RBA keeps interest rates on hold as expected (COL, WSA)

WHAT MATTERED TODAY

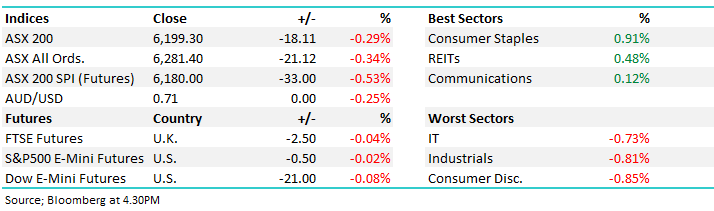

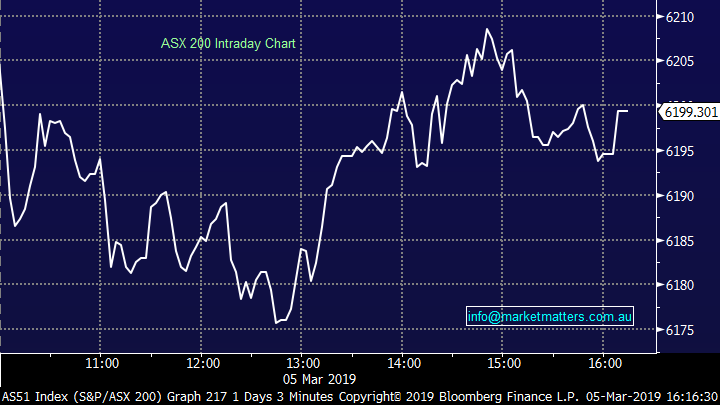

The US market was weak overnight, the S&P 500 off by around -0.40% and that selling ticked into local stocks throughout our session today, more so in the morning before buyers stepped up into weakness and the market finished ~25 points up from the session lows, but still in the red. While the market is showing signs of topping out, tops take time and often test ones patience - even shorter term ones like we’re targeting and todays buying of weakness suggests the market may not be ready to roll over – just yet. The US market obviously key here and the S&P 500 is knocking its head up against resistance…

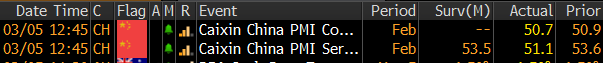

China was in focus today lowering its economic growth target + they also announced tax cuts as they attempt to insulate against the external trade related factors impacting growth. They now target growth of 6-6.5% which was expected, consensus sitting at 6.2% so no real movement on the back of that call. On the data front, both Chinese services and manufacturing data were out around lunchtime, both printing on the softer side, however the Chinese market + the rest Asia remained fairly mute.

Chinese Economic Data out today

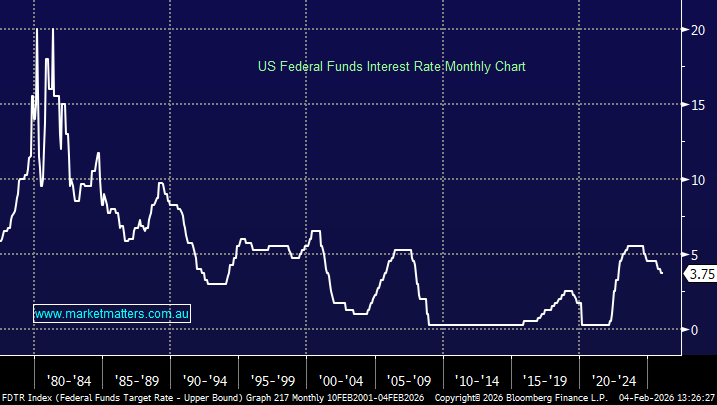

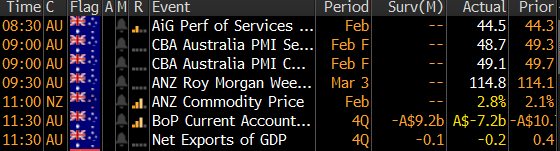

Locally, there was a flow of economic data out which put some pressure on the Aussie Dollar, while the RBA kept interest rates on hold at 1.5% (as expected) this afternoon. The market is now pricing a 52% chance of a 25 basis point cut in August while a few of the better known economists expect more. Bill Evans at Westpac reckons they’ll cut in August and one in November while UBS has also joined the party calling for 50bp of cuts. We think they’ll hold fire.

Local Economic Data out today

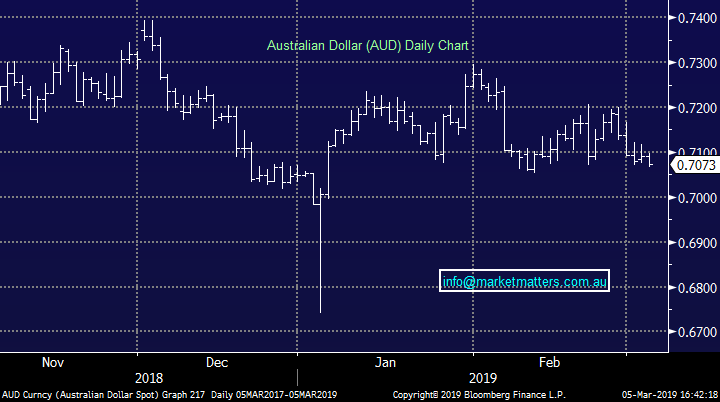

The Aussie Dollar saw some selling today, settling around 70.73 at time of writing

Australian Dollar Chart

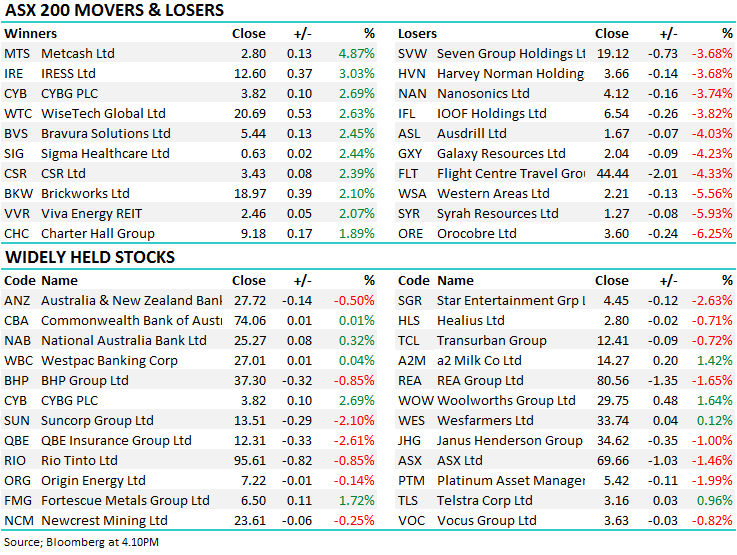

There was some buying in the defensive areas of the market today however the main (positive influence) came from the banks which outperformed in a weak market, CBA, WBC and NAB actually closing higher on the session – it’s hard for the market to sell off when the banks are being supported.

Overall today, the ASX 200 fell by -18 points or -0.29% to 6199. Dow Futures are currently trading down -19pts / -0.08%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Not a lot from a stock specific perspective today…

Coles (ASX: COL) –0.18%; although more known for the supermarkets, Coles does still have interests in a number of hotels Australia wide which today it moved to sell down part of its ownership. Coles has entered into a joint venture with Australian Venue Co. which is majority owned by private equity firm KKR. The deal sees AVC manage 87 of Coles’ hotels while Coles will continue to operate the retail liquor stores, 10 of which are attached to the hotels, whilst receiving around $200m from AVC. At around $300m revenue/year, the hotels are not a huge portion of the company’s earnings, and with the cash injection from the sale Coles can look to reduce its large debt balance or take a more aggressive approach in the supermarket war. Despite the sale being around 10% below book value, it seems the logical move for Coles.

Coles (COL) Chart

Broker Moves;

· Cimic Downgraded to Neutral at Macquarie; PT A$50.90

· Collection House Upgraded to Buy at Canaccord; PT A$1.60

· CSL Downgraded to Hold at Morningstar

· Perpetual Downgraded to Sell at Morningstar

· Nine Entertainment Downgraded to Hold at Morningstar

· McMillan Shakespeare Downgraded to Hold at Morningstar

· Cochlear Upgraded to Buy at Citi

· Tabcorp Downgraded to Underweight at JPMorgan; PT A$4.20

· Senex Downgraded to Underweight at JPMorgan; PT A$0.34

· Goodman Group Cut to Sell at Shaw and Partners; PT A$11.30

· Vicinity Centres Cut to Neutral at Credit Suisse; PT A$2.67

· SCA Property Upgraded to Neutral at Credit Suisse; PT A$2.25

· CYBG GDRs Downgraded to Hold at Bell Potter; Price Target A$4

OUR CALLS

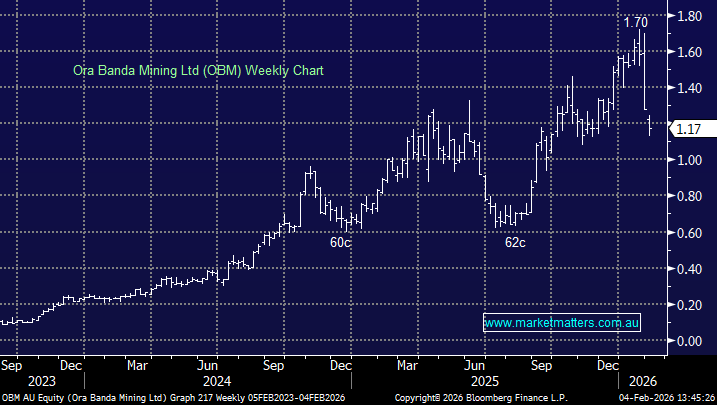

Regarding the WSA alert today we’ve sold because the trading action has been weak in the stock against a backdrop of positive underlying dynamics in the resources market, and Nickel specifically. Since the purchase date of WSA, the Nickel price has added almost 10%, while our holding in WSA only yielded 2.2%. The underperformance is what concerned us, and there still seems to be sizable selling out there as evidenced by the lack of support the stock showed again today.

The half year report was okay for longer term holders, although the short term trends were weak, which explains most of the underperformance to the underlying commodity. Operationally, Western Areas milled less nickel in the first half compared to the same period in FY18, which put upwards pressure on costs. While the backdrop for Nickel actually looks bullish, the short term operational outlook for WSA is more muted – hence the we sold for around breakeven today and went to cash.

Western Areas (ASX: WSA) Chart

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.