BHP to return $10.4bn to shareholders (BHP, NAB, WOW)

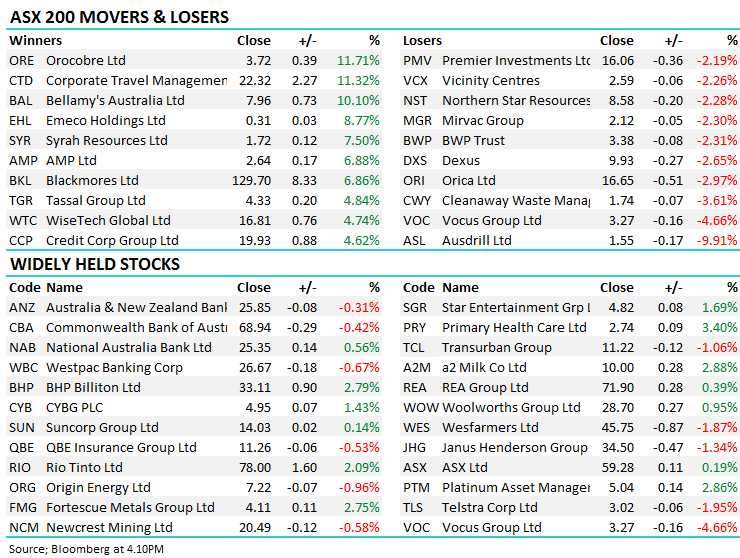

WHAT MATTERED TODAY

The market was strong early on today before petering out into the close. Early optimism stemming from a reasonable NAB result but more importantly, the announcement from BHP that they’d return $US10.4bn back to shareholders through an off market buy back and a big special dividend. That saw the stock rock n roll one open with the very bullish start to trade (+5%) at $34.20, the level we saw a huge line of 12.93 million shares cross at $34.20 worth $442.1 million – apparently the MQG insto desk was the broker to the trade and on standard rates of 0.20% on both sides, that’s a ~$1.7m trade ticket – a good day in the office! Someone keen to buy BHP given the strong price paid and a 400m line is a fairly rare event in Australia.

Elsewhere, Perpetual (PPT) had their AGM today with no real surprises one way or another – the stock lost -1.1% however it has been strong the last two sessions. Woolworths (WOW) was also out with a sales update which were weak but that was largely to be expected – the stock ending 0.95% higher at $28.70, while AMP rallied again (+6.88%) after providing more substance as to why it’s selling its life business, while we’re hearing some murmurs that Macquarie (MQG) could be considering a bid for the stock – that would be a bold move. Fortescue (FMG) was again strong adding another +2.75% to close at $4.11 confirming a breakout of its current range while RIO was also strong adding 2.09%. The resources as a sector overcoming recent weakness to be the biggest index contributor accounting for +13.56 index points – or in other words, the rest of the market was flat / down.

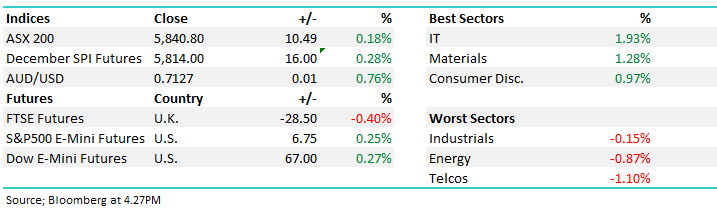

The ASX 200 closed up +10 points or +0.18% at 5840. Dow Futures are up +69points or +0.28%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; CBA in focus after Mitsubishi UFJ agreed to buy CBA’s global asset unit, adding A$213 billion ($150 billion) in assets under management across Australia, the U.S. and Asia. The deal could mean CBA has $3 billion to return to shareholders from FY20.

RATINGS CHANGES:

· Independence Group Upgraded to Buy at Citi; PT A$4.70

· Vocus Downgraded to Sell at Morningstar

· NIB Holdings Upgraded to Add at Morgans Financial; PT A$6.49

· Gascoyne Cut to Speculative Buy at Argonaut Securities; PT A$0.24

· South32 Upgraded to Buy at HSBC

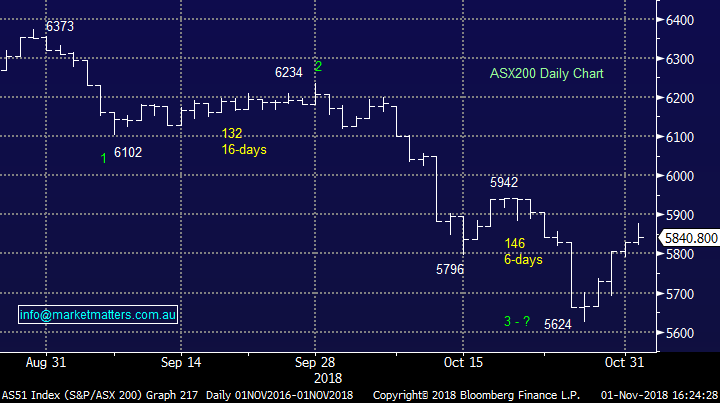

BHP Billiton (BHP) $33.11 / +2.79%; The big Australian has today announced a big capital return to shareholders, ending months of speculation as to how BHP would return over $US10b of asset sale proceeds to shareholders. The bulk of the sale of BHP’s US shale assets went to BP, which paid half of the consideration today with 6 equal monthly instalments to cover the other half. From the company:

“BHP plans to return US$10.4 billion to its shareholders through the combination of an off-market buy-back and a special dividend.

The program will commence immediately with BHP targeting an off-market buy-back of US$5.2 billion (A$7.3 billion)(1) of BHP Billiton Limited shares (Off-Market Buy-Back) under which BHP Billiton Limited can buy back shares at up to a 14% discount. BHP intends to pay the balance of the net proceeds from the sale of its Onshore US assets (expected to be US$5.2 billion) to all shareholders in the form of a special dividend (Special Dividend) to be determined following completion of the Off-Market Buy-Back, and to be payable in January 2019.”

So special dividends and buy-backs, not too dissimilar to Rio’s ongoing capital return and is much the same as what the market was expecting – although the lack of on-market buyback of UK listed Plc shares is surprising. The structure allows a large amount of the company’s franking credits to be paid away attached to both the special and the buy-back. Expect the special dividend to be around $1.40 depending on exchange rates.

BHP Billiton (BHP) Chart

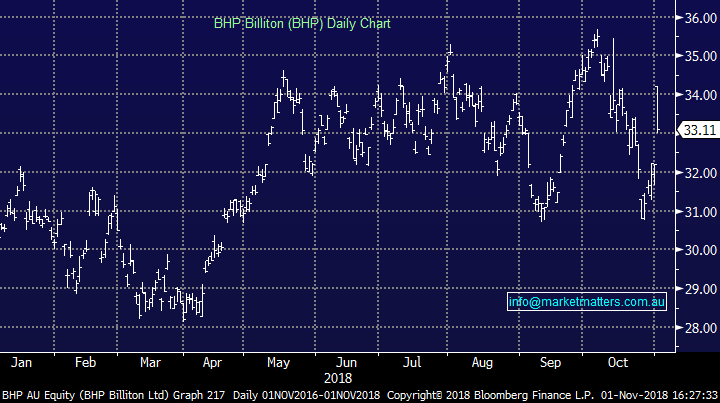

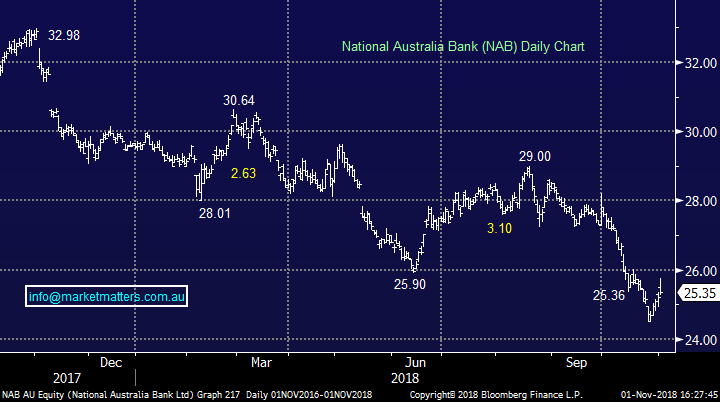

NAB (NAB) $25.35 / +0.56%; NAB reported FY18 results this morning and they were pretty much inline (to a slight miss) however clearly the negative positioning towards the banks means that a weakish result void of any large negative surprises is met with buying. NAB’s capital position is weak however planned asset sales should rectify that while they maintained the 99c dividend for the half taking the full year to $1.98. On current prices NAB is yielding 7.8% fully franked or 11.1% while trading on a PE of 10.7x, making it 11% cheap versus its 5 year average.

NAB Chart

Woolworths (WOW) $28.70 / +0.95%; The supermarket group is tracking slightly higher despite posting its worst quarter of like for like (LFL) sales growth in two years, impacted by the Cole’s little shop promo and plastic bag saga. The result was more or less as expected, with some positives surprises albeit off a low base.

Food – makes up about 70% of the groups EBIT – saw LFL sales growth of +1.8%, over average prices excluding tobacco & fruit/veg fell -2.9% as they discounting was used to drive some growth. Online sales grew from 2.7% to 3.3% of food sales.

Liquor – ~20% of the EBIT – managed LFL growth at 1.7% for the quarter, slightly below the markets expectations

Big W – drags EBIT -9% – one positive in the announcement, Big W saw LFL grow 2.2% as signs the big (W) headache is easing. For only the second time in the last five years, Big W had back to back positive LFL growth

The group is also looking to divest its petrol assets which saw 8.1% growth over the quarter. A decision is yet to be made as whether the business will be sold or de-merged through an IPO. A tough sector to be in these days – particularly in the Australian market with Aldi taking market share and the German supermarket Kaufland looking to set up shop. Growth for Woolworths is forecast at low-mid single digit (3-4%) for the next few financial years, as such the PE of ~21x FY19 is too expensive for us.

Woolworths (WOW) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.