Markets rebound strongly (BHP, TRS, APT, Z1P, ALL, SUN)

WHAT MATTERED TODAY

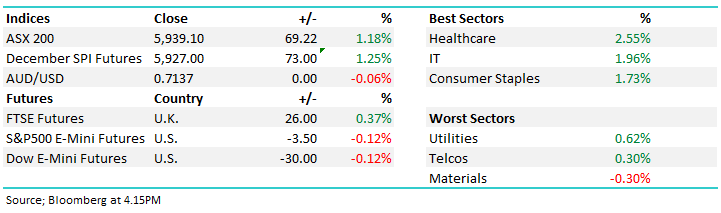

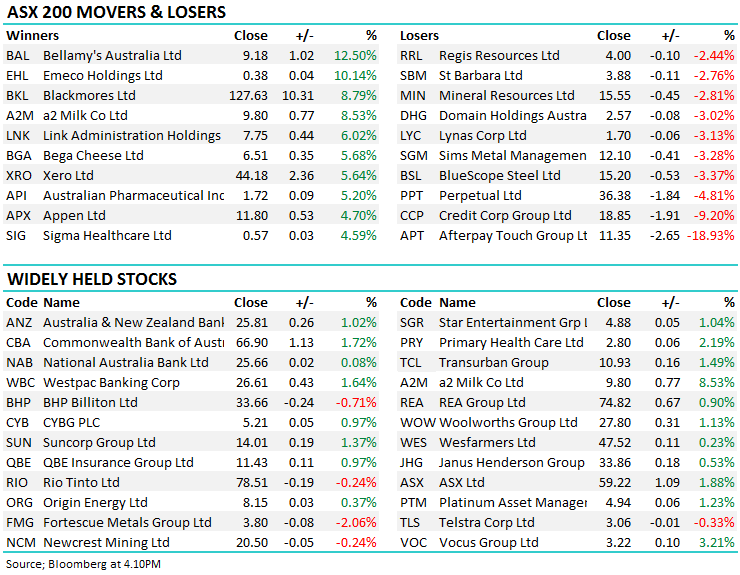

Reasonable strength for a second day running as the ASX piggybacked on the US markets positive move overnight. Although slightly underperforming the US indices, the top 200 index did grind higher throughout the day to finish near the session highs. Banks in particular found some love with financials adding 1.38% as a sector today. Buying was seen here on the back of solid results from Goldman’s and Bank of American in the US overnight as US reporting season heats up. Resources weren’t as strong as commodities with iron ore and metals edging lower which meant the materials sector was the only one to finish in the red.

Stock specific news continues to roll in. OZL say they’ll reach the top end of full year guidance at their Q3 production report today - BHP also released their quarterly which we discuss below – slightly soft. Afterpay (APP) & Zip co (Z1P) were taken to the cleaners late today on news of a Senate inquiry – more below as well as The Reject Shop (TRS) which sunk on a 40% earnings downgrade.

Also worth mentioning A2 Milk (A2M) which put on +8.53% as they reiterated guidance at the Citigroup Conference which is on today and tomorrow, Bellamy’s rode their coattails climbing 12.5% as well. There’s a new block chain option on the ASX as Identitii listed today, jumping +12.67% under ticker ID8 – the company is looking to help payments systems meet compliance requirements by integrating the technology – and to finish things off, CSL reiterated guidance of 10-14% NPAT growth on the year at their AGM today – the stock rose +2.46% as a result.

Today the ASX 200 closed up +69 points or +1.18% at 5939. Dow Futures are down -30pts/-0.12%

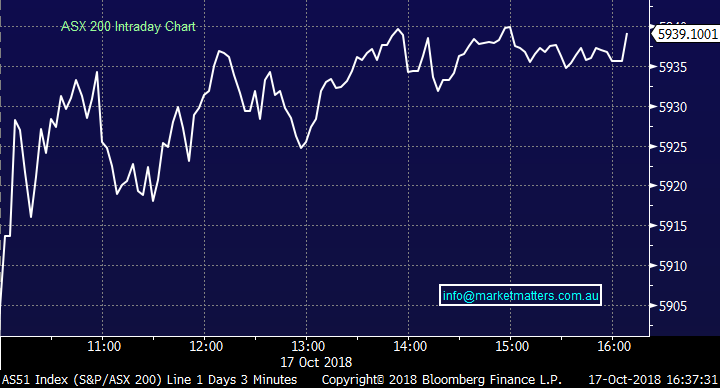

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Deutsche is the latest broker to sing the praises of Aristocrat Leisure (ALL) saying that ALL has scope for more market share gains. The stocks added +1.86% today to close at $29.58

Aristocrat Leisure (ALL) Chart

RATINGS CHANGES:

· Webjet Upgraded to Buy at Ord Minnett; PT A$16.80

· Pacific Current Rated New Outperform at Taylor Collison

· Link Administration Upgraded to Buy at UBS; PT A$8.90

· Orora Upgraded to Hold at Deutsche Bank; PT Set to A$3.20

· Newcrest Downgraded to Hold at Morningstar

· Sydney Airport Upgraded to Add at Morgans Financial; PT A$7.34

· Whitehaven Upgraded to Add at Morgans Financial; PT A$6

· Navigator Global Upgraded to Buy at Shaw and Partners; PT A$6

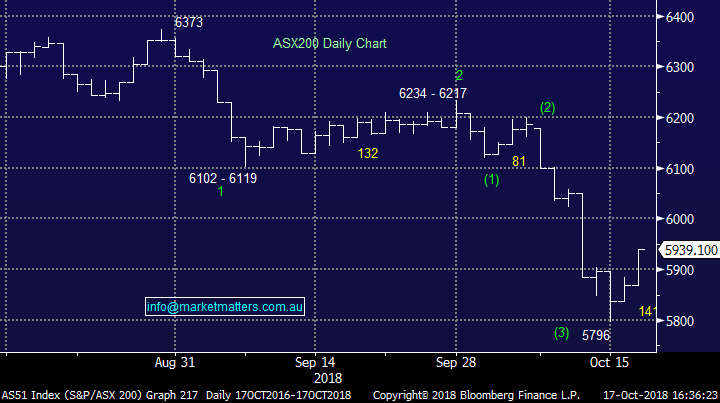

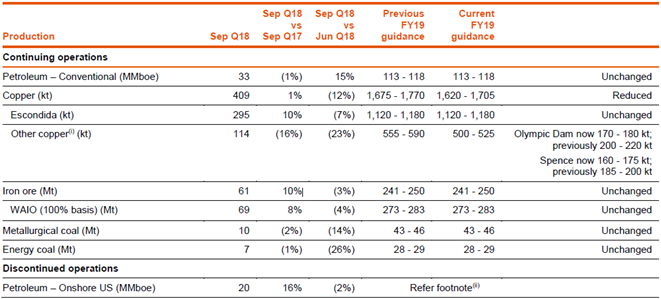

BHP Billiton (BHP) $33.66 / -0.71%; A day after Rio’s quarterly, BHP has posted their figures for the previous three months with Copper the only drag on production numbers. Petroleum was the only output that saw growth on the June quarter, with the falls in Iron ore and Coal outputs put down to maintenance work that should see production rates increase for the rest of the year, helping meet previously supplied guidance. Copper guidance for the full year was revised 3% lower as a result of disruptions to BHP’s two smaller operations

The company also mentioned the US asset sales saying the “process is on track to be completed by the end of October 2018, with the Fayetteville transaction completed on 29 September 2018. The net proceeds from the sale of our Onshore US assets are expected to be returned to shareholders.” Also discussed was the increase in BHP’s holding in SolGold, a Copper-Gold project in Ecuador. BHP now own 11.2% of the company and it appears to be aiming up for a takeover here. BHP traded lower today as a result of the copper guidance – keep an eye out for the Australian AGM in early November for the capital return news.

BHP Billiton (BHP) Chart

The Reject Shop (TRS) $2.73 / -38.93%; The discount retailer has today dropped FY19 profit guidance by a huge 40% - hard the fathom but that’s what occurred! Although sales were expected to fall, the rate at which they have done accelerated substantially over recent weeks, down -2.4% for the first 15 weeks of the financial year. The company blamed the poor performance on mortgage rate hikes forcing consumers to tighten the budget belt. Seems like a convenient excuse to us. Much of the company’s performance will now rely on the Christmas period which did serve them well last year.

We have spoken at length around the struggling retail market, even taking a look at TRS as an income play a few weeks back given their significant franking credit balance. At the time we concluded that while TRS is dirt cheap (8.6x expected FY19 earnings) and is expected to yield 7.6% fully franked on a 60% payout ratio, it does have its challenges. TRS is positioned as a discount retailer in a period when Aldi, Lidl and AMZN are all scaling in the Australian market. Life for like sales have been declining with a cost out program yet to offset the earnings deterioration. While they’re doing some positive things to improve the business particularly around the supply chain, it all seems a bit of a challenge for TRS at the moment, and the technical picture on the charts is a messy one.

The Reject Shop (TRS) Chart

Afterpay (APT) $11.35 / -18.93% & Zip Co (Z1P) $0.93 / -12.26%; News hit the ticker this afternoon that a Senate inquiry into alternative credit options had the votes to pass parliament. Both names opened up higher this morning before the article was released mid-afternoon – APT closed -24.9% from the day’s high, while Z1P was down -15.1%. The news isn’t all that new – ASIC had already launched an investigation into the loopholes that these companies use and the market should have realised this area was ripe for some form of regulatory intervention. Speculation on the terms of the inquiry seem to target high interest, payday and consumer leasing businesses over point-of-sale credit options like these two companies but still, the market voted with its feet.

We’ve highlighted the regulatory risk in this sector for some time - granted we’ve missed a lot of upside here but simply chasing momentum trades will often end in tears.

Zip Co (Z1P) Chart

Afterpay Touch (APT) Chart

OUR CALLS

We halved our weighting in Suncorp (SUN) today in the Growth Portfolio, a decision taken for a few reasons. Initially, SUN now has a bigger picture bearish set up which we take note of however the fundamental picture remains strong. Given the conflicting signals + our big overweight on the stock (8%), plus of course our desire to increase cash / flexibility given current volatility led us to reduce the position at $14.00 today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.