Production reports dominate the news flow today

WHAT MATTERED TODAY

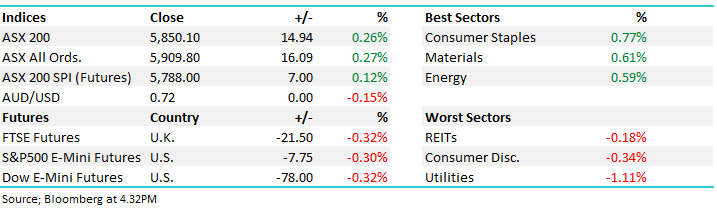

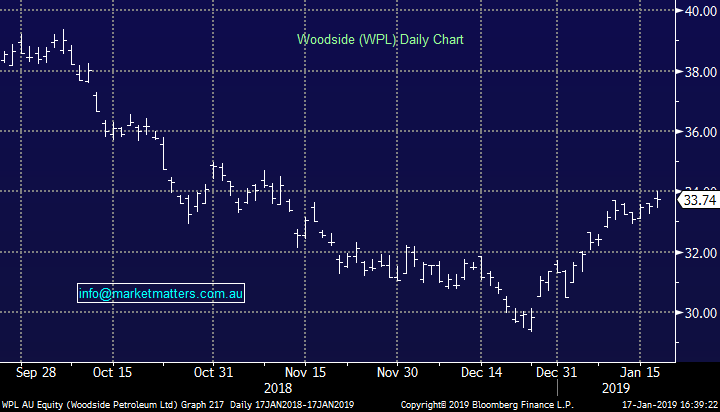

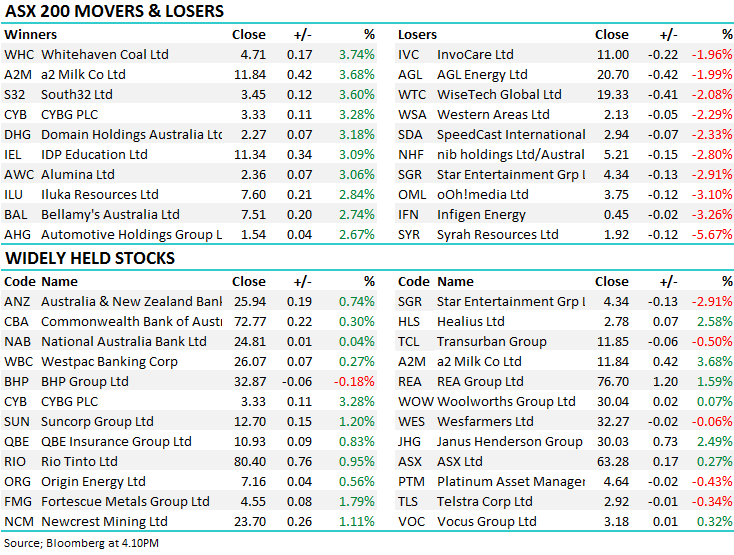

A choppier session today with the market well bid early one only to suffer a case of the wobbles when Asian markets came on stream and US Futures drifted lower around midday, however the bulls regained control and the ASX 200 bounced ~30points from the low to close near the high of the day. From the low on the SPI Futures on the 24th December at 5330 to ~5800 today, the market has rallied ~470pts or nearly 9% unabated – a strong recovery following an atrocious December quarter. Today it was the consumer staples that provided most support, however they were ably assisted by both the resources and energy names. On the flipside, the defensive areas, the utilities and the like that we discussed this morning provided the biggest drag.

Strong quarterly results in the US overnight, particularly from Goldman Sachs and Bank of America was supportive of Macquarie today which added ~1% to close back at $117.18, a good bounce from its recent $103.30 low. Reporting in the US tonight will be interesting with Morgan Stanley along with Netflix out with results + American Express and State Street also out with numbers. Netflix is up +30% in the first two weeks of the new year after raising prices on their 58 million subscribers in the US - expect price increases here in the not too distant future.

Overall today, the ASX 200 closed up +15points or +0.26% to 5850. Dow Futures are currently trading down -70pts or -0.28%.

ASX 200 Chart – choppier session today

ASX 200 Chart

CATCHING OUR EYE;

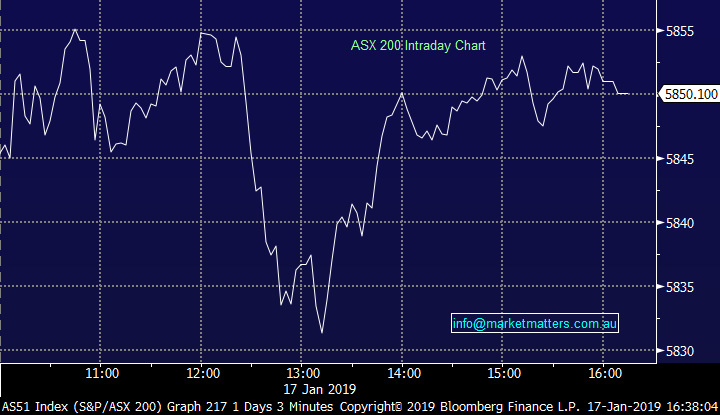

Broker Moves; Beach Energy stands to benefit from potential consolidation among Australia’s east coast gas producers and could spend ~A$700 million on M&A by 2020 says a report by Credit Suisse. Beach was a stock we flagged into recent weakness however given our tight cash position at the time, we didn’t pull the trigger. The stock has bounced from ~$1.30 to ~$1.60 in line with the rest of the sector. The bulk of analysts are keen on the stock - of the bulge brackets Morgan Stanley the most bullish.

The stock closed today at $1.66, up +1.22% on the session.

Broker calls on BPT

Beach Petroleum (ASX: BPT) Chart

ELSEWHERE:

· Beach Energy Upgraded to Outperform at Credit Suisse; PT A$1.75

· Freightways Upgraded to Neutral at Forsyth Barr; PT NZ$7.50

· Starpharma Rated New Outperform at Macquarie; PT A$2

· Michael Hill Upgraded to Hold at Morgans Financial; PT A$0.62

· Computershare Downgraded to Hold at Morningstar

· Evolution Mining Downgraded to Neutral at Goldman; PT A$3.80

· Saracen Mineral Downgraded to Neutral at Goldman; PT A$3.10

· Suncorp Reinstated at Shaw and Partners With Buy; PT A$16

· AGL Energy Downgraded to Neutral at JPMorgan; PT A$23.20

· Navigator Global Upgraded to Buy at Shaw and Partners; PT A$4.65

Production Scorecards – lots of them

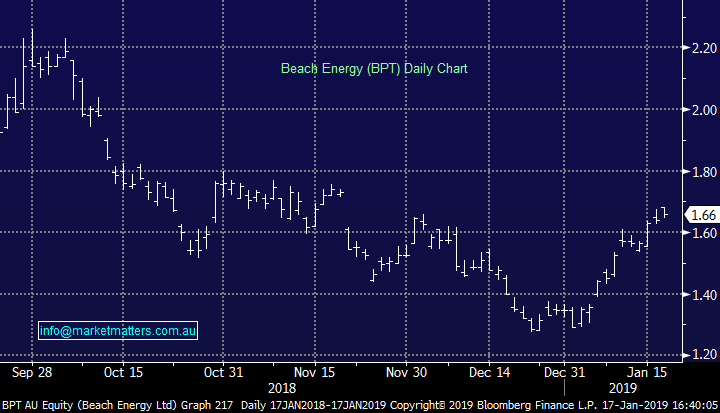

Woodside (ASX: WPL) $33.74 /+0.66%; Q4 production numbers out today plus they gave some detail around their Scarborough project. All in all, production was good, slightly above some market expectations (Shaw’s analyst looking for 22.7MMboe and they delivered 24.1MMboe) and although the price of Crude took a dive through the period there was limited impact on revenue growth given the lag on LNG pricing. Average unit prices were US$59/boe compared to Brent of US$68.5/bbl. LNG prices reflect Brent with a ~3 month lag, so the full effects of the November oil price crash won’t be evident until the next quarter. Overall, a good year for WPL in 2018 and they have some interesting growth projects bubbling away in the background.

In terms of 2019 annual production, they forecast 88-94 million barrels which was a tad light on – most expecting around 96MMboe from what I can see, however the variance is tolerable. As we suggested in the income note yesterday, we’re keen on WPL into $1 retracements in share price.

Woodside (ASX:WPL) Chart

Alumina (ASX:AWC) $2.36 / +3.06%; A record QTR for AWC on a number of levels and the scorecard was an impressive one. Prices were up, production was up leading to 4Q AWAC distribution coming in at a record of $273m and FY18 distributions up over 2x to $827m. In short most numbers should be seen as impressive, albeit not unexpected. We hold AWC in the income portfolio and it looks like the dividend outlook is on track, although not a beat to current market expectations. That said, AWC has enjoyed some strong trail winds in recent times, largely a result of Russian sanctions that have curbed production (and thus supported prices) which look like tailing off in 2019 – therefore, the price tailwinds of 18 may not be enjoyed to the full extent in 19 – Key support ~$2 while $2.65 is our upside target.

Alumina (ASX:AWC) Chart

Whitehaven Coal (ASX:WHC) $4.70 / +3.74%; A great set of quarterly numbers today and the stock is reacting accordingly. We were hoping to see WHC bounce back from a weak prior quarter and they did that in spades, producing 5.5mt up over 30% from the prior period. Commodity prices have been lower through the period - Thermal coal now >20% below 2018 peak and met coal price now ~15% below recent 2018 peak , however that’s already been reflected in the share price coming back from ~$5.80 to near $4.00 at the recent low. Trends look good here and this could clearly be an interesting ‘income’ stock in 2019 as discussed in the Income Report yesterday (click here)

Whitehaven Coal (ASX: WHC) Chart

South32 (ASX:S32) $3.45 / 3.60%; We spent less time on this one today however numbers looked okay and SP reaction suggests it was good. On quick read through, numbers pretty much on track, guidance maintained for all assets and a slight uptick for met coal (7%). Importantly manganese production (Aust/Sth Africa) at or near record levels - nice timing given continued buoyant prices. In terms of capital management, they have complete 79% of the $1B capital management program, paid $154M special dividend and purchased 272M shares back…miners are clearly printing cash! $3.00 support with upside target of ~$4 so the risk / reward at current levels no that exciting.

South32 (ASX: S32) Chart

OUR CALLS

We sold our position in Altium (ASX:ALU) today for a ~13% profit.

Altium (ASX:ALU) Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.