Materials & Energy run, but Banks sag (CIM, TLS)

WHAT MATTERED TODAY

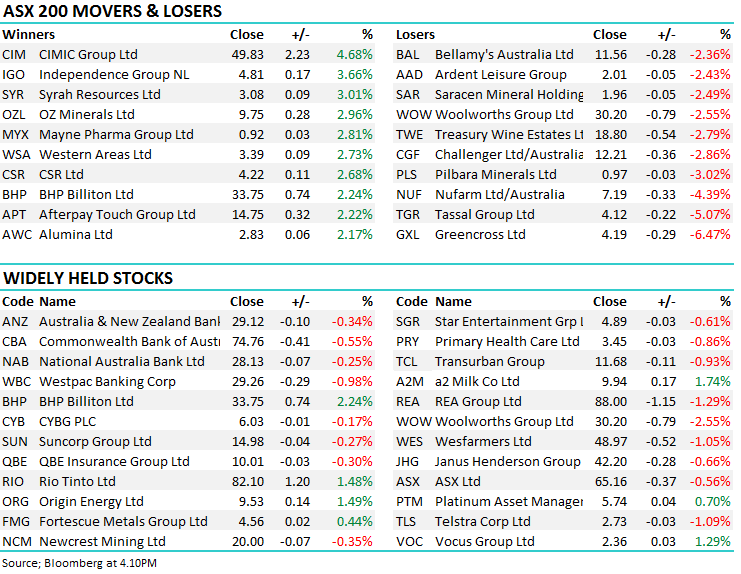

The market opened reasonably well this morning, largely underpinned by buying across the commodity stocks however as the banks rolled off from their earlier highs, the index followed suit. Kogan (KGN) again was under the pump down around 11% on the session with the fallout from yesterdays’ earnings ‘hose down’ still playing out. There will be a point to step up and buy this stock however given the strength in downside momentum, it may take a few more days for the selling to wash through. The $US earners were also on the nose today, given the recent weakness in the US currency - the likes of Resmed (RMD), CSL and Cochlear (COH) in the healthcare space all down between -1.6% % -2.09% while Macquarie (MQG) was off by 0.56% ahead of their AGM tomorrow.

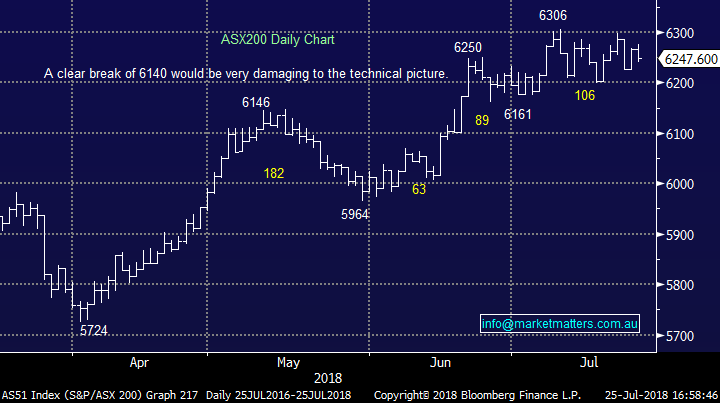

Another day were the ASX 200 remained in its tight +/- 100pt trading range, with the pull of a strong US reporting session being offset by a growing consensus that the market is in the final stages of 9+ year bull market. Hamish Douglas of Magellan fame the latest to talk about a bearish scenario playing out, with a 20% correction on the cards. The roll out of fiscal stimulus (tax cuts) in the US along with a very tight labour market could stoke wages growth and therefore inflation, putting in place the ingredients for the ultimate top in equities as the Central Bank is forced to raise interest rates at a quicker rate than the market is comfortable with.

Anyway, as we’ve discussed in recent notes, tops are very hard to predict and can take time to play out. In the interim, we’re nibbling away at some shorter term positions that are less correlated to the overall market, while offsetting market risk by holding some negative facing ETFs with the view of increasing our weightings here into any further strength.

Overall today, the ASX200 lost -18points or -0.29% to close at 6247 – Dow Futures are currently trading up 1pt. We remain neutral here, with the trigger to turn more bearish at 6140 on the XJO.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Morgan’s have published a more upbeat assessment of the retail landscape saying that Amazon’s entry to Australia has yet to trigger any discernible erosion of incumbent retailers’ sales. They like specialty retailers like Adairs, Apollo Tourism & Leisure, Baby Bunting and Noni B on less Amazon exposure + “solid” growth prospects. I was on the box with Chris Macdonald from Morgan’s today and he was singing the praises of Adairs (ADH).

Elsewhere, Citi are saying that Downer is the best placed stock to benefit from Australia’s construction boom, saying that total, rail, road and resources capex to reach A$38b through FY22. DOW was up +1.26% today however CIMIC (CIM) which we’ve targeted as a buy below $47 put on an impressive +4.68% today to close at $49.83!

Cimic Group (CIM) Chart

Elsewhere:

· CSR Upgraded to Neutral at Evans and Partners; PT A$4.39

· Adelaide Brighton Cut to Negative at Evans and Partners

· Resolute Mining Downgraded to Sector Perform at RBC; PT A$1.50

· Bapcor Downgraded to Hold at Morgans Financial; PT A$6.86

· AP Eagers Downgraded to Hold at Morgans Financial; PT A$8.92

· Accent Group Upgraded to Hold at Morgans Financial; PT A$1.39

Telstra (TLS) $2.73 / -1.09%; Telstra eased today following an S&P Global Ratings report that attacked the NBNs long term viability, forecasting a significant write-down of its assets as the regulatory framework that protects it unwinds. In theory, this should be a positive for big telcos such as Telstra, as competition opens up it will provide an opportunity for companies with robust communications infrastructure in place – however S&P argue otherwise. A write-down would likely trigger further government spending in an effort to get NBN to compete with the telcos one way or another, and competition is inevitably bad for other businesses. Realistically, however, the NBN model appears to be broken, and short of a complete redesign, it is unlikely to achieve the 75% market penetration of home broadband it has forecast. Telstra now has the opportunity to build a 5G network to compete with NBNs infrastructure and gain a majority share of the predicted 25% of households that will only have fixed wireless or mobile only broadband in the 2020s – in our view, Telstra currently has upgradable infrastructure to offer this service on the widest scale. Optionality is starting to present itself.

Telstra (TLS) Chart

OUR CALLS

We added Healthscope (HSO), Mineral Resources (MIN) and IRESS (IRE) to the MM Growth Portfolio today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here