The retailers come under pressure (SUL, NCM, CIM)

WHAT MATTERED TODAY

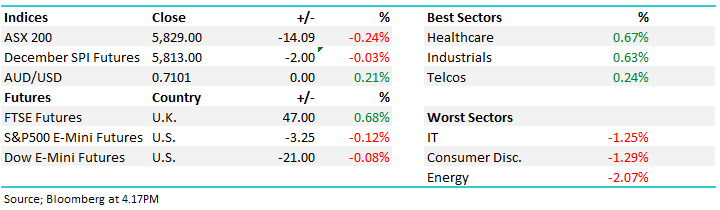

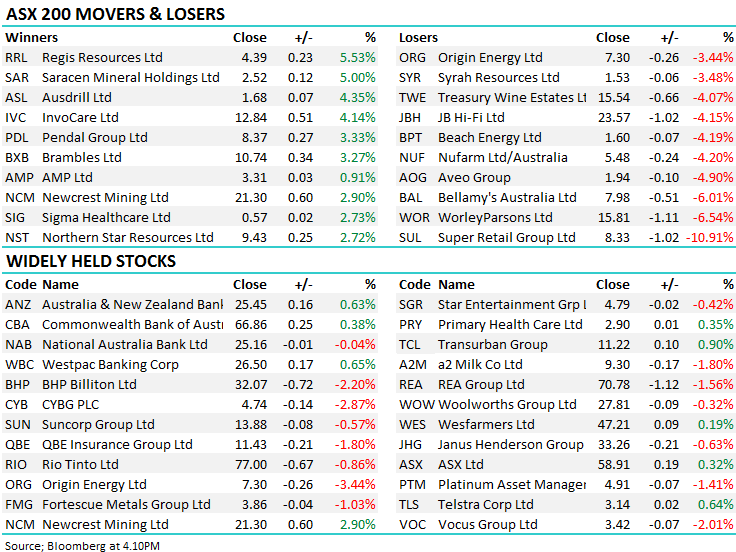

A choppy day on the market, with the local bourse tracking the US Futures over the strength in Asia today – the Hang Seng (HK) Futures trading up +0.4% after yesterday’s slump while the rest of the region saw copped a decent bid. The US futures ebbed and flowed throughout our session, eventually finishing the session lower. The ASX spent most of the morning in positive territory before slipping later in the day. Locally, banks saw some buying although not across the board with Westpac finishing +0.65% while NAB was off slightly, falling by -0.04%. Resources were softer, dragged by weak commodity prices, while energy felt the pain of the >4% slump in oil prices over night.

Property group GPT upgraded dividend guidance thanks to an increase in funds from operations partly attributed to the recent acquisition of Eclipse office - the stock up +1.97% on the announcement. Bellamy’s (BAL) tracked back below the key $8 level today, closing off -6.01% thanks to some soft news from their AGM – a volatile beast that was trading at ~$23 earlier in the year. The company is yet to receive a key licence for sales in China, whilst also noting that full year numbers are now expected to be at the lower end of prior guidance.

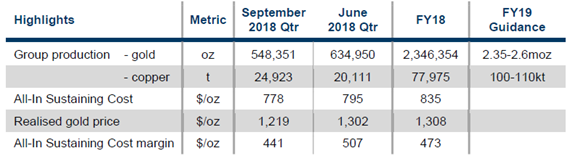

Treasury Wine Estates (TWE) also took a hit, off -4.07% on news that Aussie wine exports to the US had fallen 8% in the past year despite the fall in the AUD making our exports cheaper. Treasury are yet to comment, however the US (alongside China) has been flagged as key to the growth rate of the company’s sales. Newcrest (NCM) was up, but in line with gold peers following their first quarter report that lacked any surprises. Below we discuss Newcrest, Cimic’s third quarter update and Super Retail Group (SUL), which fell -10.91% on news the CEO would be leaving the company after 13 years.

Today the ASX 200 closed down -14 points or -0.24% at 5829. Dow Futures are down -21pts/-0.08%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

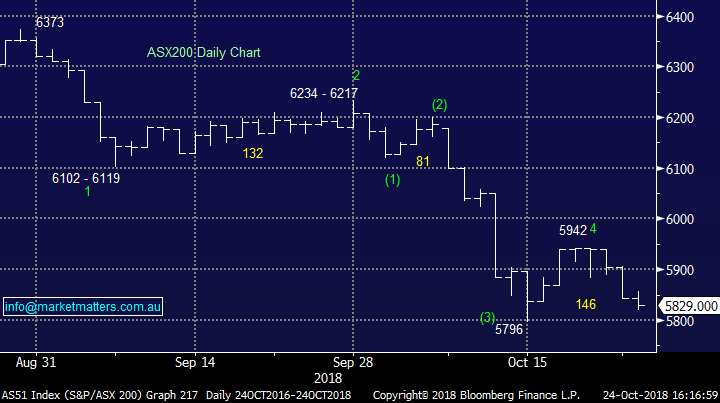

Broker Moves; Brambles (BXB) caught an upgrade from two brokers today following yesterday’s trading update. Credit Suisse turning positive on the logistic company on expectations they will increase margins as they push through rising cost pressures, largely in terms of transport. Brambles has been stuck in a loop over the past few years as many consider their relevance in the ever changing consumer environment.

Brambles (BXB) Chart

Elsewhere;

· Atlas Arteria Downgraded to Hold at Morgans Financial; PT A$6.95

· Nick Scali Downgraded to Neutral at Macquarie; PT A$5.70

· Stockland Downgraded to Underweight at Morgan Stanley; PT A$4.15

· Reject Shop Cut to Underweight at Morgan Stanley; PT A$2.10

· Brambles Upgraded to Outperform at Credit Suisse; PT A$11.50

· Brambles Upgraded to Equal-weight at Morgan Stanley

· Cimic Cut to Neutral at Credit Suisse; Price Target A$47.50

Super Retail Group (SUL) $8.33 / -10.91%; Down sharply today after they announced that the CEO Peter Birtles will retire from the group in 2019, plus they also gave a trading update around sales growth, which has slowed in a number of their key brands. The update comes close on the heels of a similar sort of announcement from Nick Scali (NCK) at their AGM yesterday and both stocks have been sold off as a result. Looking at the Supercheap Auto brand, like-for-like sales growth slowed to 3.1% in the past 4 months, versus about 5% in the 1st 6 weeks of the FY through mid-August while Rebel and my favourite BCF have also slowed, although sales have accelerated at Macpac. This announcement today was about slower growth in sales rather than anything more sinister, however the pending retirement of Peter has probably been the bigger driver of the market’s reaction.

Super Retail Group (SUL) Chart

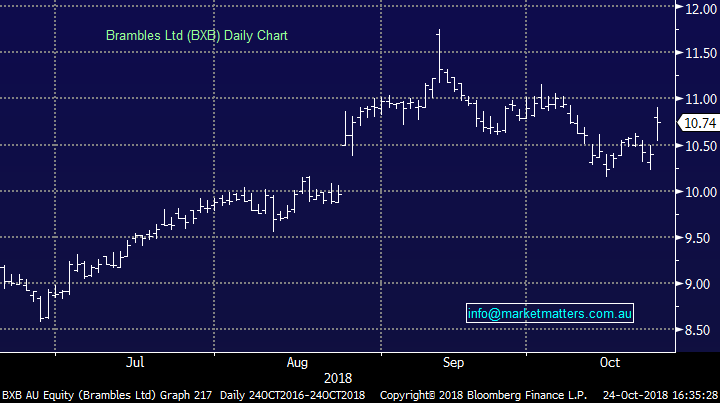

Newcrest (NCM) $21.30 / +2.9%; Newcrest has tracked higher today, although in line with other gold miners, on a reasonable quarterly report from the miner this morning. Although production for the September quarter was down over 13% on the June quarter, and well below the run rate required to reach the full year guidance, the market was pleased enough with the quarters work, and the stock was bid up after the company maintained guidance. Planned maintenance dragged on the run rate, but the company said they “expect gold production to increase over the remainder of the financial year.”

Costs were seen lower on a per oz basis, and while the realized price was slightly lower this wasn’t unexpected – prices are pushing higher now in both USD and AUD terms. They hold their investor day tomorrow, and a site visit to the Cadia mine on Monday. We hold the stock, mostly because the gold price looks to be pushing higher and NCM have a world class gold asset.

Newcrest (NCM) Chart

Cimic (CIM) $47.71 / +1.6%; Yesterday afternoon (after market) CIM released a Q3 trading update saying that net profit increased by 13% in the nine months through September and re-affirmed full year guidance of $720 – $780m for the full (calendar) year. While some in the market thought CIM would upgrade, the update was clearly a strong one setting the infrastructure stock up for a full year result that at least hits the top of the guided range – although we think it probably beats. This is clearly a play on the Infrastructure build in Australia and they’ve successfully bedded down some large acquisitions in recent times including engineering services company UGL and mineral processing company Sedgman. The CIM pipeline of work now totals $35 billion. We continue to like CIM

Cimic (CIM) Chart

OUR CALLS

Growth Portfolio; We excited the BBUS today, which was the short S&P 500 exposure

Income Portfolio, We added Alumina (AWC), up weighted Nick Scali (NCK) into today’s weakness while we exited positions in the Australian Leader Fund (ALF) and Eclipx Group (ECX).

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.