Subscribers questions (Z1P, APT, AAPL US, TSLA US, MOZ, PBH, IFL, RMD, MFG, NEA, BHP)

Its refreshing to be starting the week on a reasonable footing after a tough couple of weeks, on Saturday morning the futures were calling the ASX to open flat this morning but with BHP up strongly in the US I feel they were probably erring too much on the side of caution. Fresh market relevant news over the weekend was fairly thin on the ground although the re-start of the Harvard / AstraZeneca clinical trial after being suspended last week is a positive, the COVID-19 statistics are improving in Victoria although nobody knows when the lockdown will be relaxed while NSW keeps bouncing along with around 10 fresh cases per day.

The health of the Australian housing market is integral to our economic recovery and outside of Victoria it remains firm although undoubtedly patchy, however a cloud seems to be forming over investment properties , especially units with yields in Sydney down 10-25% depending on the location. I would be uncomfortable forecasting that unit construction will recover strongly over the next few years but I do still have a good feeling around good old fashioned “house and land” – one thing’s for certain in my opinion after we’ve seen the major government efforts to bolster the ailing economy via the likes of JobKeeper they won’t let property fall too far without a fight because it will stop any recovery in its tracks. The important factor here is I believe the share market is factoring in a very rocky road for property prices leaving some room for a pleasant surprise.

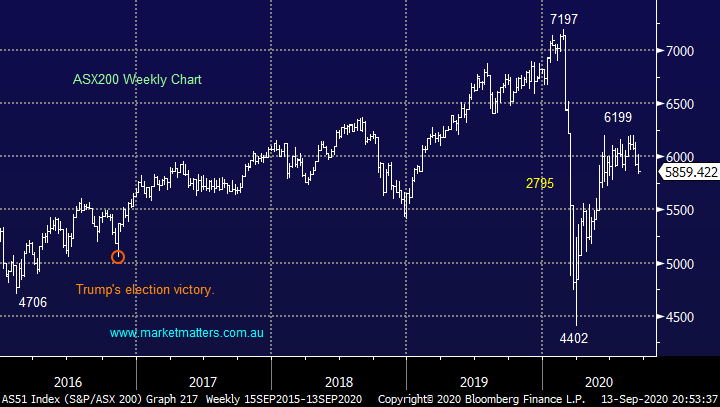

As for the local index, it remains comfortable bouncing around between 5700 and 6200 and as we slip down towards major support at the same time the strongest seasonal months and period rapidly looms on the horizon MM is considering adding to our equity exposure in the weeks ahead.

MM remains bullish Australian stocks medium-term.

ASX200 Index Chart

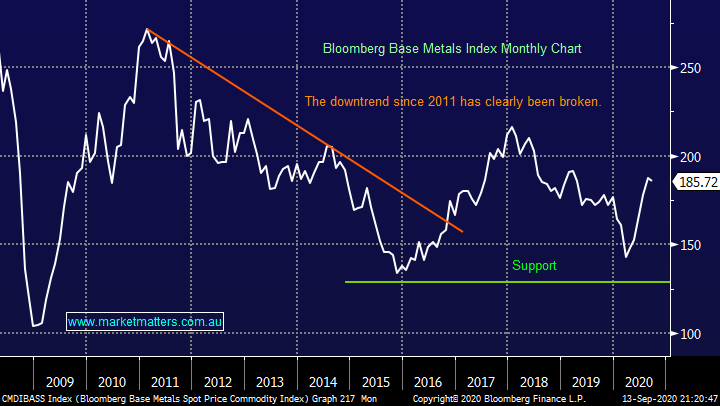

Base metals have enjoyed a stellar rally in 2020 but if we look at the chart below of the last 5-years its just bounced back to the mid-point of its recent trading range, still well below the highs of early 2018. It “feels” like were due for a period of consolidation after its strong recovery although in both its rally from 2015 and subsequent descent from 2018 the move was fairly uninterrupted hence at MM we intend to hold onto a core resources position, in line with our reflation outlook.

MM remains bullish base metals / the reflation trade.

Bloomberg Base Metals Index Chart

**Emeco (EHL) 85.5c** The entitlement offer closes tomorrow 15th September at 5pm. Shares are being offered at 85c which is essentially the same as the current market price. MM is not taking up our entitlement given the very slim premium the stock is currently trading. We are simply holding our existing position.

Thanks again for the much-appreciated questions, a decent cross section today.

Question 1

“Hi James, I was thinking of topping up my Z1P position but looking at the company report it is not so appealing. Currently the company has negative earnings and it remains negative until late 2022 by forecast, the company debt level is really high sitting at about $1b. What are your thoughts on this?” - Tony N. Keep Smiling!

Morning Tony,

Zip Co Ltd (Z1P) is a classic growth stock, investors need to look through the now into the future - remember companies like Amazon, they didn’t turn a profit until the fourth quarter of 2001 and that was on a turnover of $US1bn admittedly the real share appreciation didn’t kick in until almost a decade later. The volatility in these growth names can be huge and Z1P is undoubtedly no exception, there a number of moving parts to consider here such as:

1 – Will companies like BNPL pioneers Afterpay (APT) and Zip (Z1P) continue to dominate the BNPL space or will global goliaths like Paypal steamroll their way into the area curtailing the rapid growth of the incumbents.

2 – We’ve seen hot sectors come and go like the lithium stocks a few years ago while others such as the FANG’s have gone from strength to strength both on a very volatile rollercoaster of optimism & pessimism.

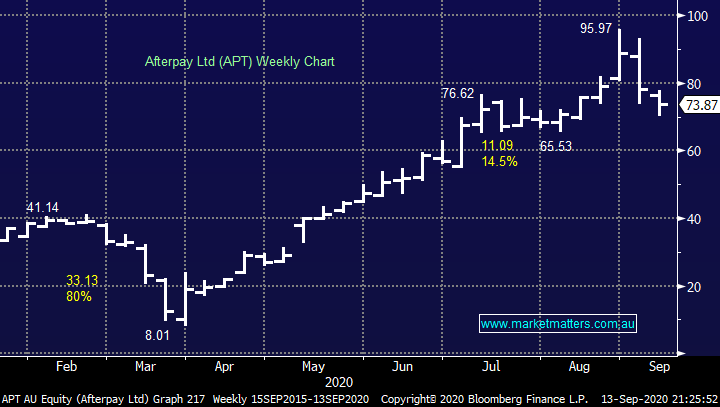

We believe the BNPL space is here to stay but it will in all likelihood morph along the journey and in a few years’ time it’s only the best and brightest who are likely to be thriving. Over the last few months we felt a pullback in sector heavyweight APT towards the mid $60 region was a strong possibility, this pullback is unfolding and Z1P is following in an amplified manner hence we see no reason to panic but we will be very fussy at levels where MM increase our exposure to the space.

In terms of debt levels, they’re essentially in the business of lending money so debt is going to be high however it should be viewed differently to a say an industrial company that is running high debt levels.

MM likes accumulating Z1P below $5.50

Zip Co Ltd (Z1P) Chart.

Afterpay Ltd (APT) Chart

Question 2

“Morning I hold shares in Apple and Tesla and have read indirect reports on the stock split but have no notice from those companies. I believe it to be a 5 for 1 split and understand the ideal of this but would like some detail on how it proceeds and the new split company. Any news on this? Regards Greg W.

Morning Greg,

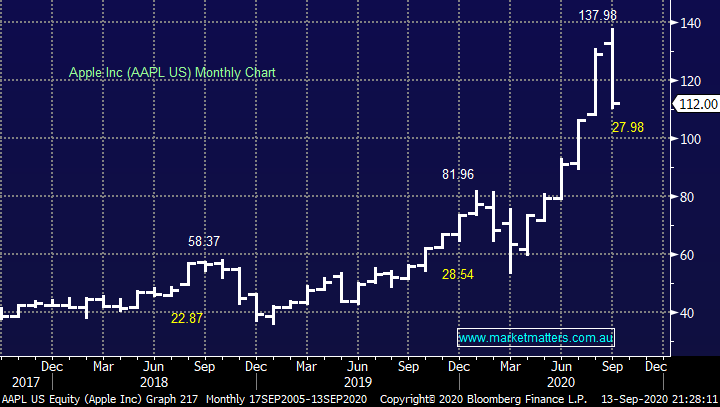

We’ve discussed the implications / results of these big splits a few times over recent reports, the simple reason the companies “split” their shares is to make investment more accessible to the average player – its simple if you had 1 share in Apple before now you have 4 but trading at a lower price, no theoretical change.

Apple Inc (AAPL): Apple shares split 1 for 4 on August 28th of this year i.e. there will be 4x the number of shares listed at a quarter of the price.

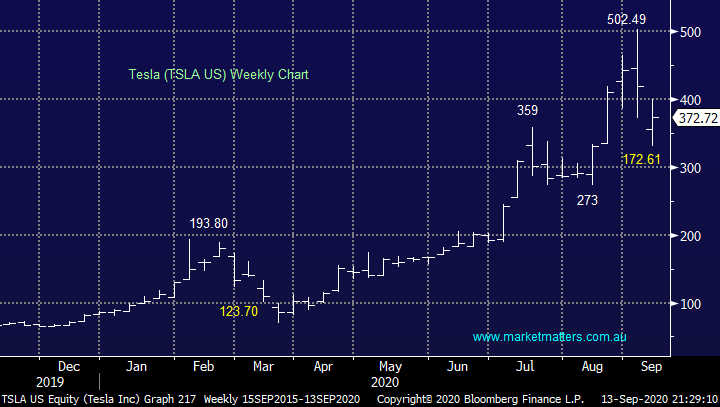

Tesla (TSLA US) Inc: Tesla shares split 1 for 5 1 on August 31st of this year i.e. there will be 5x the number of shares listed at a fifth of the price.

MM likes both of these stocks into current weakness.

Apple Inc (AAPL US) Chart

Tesla (TSLA US) Chart

Question 3

“Hi MM team, Love the newsletter, any thoughts on MOZ?” - Kind Regards, Oliver A.

Morning Oliver,

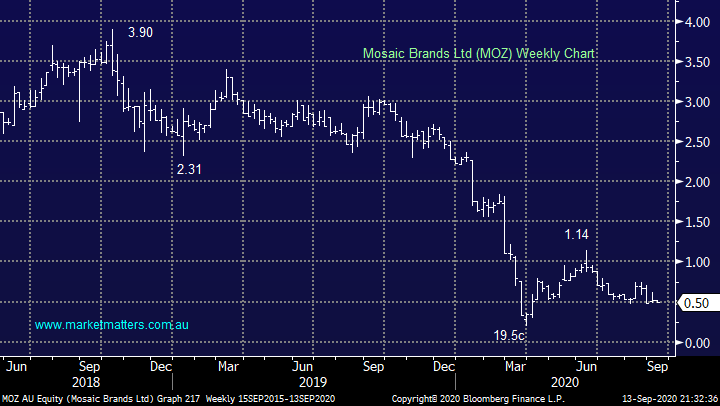

Thanks for the thumbs up much appreciated. Retailer Mosaic brands (MOZ) owns the likes of Noni B, Millers, Rivers and Katies but alas its doing it really tough with the company announcing a more than $45m loss for the FY20. The combination of the bushfires and COVID-19 is clearly weighing heavily on the stock although it’s been struggling since late 2018 with a progressive decline in sales. The companies expecting to close between 300 and 500 stores over the next 1-2 years as the retail landscape transforms dramatically – also not good for their nemesis the landlords with unrealistic rent expectations, surely something is better than nothing?

I have little doubt the stock will double again at some stage over the next year but from what level is pure guesswork, MOZ holds too much debt relative to subdued earnings, is just too hard from an investment perspective.

MM has no interest in MOZ.

Mosaic Brands Ltd (MOZ) Chart

Question 4

“Hi James, I signed up for 3 years today, not sure if this is the correct email address to send queries to but PBH has dropped 17% today to $11.40. Is this a buy?” - Many Thanks Peter C.

Morning Peter,

Welcome on board! PBH fell 20% last Wednesday after raising A$353m which is to be used to fund its US expansion alongside NBCUniversal. This is a big deal for PBH that comes with big risk but if they pull it off there’s huge upside through the enormous US sports betting market. To put the deal into context, PBH has committed to US$393mn of marketing expenditure with NBCUniversal over the next five years irrespective of how successful their push is.

It seems they’re basing their push into the market on some strong result in New Jersey where they’ve been a very credible new entrant in the online sports and online casino market capturing 5-6% market share in a large field of well-funded competitors.

Before the venture PBH delivered an ok FY20 performance considering COVID-19, there wasn’t much sport taking place! Interestingly the stock basically doubled on the news of the 5-year deal with NBCUniversal, the cap raise might just be providing a good risk / reward entry into a stock that’s not particularly expensive relative to international peers (PBH trades on around 3x forecasted FY21 revenue, peers are trading around 6-9x). The raise to existing holders was priced at $6.50 and included a 1 for 2 option with an exercise price of $13.00 expiring in September 2022. They then placed 18.2m shares at $11 through an institutional placement The weakness in the stock is likely due to holders trimming shares because they now have an option on upside above $13.

This is a very aggressive play but the risk / reward looks ok around $10 but I stress the risks with its exciting US expansion.

MM likes PBH under $10.

PointsBet Holdings (PBH) Chart

Question 5

“Hello As a IFL shareholder at an average of $8.00 . I would like to bring down my average cost price. Am I better off buy from the current market at $3.27, or from the SPP at $3.50.” - Thank you, Peter.

Morning Peter,

I’d be buying in the market ~$3.26 before taking up the SPP at $3.50. The market looks to have little faith that IFL can successively integrate the MLC business with their shares now trading well under its cap raise at $3.50. We were originally looking at IFL as a turnaround play however, I’m now concerned that the underwriter (Citi) will end up with a lot of shares they don’t really want at $3.50. For that reason, we’re happily on the sidelines at this point in time.

MM is currently neutral IFL after it failed to hold the $3.50 area.

IOOF Holdings (IFL) Chart

Question 6

“Hi James! Wednesday 9th September and S& P 500 and Nasdaq thrashed again along with our market. Lots of stocks have fallen so..........(1) Is ResMed a buy at $23 with a depreciating US$ (2) What about Magellan MFG right now?” - Thanks, Kim B.

Morning Kim,

We discussed MFG in the Weekend Report (click here) hence will focus on sleep disorder business ResMed (RMD). We believe RMD is a quality business which has been delivering on both the growth and margins front although COVID has thrown up its unique challenges to RMD but facilities are now reopening across much of the world, an extensive 2nd wave will be very painful to the business but it won’t be on an island as we all know.

I like RMD but it’s not overly cheap considering the current risks hence our approach would be to scale in buying below $24 leaving room to average ~$20 – as we can see on the chart below this can be a volatile stock. As pointed out RMD does receive plenty of overseas earnings which is likely to become a headwind in our opinion hence another reason to enter slowly.

MM likes RMD into weakness.

ResMed Inc (RMD) Chart

We discussed MFG in the Weekend Report, we are considering averaging our position into a deeper pullback.

MM likes MFG below $54.

Magellan Financial Group (MFG) Chart

Question 7

“Question for next round of questions: Nearmap's (NEA) business model seems ripe for the post COVID world. What are your thoughts on the stock for the growth portfolio?” – Kamil.

Hi Kamil,

NEA recently raised $90m capital to help its penetration into North America, logical in our opinion. However we weren’t excited to also see a director sell down within the raise by the $1.3bn geospatial (mapping) business Nearmap (NEA). In the last financial year NEA’s turnover was close to $100m with nearly 40% coming from North America hence its already a relatively well understood marketplace for NEA.

We think this is a solid growth stock although the reaction to the raise and the fact it is trading below the raise price straight off the bat implies there’s a few sellers about - its unlikely to find its way into our portfolio anytime soon.

MM is neutral to positive NEA.

Nearmap Ltd (NEA) Chart

Question 8

“Can you please advise on PBH and Z1P holding from higher levels.” – Regards Sanjay S.

Hi Sanjay,

Both of these stocks are covered above but I think the most relevant part of your question is “from higher levels”, at MM we continually strive to remove all human emotion from our investing which I stress is not always easy!

It’s very important to make a plan with an investment before initiating because once an investor $$ are in the market we all become increasingly vulnerable to “Fear & greed”, often wealth destroyers. The point I’m making is what matters is how the stock looks today whether it be fundamentally & / or technically, if possible, the price of any initial entry should be ignored otherwise it will often adversely influence logical thinking.

Question 9

“Dear James and the Team, A Monday Report question if I may (actually, two if I can be cheeky). Noting that today’s Sunday report mentioned a possible sale of the Income Portfolio's RIO position 'into strength'. Can I ask, then, what your thoughts are on BHP, given they are so heavy in Iron Ore? Last month I decided to sell my BHP in the mid $40 dollar range, and it didn't quite get to my target sell price. In your view, what is BHP a sell at now? My second question (if I may) is broader: given the squeeze on yield levels across most if not all asset classes and the prevalence of yield traps in aussie shares, should income investors now be thinking of deriving some of their income from growth shares? Keep up the good work!” – Karl B.

Hi Karl,

A great question, overall, we remain bullish the reflation theme but have decided to diversify away from the hot iron ore space over recent weeks initially through taking profit in RIO Tinto (RIO). Hence if BHP finally pushed back above $40 we are likely to trim back our large position but due to our core outlook moving forward it’s unlikely we will sell it all plus we will be looking to re-enter other quality resource stocks at attractive levels moving forward. i.e. our recent move to trim OZL and increase WSA is an example of such a move.

MM remains bullish the reflation theme.

BHP Group (BHP) Chart

If you look at our Income Portfolio well over 10% is already focused on less traditional areas, I can like yourself see this slowly increasing over the next year as some more traditional areas simply let us down.

MM Income Portfolio: Click here

Question 10

“Hi James and Team, I agree with you that the FANG index will bounce back, probably after some consolidation. From the NYSE FANG Index below it appears that there is a support level at around 4750 , some 5% below the current level . Would this be an appropriate entry point ( 5 % lower )? I noticed that are likely to top up MFG at 5 % lower” – thanks & Cheers David P.

Morning David,

In our opinion accumulation is the “game” to play at present and this is reflected by our resting orders in the QQQ ETF for our Global Macro Portfolio. Picking an exact bottom is not a science, in our opinion its guess work hence we like the idea of buying slowly. The FANG’s have already dropped ~15%, the March pullback was double in pure points perspective hence never underestimate the market, but we are pretty close to pressing our first buy button.

MM likes the FANG Index into weakness.

NYSE FANG+ Index Chart

Question 11

“Hi James & Team, I would like to get back into Points Bet Holdings after selling the stock before the stock doubled recently.

1) How would you rate the potential of the stock?

2) Which will be a better way to re-enter the stock, buying it outright or buying the rights?

3) what will be a fair price between the stock & the rights?

4) What does one has to do to exercise the rights after they are purchased?

Many thanks for your advice.” - Sidney H.

Morning Sydney,

PBH has been covered earlier hence I will just touch on your questions around the Right’s Issue.

PBH have announced a fully underwritten, accelerated renounceable pro-rata entitlement offer. Fully underwritten means the funds have been guaranteed by an investment bank / broker, accelerated means fast, renounceable means the rights are tradable on the ASX (PBHR) and pro-rata means based on the number of shares held. To further complicate matters, the rights have an attaching option.

For non-holders of the shares, there are two options available:

1 - To keep it simple, buy the stock on the market assuming your intention is to go long bearing in mind that you are buying stocks at $10.92, an 8c discount to the recent institutional placement price however institutions were granted a free option for every two shares bought.

2 – Buy PBHR, however it’s important to do the calculation at the time bearing in mind that you are paying for the rights, then paying to buy the stock as well + I’m not sure on the liquidity of the rights. You would then need to take up the rights via the application process via the share registry.

As suggested above, we like the stock under $10 considering institutions paid $11 however they also got options with a $13 strike price.

PointsBet Holdings (PBH) Chart

Have a great day

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.