Gold, Healthscope & the BBUS a few green spots in a sea of Red (HSO, NCK)

WHAT MATTERED TODAY

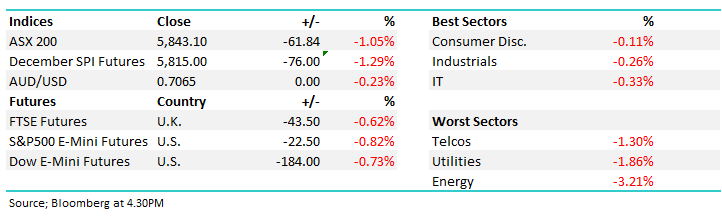

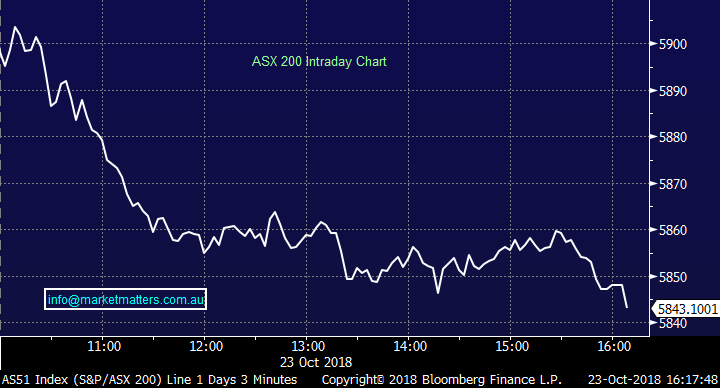

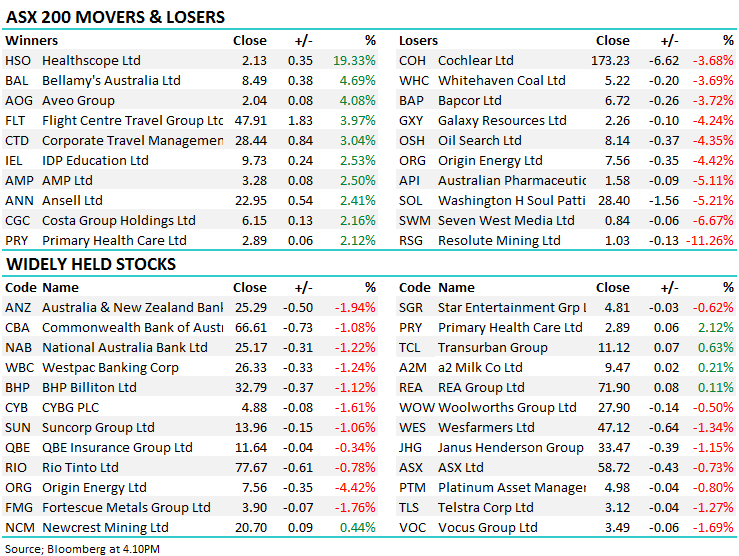

The market was hit again today after a poor lead from the US was exacerbated by weakness across Asian markets – the polar opposite to yesterday’s flow. A reasonable open for Aussie stocks initially, but when the Chinese market came online and was sold off fairly aggressively our market followed suit and we grinded lower throughout the afternoon, before getting an added kick in the guts on the close with some big selling in the Futures. Not helping the weakness was concentrated selling in the local energy names which were targeted by ScoMo, calling on retailers to lower prices and threatening a spate of new regulations that would benefit consumers but hurt profits. The energy sector ended down -3.21%, while AGL (-2.71%) also dragged the Utilities sector -1.86% lower.

Across the market there was plenty of stock specific news flow. We discuss Healthscope’s (HSO) takeover offer below, as well as news out of the Nick Scali (NCK) AGM. Elsewhere, Resolute Mining (RSG) was off -11.26% on a soft quarterly, despite maintaining guidance. Oz Minerals (OZL) closed lower despite spending most of the day strongly higher on positive news from the joint venture project at West Musgrave showing high grade nickel interceptions – OZL eventually got caught in the wider resource selling and closed down -0.11%. Fisher & Paykel (FPH) closed -2.44% lower as they were deemed to have infringed patents held by ResMed (RMD, -0.14%), although there is still a lot to play out in this story with more court action pending.

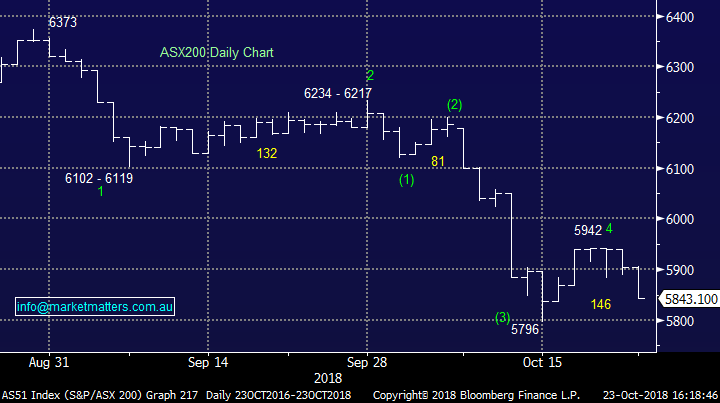

Overall, not a pretty oneas the ASX 200 closed down -61 points or -1.05% at 5843. Dow Futures are down -184pts/-0.73%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

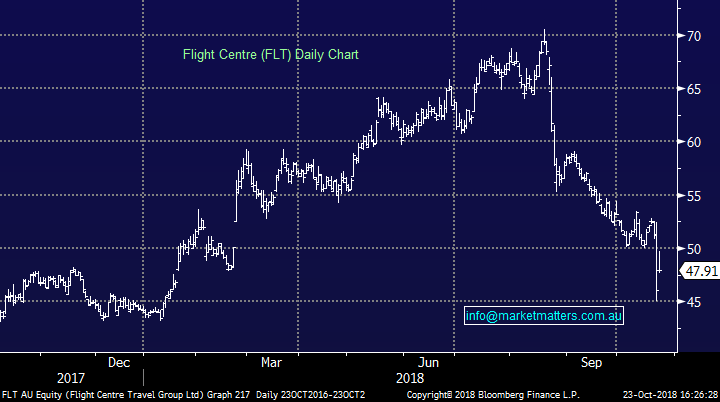

Broker Moves; Flight Centre (FLT) saw a lot of love from the brokers today despite yesterday’s poor guidance update. Macquarie upgraded to neutral on the view that the recent share price decline had re-rated the stock to a level that guidance justifies, previously being underweight with the view that consensus was too high. This take was similar to many analysts, with the stock down ~10% yesterday on a 4.5% miss on guidance at the midpoint to consensus. Flight Centre rallied +3.97% today bucking the overall market weakness.

Flight Centre (FLT) Chart

RATING CHANGES;

· Domain Holdings Upgraded to Neutral at Citi; PT A$2.75

· Vocus Downgraded to Neutral at Citi; PT Set to A$3.55

· WorleyParsons Upgraded to Neutral at Credit Suisse; PT A$17.60

· Flight Centre Upgraded to Neutral at Macquarie; PT A$47

· Flight Centre Upgraded to Overweight at Morgan Stanley; PT A$59

· Flight Centre Upgraded to Neutral at Credit Suisse; PT A$43.67

· Flight Centre Upgraded to Add at Morgans Financial; PT A$51

· Flight Centre Upgraded to Overweight at JPMorgan; PT A$63

· CYBG Rated New Underweight at Barclays; PT 2.80 Pounds

· MGC Pharmaceuticals Rated New Corporate at Edison

· Virgin Australia Upgraded to Neutral at Credit Suisse; PT A$0.20

· South32 Upgraded to Hold at SBG Securities

Nick Scali (NCK) $5.74 / -5.53%; Held their AGM today and the stock is down as a result. It seems the key to the market’s reaction in our view lies in one line from the CEO – “same store sales growth will be challenging in this volatile trading environment, particularly given the significant slow-down in residential sales, a key driver and catalyst for furniture sales.” We have previously discussed the impact a weak housing market would have on Nick Scali, however the company is doing a fine job in driving sales growth where it can while also opening new stores to drive earnings growth. We’ll cover this in more detail in tomorrow’s income report.

Nick Scali (NCK) Chart

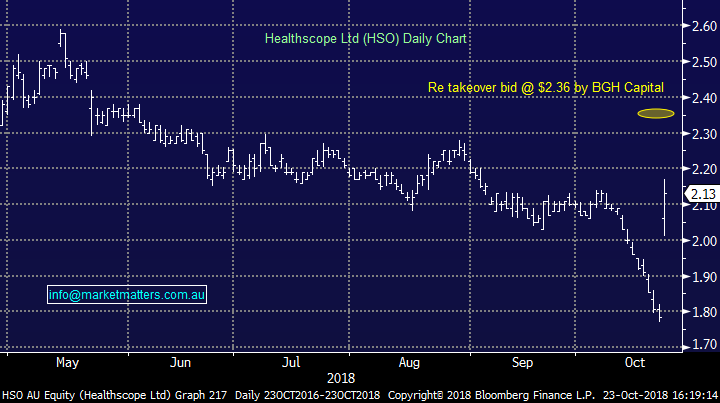

Healthscope (HSO) $2.13 / +19.33%; We were looking to sell the hospital operator Healthscope into strength from a new takeover offer from BGH & AustralianSuper, however the stock never quite reached our price limit. Our limit at $2.25 is a 4.7% discount to the offer at $2.36, and the stock closed at an almost 10% discount to the offer highlighting the markets concern around the validity of the bid.

The new offer is 5.6% below the recent Bookfield offer of $2.50, but at the same price as BGH’s original offer of $2.36. At the time, Healthscope said both offers materially undervalued the company. The new offer has some additional caveats in this current announcement around meeting earnings expectations, debt levels and the requirement that no recurring cash costs were classified as “non-operating expenses’ in the FY18 result. These caveats, combined with the poor recent price action in HSO stock makes us nervous that in fact, HSO earnings may have deteriorated impacting debt levels + there is obvious concern from the bidders around HSO accounting policies.

Healthscope (HSO) Chart

OUR CALLS

HSO – we have an active alert to sell at $2.25 of better in the Growth Portfolio, which was not filled today (the stock had a high of $2.17). We will retain this alert until further notice. While the bid price is $2.36, we think there are obvious risks that the deal does not proceed.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.