Has the Healthcare sector regained its “Mojo”? (RHC, FPH, HLS, NAN, SHL, APT)

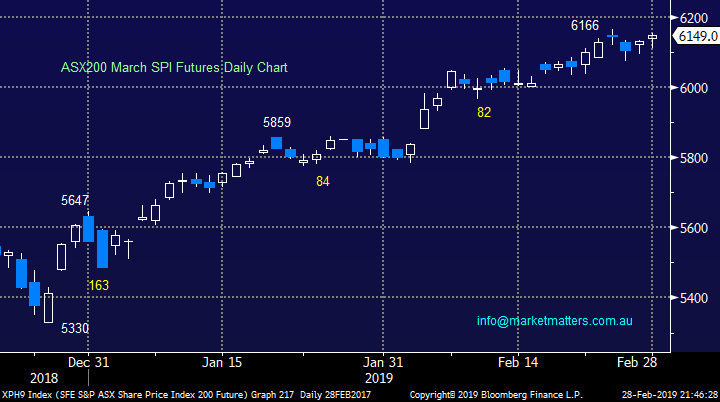

The ASX200 enjoyed another firm day to end February rallying another 18-points and as Led Zeppelin immortalised in both lyrics & movie “The song remains the same” – I just checked they released the concert film in 1976 showing, clearly I have taste beyond my years! The point I was attempting to make before getting carried away was the market opened, then rapidly slipped ~35-points before recovering from lunchtime and finally pushing to new daily highs after 3.30 pm – I’ve written a similar tale for many days in 2019. The ASX200 actually closed out February with its best monthly performance since 2016, investors are clearly now comfortable to buy shares again, especially as property is no longer regarded as a sure thing.

Under the hood we saw broad strength which was lead by the healthcare and banking sectors while profit taking looks to be creeping into some resource stocks, no major surprise after their recent stellar 3-month advance. It was nice to see our recent purchase Bingo Industries (ASXC: BIN) surge over 15% to be the top performer on the day but we won’t count our $$’s just yet, this is a fickle market where profits can vanish as quickly as they arrive i.e. remain open-minded and flexible.

The upside momentum of the local index continues to reduce but while our ideal short-term scenario is a pullback towards the psychological 6000 area no technical sell signals have materialised to-date.

MM remains in a patient “buy mode”, importantly we are not chasing the market in general at current levels.

Overnight US markets closed down -0.25% but the SPI futures are pointing to a slightly higher open locally.

Today we have looked at 5 names in the Healthcare sector which have caught our eye over recent weeks.

ASX200 March SPI Futures Chart

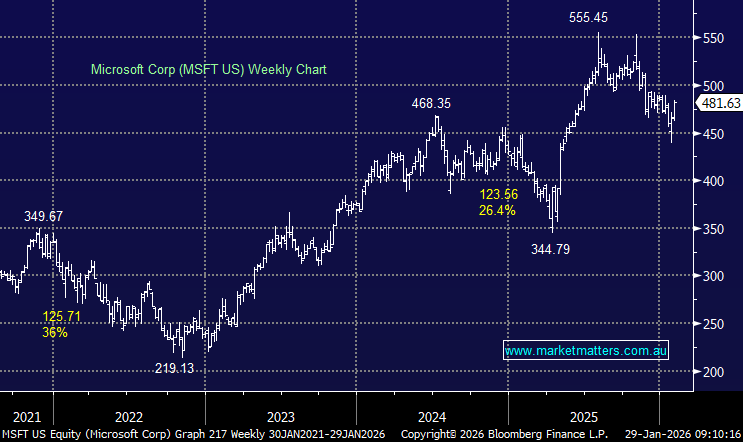

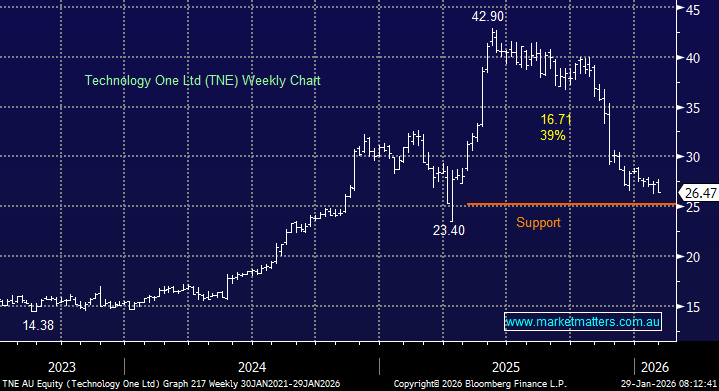

We have been discussing a few of the high flyers from the Software & Services Sector over recent weeks / months and they continue to evolve in an interesting manor although we are not yet considering pressing the “buy button”.

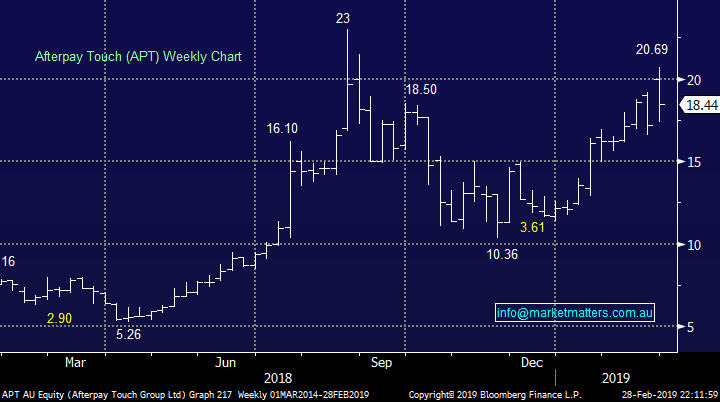

Afterpay Touch (ASX: APT) bounced over 4.5% yesterday after slipping 16% following its latest company update. If the stock follows its rhythm from 2018 its should now calm down for a few weeks with a likely downward bias towards $16.50-$17.

MM has interest in APT from a risk / reward perspective around 8% lower.

Afterpay Touch (ASX: APT) Chart

Its wonderful to see an Australian business excel in the overseas dominated Artificial Intelligence space (AI), and Appen is certainly doing that. The stock still feels relatively cheap considering its strong position in a new industry, its rare that we say a P/E of over 40x is not too concerning.

However following its recent explosive gains we feel prudence is to be patient, at least for now.

MM remains bullish APX looking for an opportune entry.

Appen Ltd (ASX: APX) Chart

Overseas indices

No change with US markets, we still believe they have a strong risk to the downside with our target ~5% lower but we should a remember that tops, even short-term ones, generally take longer to evolve as opposed to bottoms which usually react like a tensioned spring board.

US Russell 2000 Chart

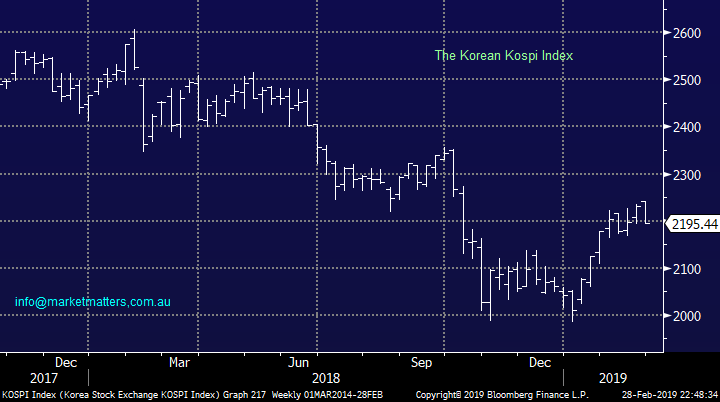

Yesterday President Trump demonstrated that he is not always the markets saviour as he walked away from negotiations with North Korea sending the South Korean KOSPI down close to 2%.

Expectations for Donald Trump’s second summit with Kim Jong Un were mixed but the market was taken by surprise by its abrupt end. The U.S. president said he walked out because the North Korean leader’s offer to dismantle the nation’s main nuclear facility at Yongbyon “wasn’t enough.” I actually thought the response by Trump and his associated explanation showed a rare moment of composure.

The Korean KOSPI Index Chart

No change with European indices who have reached major resistance and our target area following their ~12% bounce, we are now neutral to bearish from a simple risk / reward basis.

This reaffirms our believe that patience is likely to be rewarded with buying of the market in general – clearly not necessarily on a stock by stock basis.

German DAX Index Chart

Has the Healthcare Sector regained its “Mojo”?

Over the last 5 trading days stocks in the Healthcare Sector have garnered a clear “bid tone” with a few solid performances e.g. Ramsay Healthcare (ASX: RHC) +8.8%, ResMed (ASX: RMD) +3.6%, Sigma Healthcare (ASX: SIG) +7% and Nanosonics (ASX: NAN) +15%. This is arguably similar to what we have seen with other recently beaten down stocks across the index as investors search for relatively cheap exposure to a market that keeps climbing a wall of worry e.g. previous market favourites CSL (ASX: CSL) and Cochlear (ASX: COH) remain 16.7% and 23% respectively below their 2018 highs.

Today I have looked at 5 stocks in the sector to see if we can find any potential opportunities for the weeks ahead.

1 Ramsay Healthcare (ASX: RHC) $64.78

RHC has broken out to the upside with gusto following the release of their half year results which were solid, however importantly to us it’s the first time in a while we heard them talk about improvement in the UK and France. From an earnings perspective, profit came in a tad above expectations and guidance was more or less in line with current market expectations, however it was the commentary around volume growth in the UK and better pricing outcomes in France that underpinned the days buying.

RHC could certainly be considered a “dog” if we consider the last few years with the stocks still well over 20% below its 2016 high – remember the “dogs” have been a hot area of late. RHC is now trading on an Est P/E for 2019 of 21.3x which is low for a quality global healthcare company. Over the past 5 years, RHC’s average P/E has been 24.4x, the more recent discount a result of concerns about their big overseas expansion, and yesterday’s result goes so way of dispelling those concerns.

While they guided for profit growth of ‘up to 2%’ for FY19, RHC has been putting the foundations in for a ‘stronger for longer’ growth profile, and from 2020, they should be growing profits by around 10%

RHC Historical P/E

At this stage we are inclined to be observers short-term to see how the result is digested over the coming days / weeks with ideal entry a few $$ lower.

We are interested in RHC moving forward.

Ramsay Healthcare (ASX: RHC) Chart

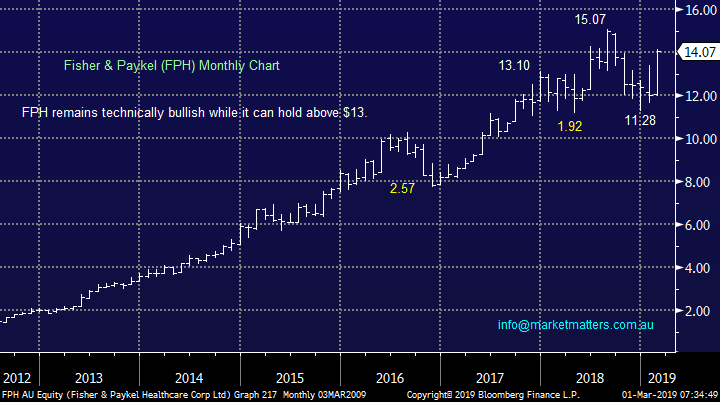

2 Fisher & Paykel (ASX: FPH) $14.07

Last month FPH settled an annoying patent dispute with rival ResMed (ASX: RMD) and the board used the opportunity to announce that the settlement will not have a meaningful impact on its NPAT guidance for the 2019 financial year.

This respiratory care business has an excellent medium-term track record of growth which can be seen from the share price gains below. Similar to ResMed (ASX: RMD) its market opportunities are growing as countries like China and India mature economically. Following the recent price appreciation the stock is no longer in the cheap corner but we are still bullish with an eventual target ~10% higher.

We like FPH at present but feel our exposure to the area through ResMed is sufficient.

Fisher & Paykel (ASX: FPH) Chart

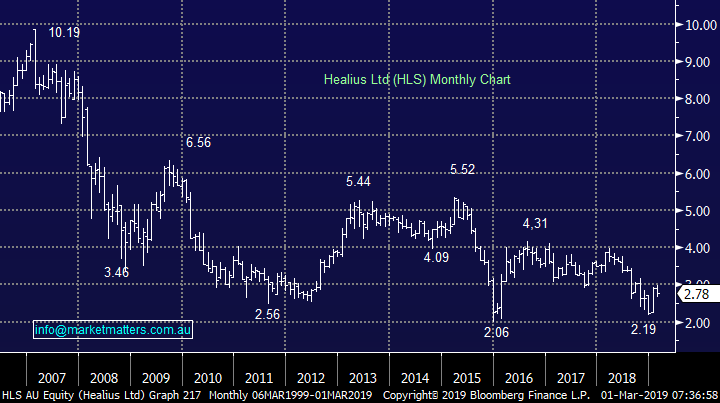

3 Healius Ltd (ASX: HLS) $2.78

In January Healius (the old Primary Healthcare) rallied following a conditional takeover offer at $3.25 per share from Jangho Group Hong Kong Limited who already own over 15% of the business.

Clearly the stock price implies that a deal completion is unlikely but as we saw with Healthscope (ASX: HSO) these things often have more than one chapter.

The hurdles to the current deal include due diligence and then often onerous Australian regulatory approvals (including the Foreign Investment Review Board) – perhaps BGH-Australian Super will have interest as there war chest looks for targets.

From a risk / reward perspective we like HLS at current levels.

Healius Ltd (ASX: HLS) Chart

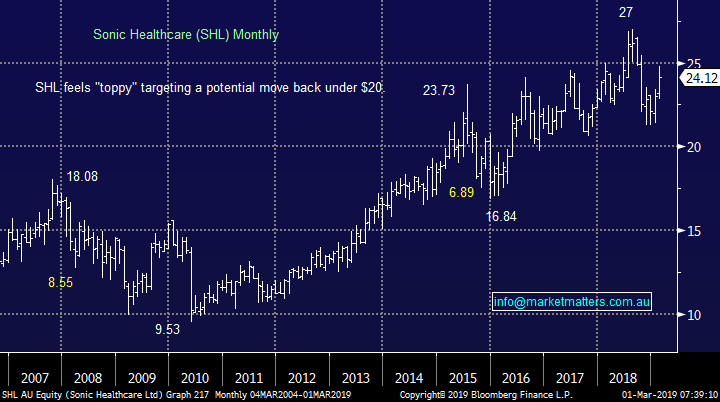

4 Sonic Healthcare (ASX: SHL) $24.12

Interestingly SHL is down almost 2% over the last 5-days which ties in with our technically bearish view of the stock.

The medical diagnostics business released solid first half results last month and upgraded guidance but we are always wary a stock that cannot rally on good news. The stocks trading at fair value leading us to see better opportunities elsewhere within the sector.

MM has no interest in SHL at current levels.

Sonic Healthcare (ASX: SHL) Chart

5 Nanosonics (ASX: NAN) $4.15

The biotech business which specialises in the development /commercialisation of infection control has enjoyed a stellar 2019 after announcing first half revenue up over 35% and an operating profit after tax of $11m.

The business is well positioned moving forward following a renegotiated distribution deal in the US and a new earnings stream in the next few years from replacement/upgrade opportunities for their Trophon2 device. While earnings here are not the driver – growth is - maintaining current growth rates may- be challenging.

NAN is technically bullish while it holds above $3.60 but risk / reward opportunities are hard to identify.

MM is neutral / bullish at current levels.

Nanosonics (ASX: NAN) Chart

Conclusion

We own Resmed in the Growth Portfolio and remain comfortable with the holding for now

Of the 5 stocks looked at today we like Healius (ASX: HLS) as a takeover play and Ramsay Healthcare (ASX: RHC) a few dollars lower.

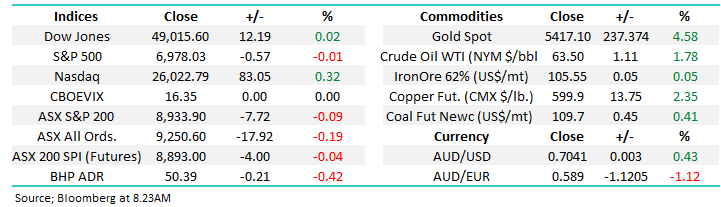

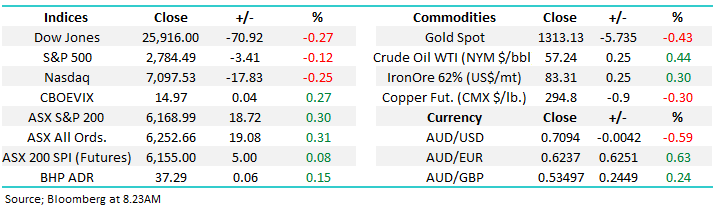

Overnight Market Matters Wrap

· The US continued its descent overnight, ending its session lower however ending the month of February at a high, with the S&P 500 up 2.97% and the Dow up 3.67%.

· US GDP came in at 2.6% vs analyst’s expectations of 2.2%. Meanwhile, Fed officials argue that they can be patient given benign inflation and a weak world growth outlook, led by China. Caixin China PMI manufacturing data will be released at 12.45pm today, where analysts expect a reading of 48.5.

· Base metals were mixed, while iron ore rose. Gold fell to $US1313.13/oz. and crude crude oil continued to climb.

· The March SPI Futures is indicating the ASX 200 to open with little change this morning, around the 6170 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.