ASX whacked for a second day – growth stocks feel most pain (COH)

WHAT MATTERED TODAY

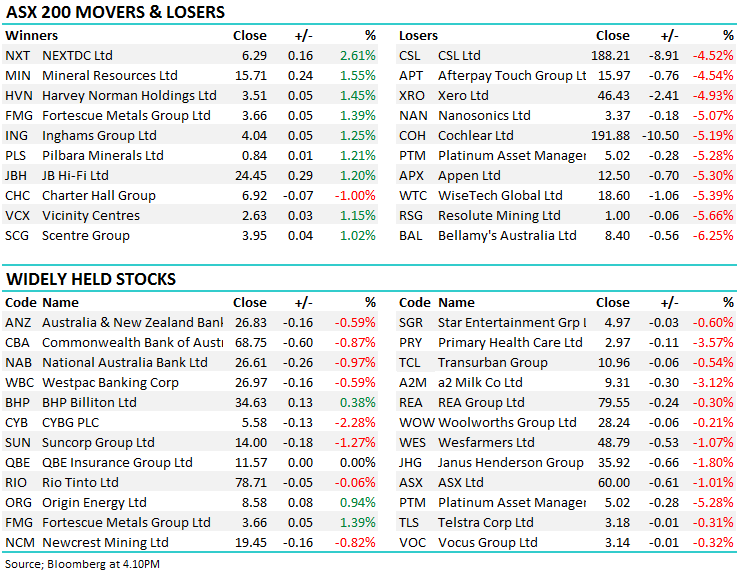

Another pretty aggressive day of selling for the ASX with most of the pain targeted towards the high valuation growth stocks in the market. Asian markets held up well today with Japan the only major regional market to see a drop, while US Futures were also fairly lethargic during our time zone. In other words, Australia was the ugly duckling of the region once again today. Turning back to the growth area of the market for a moment, this has been a clear momentum trade in the past 12 months or so – and it’s been a good one, however it seems obvious that the momentum has turned towards stocks that are tarred with the growth brush. That said, it’s hard to throw all growth stocks into the same basket - comparing CSL to Appen (APX) or Wisetech (WTC) is like comparing peas and carrots – sometimes they sit in the same bowl but that’s about it.

Worst performing stocks in the ASX 200 over the past week

Looking at the table above tells an interesting story. The majority of these are high valuation – lots of blue-sky style stocks that attract hot money but when markets turn these stocks get hurt. That’s not to say these companies are not strong businesses, or have not been great investments over the past 12 months, many certainly have been, however by looking at where the selling is being focussed in any market decline tells a critical story. Hot money is coming out of hot stocks but that’s about it. The more mundane parts of the market, the areas that have struggled, the boring blue-chips we’ve written about in recent times have in large part outperformed into this recent weakness.

I put out a quick Direct from the Desk Audio version just before market close today which covers some of the day’s trade – click on the image below to listen.

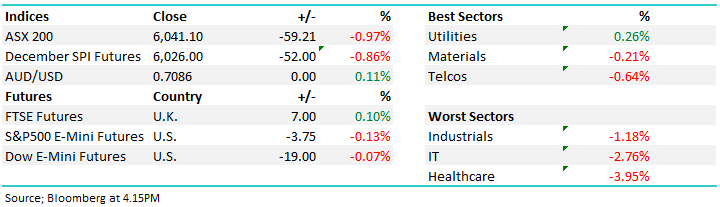

Overall, the index closed down another -59 points or -0.97% today to 6041. Dow Futures are currently trading down -0.11%/ -29pts Hang Seng (Hong Kong Futures) are up +0.32%/84pts.

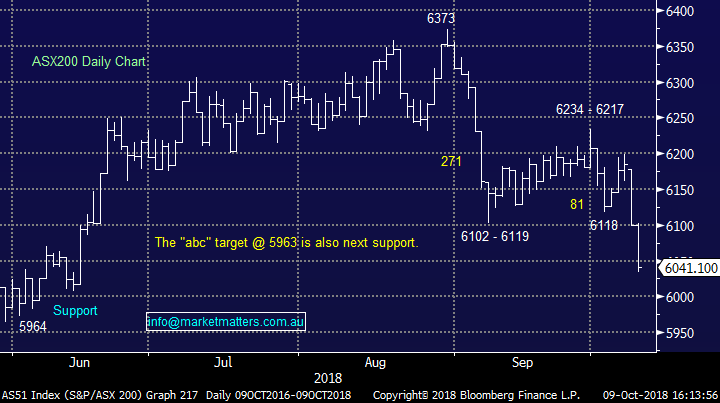

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Credit Suisse reckon that it will be a one horse race for MYOB with KKR the only logical buyer of the business, largely given the legacy issues around MYOBs platform.

RATINGS CHANGES:

· NextDC Upgraded to Hold at Deutsche Bank; PT Set to A$6.30

· ANZ Bank Upgraded to Add at Morgans Financial; PT A$28.50

· Beach Energy Upgraded to Hold at Morningstar

· InvoCare Upgraded to Neutral at JPMorgan; PT A$12

· Oil Search Upgraded to Buy at Shaw and Partners; PT A$10.50

· Temple & Webster Group Upgraded to Buy at Bell Potter; PT A$1.36

· Decmil Upgraded to Buy at Hartleys Ltd; PT A$1.25

Cochlear (COH) $191.88 / -5.19%; Cochlear is a hearing implant manufacturer and distributor whose product is near enough unrivalled in quality and market share. The drivers for COH are similar to CSL, global population growth, as well as the rise in the Asian middle class has seen demand for healthcare grow at consistently high levels for the past decade. This trend is set to continue, opening up more markets for these two big healthcare companies to move into.

We’ve targeted a pullback down to ~$190 in COH and CSL for some time, and the 15-20% decline we’ve seen in both stocks now presents an opportunity.

Cochlear (COH) Chart

OUR CALLS

We added CSL & COH to the Growth Portfolio today, both with a 3% weighting below $190

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.