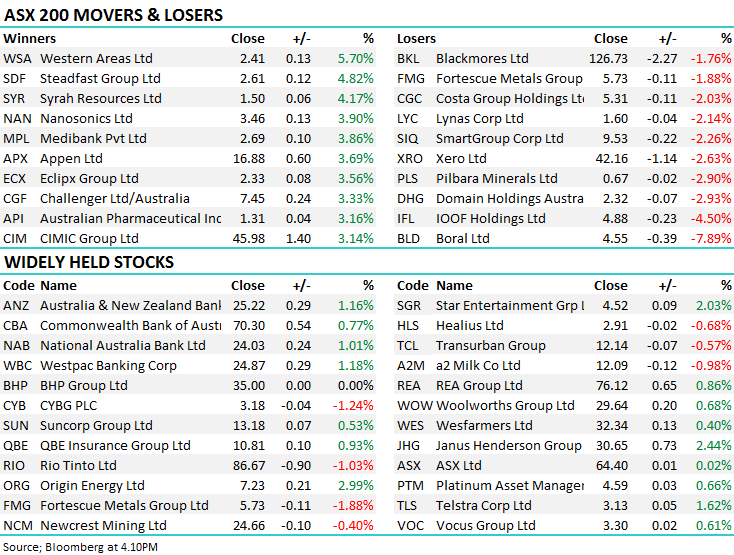

Royal Commission final report released (WSA, BLD)

WHAT MATTERED TODAY

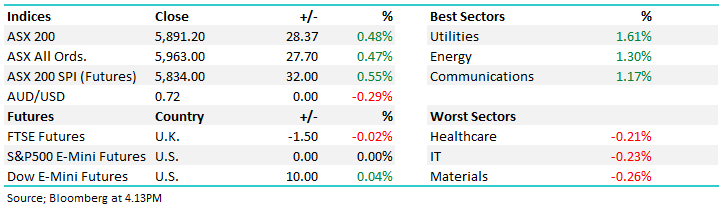

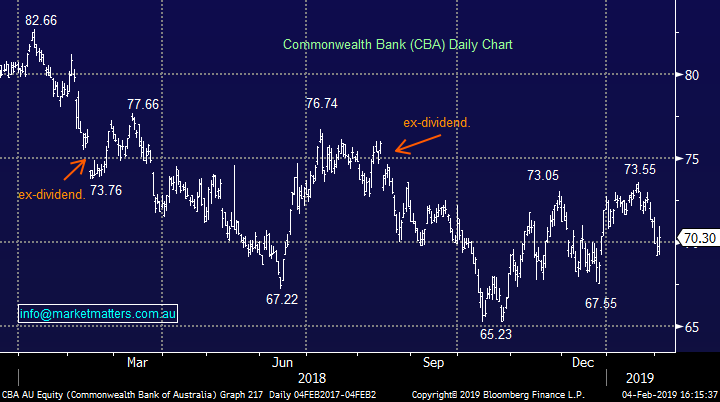

The market was soft on open this morning giving back all the gains and then some implied by the SPI Futures on Friday (+20pts), however buyers stepped up to the plate largely focussing on the banking stocks ahead of the Hayne RC report which is just out – my initial thoughts after a quick scan below. Obviously most focus on the RC today, however eco data out this morning was also soft…Building Approvals -8.4% versus 2% expected which took the wind out of the sails of the AUD.

Overall today, the market was strong – surprisingly in the face of the weaker data + of course the RC final report…

The ASX 200 closed up +28points or 0.48% to 5891. Dow Futures are currently trading up +8pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

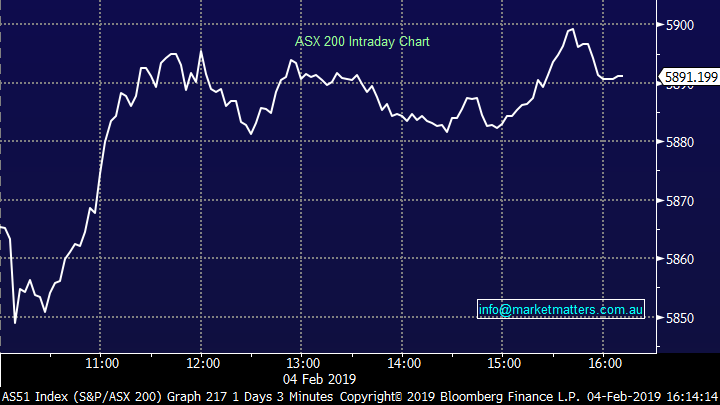

Royal Commission (RC); All in all, I actually think the outcomes here will be good for banks stocks – while I haven’t had a lot of time to review some high notes below;

In 76 recommendations, Hayne recommends tougher regulation, more scrutiny of pay and culture and pushes the securities regulator to consider court action as a first option. But stops short of calling for them to be forcibly broken up to stop them offering financial advice and wealth management. Basically, vertical integration stays which is a win for AMP and IOOF plus Westpac as the bank that has kept their wealth business (all else have sold).

"Enforced separation of product and advice would be a very large step to take,’’ Hayne wrote. ``It would be both costly and disruptive. I am not persuaded that it is necessary to mandate structural separation between products and advice.’’

The root cause of much of the industry’s wrongdoing is pay and bonus structures, Hayne said. The prudential regulator APRA will be tasked with stepping up supervision of remuneration, and banks should review their pay systems for frontline staff at least once a year.

Mortgage brokers to be paid by the borrowers, not the banks. That’s tough for the brokers but good for the banks with big domestic footprints – best for WBC and CBA + also good for comparison sites I would think.

No criminal charges recommended…

More to come in the MM AM report tomorrow

Commonwealth Banks (ASX:CBA) Chart

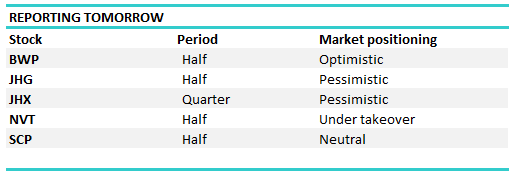

Reporting; No stocks out with reports today – BLD downgraded we start to get a few out tomorrow. CBA on Wednesday a big one.

Western Areas (ASX:WSA) +5.7%; One of the resource stocks that recently plumbed new 52 week lows and is now starting to see some strong buying. Looking at resources more generally, the Australian miners (XJR) have added a whopping ~17% (USD terms) since 20 December when the index plumbed a 15 month low. This was at the tail-end of a tumultuous year (XJR down ~11%) whipped around by Trump-Trade –Tariffs with most of the downdraft in the final quarter. We like WSA, targeting higher prices but remember, resources are very cyclical.

Western Areas (ASX:WSA) Chart

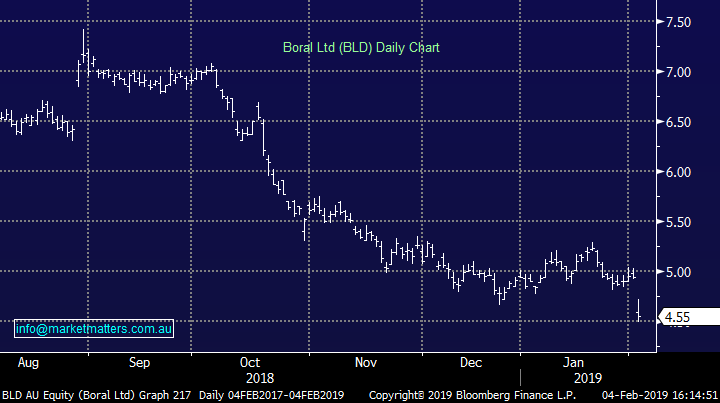

Boral (ASX: BLD) -7.89%; Despite record levels of infrastructure spend locally and in the US, Boral today lowered guidance heading into the first half result. The building materials company is now expecting little to no growth in EBITDA in the first half of FY19, while guiding to NPAT of around $200m.

Commentary for the full year result also turned a little sour with Australian operations seen flat for the year down from previous guidance of low single digit growth, North American operations to see 15% growth at the EBITDA line which is down from 20% growth at previous guidance, and profits from the USG Boral joint venture now expected to be slightly lower in FY19, down from profit growth of around 10%.

Also concerning investors is further warnings around a strong second half skew to the result, with Boral pointing to volume lags, project delays and extreme weather in the first half holding back earnings despite strong underlying market conditions.

Boral will report their first half result on February 25.

Boral (ASX: BLD) Chart

Broker Moves;

· Flight Centre Upgraded to Hold at Morningstar

· GUD Holdings Upgraded to Overweight at JPMorgan; PT A$12.70

· Asaleo Care Upgraded to Outperform at Credit Suisse; PT A$1.25

· Vocus Reinstated at Credit Suisse With Neutral; PT A$3.25

· TPG Telecom Reinstated Underperform at Credit Suisse; PT A$5.60

· Telstra Reinstated at Credit Suisse With Neutral; PT A$3.10

· Sydney Airport Cut to Underperform at Credit Suisse; PT A$6.40

· IOOF Holdings Downgraded to Sell at Bell Potter; PT A$4.35

· Insurance Australia Upgraded to Overweight at JPMorgan; PT A$8

· Sandfire Downgraded to Accumulate at Hartleys Ltd; PT A$8.36

· Resolute Mining Upgraded to Buy at Hartleys Ltd; PT A$1.52

· Rio Tinto Upgraded to Add at AlphaValue

OUR CALLS

No amendments today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.