NAB’s CEO & Chair shown the door… (CYB)

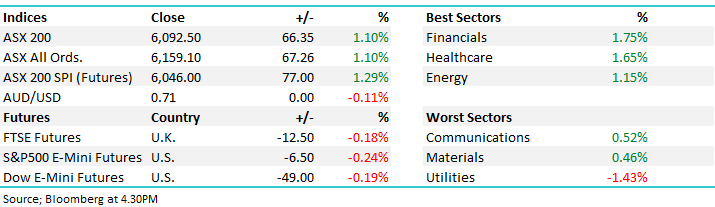

WHAT MATTERED TODAY

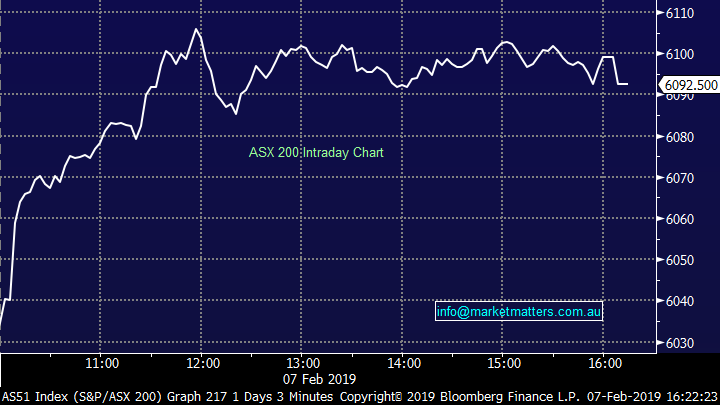

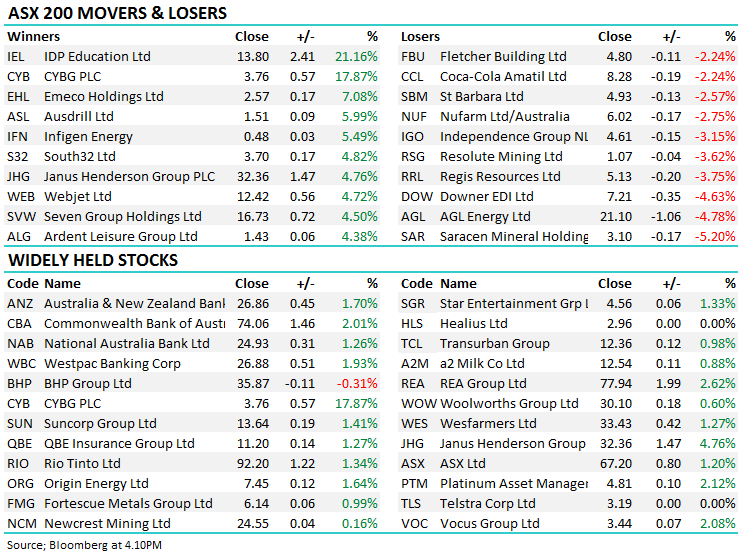

Another day where the ‘Pro Australia’ theme was alive and well – the index opening marginally higher before yet another wave of strong buying across the market played out. Both resources and banks were strong, along with pretty much everything else as the cool winds of FOMO are blowing hard across the Aussie bourse, it’s starting to get a bit chilly across our desk as well! Looking across the region it was fairly muted, Hong Kong slightly lower, China rallied ~1.3% while US Futures drifted down throughout our time zone. It’s not often we see such a combination of index friendly factors combine so aggressively to push our market up ~250 points this week, and ~700 points in the last 6 weeks. While it’s hard to argue with the current momentum in stocks, it’s worth remembering that the resources have been supported by an external event curtailing supply in one key commodity (Iron Ore) while the banks are basking in the post RC sun. Throwing fuel on the fire was Governor Lowe who remains willing and able to cut rates if warranted – a bullish combination for the Australian index.

Insto’s are buying banks and those who are short seem to be covering. We had a few decent lines to buy today and there was simply no interest on the sell side to cross meaningful volume…

***News just across the ticker on NAB with both CEO Thorburn & Chairman Ken Henry to depart, the CEO out on the 28th of the month while Henry will leave once they appoint a new CEO. Current NAB Director Phil Chronican will be acting CEO during the search. Clearly, Commissioner Hayne had the final say here***

Overall, the ASX 200 closed up +66points or +1.1% to 6092. Dow Futures are currently trading down -51pts or 0.20%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

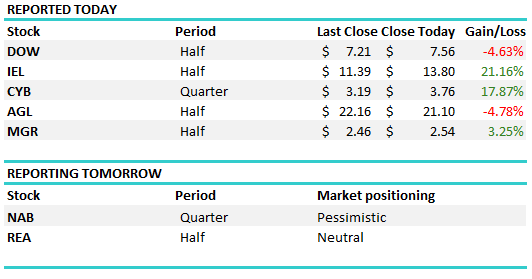

Reporting; A mix of results out today. IDP Education(ASX: IEL) was better than expected, and today’s 21% jump took the 12 month performance to over 100%. Highlights were growth in the India language education & student placement services which drove a 34% lift in first half profit – a cracking result from the spin out of Seek Learning. Clydesdale (ASX: CYB) reported 1st quarter overnight in the UK, the stock putting on an impressive ~17% here although it remains ~50% below its 12 month high.

Contractor Downer (ASX: DOW) initially opened higher and on first read through it looked like an impressive beat on full year guidance, however they’d it incorporated the benefit of an acquisition in the numbers. Still, a marginal beat on the profit line for the half while they more or less met current market expectations in terms of guidance for the full year.

AGL Energy (ASX: AGL) was a more complicated set of numbers with some good, and less good parts. The half year was strong with profit of ~$534m which was above expectations and they re-confirmed guidance to be at the mid-point of the $970-$1070m range, however consensus was already at the top end ($1035m) implying a 3.5% miss on the full year. There was also some expectation that AGL would announce a buy-back, and that didn’t happen, their preference to improve efficiency internally. After a begrudging run higher from ~$17 to ~$22 (the mkt hates the stock), a miss on guidance + no buy-back it was understandable to see the stock end down -4.78%

Clydesdale Bank (ASX: CYB) +17.87%; The old UK arm of NAB took flight today on a better than expected 1st quarter update. The market’s reaction has been driven by two major pieces of the update with the net interest margin (NIM) reporting better than expected, while further increases to the expected synergies of the merger with Virgin Money were also announced. After seeing sliding margins over the last 12 months, Clydesdale’s NIM remained steady at 172bps driven by better mortgage loan growth and liquidity in institutional funding which offset the slow deposit growth. The company update NIM guidance for the full year to the higher end of the previous range, now 165bps-170bps

The bank also increased the minimum level of cost synergies it expects to achieve, upgrading it from £120m/year to £150m/year from FY21 onwards. A nice 25% increase to the synergies which continue to validate the merger with Virgin Money. There are some underlying issues within the report – namely a lack of deposit growth which grew only 10% of that of the loan book. NIM will continue to slide, and it looks as though this result is masking the problem. The UK economy continues to face challenges as well which may see the impairments rise and loan growth slow. The upside remains around the merger as the combined entity will produce a better product on a more cost efficient rate.

Clydesdale Bank (ASX: CYB) Chart

Broker Moves;

· Chorus Upgraded to Buy at UBS; PT NZ$5.70

· Caltex Australia Downgraded to Neutral at JPMorgan; PT A$27.50

· Independence Group Downgraded to Sell at Morningstar

· Adelaide Brighton Downgraded to Hold at Morningstar

· Coles Group Downgraded to Hold at Morningstar

· Westpac Downgraded to Neutral at JPMorgan; PT A$28.90

· Insurance Australia Cut to Neutral at Credit Suisse; PT A$7.80

· IDP Education Rated New Neutral at UBS; PT A$11.30

OUR CALLS

No amendments today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.