ASX hits 5 months high (MTS, NUF)

WHAT MATTERED TODAY

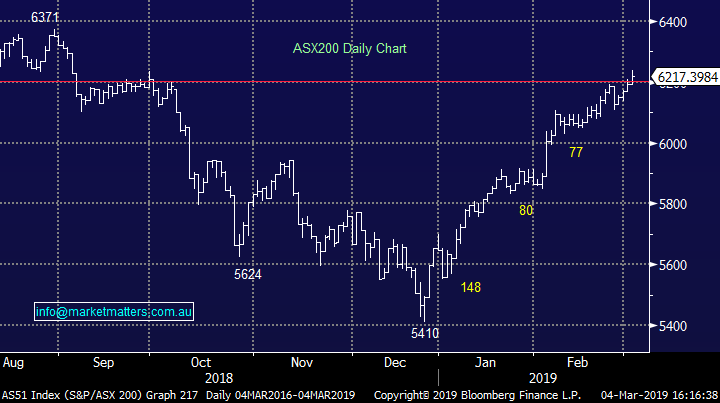

The Aussie market rallied strongly again today – mostly early with the ASX 200 hitting a 5 month intra-session high of 6240 just before lunchtime and that seemed get a few sellers out and about despite strong buying throughout Asia and US Futures that opened up +0.40% and stayed well bid throughout our session. Since the Christmas Eve low of 5410, the market has now put on +830 points to today’s high, or 15.3% - a remarkable bounce without any real pause. That’s clearly a phenomenal start to the year and now we find ourselves with a market on a forward PE basis that has risen from a fearful 13.5x at Christmas to 15.2x today, even though earnings have been falling, Momentum money is piling into stocks and we’re also seeing it in other areas, like hybrids, with both the recent NAB and MQG Hybrid notes copping a huge amount of bids. Cash is becoming uncomfortable in a rising market and ‘buying stuff’ seems like the most obvious decision.

One of the trends that is becoming obvious (and supports the above), is buying is now starting to be focussed on the cheaper areas of the market – stocks that have been sold off in the past 12 months or so and are trading on depressed multiples for whatever reasons. When markets become frothy, investors look for perceived value typically ignoring why the stock is cheap in the first place. That’s not necessarily a bad thing – and very strong gains can be achieved from buying stocks that have been kicked to the curb, however don’t forget why they were there in the first place!

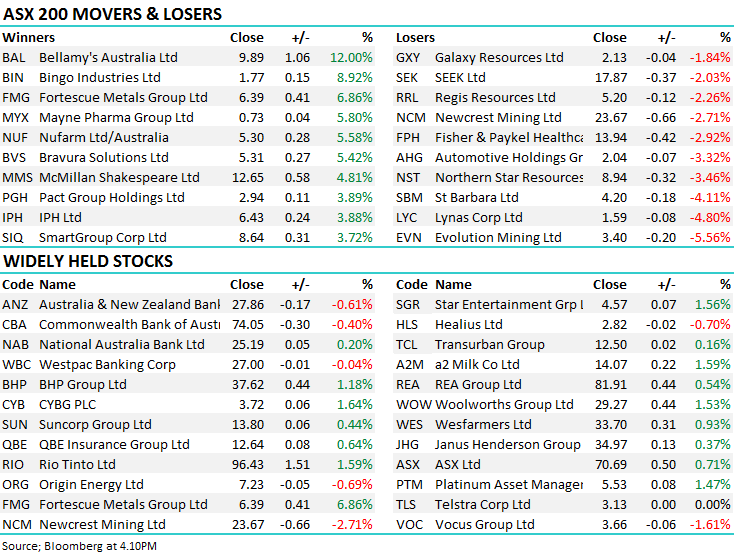

We’ve bought a couple of these ‘dogs’ and flagged a few more that have started to move. Bluescope (BSL) put on +3.48% today while Bingo Industries (BIN), a stock we bought into recent lows added ~9% to close at $1.77 – on strong volume which is encouraging implying $2 seems a strong chance in the near term. Elsewhere, Nufarm (NUF) - which Harry looks at below – was up +5.58% on a broker upgrade, while Bellamy’s (BAL) was also hot today adding +12%...

On the flipside, Gold stocks, which have been strong in the last 12 month have turned – selling now targeting the precious metal and the stocks that produce it. There will be a time to go back into gold this year, just not yet. St Barbara (SGB) down -4.11% today, Northern Star (NST) down -3.46% the worst of them.

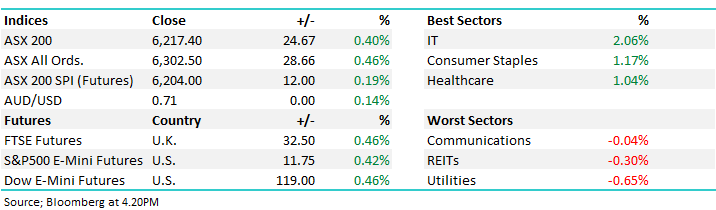

Overall today, the ASX 200 added 24 points or +0.40% to 6217. Dow Futures are currently trading up +106pts / +0.41%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Metcash (MTS) +2.69%; Metcash held their strategy day and outlined a plan to drive growth across the business. MTS is the wholesale supplier to many IGA supermarkets, Mitre 10 outlets and various other brands and continues to battle the retail wide headwinds with slow growth amid increased competition however today they detailed a $165m plan over the next 5 years to ensure growth outpaces the sector.

Metcash identified convenience, store upgrades and private label products as key to delivering profits. Around 500 stores have been identified for a bit of a nip-n-tuck, while currently less than 5% of sales are of private label products – MTS are looking to increase their offering. Both liquor and hardware are witnessing a slow growth phase and change in tack from consumers. Through their Porters liquor brand, MTS is looking to respond to the ‘Premiumisation’ of sales, positioning themselves as a higher end supplier. Home Timber and Hardware are struggling with the housing down turn and lower construction starts, similar to the issues facing Bunnings. Here Metcash are looking at digitalization as they target growth in market share of house builds from ~30% to 70%.

The strategy update also came with a trading update as Metcash enter the last month of their April year end, with food sales to be marginally higher than last year, liquor performing well with increased wholesale numbers while hardware sales are softening. We like Metcash from a valuation perspective and while they are still facing some cyclical issues and have plenty left to do in terms of operational efficiency and strategy execution, a strong turnaround is not priced in. We are positive on MTS at current levels.

Metcash (MTS) Chart

Broker Moves; Nufarm (NUF) saw a decent amount of buying on the back of an upgrade out of Deutsche Bank on valuation grounds after the stock traded down to 4-year lows recently. The company which distributes crop protection products has been under weather related pressure, but today found a friend in DB which gave the stock a price target of $6. DB said the company was trading on a 23% discount to its long term EV/EBITDA multiple, and a 20% discount to the average PE whilst seeing upside in its canola seed technology. NUF took a chunk out of the multiple discount today by closing 5.58%, but at one stage was trading over 10% higher.

Nufarm (NUF) Chart

Elsewhere;

- Fortescue Upgraded to Buy at Ord Minnett; PT A$7.30

- Nufarm Upgraded to Buy at Deutsche Bank; PT Set to A$6

- Automotive Holdings Upgraded to Buy at Morningstar

- Sandfire Upgraded to Hold at Morningstar

- Rio Tinto Downgraded to Hold at HSBC; PT 46.50 Pounds

OUR CALLS

No changes to the portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.