Employment Data Stronger than the Market Today! (RIO, Z1P)

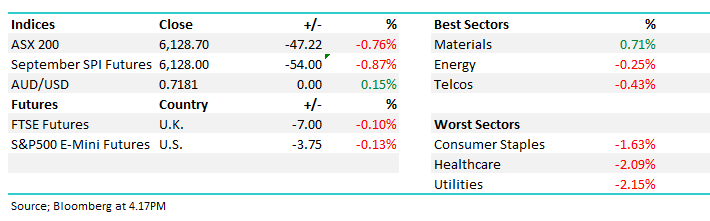

WHAT MATTERED TODAY

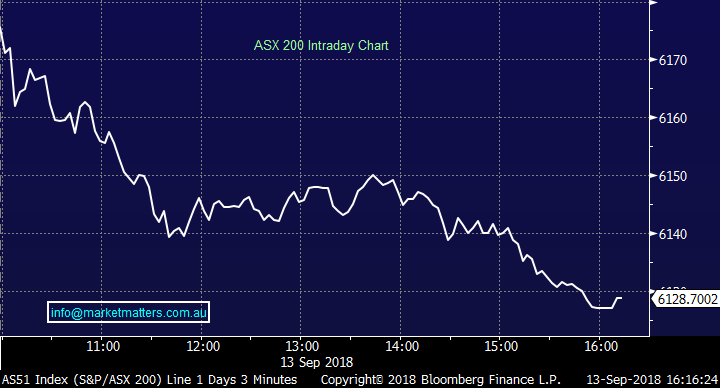

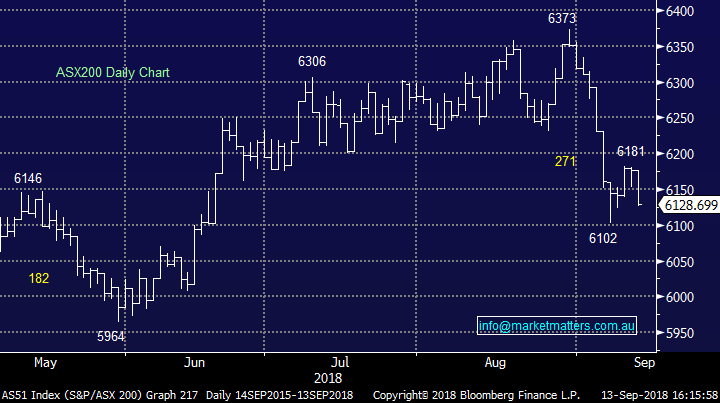

After a sluggish rebound to the upside over the past few days, the market rolled over today with selling playing out in the morning session, some semblance of support over lunchtime before stocks slid lower into the close – finishing on the low of the day. This is now the 4th session where we’ve seen the ASX 200 consolidate below 6200 and I think it’s worth re-emphasising the phrase we’ve rolled out recently…“the more time the market spends under the psychological 6200 area the more likely the next leg will again be down”.

It now seems likely the ASX is setting up for another leg lower with our ideal target ~5800, or another 5-6% lower.

Worth remembering though that massive amounts of dividends are paid in September – the highest amount on record and if we overlay that with the high cash levels currently residing in funds + the caution I keep reading about in the media, it supports our thesis that this market pullback will be one to buy – not panic out of. At this stage we expect to be strong buyers of weakness / close out our shorts towards the end of this month.

On the data front today, Aussie employment headlined the docket and it was stronger than expected with +44k jobs added versus expectations for +18k. The unemployment rate stayed stable at 5.3% although the participation rate was a shade above expected at 65.7%. This is a data set that worth watching closely and for now the employment situation looks strong. We say watch closely simply because house hold debt is high and while interest rates are low, it won’t become a problem unless of course we get an uptick in unemployment. Makes sense right, we can service our loans while we have a job, but it gets harder if we don’t. This is an important data point for holders of bank shares.

Aussie Employment Data

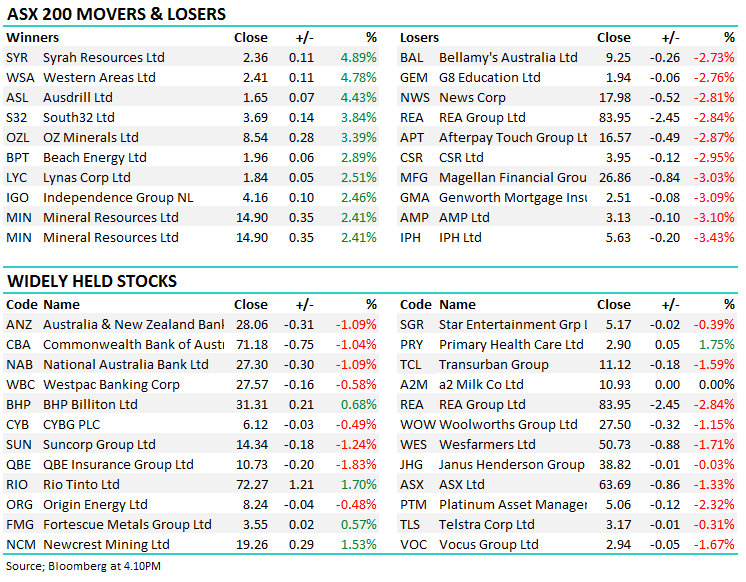

Interestingly enough today it was the defensive areas that saw most pain – utilities, healthcare and staples – better employment data = upward pressure on interest rates = higher Aussie Dollar = negative for interest rate sensitive names. We will continue to give those stocks that are exposed to higher rates a wide birth. Overall, the index closed down -47 points or -0.76% today to 6128. Dow Futures are currently trading off -30pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A lot out in the broker sphere / media today about the Labor Party’s policy to remove refunds on dividend tax credits. Most are sourcing an article from Citi that claim the change may reduce the difference of after-tax returns between Australian and international equities enough to contribute to the market moving lower. They reckon that bank stock valuations may fall 5%-10% on changes to franking credits, Telstra may lose favor with retail shareholders and the premium for BHP, Rio Tinto’s Sydney-listed shares over London- listed counterparts may reduce. We’ll delve into this in more detail in the next week or so - I have some thoughts around this and why it’s probably not as big of a deal as it’s being made out to be.

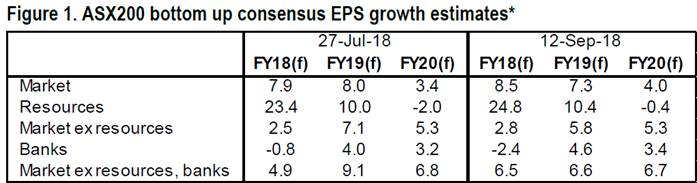

Staying with Citi for a moment, they did put out a good chart recently on earnings growth expectations for the Aussie market, pre and post reporting (see below). In terms of the market, analysts were expecting earnings growth of 8% in FY19 before reporting season and that’s been revised down to 7.3% post reporting, so a slight earnings downgrade overall. Resources and banks – the ‘old world’ stocks we’ve been speaking of recently saw upgrades overall, while it was the market excluding the banks and resources that saw the biggest deterioration in earnings expectations, or in other words, analysts had been drinking the Kool-aid ahead of results and have since watered down growth expectations outside the two main sectors.

Elsewhere, RIO and Fortescue closed up today, RIO +1.7% and FMG +0.57% on reports that MQG are expecting lower Ore to be shipped relative to the June QTR – down around 100mtpa from the June peak

Rio Tinto (RIO) Chart

RATINGS CHANGES:

• Myer Upgraded to Neutral at JPMorgan; PT A$0.43….Stock rocketed +37% today to close at 57c

Myer (MYR) Chart

Zip Co (Z1P) $1.09 / 5.83%; announced today a partnership with Target Australia to offer Zip interest-free payments to its customers. Target has a national network of 303 stores and prior to WES combining Target with Kmart, Target was generating annual sales of >$3.4b in 2015 and 2016 – now it generates sales of around $1bn. If Z1P can generate just 5% of transactions, this would be meaningful. The other important consideration here is that Target is obviously part of a wider conglomerate (Wesfarmers) that includes bigger, and more meaningful retail operations. The group has already rolled Z1P out through OfficeWorks and given they’ve now decided to offer it through Target, it seems like a staged, progressive roll out could be underway.

WES obviously sees the benefit in offering the platform which is good sign of validation. Rollout is planned for end of October. A speculative growth stock which has failed to rally along with the wider ‘growth thematic’ in recent times, we like the stock around current levels

Zip Co (Z1P) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.