Reporting season ramps up, RBA turns cautionary (VEA, COL)

WHAT MATTERED TODAY

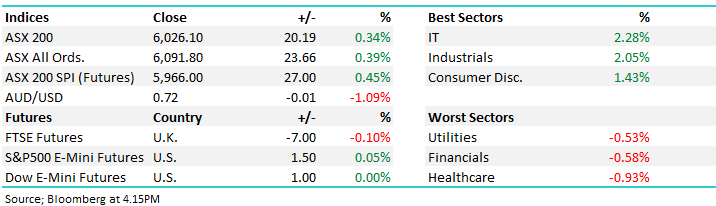

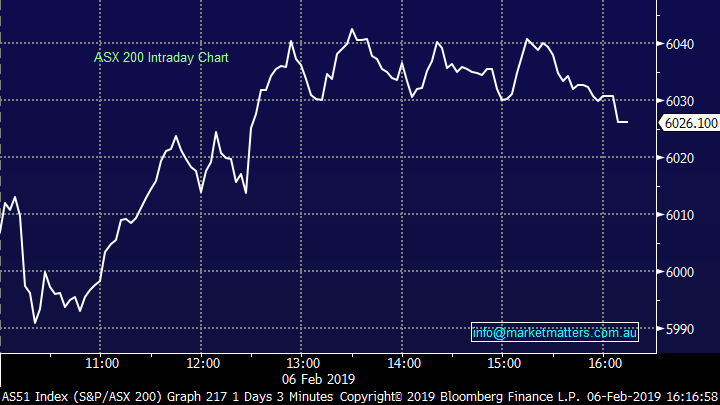

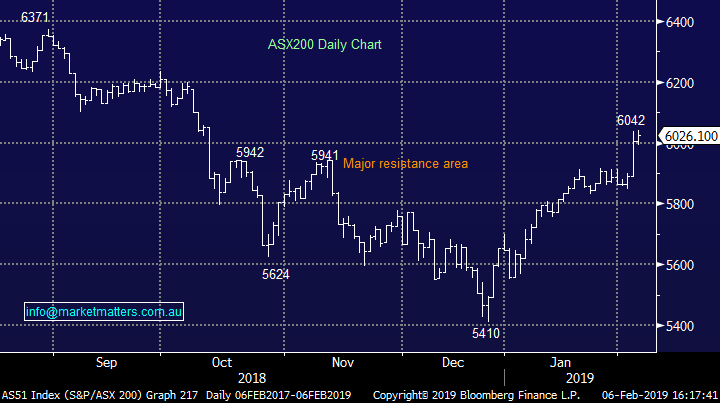

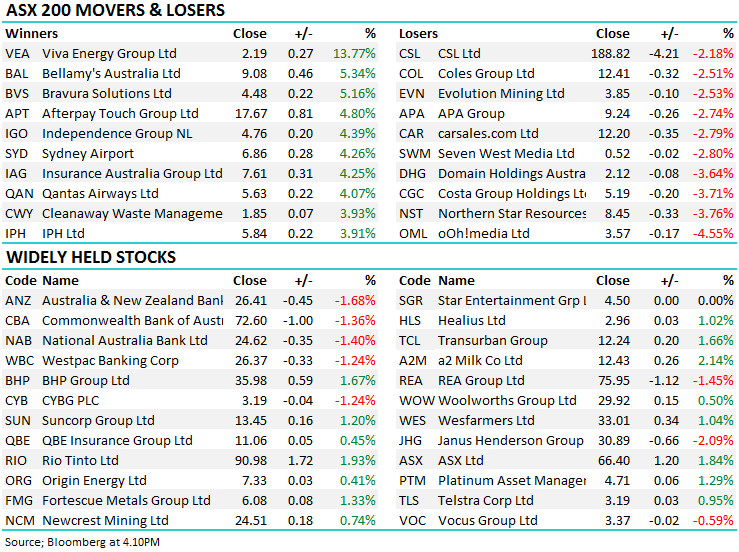

The market crept higher again today, continuing with the momentum gathered yesterday, albeit at a slower pace. The banks dragged however that was offset by some decent buying in some of the beaten down names (retailers etc.) while we also saw some good moves continuing in the tech space. Resources rallied however CSL provided a drag after a Credit Suisse downgrade – the stock down ~2% highlighting that it only takes one less positive call to knock these high value stocks around.

The Aussie dollar took a hit today as RBA Governor Phillip Lowe cooled on the Aussie economy. The RBA has clearly backed off its tightening stance, and Lowe talked of being more accommodative especially if signs of stress within the economy continue to rise. “Over the past year, the next-move-is-up scenarios were more likely than the next-move-is-down scenarios. Today, the probabilities appear to be more evenly balanced,” Lowe said. Lower rates = good for asset prices and the RBA now doing their best to help support a languishing property market

The reserve bank downgraded growth expectations yesterday then moved to a more neutral stance on rates today. The AUDUSD quickly fell ~1% as low ball Lowe put the boot in!

Trump also took to the podium today, with the President addressing congress for the State of the Union speech. It was largely as per programmed with Trump sticking to his strengths in the economy, border security and foreign policy.

Overall, the ASX 200 closed up +20points or +0.34% to 6026. Dow Futures are currently trading flat

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

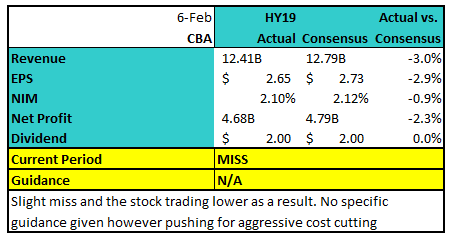

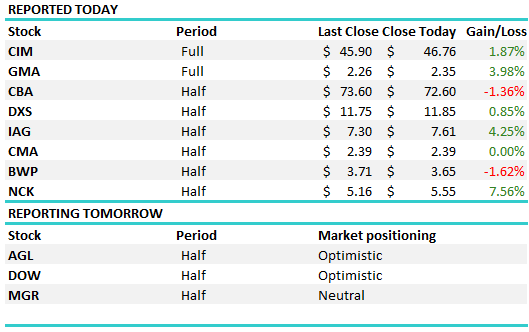

Reporting;Main focus was the CBA result which we discussed in the Income Report today. As a quick recap, the result was soft with slowing income growth and poor treasury markets, missing expectations by around 2%. All the banks traded lower today as a result – and likely some profit taking after yesterday’s rally, all finishing over 1% lower.

GMA went up on their result as did IAG - again, we covered both in the income note today – click here. Elsewhere, a number of property stocks delivered first half numbers;

CMA: Reported 1H19 Funds from Operations of $26.5m, in line with expectations while FY19 guidance reiterated at FFO/Share of 18.7¢, with DPS of 17.6¢.

DXS: Reported 1H19 Funds from operations of $353.3m, in line with expectations while guiding to 3% FFO/share growth (or ~66.1¢) and ~5% DPS growth

BWP: Reported Distributable income of $57.4m slightly above expectations while guiding to dividend growth of +1.7% - including the payout of capital profits.

All were fine, BWP is simply too expensive and fell as a result.

Nick Scali (ASX:NCK) defied the general gloom in retail reporting solid numbers, profit for the half of $25m versus $23m expected by the market. They reported ~10% top line revenue growth with profit up ~8%, all a result of new store rollouts. Same store sales were flat and they didn’t give guidance, which they generally save for their AGM.

Viva Energy (ASX: VEA) +13.77%; The struggling petrol station IPO of 2018 has been dealt some respite today with the announcement of a new fuel deal with Coles (ASX: COL). The biggest IPO of 2018, which only briefly traded above its IPO price of $2.50, and traded to a low of $1.66 late last year, has bounced 13% today on news of the 10 year deal with the Coles convenience business. The new deal changes the relationship from a supply contract into a commission model where Viva will have the pricing power, and Coles will receive a rate on each litre sold.

The deal ensures each company’s specialty becomes their responsibility, with Coles focusing on convenience for the consumer, and Viva to focus on fuel retailing, aimed at delivering “a more competitive customer offer… and better align contributions and incentives for each party.” Coles reiterated that convenience remains challenging in the first half with EBIT expected to be $47-$51m for the 6 months, a small portion of the Coles group earnings. We struggle to see value in either of the names above at this stage. Coles margins continue to come under pressure, and Viva’s problems won’t be solved with just this one new deal with refining margins yet to be inspected.

Viva Energy (ASX: VEA) Chart

Broker Moves;

· Sandfire Downgraded to Sell at Morningstar

· AMP Downgraded to Hold at Morningstar

· Steadfast Downgraded to Hold at Morningstar

· Woodside Downgraded to Equal-weight at Morgan Stanley; PT A$35

· OceanaGold Downgraded to Sell at Haywood Securities; PT C$4

· OceanaGold Downgraded to Neutral at Macquarie; PT C$5

· HT&E Upgraded to Outperform at Credit Suisse; PT A$1.95

· CSL Downgraded to Neutral at Credit Suisse; PT A$210

· Evolution Mining Cut to Underweight at Morgan Stanley; PT A$2.90

· Fortescue Cut to Equal-weight at Morgan Stanley; PT A$6.30

· Australian Finance Cut to Speculative Buy at Hartleys Ltd

· CYBG Resumed at Deutsche Bank With Hold

OUR CALLS

No amendments today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.