Westpac result okay, Webjet to buy Dubai travel business (WBC, BIN, WEB)

WHAT MATTERED TODAY

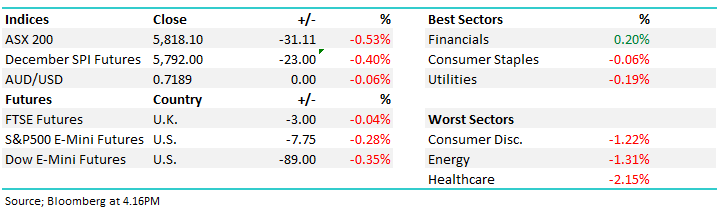

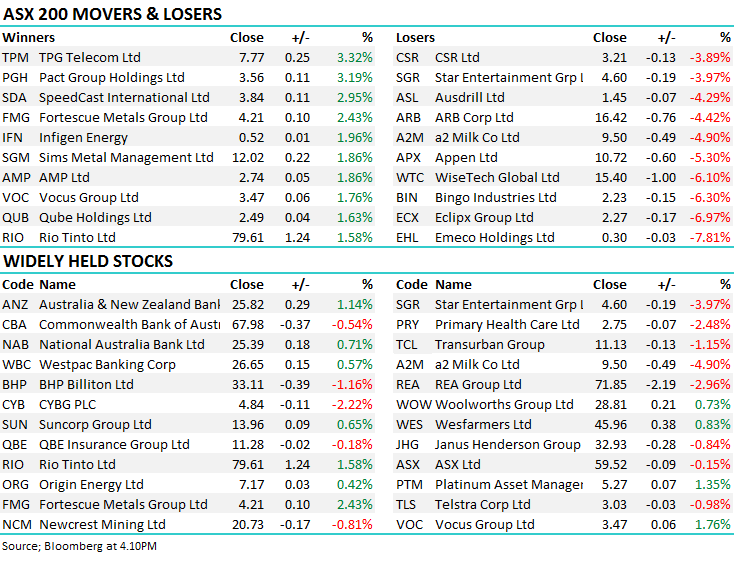

A reasonalble open to trade this morning following Westpac’s FY18 result which held no real major surpirses, while better than expected ANZ jobs data helped to support the banking sector early on - however sellers got stuck in from the 1pm high and the market lost a quick ~37 points into the closing bell. Resources were a mixed bag – the Iron ore miners doing well, FMG + 2.43% to $4.21 while RIO traded briefly above $80, before settling up 1.58% to $79.61. Multiple news articles talking up the gains of lower quality Iron Ore in recent times – a thematic we’ve discussed in recent notes which is providing a tailwind for FMG. Elsewhere though, it was a weaker session for the miners as they were sold from ealier highs – Kidman (KDR) an example after pushing up to a $1.43 high during early trade, only to be sold off to close at $1.29, down ~3% on the day, a very volatile play.

The ASX 200 closed down -31 points or -0.53% at 5818. Dow Futures are currently down -73points or -0.29%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Brokers have been busy on Macquarie after they upgraded guidance last week for EBITDA growth of 10% for FY19. MQG had originally guided to earnings largely flat on FY18 however the market never believes that, so consensus was already sitting at +8% growth. While 10% is a slight upgrade the street is very bullish on MQG – 10 buys, 5 holds and no sells which leaves very little room for disappointment. If the market becomes more volatile as we expect it will, MQG is a high beta play on the market, expect MQG shares to be volatile. Selling strength in a stock that seems to be universally loved in my view makes sense. The stock ended down -0.57% today at $121.72

Macquarie Broker Consensus

RATINGS CHANGES:

• Macquarie Group Downgraded to Hold at Morningstar

• Macquarie Group Upgraded to Overweight at JPMorgan; PT A$132

• Orica Downgraded to Equal-weight at Morgan Stanley; PT A$17.90

• Orica Upgraded to Outperform at Credit Suisse; PT A$19.08

• MYOB Downgraded to Neutral at JPMorgan; PT A$3.77

• Xero Upgraded to Overweight at JPMorgan; PT A$48

• Mineral Resources Upgraded to Overweight at JPMorgan; PT A$18

Westpac (WBC) $25.35/ +0.56%; WBC reported FY18 results this morning and they were pretty much inline (to a slight beat) however as was the case with both ANZ and NAB, the negative positioning towards the banks means that an inline / slight beat void of any large negative surprises is met with buying. WBC revenue was up 3% for the year, although the growth moderated in the 2nd half which is a slight concern. The dividend was flat at 94cps as expected while capital was slightly above market expectations. On the positive side, cost guidance for FY19 was better at a 1% decline versus around +2% growth which was forecast by the market.

Here's a quick view of the result we put out before open this AM;

On 11.1x WBC is 15% 'cheap' versus historical averages, however housing related headwinds remain. We own WBC in the Growth Portfolio.

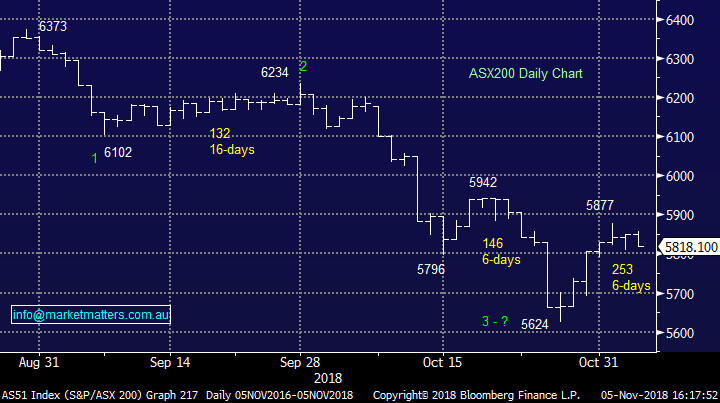

WBC Chart

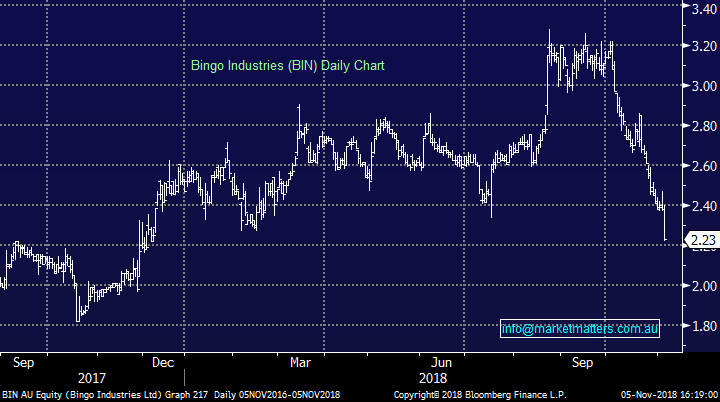

Bingo (BIN) $2.23 / -6.3%; No real news flow on BIN today, however it simply caught my eye as a stock that has experienced a massive re-rate in PE multiple after making a large acquisition (Dial-a-Dump). The is relevant for WEB (discussed below) and highlights simply how savage the market can become when a growth stock stops delivering such strong growth rates. We get the reduction in earnings expectations magnified by the contraction in the PE – in the case of BIN down from 23.6x to 15.4x, which is pretty close to a market multiple.

Bingo (BIN) PE

Bingo (BIN) Chart

Webjet (WEB) $12.91 /unchanged; WEB remains in a trading halt after announcing the purchase of Dubai-based hotels wholesaling business Destinations of the World for $240 million. The purchase is from private equity and the deal is based on unaudited accounts, with only 12% of the purchase price being through an earn out over time. The bullish rationale for the deal centres on scale, with Destinations of the World having contracts in place with 5,600 hotels across the Middle East, Europe, Asia Pacific and North and South America. It is a strategic fit given it’s a business-to-business wholesale platform that essentially links hotels with travel agents, tour operators and any operator that books hotels for their customers.

In terms of the seller, Gulf Capital is the biggest PE firm in the Middle East – they know their stuff so I’m sure the market will be somewhat sceptical of the deal when shares come back on the market post capital raise. WEB will offer existing shareholders 1 new share for every 9 they hold at $11.50, a steep discount to the $17.57 price shares were trading at in August before the ‘growth sector’ got hit. We remain bearish WEB with a technical target ~$10.

Webjet (WEB) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.