MM’s favourite 3 from Macquarie’s recovery picks (SNOW US, SGR, APX, RHC)

Firstly, what a cracking morning in Sydney. I took this pic on the way in today looking out the heads. On the left is Seaforth, Castle Rock which is one of my favourite places, the kids love it and Balgowlah Heights towards the point. You can walk around there as part of the Manly to Spit walk, it goes through the national park and around North Head. On the other side of that headland is Manly. Just to the right of the pic which you can’t see is Chinamans Beach, Ken Done (the artist) has a fantastic house at the end of Chinamans and then around that point is Balmoral. The next beach on is Cobblers Beach, just past a Navy base - any form of clothing is highly optional at Cobblers! The water area shown is all fairly shallow relative the rest of the harbour, but it deviates a lot with the right-hand side being a lot deeper, the drop off is a good fishing spot, so I hear. I try but the fish don’t like me much.

Source: JG’s iPhone

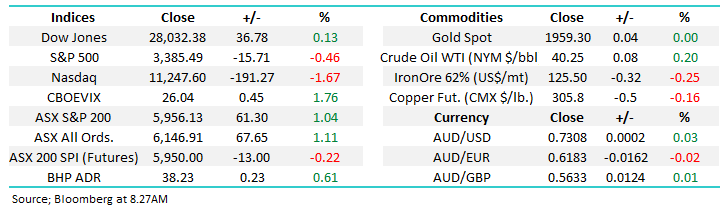

Anyway, back to reality and the ASX200 enjoyed a good Wednesday which saw the index rally over 1% courtesy of broad-based buying which pushed almost 80% of stocks into positive territory on the day. All 11 sectors closed up with the recently embattled IT Sector regaining some lost ground, on the reverse side of the ledger we saw pure iron ore stocks struggle as the bulk commodity tumbled over 3% in Asia, however diversified heavyweights BHP & RIO still managed to close solidly.

We mentioned the domestic housing market disappointing the doomsday merchants in yesterday’s report, the AFR led with a similar story overnight, overall residential prices fell by just -1.8% in the June quarter, significantly less than back in 2018 – the banks clamping down on lending hit housing prices harder than COVID! The bottom line is we love our property in Australia and while interest rates remain at unprecedented low levels, banks are prepared to lend and the state / federal governments are doing everything in their power to get the economy back to its late 2019 levels prices appear set to remain firm. Remember as the pandemic broke out the RBA gave banks access to 3-year money at 0.25% hence we got the creation of 2 & 3-year home loans at just over 2% i.e. paying the mortgage has got much cheaper for those still with a job.

Arguably as the economy improves and Queensland / Victoria eventually re-open their borders we could easily see prices again rising in most major cities, its only when you look at investments properties and especially apartments that the data is less encouraging. It may surprise many to know that housing prices are rising strongly in the UK and they’re ok in the US, we believe the pessimists should reconsider the impact of interest rates and huge government stimulus on property i.e. if stocks can bounce over 40% since March property can also surprise on the upside.

MM remains bullish the ASX200 short-term.

ASX200 Index Chart

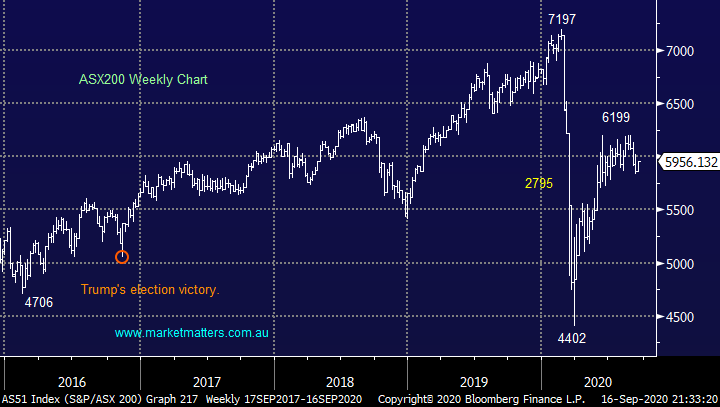

As we mentioned earlier iron ore fell yesterday taking its recent pullback to over 9%, conversely copper which often leads the commodities remains close to its 2020 high although we believe it is also not far from a ~10% pullback. To clarify our thoughts for the resources to subscribers:

1 – Short-term we remain bullish in line with our view that the $US will make fresh 2020 lows in the coming weeks.

2 – Assuming such a move unfolds MM is looking to take some profit from our large resources exposure.

3 – However we remain bullish the reflation trade through 2021 hence this is an active play where we will be looking to re-establish a decent resources exposure into a pullback e.g. Fortescue (FMG) has now corrected 12.5%, another 10% and we will have interest.

MM is looking to take some money from the resources sector into strength.

Iron Ore (CNY/MT) Chart

Copper ($US/lb) Chart

Overseas Indices & markets

Overnight the US Fed signalled interest rates would stay near zero for at least 3-years, good news for anyone repaying debt such as a mortgage. Officials also changed their economic forecasts to reflect a smaller decline in GDP and lower unemployment in 2020 i.e. COVID hasn’t been as bad as originally feared. Overall, all good news but pretty much in line with what the market was expecting, bond yields actually edged higher given the tweaks to GDP and unemployment expectations.

Stocks edged lower during the press conference, the comment that probably did the damage was Fed Chair Jerome Powell saying “he’s not sure if the faster-than-expected economic recovery will continue”, personally I reckon if he was to say anything different we’d all question that! The reality is the Fed are going to do whatever’s necessary to stimulate the economy so that’s a tick, the only issue at present is some of the irrational short-term exuberance needs to be wiped from some pockets of the market – when people assume they cannot lose the airs getting thin!

MM remains bullish US Bond Yields medium/long-term.

US 10-year Bond Yield Chart

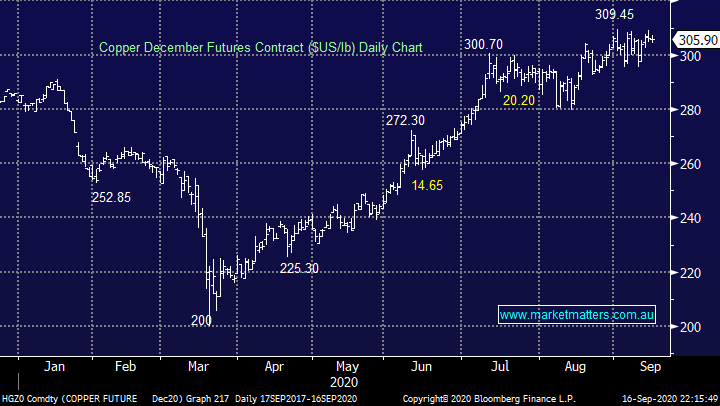

Overnight US stocks failed to get excited by the comments from the Fed which of course left interest rates unchanged, almost an afterthought at the moment it’s so expected. Overall I was a little disappointed to see stocks unable to hold onto early gains although it was the tech sector who again slumped as it appears the washout might not be finished, we are 50-50 at this stage. The Energy Sector rallied almost 4% in the US which enabled the Dow close up for the day, this should add support to the likes of BHP today who looks set to open firmly this morning.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

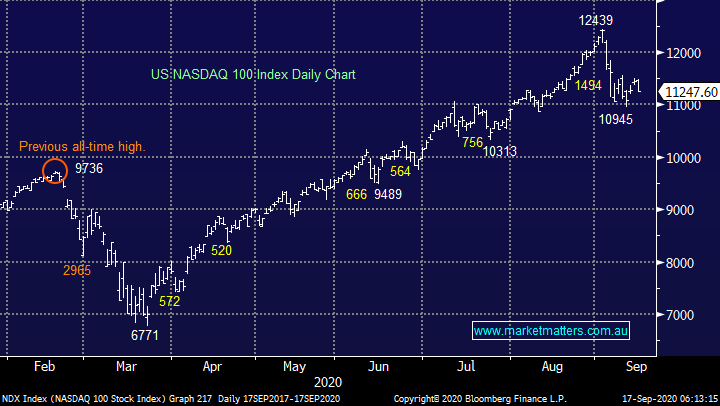

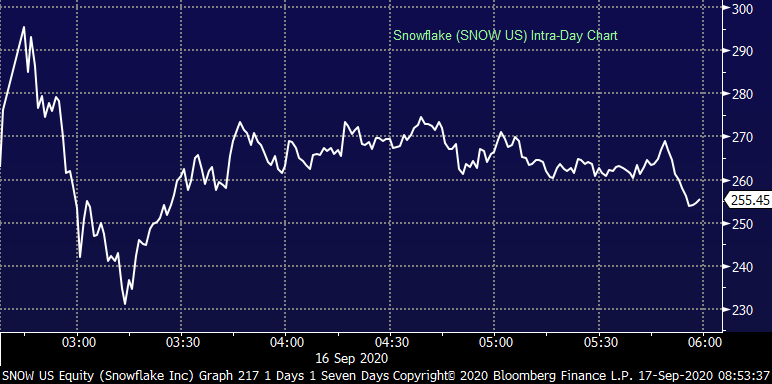

The much-anticipated Snowflake (SNOW US) IPO opened in the US overnight and more than doubled closing at $US253.93 relative to their $US120 issue price. It did trade as high at $US319 just after open as all those market orders on open were filled.

Snowflake (SNOW US) Chart

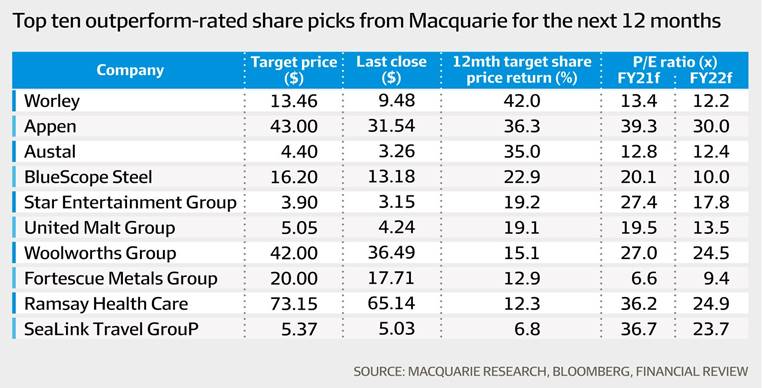

Our favourite 3 stocks from Macquarie’s recovery picks.

On Monday the AFR ran a story outlining “Macquarie’s top share picks for the next phase of the recovery” - the initial obvious observation is they are anticipating / positioning for an ongoing economic recovery. I spend a lot of time reading on most days and what I particularly like about these style of articles is they can occasionally make me revisit a stock which I had placed in the “boring or too hard basket” just when it might be about to start climbing its way out! We felt today was an apt time to publish this missive after the Fed stated the US economy has performed better than expected.

Obviously the performance of any recovery story is going to be largely determined by when a vaccine is delivered however the odds appear to be improving for next year, or if Trump has his way, we might see one just before the US election - hence we’ve looked at stocks which are likely to bounce strongly when the economy opens back up. We’ve already seen huge amounts of stock / sector rotation in 2020 but by definition its only been tentative with regard to the recovery story because the unknows are plentiful. We liked Macquarie’s catch phrase of “key vaccine beneficiary” its undoubtedly an area of the ASX that many fund managers are currently scouring.

Today I have looked at 3 of these stocks that most caught my attention.

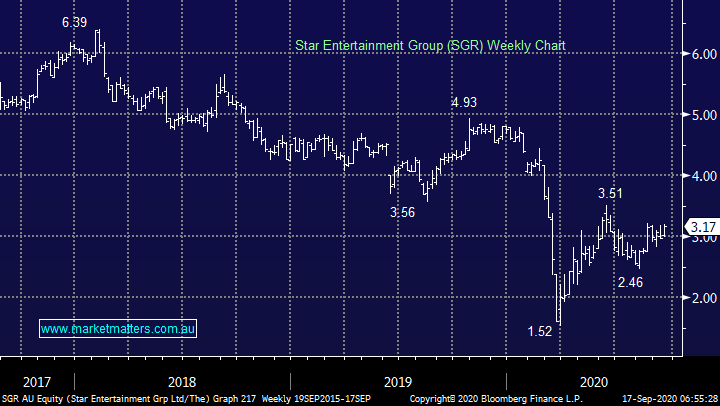

1 Star Entertainment (SGR) $3.17

SGR remains well below its levels at the start of the year, at MM we believe the stock is very tempting after a solid result in August. The company performed strongly in 2019/2020 before the pandemic implying that once its behind us the company is positioned to continue higher. Obviously this is all about looking forward through the haze of COVID but around the $3 region we feel the risk / reward is very good, especially as most people I talk to are keen to start travelling when permitted, unfortunately the overseas VIP will be slower to return and our deteriorating relationship with China is not good news but we remain a clean and safe destination.

Lastly the finalization of gaming negotiations in NSW giving the operator exclusivity for the poker machines in casinos over the next 20-years is a large plus. We can see a challenge of the $4 area into Christmas.

MM is bullish SGR at current levels.

Star Entertainment (SGR) Chart

2 Appen Ltd (APX) $32.35

Artificial intelligence (AI) business APX delivered a strong half year result however their guidance was a slight disappointment relative to the markets up-beat expectations. For the half year ending June 30th they delivered a nice 25% increase in revenue to over $305m which flowed down to an 8% increase in net profit of just over $22m. The AI business looks fairly good value to MM after its 30% pullback and once the US tech correction finishes, we feel APX can rally strongly now its only trading back on ~30x estimated earnings for 2022.

MM likes APX at current levels.

Appen Ltd (APX) Chart

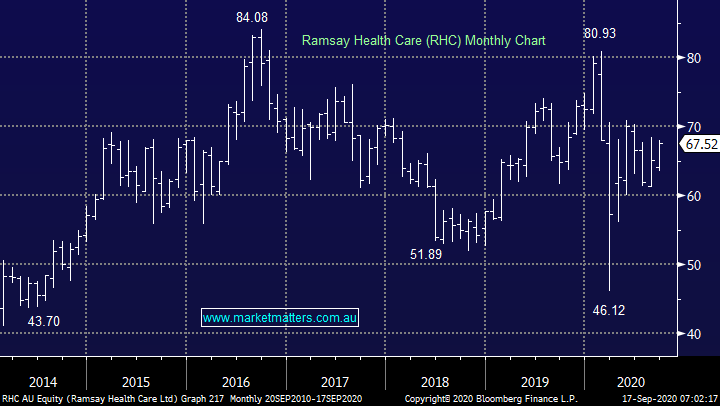

3 Ramsay Healthcare (RHC) $67.52

Global healthcare stock RHC has experienced tough conditions in the private hospital sector but I like it moving forward given the huge pent up demand for elective surgeries. Wait lists have been growing significantly and as we come out the other side of COVID, RHC will benefit. This morning we had a zoom meeting Mike Clulow who is a senior portfolio manager at EFG in the US (parent company of Shaw) focussing on US healthcare. I’ll have some more views around this in future notes.

MM likes RHC at current levels.

Ramsay Healthcare (RHC) Chart

Conclusion

MM likes the 3 stocks looked at today in order of SGR, RHC and lastly APX.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.