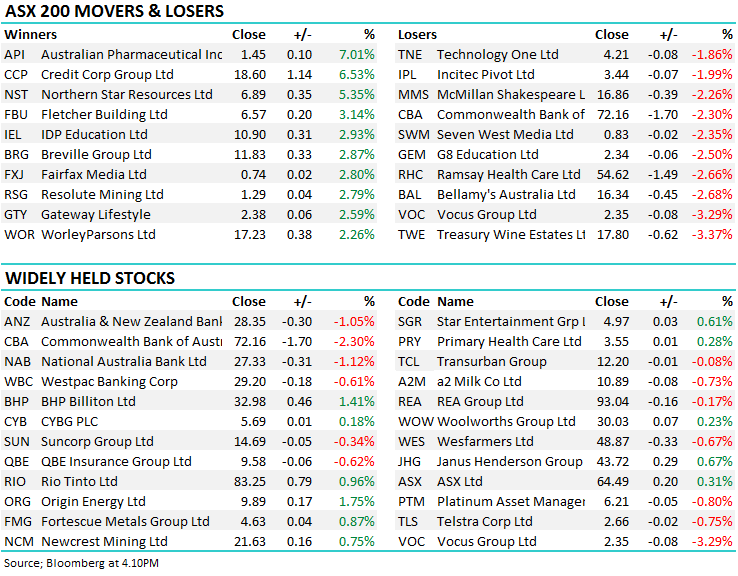

Locally, CBA was front and centre (-2.3%) after announcing plans to hive off its wealth management and mortgage broking businesses into a separate entity which would reduce reputational risk + importantly will free up capital to focus on the real driver of earnings – the retail banking business. Elsewhere, Metcash reported okay numbers + announced a $125m buy back which saw the stock pop on open (short covering I presume) however the optimism was short lived and the stock gave back the early gains.

CBA took -11pts off the index today…

On the sector front, the energy stocks were best benefitting from a resurgence in the Oil price on Friday – the materials were okay but still look vulnerable here in the short term, while the banks weighed.

Overall the ASX 200 index fell 14points or -0.24% to close at 6210.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Credit Corp (CCP) has bucked the ‘short report’ thesis that was circulating last week recovering all of their lost ground. When such as explosive thesis is written (as was the case last week) its validity is obviously down to substance, but (as with most things in this industry) it revolves around track record, something that Checkmate seems to be light on…Morgans were quick to upgrade the stock again after slapping a ‘cautious’ hold on it last week…JP Morgan also more optimistic on the stock.

· ANZ May Commit A$6.75b to Buybacks Through FY19-20: Ord Minnett Likely to see A$2b/half in FY19, slowing in FY20

· Northern Star Upgraded to Buy at UBS; PT A$7.50 – double upgrade with the note saying Long-term output target may be raised to 700kozs/yr

· Credit Corp Upgraded to Add at Morgans Financial; PT A$21.14

· Credit Corp Upgraded to Overweight at JPMorgan; PT A$20.50

· CYBG Downgraded to Sell at Investec

· Metro Mining Reinstated at Morgans Financial With Add; PT A$0.34

Northern Star (NST) Chart

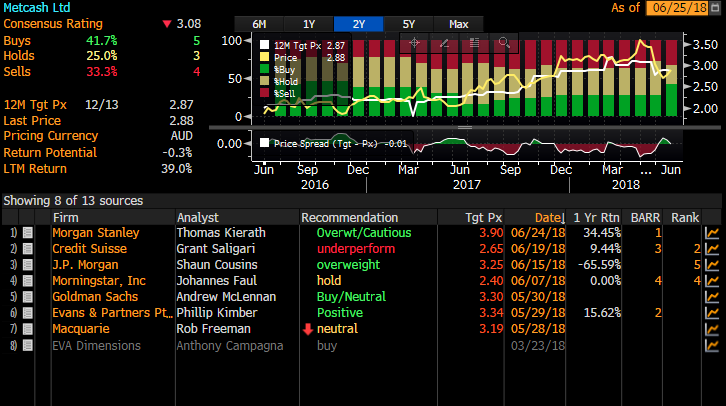

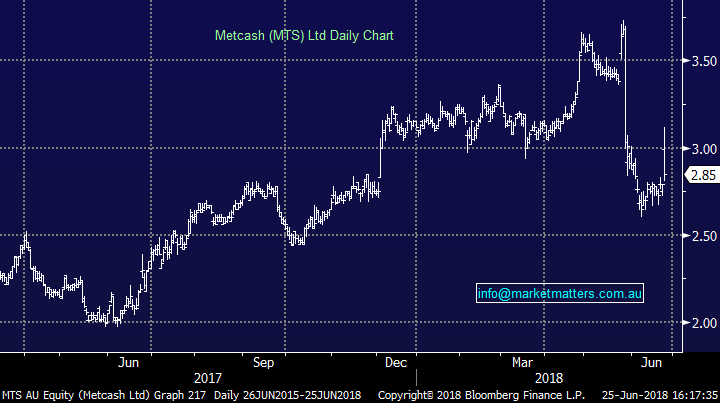

Metcash (MTS) 42.85 / +2.15%; announced their full year results this morning, and surprised to the upside. Sales and underlying profit ($14.5b & $215.6m respectively) were inline, however EBIT at $332.7m was 3% above the consensus view. Growth in hardware sales was the biggest driver of the beat, with construction and DIY activity higher than expected, a sign of a growing sector rather than Metcash taking market share from Bunnings. Probably the most important part of the result was the announcement of a $125m buy back, highlighting management’s belief in the business after what has been a difficult few months as more players enter the Australian supermarket space. We like Metcash, and it has run well after informing the market of a sizable impairment just a few weeks ago.

We prefer MTS over WOW & WES on valuation grounds, and the buyback will be supportive. The market is split on the stock with 5 b buys, 3 holds and 4 sells with a consensus price target at current levels.

Metcash (MTS) Chart

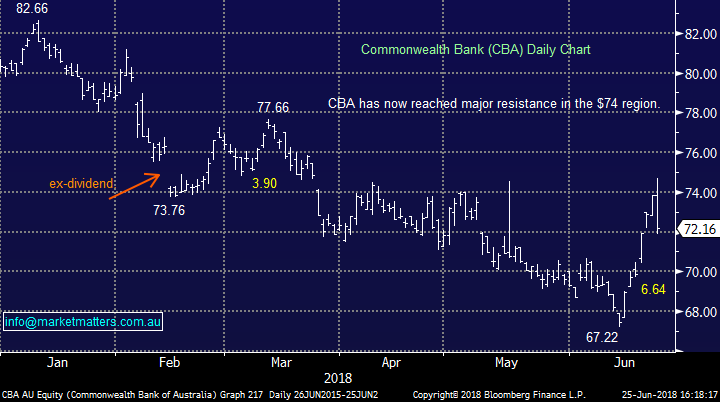

Commonwealth Bank (CBA) $72.16 / -2.30%; A lot happening in the banking space today with Com Bank announcing plans to spin off their Wealth Management and Mortgage Broking business into a separate entity – still owned by CBA but clearly a stepping stone for complete divestment. The entity will house Colonial First State, the CFS Global Business, Aussie Home loans + their life insurance business. When done (sometime in the 2019 FY) it will represent about 5% if CBA profits on about 10% of revenue. The view now – in a post Royal Commission world, is that a financial planning network provides reputational and earnings risk – a life insurance business brings life insurance risk specifically around decisions on claims and the rejection of claims brings reputational and earnings risk while the revenue margins in wealth management are falling faster than bank margins are – all of these risks seemed to come to a head at the Royal Commission with some scathing examples outlined. That said, CBA’s response has been swift under new CEO Matt Comyn.

Commonwealth Bank (CBA) Chart

OUR CALLS

No trades across the MM portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here