First day back and markets chop around par

WHAT MATTERED TODAY

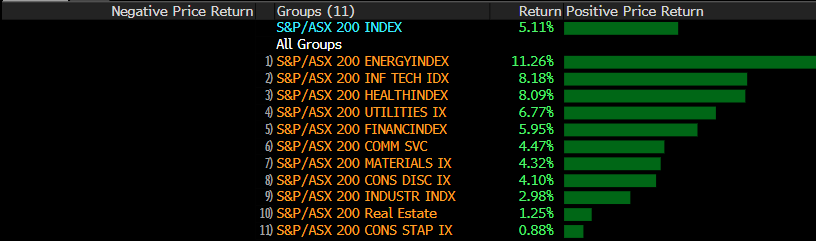

First day back on the desk and the market chopped around par for much of the session, trading up to 5801 and down to a 5756 at the afternoon low before closing mid-range. Not a huge amount of conviction across the board after a fairly aggressive bounce back from the end of December low of ~5400. The defensives did best today while the consumer discretionary names were hit hardest. I read a lot over the break and the bulk of content on Australian equities discusses the risks of high household debt levels and the subsequent impact this will have on consumers appetite to ‘buy stuff’, particularly as house prices fall. The main question seems to be whether or not the wind will be let out of the balloon slowly or we see a more aggressive “pop” and from the look of today’s move out of the sector, it seems a few market players have come back with a more bearish outlook, particularly towards the retailers.

The 2nd week of January is generally the time when most participants come back to work, however it takes a few days to get the feet under the desk and plan for the quarter ahead. I’m finishing off an Outlook Report that we’ll put out on Wednesday morning coinciding with the first Income Report for the calendar year. Stay tuned for both on Wednesday following our usual Monday subscriber questions which will be out tomorrow.

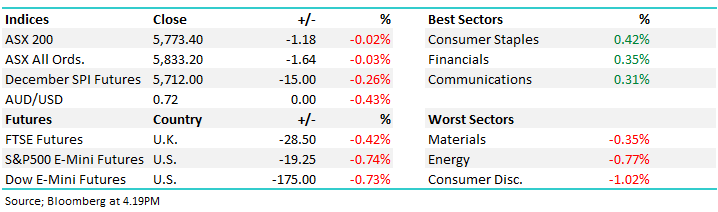

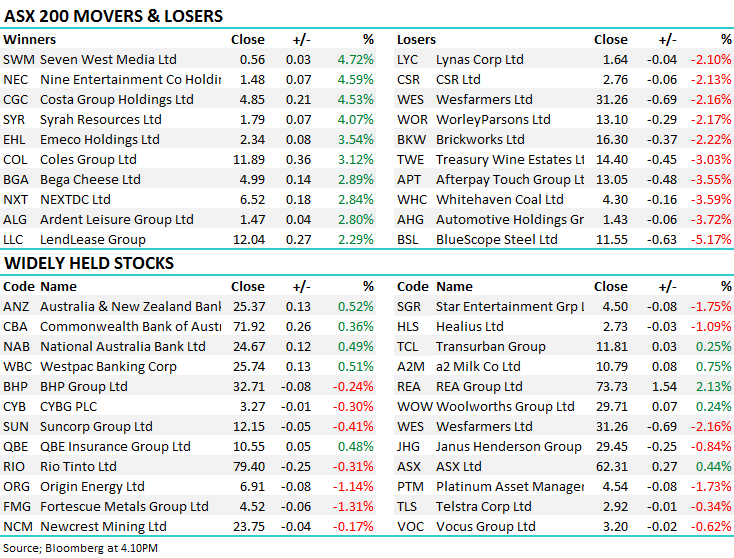

Overall today, the ASX 200 closed down -1 point or -0.02% to 5773. Dow Futures are currently trading off by -173pts or -0.72%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

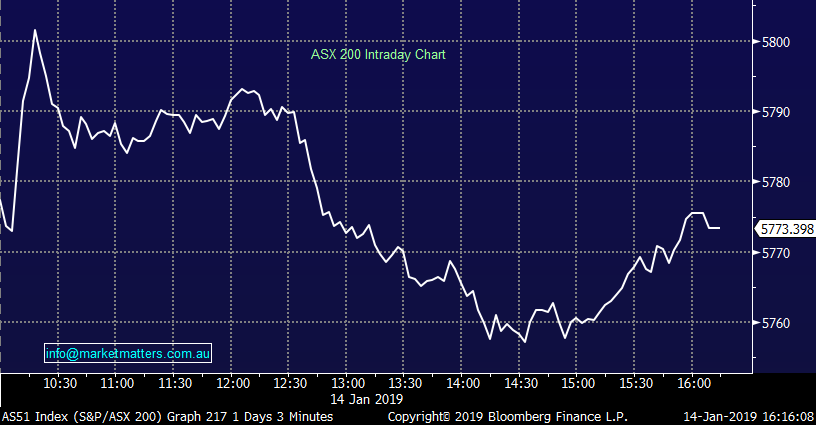

Broker Moves; Not a lot out from the brokers however Morgan Stanley put out a piece talking about the Aussie fund managers, highlighting how cheap they are, however they think that given current outflows there is little catalyst for a near term re-rating in the sector. They like Magellan more than they like Platinum at current levels…

Here’s a quick look at sector multiples.... Perpetual (ASX:PPT) screens best on valuation metrics

Source; Bloomberg

ELSEWHERE:

· Platinum Asset Cut to Underweight at Morgan Stanley; PT A$3.50

· Magellan Financial Raised to Equal-weight at Morgan Stanley

· Treasury Wine Rated New Add at Morgans Financial; PT A$17.20

· WiseTech Rated New Neutral at Evans and Partners; PT A$17.28

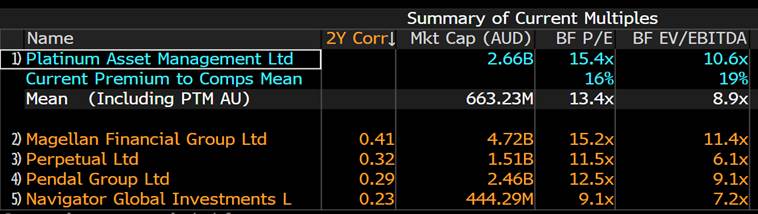

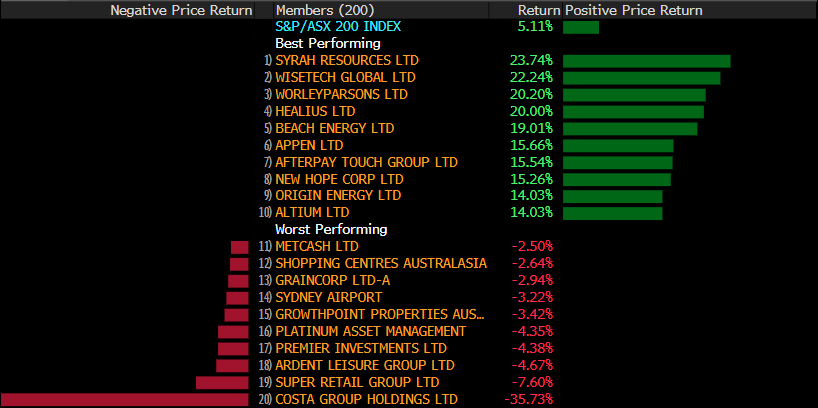

While we were away; Markets never sleep and over the Christmas period and the first few weeks of 2019, we’ve certainly seen some big volatility play out. With many fund managers and traders away over the period, markets move on light volume with small bits and pieces of information having a bigger impact than they generally would. Over the period of 24 December to 11 January, the local market rose an impressive 5.11%, with all sectors of the market moving higher. Overseas markets also rebounded after trading at long term lows around the middle of December.

- The Dow Jones Industrial Average (US: DJAI) fell over -9% but since Christmas Eve, it has bounced back +10.8%.

- The UK FTSE index shows a similar, but less volatile tune, falling -3.88% in December, but is up 4.1% since the break.

- The MSCI Emerging Markets index has gained 5.1% in the past 3 weeks, while it fell 2.92% in the last month of 2018.

The global rebound was lead by energy as Oil turned a corner, bouncing back from its aggressive selloff beginning in October on news that OPEC would work to cut production, as well as global growth fears subsiding and the story was no different locally.

Sector Performance 24/12/2018 to 11/01/2019

Source; Bloomberg

Both tech and healthcare names also moved higher – two sectors MarketMatters were overweight heading into the Christmas period. While still showing positive returns in the last 3-weeks, the safe havens of consumer staples & real estate underperformed the index during the period.

At a stock level, the heavily shorted Syrah Resources (ASX: SYR) was strong after production of graphite kicked off in their US facility. Healius (ASX: HLS) – the old Primary Healthcare (old code was ASX: PRY) rallied strongly following a bid from Hong Kong’s Jangho for $3.25/sh. The board rejected the “opportunistic” bid, however the stock held most of the bump. Other names in the top 10 mostly consist of energy and tech stocks carried higher as risk on came back on the table following the December sell off.

Stock moves 24/12/2018 to 11/01/2019

Source; Bloomberg

On the other end of the spectrum, Costa Group’s Avocado’s and berries have seen sliding demand leading to falling wholesale prices causing the company to release a profit warning. The stock fell 38.8% on the day – a huge move relative to the downgrade. Other stocks languishing at the bottom had no company news and mostly consisted of the retail sector which by many reports had a poor Christmas trading period. This is a sector we’ll discuss in more detail as the week progresses.

All in all, a difficult period in markets over the Christmas break and as the week unfolds we’ll get a better feel for likely trends moving forward.

OUR CALLS

No changes today, however we have sold Suncorp (ASX: SUN), Xero (ASX:XRO), CSL (ASX:CSL) & Ramsay Healthcare (ASX:RHC)

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.