Subscribers questions (APT, SPT, FFF, WHC, THR, NCM, EVN, NST, BUB, ORE, MYR, PAR, SPL, SHL)

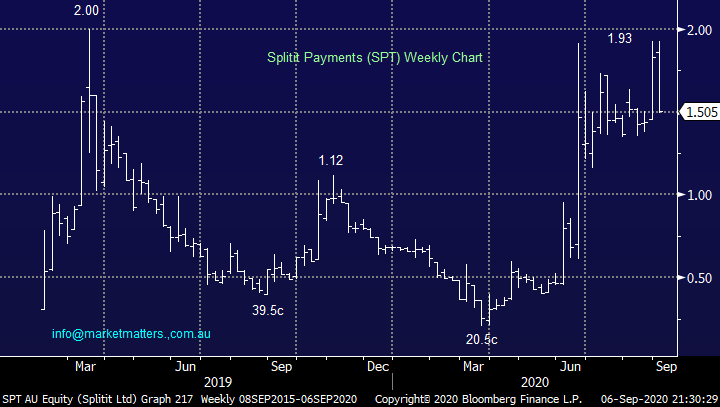

Aside from Wall Street’s 2nd day of steep falls which was again focused in the tech space, the main news over the weekend was Daniel Andrews aggressive stance for Victoria against COVID-19, I admire a person who sticks to their guns in the face of a tidal wave of criticism but I think he’s considerably shrunk his Christmas card list with his latest decisions! Businesses are haemorrhaging and his statement that Victoria requires 28-days of zero cases to enter “COVID normal” feels like the stuff of fantasy, I’m not surprised Scott Morrison’s fuming, after all its federal money that’s helping so many in the southern state.

Given it’s such an infectious virus, expecting to both eradicate and then contain future outbreaks is tough to comprehend, just ask NZ who did an amazing job, but the virus still returned after 102-days of zero cases. My “2 cents worth” is we should be looking for ways to live and work with the virus until a vaccine is readily available to the public, hopefully sometime early in 2021.

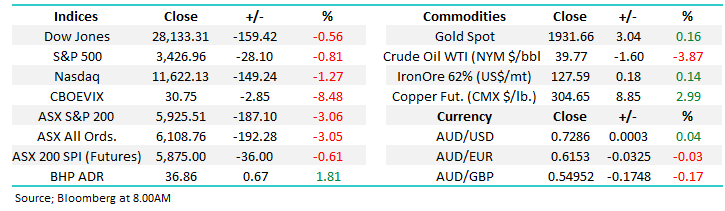

Following weakness in the US the SPI Futures was calling the ASX to fall over 0.5% and the decision in Victoria feels unlikely to cushion the fall.

Elsewhere the news was pretty thin on the ground over the weekend but if the local markets going to follow the trend of the last 6-weeks it may feel distinctly “shaky” at present but come Friday it will probably be up – with the Financials and Resources trading higher in the US on Friday night I actually wouldn’t be surprised to see this morning provide a better showing than the futures were implying on Saturday morning.

MM remains bullish Australian stocks medium-term.

ASX200 Index Chart

The US tech stocks garnered most of the market attention last week as they plunged over 10% in a just a few days however in the last few hours of trade on Saturday morning (AEST) the market quickly regained ~37% of the losses in quick fashion. We believe investors should start the week very openminded, we can see the NASDAQ hitting 12,600 or 10,600 in the coming weeks, or perhaps even both!

MM remains bullish US stocks – for now.

US NASDAQ Index Chart

Last week we held a Webinar with a focus on Resource Stocks. I was joined by Analysts Peter O’Connor and Andrew Hines from Shaw & Partners looking at opportunities large and small in the resource sector. The link below is available for members to view the Webinar at your leisure. Thanks to the large number of members who joined us live, next time I’ll allow more time for questions. I believe there is some good value in these, and we plan to hold regular Webinars in the future with other analysts that I regular draw on.

The Resource Roundtable – click here

Thanks again for the much-appreciated questions, as we’ve said previously were delighted to have such an engaged subscriber base.

Question 1

“Hi James, What to do with our BNPL stocks today ? There must be lots of subscribers who would be keen to get your advice. ?? sell ??” - best wishes John K.

Morning John,

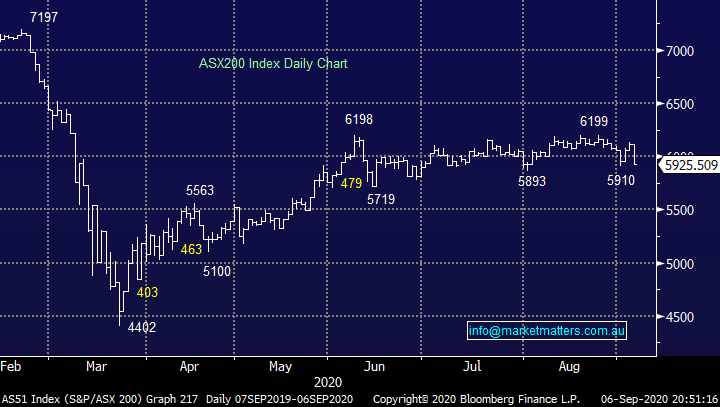

I have used sector heavyweight Afterpay (APT) as my yardstick for obvious reasons and to us its unfolding like a healthy bull market pattern, at least at this point in time. We’ve alluded to the possibility of a pullback to ~$60 area over recent weeks and the news last week that PayPal was entering the BNPL space with its Pay-in-4-credit platform, an offering like APT which doesn’t slug customers with interest just late payment fees, has accelerated such a correction. However, the move by the US giant was inevitable, they already have instalment solutions in Germany and France.

This is a very large new market and with regard to fresh competition it was always a case of when not if, our only major concern for the likes of inevitable of APT and Z1P is what growth multiple will the market now accept as the competition heats up overseas. At this stage we’re comfortable with the space and with regards to APT it’s an exaggerated form of the ASX i.e. we would look to accumulate under $70 and take some money from the table above $100.

NB: This is a high-risk area of the market and position sizes should be reflective of that. At MM we have a 3% weighting in Z1P for our growth portfolio.

MM believes APT will break above $100 in the next 6-months.

Afterpay Ltd (APT) Chart.

Question 2

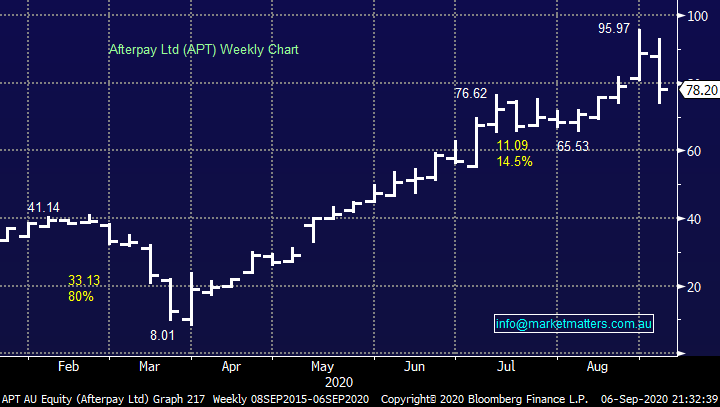

“Splitit (SPT) Hi James, Splitit have announced a SSP for Retail Investors following the Capital Raise for Insto's. The offer is the same @ $1.30 per share to be made in pre-determined bundles, closing on 15 Sept, 2020. As a Holder, I am considering taking up this offer , which probably will be oversubscribed, however SPT reserve to the right to vary the Terms and accept oversubscriptions, which could result in further dilution. I would appreciate your thoughts. Thank you for your sound commentary in these volatile times” - Richard O.

Morning Richard,

Another BNPL company Splitit (SPT) is experiencing a pullback after a stellar run over the last 6-months. My opinion with SPT is KISS (keep it simple stupid) I would be comfortable buying SPT at $1.30, the variance of terms relating to oversubscriptions is fairly standard.

MM likes SPT into this pullback as a ‘high risk’ stock.

Splitit Payments (SPT) Chart

Question 3

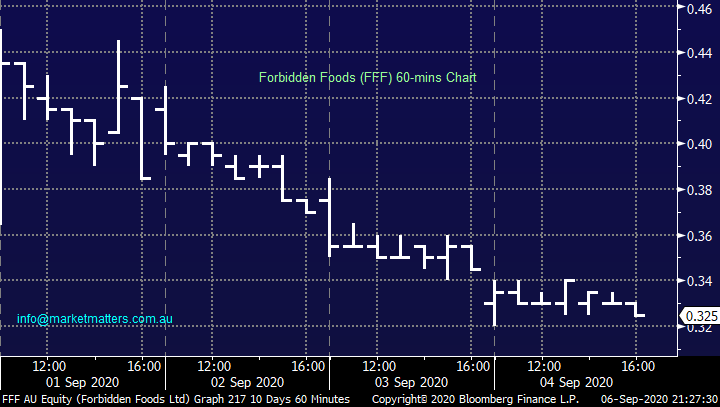

“Hi James et.al, Have you heard any interesting snippets on Forbidden Foods (FFF) recent IPO? Appreciate market cap too small for MM but healthy foods is a growth area and the company has a 10-year history. Any thoughts?” - Cheers, Jeff M.

Morning Jeff,

FFF is a Victorian based food business that has a focus on rice-based products tapping into the healthy living/ more plant-based phenomenon. They only listed on the ASX at the end of August with a 20c issue price having raised $6m. They opened at 32c, ripped up to a high of 45c and are now back to 32.5c – clearly a wild ride. They now have a market cap just over $24m.

Clearly the IPO has some interest, it was listed by BW Equities in Melbourne, a firm I’m not familiar with however given 40% of the shares are held by the top 9 holders there’s not a lot of free float meaning the shares can be pushed around a lot on reasonably small volume. Other than that, I’m not overly familiar with the company, I know they are losing money (about $2.5m in FY20) but the raise at 20c is still looking highly profitable for investors. I think the “better for you” and plant-based food sector has legs and as you say, these guys have a real business that has been operating since 2010.

Certainly, one worth watching.

Forbidden Foods (FFF) Chart

Question 4

“Whitehaven coal is my largest investment, which i purchased on your recommendation for $4. Now at 85 cents, should I hedge and buy double.” – Graeme C.

Morning Graeme,

What makes MM different (in our view) is that our buy calls are part of a portfolio and we manage the positions on an ongoing basis. In the case of WHC, we bought the stock in the Income Portfolio on the 22nd May 2019 at $4.29. We picked up 0.33c worth of dividends however cut the position for a 13% loss on the 19th September at $3.38 writing at the time, “while WHC are producing strong free cash flow falling coal prices are putting pressure on the stock. The position is in the red by ~13% and we’re cutting it to re-allocate elsewhere”.

Incidentally, on the same day we also cut Estia Health (EHE) for a 7% loss at $2.47 / currently $1.52 and Flight Centre (FLT) for a 19% profit at $47.16 / currently $12.70 .

While we don’t own WHC , we have spoken about it in 2020 a number of times concluding it was ‘all too hard’ as the stock is suffering from a painful 2-edged sword – a collapsing coal price and many global fund managers no longer investing in fossil fuels – technical support for the downtrend unfortunately doesn’t come in until sub 50c.

What concerned me in their last update was the rise in gearing, which ticked up meaningfully. Our analyst in the stock Peter O’Connor actually likes it at current levels on valuation grounds (he has a $1.80 price target), however I’m not convinced. We discuss the stock in the Webinar above.

MM is neutral WHC.

Whitehaven (WHC) Chart

Question 5

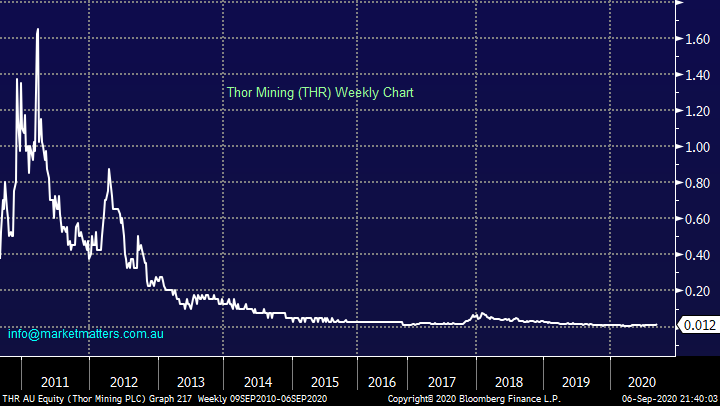

“Thor Mining (THR) : Could you comment on this stock please !. I hold 500,000 of these and for the last 3 years they keep producing great stories about their gold, copper etc strikes and its always positive . Amazingly, they are still attracting capital raisings They once got to about 8 cents .However the share price goes nowhere and they languish at a lot less than that. They are worth so little that I just leave them in my speculative portfolio and wait.” - Cheers, Rob M.

Morning Rob,

THR is now a company with a market cap of just $15m which is no surprise considering its share price. Without knowing much about this stock specifically, unfortunately your story is all too common, mining companies telling a great story but not delivering. The story has a habit of getting better just before they need to raise capital then tapering off until the coffers run low. The cynic in me calls these ‘lifestyle companies’ not for you or I but for the guys / girls pulling a nice salary from them.

That view might be too harsh for this company, as I say, I don’t know it well, however there are many companies like this on the ASX, and I’ve heard a lot of ‘great stories’ in my time with only a small portion of those stories becoming reality.

Thor Mining (THR) Chart

Question 6

“Hi, I have the following question to submit: which gold mining companies do you prefer? (focus on producers, not so much explorers / developers)” – Thanks Mads.

Morning Mads,

We covered this subject in our webinar on Wednesday, if you missed it the link is above – at current prices our favourite producers are Newcrest (NCM) and Evolution Mining (EVN) both of whom have endured meaningful corrections over the last 1-2 months as golds unrelenting rally has started to splutter. We are currently holding Newcrest (NCM) and are considering increasing our sector exposure if / when we see gold around 6% lower probably with Evolution (EVN) for the sake of diversification.

MM remains bullish the gold sector.

Newcrest Mining (NCM) Chart

Evolution Mining (EVN) Chart

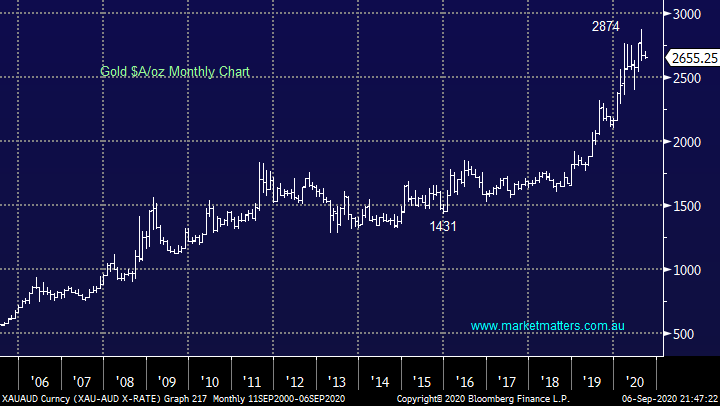

Question 7

“Hello Presenters, Re the above online seminar. May I kindly submit the following question (if deemed worthy)…Can our presenter/s please give an opinion as to what will happen to market prices of (major) Gold producer stocks if the historically high price for gold drops from its current value.

Is the answer the same for a “Small drop” versus a “Major drop” in the gold price?” - Thank you, Leon T.

Hi Leon,

All questions are deemed worthy, I teach my children that “the only silly question is the one not asked”. The answer is simple in my opinion, the price of our gold producers / stocks will follow the gold price in $A terms hence if it falls the stocks are likely to follow it lower.

MM can see gold in $A back at $2400/oz in the short-term.

Gold in $A/oz Chart

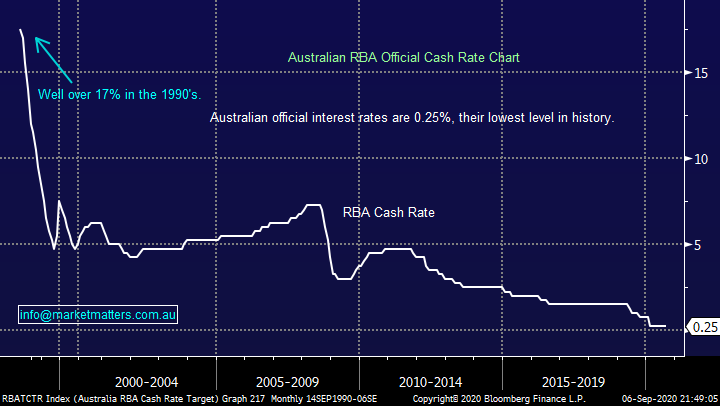

Question 8

“Should the ASX be dropping soon, on the back of recession news? Or is this just a lift for stocks to sell off.” – John R.

Hi John,

The market looks at least 6-months ahead and in today’s case the current COVID created recession is being outweighed by the massive monetary / fiscal stimulus being thrown at the global economy, while investors believe this wall of money will support risk assets and finally take us out todays recession stocks should be ok i.e. don’t fight the Fed but if / when investors lose faith in central banks hold onto your hats. Also underneath the hood of indexes plenty of sectors such as the banks are trading like a typical recession whereas new world stocks which have thrived during this pandemic are booming, not everything’s equal.

MM is still bullish stocks.

Australian RBA Official Cash Rate Chart

Question 9

“Hi James, I hope you and the team are keeping well. Q. Should we abandon Newcrest after its 7% fall in comparison to the gold price? Would Northern Star or Evolution be a better option, assuming we stay in Aussie dollar gold earners?” -Cheers Tim C.

Hi Tim,

Again we covered the gold stocks in our webinar on Wednesday – link above – we still prefer Newcrest (NCM) and Evolution Mining (EVN). I know NCM has been a frustrating operation, again, but at today’s prices it’s our preferred pick. As we can see below Northern Star (NST) has also experienced a 20% pullback and overall looks very similar i.e. out of the 3 there’s no major difference in our opinion.

MM remains positive the gold sector.

Northern Star (NST) Chart

Question 10

“Hi James & team, Thank you for MM's continuing great market comments and educational ones too! Keep it going, keep it simple (if possible). Like to know your thoughts on BUBS and Orocobre, both entities are having SPP. Worth taking them up, and your thoughts on BUBS's strategies?” - Michael C.

Hi Michael,

Obviously, we’ll take these one at a time:

Organic baby food busines BUBS has halved over the last 12-months which is clearly disappointing. We really like their vertically integrated business model controlling both its supply chain and manufacturing. The company’s latest gross revenue was up 32% for Q4 of FY20, all heading in the right direction, time will obviously tell with regard to its vitamin offering for children “Vita Bubs”. Jennifer Hawkins signing up as their brand ambassador does scare me as I always remember her as the face of the Myer IPO, the ultimate outcome was obviously not her fault!

MM likes BUB around 80c.

Bubs Australia (BUB) Chart

Orocobre (ORE) was one of the faces of the markets lithium boom back in 2017, everybody went long focusing on the increasing demand from electric vehicles but they forgot about how easy it was to crank up supply – even Toyota bought into ORE above $7. ORE’s performance hasn’t been helped by it leaving the ASX200 as its shares slipped lower due to lithium oversupply. I feel it will be a volatile journey moving forward for ORE with plenty of +/- 30% moves for the stock, one for the traders I feel.

MM is neutral ORE here.

Orocobre (ORE) Chart

Question 11

“Hi, MYR up 17% on Thursday. Plenty of shorts on this one... are they going to look to get out? Is it opportunity for quick trade?” – cheers Alan M.

Hi Alan,

Myer (MYR) is indeed carrying a large short position (~11%) but as the chart below illustrates it’s been a good ride for the bears of MYR. I think the recent optimism in the stock stems from strong reports in other retailers thanks to current stimulus packages, which makes sense. MYR report earnings on Thursday this week (10th September) and we could see some fire works as a result. The stock actually looks like it could either double and halve from current prices i.e. very high risk.

There are so many risks in this business, many are priced in but some are not. As a ‘punt’ into the result I think it looks a reasonable bet although not one for us.

MM is neutral MYR.

Myer (MYR) Chart

Question 12

“Hi James, thanks for the commentary. It is changing our approach to managing our portfolio. In the medical space, do you prefer PAR (Paradigm Biopharmaceuticals) or SPL (Starpharma Holdings) and what is your view of the relative outlook of the two stocks? What is your view on the outlook of SHL(Sonic Health) or is it time to sell?” - Regards Ram.

Hi Ram,

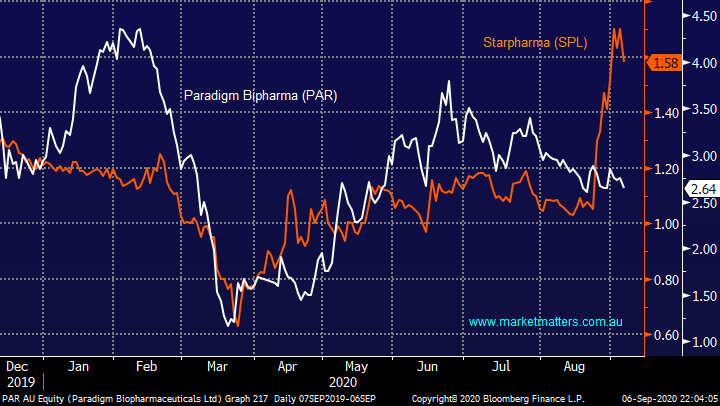

A few questions in here so please excuse the brevity. We prefer SPL over PAR.

Dendrimer products developer SPL has recently been awarded $1m funding from the government to develop a nasal spray for the treatment of COVID-19. Obviously, this hot topic comes with risks but while the stock holds above $1.40 it looks good.

PAR’s results delivered in August were ok but revenue below $5m is not exciting for a $600m business. The biotech delivered a net loss above $12m with its Phase clinical 3 trials underway likely to determine the stocks direction moving forward.

PAR (Paradigm Biopharmaceuticals) v SPL (Starpharma Holdings) Chart

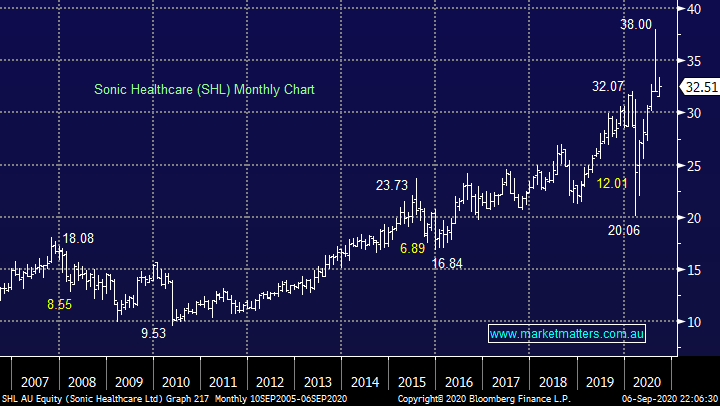

Medical diagnostics business SHL looks good risk / reward after correcting ~15%. The company has just been awarded a major COVID-19 testing contract in the US which Morgan Stanley reckon could be worth over $US3bn, even if they’re too optimistic it’s a healthy number.

MM likes SHL with stops under $31, or 5% lower.

Sonic Healthcare (SHL) Chart

Have a great day & week!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.