Seek reinvesting for growth at the expense of profits (SEK, AMC)

WHAT MATTERED TODAY

A positive session to kick off the week although it was quieter with a bank holiday reducing volumes - a couple of reasonably important company updates across the ticker – Amcor (AMC) announcing their intent to buy Bemis Company in an all scrip deal that values Bemis, which is listed in New York at around US$5bn. Bemis Company is another large packaging company that would complement Amcor’s current operations, however at around $7bn in Australian currency terms, it’s a big purchase.

Elsewhere, Seek (SEK) updated the market today on their expected profit numbers that were scheduled in about a week’s time. They met in terms of revenue and earnings for FY18 however their guidance for FY19 was soft, and the stock fell around 9%. This is the type of stock we’d avoid during this reporting season – highly valued growth orientated businesses where market expectations are high.

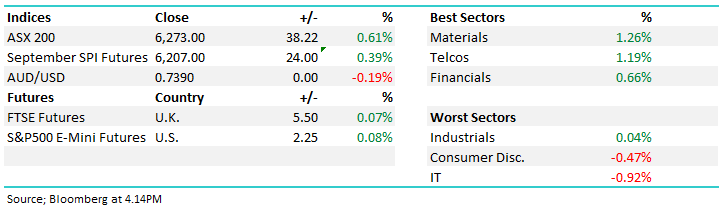

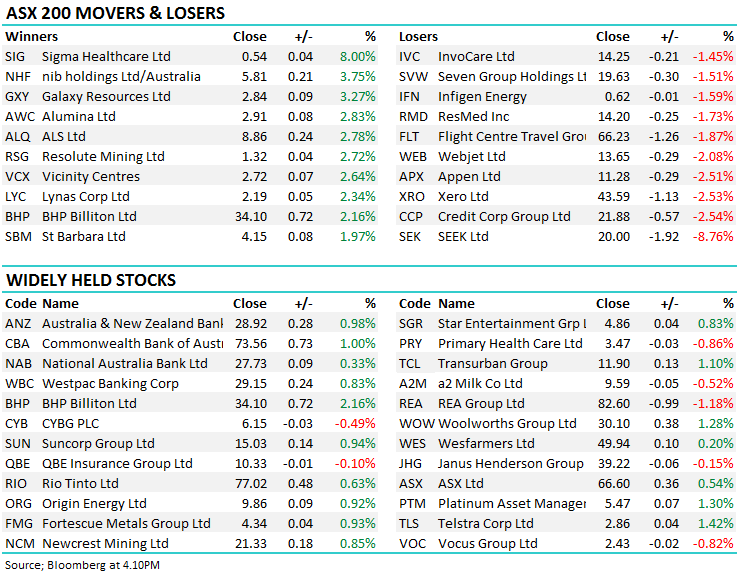

Overall, the ASX200 added +38 points today or +0.61% to close at 6273 – Dow Futures are currently trading up +30pts. We are now neutral the ASX200 with a break of 6140 required to turn outright bearish.

Australian Reporting season is underway – for a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Not a lot on the ticket today given the bank holiday – although that didn’t extend to the market / nor the MM team…

· Pilbara Minerals Cut to Hold at Baillieu Holst Ltd; PT A$0.93

Pilbara Minerals (PLS) Chart

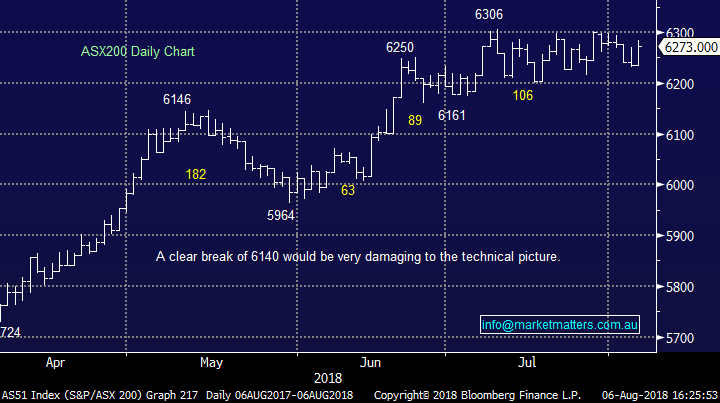

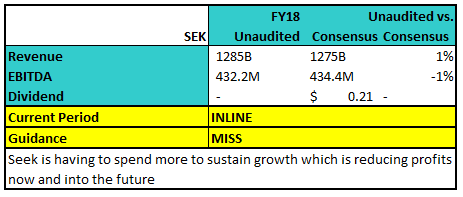

Seek (SEK) $20.00 / -8.76%; International jobs classifieds business Seek pre-released their full year result this morning ahead of their scheduled full year reporting date on the 15thAugust. While the numbers were preliminary and unaudited, the market snubbed them and sold the stock off fairly hard, down -8% at time of writing. The current year is tracking along well with underlying numbers kicking along at the top end of company guidance, however the outlook for FY 19 in terms of profit was below market expectations while we also saw a couple of asset write downs which is not a good look when the company is aggressively investing overseas.

In terms of the numbers, it looks like FY18 revenue will be around $1,285B vs consensus at $1,275B, which is good, EBITDA of 432.2M vs 434.4M which is okay, however the outlook for EBITDA and indeed profit for FY19 was well below market expectations. At the mid-point of the company guided range, SEK will do revenue in FY19 of $1.51B which is ahead of market expectations of $1.44B, however (assuming midpoint) EBITDA will be $460m versus current expectations of $483m while profit will be flat on FY18 whereas the market was looking for growth of 19% implying reported NPAT of $243m, however it will likely be nearer to $200m.

It seems to us there are a few issues bubbling away under the surface of this update from SEK which is one of Australia’s top growth stocks. The top line revenue is okay, so they’re growing the business which is good on one hand, however the cost of growing the business in other markets has been high. This means that although revenue is growing, the growth in revenue is not dropping down into growth in profits, instead they’re reinvesting in the business for future growth.

That’s fine if they invest well, however today they also wrote down the carrying value of their Brazilian operation (Brasil Online) along with their Mexican business (OCC) by a combined amount of A$178m. So on one hand they say we’re investing for future growth – trust us – and on the other hand they’re saying the value of these businesses have gone backwards and they need to be written down. This leaves a sour taste and when a business is trading on 34x forward earnings, it’s hard to swallow! SEK has an incredible operation in Australia, a market it dominates however growing overseas in larger markets will continue to cost money. We have no interest in SEK at current levels.

Seek (SEK) Chart

Amcor (AMC) $15.28 / unchanged; Amcor remained in a trading halt while considering an all-scrip deal to buy American plastic packaging company Bemis. The deal currently being worked through values Bemis on around 18x 2019 PE, above Amcor’s current PE of around 15x, however the deal will largely be focussed on synergies the combined entity can achieve, as well as fulfilling Amcor’s long desired goal of major international expansion.

Amcor has recently come under pressure some as rising oil prices forced resin prices up, however in the packaging business, scale is a very impact concept and this deal would certainly give AMC a lot of it! AMC has a strong track record of making acquisitions work however this sort of acquisition is in a new league. The final product of the deal would likely see Amcor become dual-listed on the NYSE. Watch the space!

Amcor (AMC) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here