Markets rally towards the close to end slightly higher (APX, GEM)

WHAT MATTERED TODAY

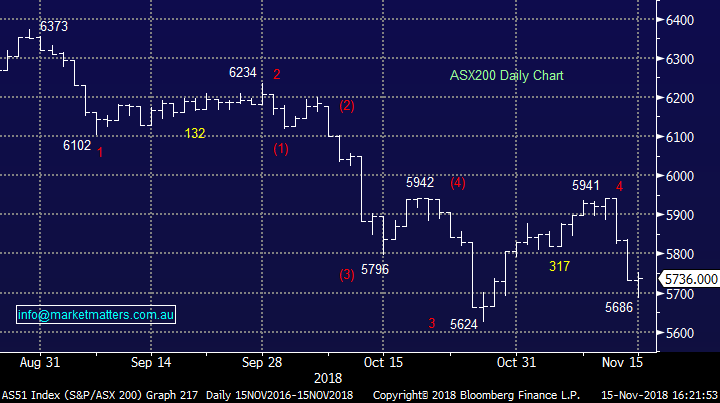

Another intriguing session for Aussie stocks today with the market holding it together till midday before sellers took hold and drove the market into a 3pm low around 5690 for the ASX 200 before we saw a strong rebound into the close – the benchmark putting on a short sharp ~50points in the last hour of trade. From a technical standpoint (charts) had the market made a new low and recovered the way it did today that would be a very bullish sign, however given the last two sessions where stocks have been consistently offered all day, it was a positive sign non-the-less to see the void of sellers into the close, allowing the market the rip higher.

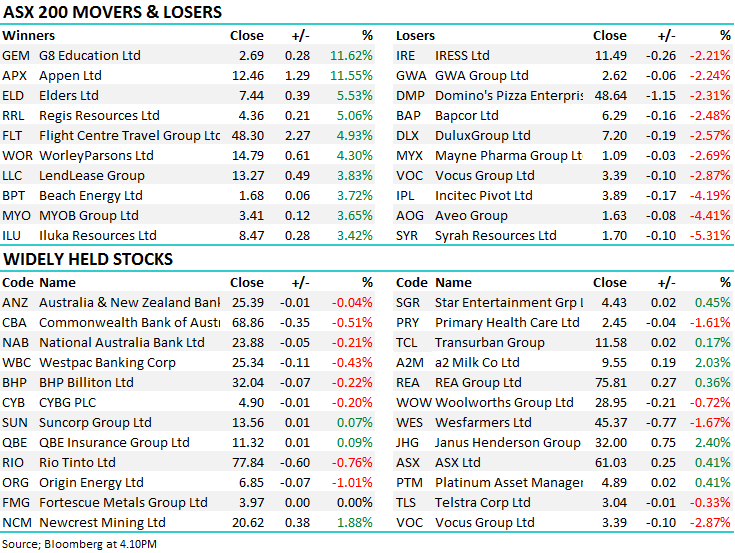

Energy stocks providing the main support today, bouncing after a period of decent weakness while there was some reasonably strong individual stock moves across the board. Appen (APX) which we’ve written of recently rallied well on an earnings upgrade while beaten down child care provider G8 Education (GEM) had a day in the sun after showing some very tentative signs that occupancy levels may be improving – more on both below.

On the economic front today, employment data headlined with the unemployment rate coming in at 5.0% versus +5.1% expected. Full-time jobs rose 42,300, Part- time jobs fell 9,500 while the participation rate and wage growth were both better than forecast. A good set of numbers.

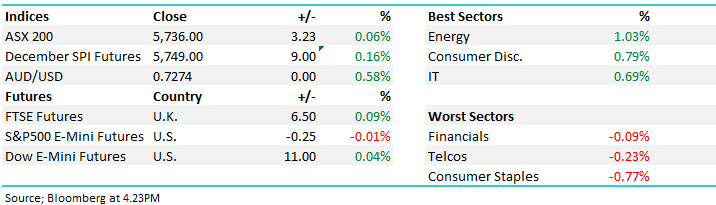

Data dump today

Overall, the ASX 200 closed up +3pts or +0.06% at 5736. Dow Futures are currently up +12points or +0.04%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Finally some love for Lend Lease (LLC) which has been down the gurgler in the last week, today the stock rallied +3.83% on a CS upgrade, although the stock still off 25% in the last 5 sessions.

· AusNet (AST AU): AusNet Upgraded to Equal-weight at Morgan Stanley; PT A$1.72

· Lendlease (LLC AU): Lendlease Upgraded to Outperform at Credit Suisse; PT A$16.20

· Rio Tinto (RIO LN): Rio Tinto Downgraded to Sell at Liberum

· CYBG (CYB AU): CYBG Upgraded to Buy at Goodbody; Price Target 3.50 Pounds

Some interesting read throughs from broker research this am. Morgan Stanley did a good note on Wesfarmers (Bunnings) following the Dulux result. The broker saying that Dulux’s full-year profit result indicates softness for housing-linked retailers given paint is a key customer traffic driver, important given that Bunnings (and thus paint) will be a larger proportion of WES earnings post Coles spin out. They go onto say that Wesfarmers’ Bunnings unit’s resilience to a soft housing cycle is overestimated as it hasn’t experienced a protracted housing downturn that’s clearly emerging in Australia. WES was hurt on that note today ending down -1.67% to $45.37

Wesfarmers (WES) Chart

Market Matters Webinar; I presented a Webinar today at lunchtime covering our views into Christmas and beyond – the bigger picture themes ahead and reasons to stay shorter term. I often here that long term investing is lower risk, however after a 10 year bull market for stocks which has seen most global indices up multiples of themselves, I simply don’t buy it at this point in the cycle. The macro backdrop is likely to have an increasingly important impact on stocks into 2019 and keeping our finger on the pulse will be very important.

For those that missed todays update, simply click on the image below to hear a recording – it goes for about 40 mins and apologies to those who asked questions, I wrapped it up fairly quickly given we were very busy on the desk today.

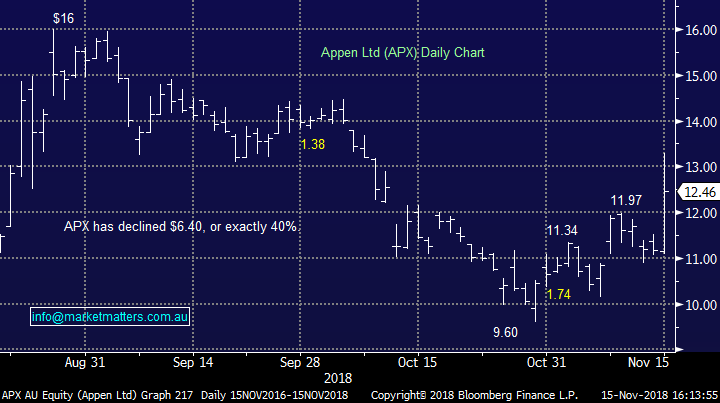

Appen (ASX: APX) $12.46 / +11.55%; Appen spent the morning lower before a trading update released early afternoon saw the stock jump this afternoon. The machine learning business today revised 2018 guidance higher just 6 weeks before the year end. The new guidance range of $62m-$65m is about 12% higher than previous guidance, and a nice ~6% higher than consensus estimates to the midpoint.

The company suggested that the driver of earnings was an increase in orders “from existing projects.” The company also noted that earnings can be derived from currency fluctuations with the new estimates based on a realised AUD/USD price of $0.80, well above the current spot price of $0.73. At the half year result, Appen noted that “almost all revenue is derived offshore, most in USD.” Hence a lower AUD is a benefit to them.We like it, but hard to chase at these levels.

Appen (ASX: APX) Chart

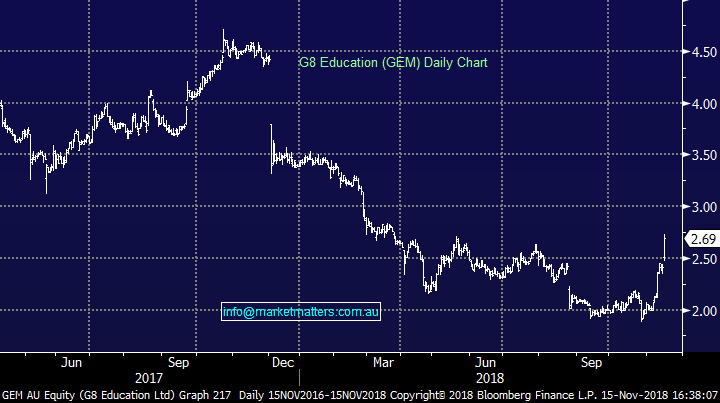

G8 Education (ASX: GEM) $2.69 / +11.62%; Was strong today after a tough 12 months as they said like-for-like occupancy growth is running slightly ahead of management expectations. The company now say that CY18 is expected to deliver EBIT of A$136-139m which is in line with consensus, however clearly there was nervousness about them hitting those numbers. Today’s update was a reasonable one and the stock popped.

G8 Education (GEM) Chart

OUR CALLS

We reduced Janus Henderson (JHG) today by a small 2% and sold Mineral Resources (MIN) for a loss, buying Orica (ORI) and Challenger Group Financial (CGF). Overall we increased our exposure to stocks by +3%

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.