Don’t mess with the Chinese Govt! (WOR, FLT)

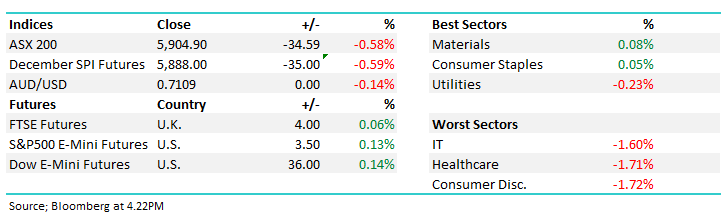

WHAT MATTERED TODAY

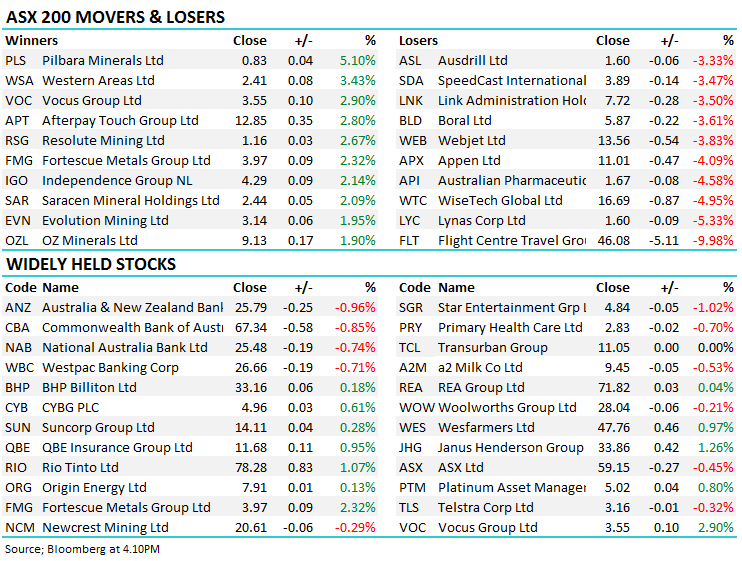

It was always going to be a struggle today for our market with the negative influences from the weekend both domestically and from the US playing out on stocks, however a recovery in US Futures throughout our session plus a very strong move on the upside across Asia (thanks to the Chinese Govt) provided some support for local stocks, particularly those exposed to emerging markets. We’re long Emerging Markets versus short the US Market looking for mean reversion of that very stretched theme, and that’s starting to play out. Other Asian focussed sectors did well today with the likes of BHP and RIO bucking off early weakness to trade higher, while Western Areas (WSA), a stock we’ve been targeting into weakness bounced well today, adding 3.43% to $2.41, Fortescue (FMG) another good performer once again threatening to break the $4.00 handle, up 2.32% on the session to $3.97.

Stocks that struggled today included Flight Centre (FLT) which took a hit after guidance fell short of market expectations – more on that below while Boral (BLD), a stock we mentioned in the video update today continued to slide, down -3.61% to close at $5.87. The high PE stocks were a mixed bag with APT ticking higher, while Wisetech (WTC) fell -4.95% and Xero (XRO) was off 1.64% on the day.

Today the ASX 200 closed down -34 points or -0.58% at 5904. Dow Futures are up +30pts /+0.12%

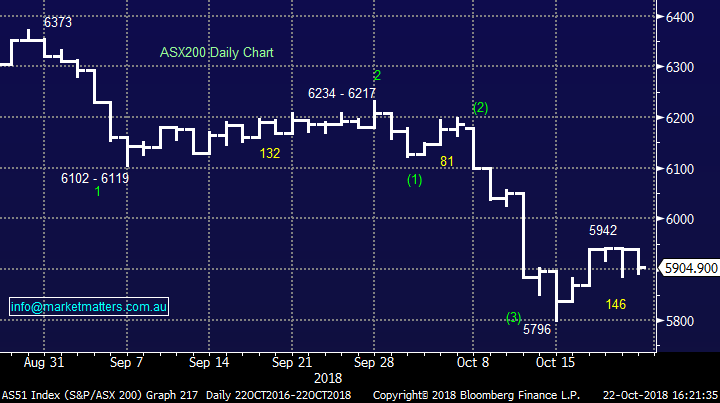

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Long term supporter of Sydney Airports (SYD), Macquarie penned a note on the Airport operator saying that the trend in international traffic growth is starting to turn, with expectations it will decline amid decrease in capacity growth – that will present another challenge to SYD’s 2019 outlook. The stock was down -1.66% today and sits in an area we simply don’t like at the moment.

Sydney Airports (SYD) Chart

RATINGS CHANGES: Brokers liked RRL although sellers hit the early strength.

· Nufarm Upgraded to Hold at Deutsche Bank; PT Set to A$6.10

· Credit Corp Upgraded to Buy at Baillieu Holst Ltd; PT A$23.25

· Event Hospitality Downgraded to Sell at Citi; PT A$12.95

· Regis Resources Upgraded to Neutral at Citi; PT A$4.25

· Regis Resources Upgraded to Buy at Canaccord; PT A$4.70

· Regis Resources Raised to Outperform at Credit Suisse; PT A$4.45

· Vocus Downgraded to Sell at Morningstar

· Iluka Upgraded to Buy at Morningstar

· Link Administration Downgraded to Hold at Morningstar

Regis Resources (RRL) Chart

Flight Centre (FLT) $46.08 / -9.98%; The woes in the travel space continued today with Flight Centre announcing guidance at their AGM today, sending the stock sharply lower. Shares initially opened ~2% higher before entering a trading halt to release the company’s AGM presentation. The company guided to pre-tax profit of $390m - $420m, which would represent growth of 1-9%, well below market expectations of $423.9m, or over 10% growth on FY18.

Clearly the market had gotten ahead of itself, and looking at the impact into future years, the consensus was around 10% growth out to at least FY22. Also shaking market confidence was the weak start to the year and heavy reliance on the second half skew to bring home the numbers, with only 35% of the company’s pre-tax profit expected to be earnt in the 6-months to December. Trading on a reasonable PE of ~17x, which seems cheap for a stock with 10% growth forecast out to FY22, but not cheap enough if the company can only manage the 6.5% guided growth.

Flight Centre (FLT) Chart

Worley Parsons (WOR) $17.84 / unch; The engineering firm Worley’s spent the day in a trading halt after announcing a huge acquisition, and a pretty substantial capital raise to go with it. The company will be tapping shareholders for $2.9b in a deal that will see the company double in size by taking the energy & resources operations off US based Jacobs in a $4.6b transaction, partially funded in debt, whilst Jacobs will also receive just shy of $1b worth of Worley stock in the deal.

The new Worley’s will derive about 50% of revenue from North America, whilst it will also vastly increase the chemicals exposure the company will have. The deal seems complimentary, opening up Worley’s to a range of new clients. High expected synergies + the use debt funding should ensure the deal is highly EPS accretive from the get go. New shares will be issued at $15.56, a 12.8% discount to the last traded price. The deep discount considers the sheer size of the transaction itself.

Worley Parsons (WOR) Chart – price on the chart is the theoretical ex-rights price

*note the last price in the chart above is the theoretical ex-rights price (TERP)

OUR CALLS

No changes in the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.