Ramsay Healthcare on the acquisition trail as stocks struggle (RHC, SRX, WHC)

WHAT MATTERED TODAY

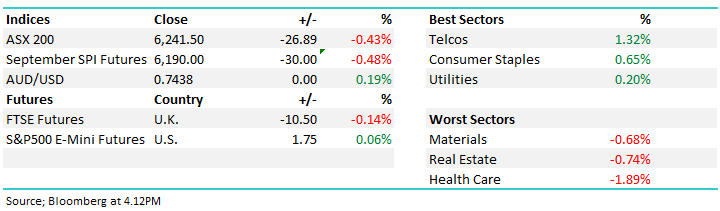

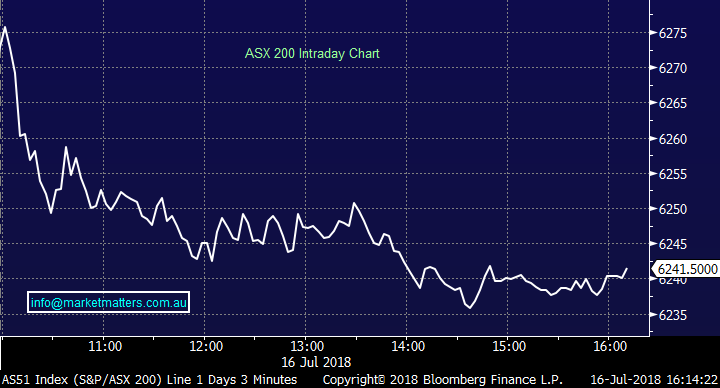

Aussie stocks came under some pressure today, however most of the selling happened in the first hour of trade and the volume was incredibly light – a consequence of school holidays no doubt. Asian markets were mostly weaker while US Futures traded in the green throughout - however the moves were fairly lethargic across the board. Whitehaven Coal (WHC) were out with an ok scorecard today meeting production expectations that were lowered back in January for the full year, while Ramsay Healthcare (RHC) traded for the first time since their subsidiary Ramsay Générale de Santé, which RHC owns 50.9% of lobbed a $1 billion bid for the Stockholm-listed European rival Capio.

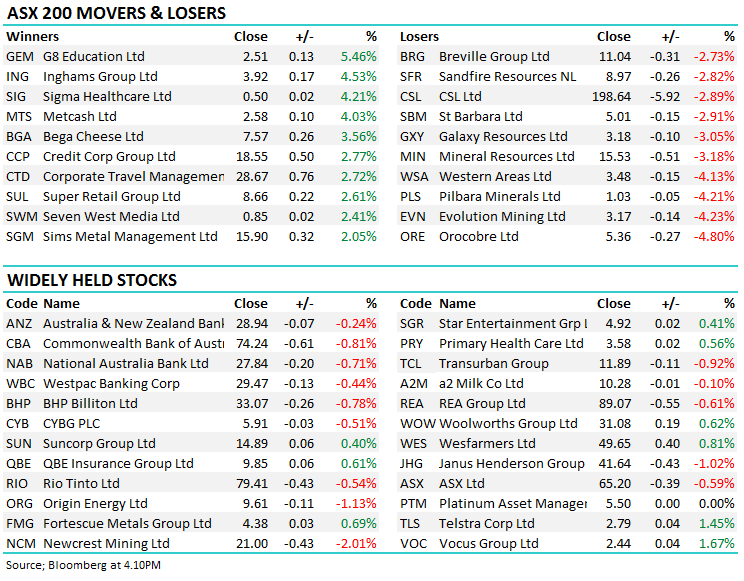

Elsewhere, there was some strong selling across the Lithium names today, with the sector giving back a whack of last week’s strong outperformance – Kidman Resources (KDR) has been hit particularly hard in recent months while Pilbara (PLS) and Orocobre (ORE) have been the two relative performers over the past view months. Gold stocks were interesting today – Newcrest (NCM) back down at $21.00 / -2.01% while Evolution (EVN) fell more than 4% to close at $3.17.

A slew of Chinese economic data was out at midday headlined by Chinse GDP which was inline with expectations at 6.7%. Industrial production was the biggest miss printing 6% versus the 6.5% expected.

Chinese Economic Data Today

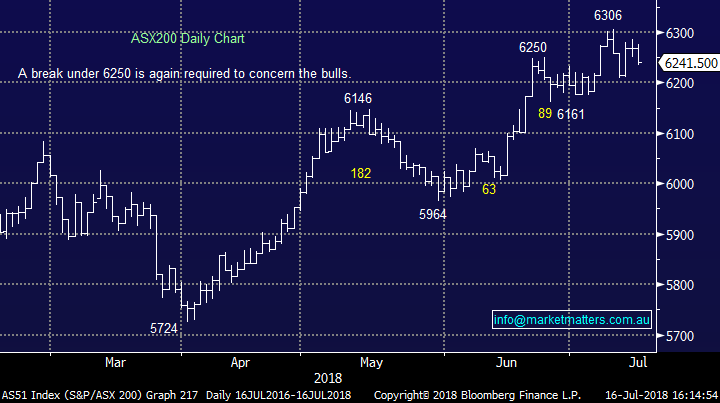

Overall, the ASX200 lost -27 points, or -0.43% to close at 6241 – Dow Futures are currently trading up +33pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; JP Morgan put a more bullish note out on Brambles (BXB) and that has helped support the stock in recent weeks after a pretty torrid last 12 months or so. Brambles Likely to Gain From U.S. Industry Performance they say.

Elsewhere…

· Freedom Foods Cut to Reduce at Morgans Financial; PT A$5.50

· Alumina Upgraded to Outperform at Credit Suisse; PT A$3.10 – We like AWC and looking for an opportunity to buy again

· Hotel Property Upgraded to Overweight at JPMorgan; PT A$3.30

· OceanaGold Cut to Sector Perform at National Bank; PT C$4.25

· Huon Aquaculture Rated New Buy at Shaw and Partners; PT A$5.73

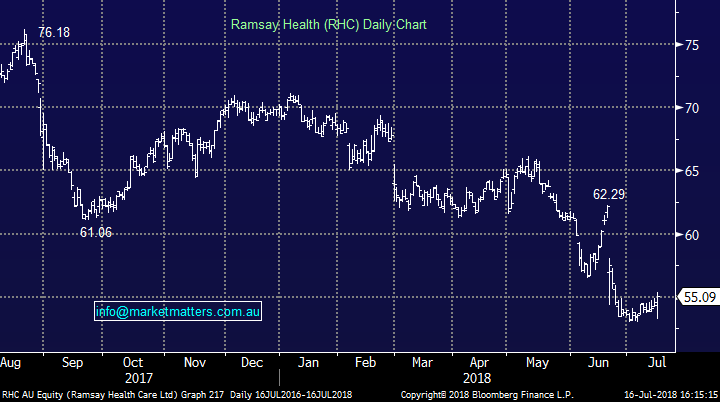

Ramsay Healthcare (RHC) $55.09 / +0.86%; It’s been an eventful few weeks for Australia’s largest hospital operator with the ink just drying on a disappointing earnings downgrade while over the weekend Ramsay’s French subsidiary, Ramsay Générale de Santé, which RHC owns 50.9% of lobbed a $1 billion bid for the Stockholm-listed European rival Capio. The bid has been re-bucked by Capio in the first instance however we doubt this will be the end of it.

Capio shares are now trading above the 48.5 Swedish Crown bid price which implies Ramsay have simply fired the first shot in a potential bidding war. Reading Credit Suisse research today on the deal, they reckon that RHC will need to sweeten the price substantially to get it across the line, and we tend to agree. Capio is a great operator particularly in the use of technology to improve better health outcomes across its network, something that would no doubt appeal to RHC, allowing them to roll out ‘Capio smarts’ across the broader RHC business.

While an overheated bidding war is not ideal in the short term for the RHC share price, we think the deal makes sense in the longer term assuming they maintain disciplined in the negotiation process.

Traders sold early but the pain was short lived and the stock closed in the green – looks bullish here.

Ramsay Healthcare (RHC) Chart

Sirtex Medical (SRX) $32.03 / -0.06%; Sirtex today announced the U.S. Federal Trade Commission has approved the private equity buy out by Chinese firm CDH Investments. FTC approval is one of a number of hurdles the deal has had to overcome, after first bettering US listed Varian Medical System’s offer and then gaining Australian Foreign Investment Review Board approval earlier this month. The offer for $33.60/share is a huge 78% premium to the last traded price before Varian’s offer in January has been given the board’s approval, and now just faces either a rival bid or a shareholder revolt – seems unlikely given the premium being offered.

Sirtex has been on a wild ride, falling over 50% in 2017 due to a profit warning late in the year among other issues. As a result, shareholders have welcomed the takeover news. The stock is still trading at a 5% discount signalling the deal still has small hurdles to overcome, although we see this as unlikely and expect to see SRX disappear from the market in the not too distant future.

Sirtex (SRX) Chart

Whitehaven Coal (WHC) $5.48 / -2.14%; Down today after they announced full year production numbers of 20.9mt which was within their guidance range of 20.5-21mt, although that had been lowered back in January from previously 22-23mt. QoQ production and sales momentum was noticeably lower. While WHC has enjoyed a considerable commodity price tailwind, commentary from the CEO today to me felt like ‘top of the cycle’ stuff!

Whitehaven Coal (WHC) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here