Banks + Resources see coordinated buying (GEM, IGL)

WHAT MATTERED TODAY

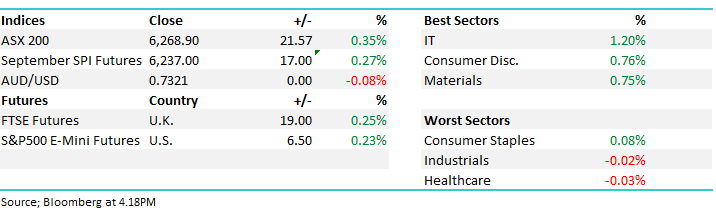

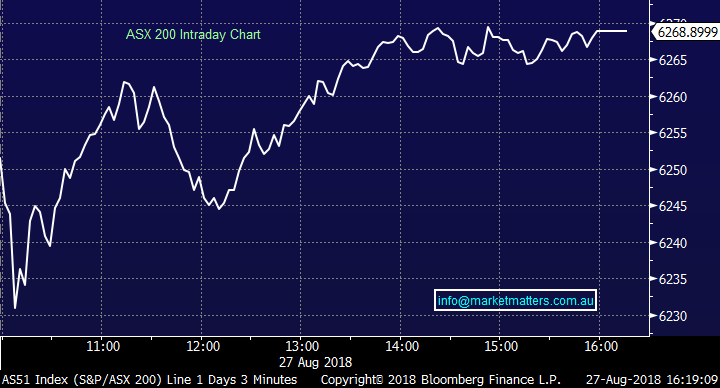

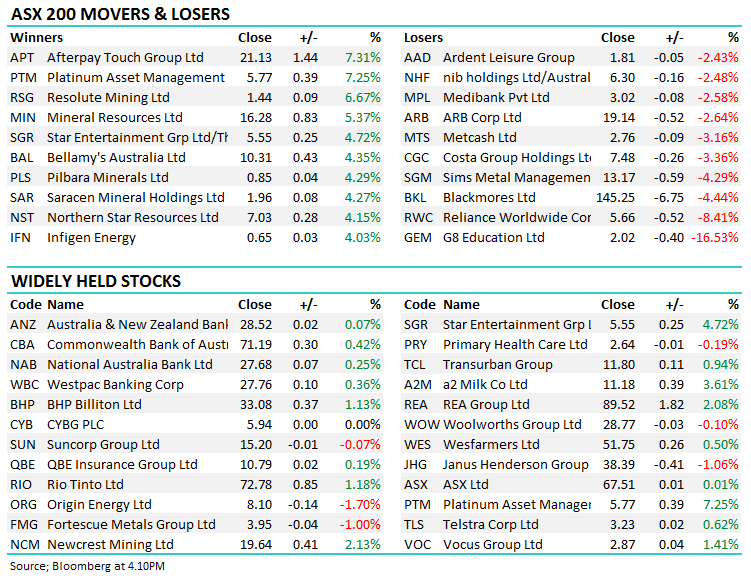

Another positive start to the trading week with the ASX brushing off some early weakness to grind higher throughout the session. The banks were well bid from early lows and the resources also found some love…RIO adding +1.18% while BHP was up by +1.13% however the most obvious moves came in the mid cap space, a number of which have been belted in recent times. Western Areas (WSA) for instance has fallen from $4 to $2.60 and bounced 2.69% today in the first sign that the worm might be turning for the sector.

We dipped our toe into RIO today, allocating 3% of the Growth Portfolio into the miner after it traded back into our targeted $71 range. Clearly the lack of detail around capital management has hurt RIO and to a lesser extend BHP, however it’s only a matter of time before the talk heats back up and the market gets re-focused on the huge amount of free cash being produced by the miners – and the large capital management initiatives around the corner.

Overall, the index closed up +21 points or +0.35% today to 6268.

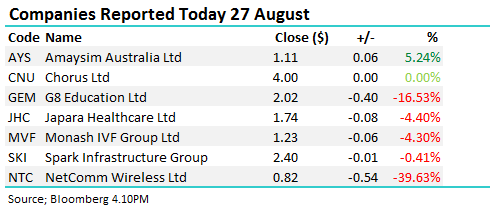

Reporting continued today, however at a slower pace, and overall stocks missed the mark; For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Macquarie put out an interesting note today on RIO and their capacity to sell more assets, potentially another ~$4b on top of the $8+bn already on the block. That would lead to more pressure to return capital to shareholders.

Elsewhere;

· Isentia Downgraded to Neutral at UBS; PT A$0.45

· Sims Metal Upgraded to Neutral at UBS; PT A$13.85

· Sims Metal Upgraded to Neutral at Credit Suisse; PT A$14.80

· Sims Metal Upgraded to Overweight at JPMorgan; PT A$16.70

· Automotive Holdings Reinstated Hold at Deutsche Bank; PT A$2.50

· Automotive Holdings Cut to Equal-weight at Morgan Stanley

· Costa Downgraded to Neutral at Macquarie; PT A$8.15

· Costa Downgraded to Neutral at JPMorgan; PT A$7.43

· Brambles Downgraded to Neutral at Credit Suisse; PT A$10.90

· Janus Henderson Downgraded to Underperform at Credit Suisse

· Platinum Asset Upgraded to Neutral at Credit Suisse; PT A$5.25

· EBOS Reinstated at Morgans Financial With Hold; PT NZ$20.43

· NRW Holdings Downgraded to Neutral at Hartleys Ltd; PT A$1.86

· Pilbara Minerals Raised to Buy at Baillieu Holst Ltd; PT A$1.05

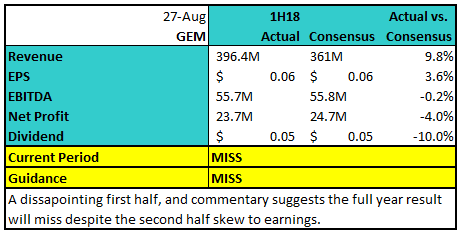

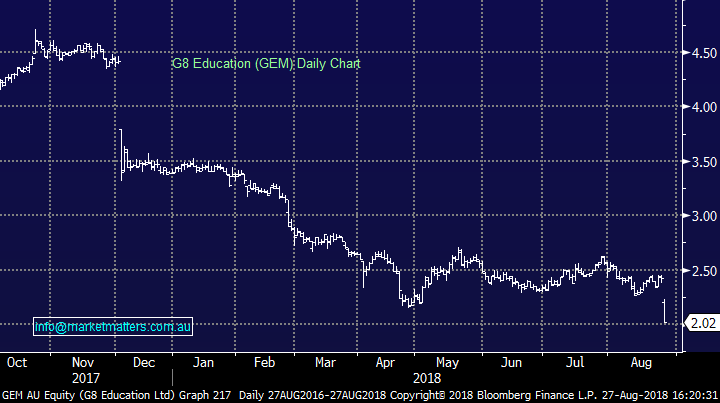

G8 Education (GEM) $2.02 / -16.53%; Childcare provider G8 announced first half results this morning that were below market expectations. The company has had a rough couple of months as it deals with a ‘very fluid market’ in terms of childcare demand, increasing supply and of course, changing Government regulation which is putting upward pressure on costs.

G8 saw significant decline in occupancy over the half, down to an average of 70.1% over 1H18 vs 79% in 2H17 or 72.6% in 1H17 – the trend resumed its move lower for the company, more than reversing the positive headway it had made last year. Along with falling occupancy, wage costs alone grew $7.2m over the half and another $1.2m was spent on training.

*note consensus numbers are limited in this stock.

Key to the guidance miss was clarification from G8 that EBIT is expected to be skewed 34:66 first half vs second. This suggests EBIT of $141.5m for the full year, -7.5% below current consensus EBIT at 153M.

G8 Education (GEM) Chart

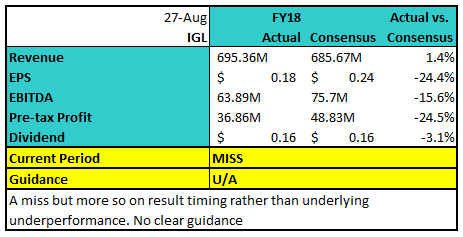

IVE Group (IGL) $2.26 / +0.00%; Marketing firm IVE group showed a messy set of numbers in their full year results today, well below market expectations but the miss was driven by some timing issues more so than poor performance. The company, which produces marketing & promotional material, showed revenue growth of near 40%, while EBITDA jumped 32% to $73.2m yet still well below analysts’ expectations. The stock is mostly unmoved today, despite what looks to be a miss, as the company talks up the continued benefit of synergies across the business, and the impact of a full year contribution of their Sydney facility – which has now been running for just 6 months.

The dividend was solid, and the company still has free-cash-flow after final dividend is paid – great news for our Income Portfolio.

IVE Group (IGL) Chart

OUR CALLS

We added Rio Tinto (RIO) to the Growth Portfolio today with a 3% weighting

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here