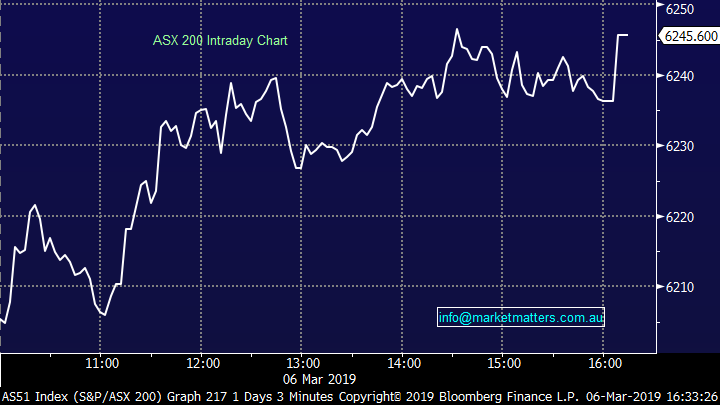

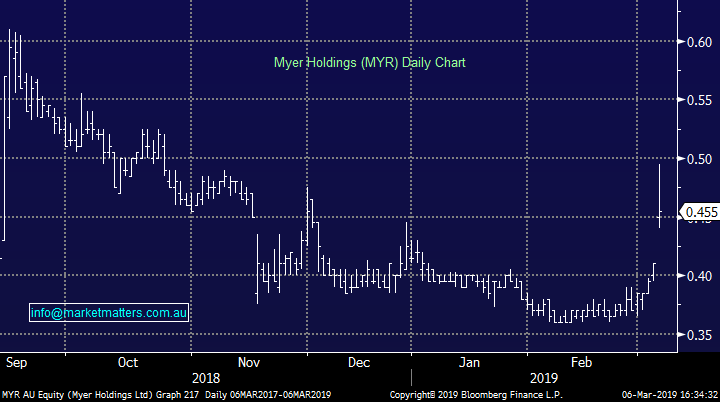

Slow growth boosts local market (MYR, COH)

WHAT MATTERED TODAY

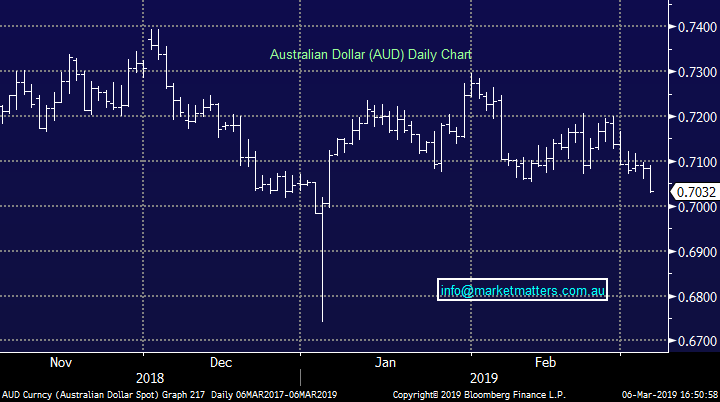

Aussie stocks rallied hard again today copping a big sugar hit from weaker than expected GDP numbers + the RBA Governor Lowe essentially ruled out any possibility of a hike this year. Interestingly enough, the market started rallying at 11am and put on a quick +20points prior to the weak GDP print being released – that always baffles me in this day and age. A weaker outcome for domestic growth saw the currency come off fairly hard – a daily high around 70.90c versus a daily low of 70.30c with the selling in the currency corresponding with strong buying of the index.

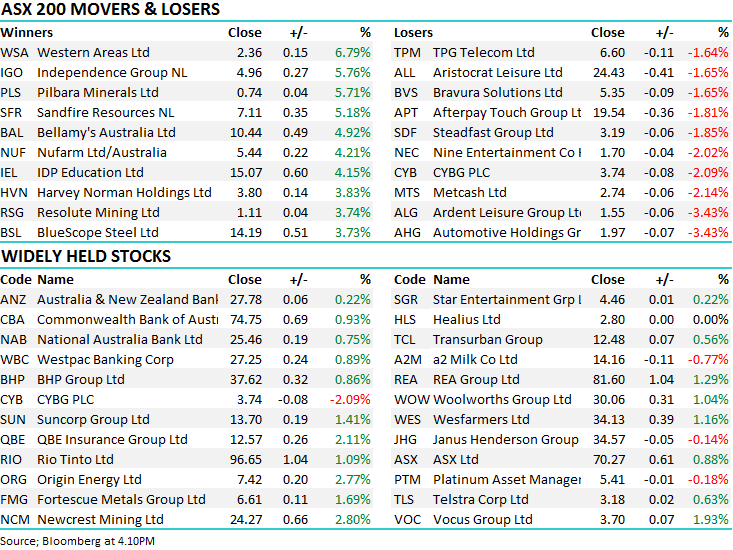

While banks are exposed to the broader Australian economy, and over time lower growth would be a negative for earnings, they all benefitted today from the strong prospect of lower rates – strong banks = strong market and today we saw ANZ +0.93%, CBA + 0.93%, NAB +0.75% & WBC +0.89% - we also saw strong buying amongst the retailers as a combination of lower rates + Bill Shorten’s election pitch for higher wages underpinned the sector – JBH +2.51%, HNV +3.83% however it was Myer that rallied most following their first half profit result – the stock up +11% on the session, although it was up much more at one stage.

Some big futures led buying on the close helped the index finish at its highest point since the 5th of September – a day over 6 months ago.

Local Economic Data out today

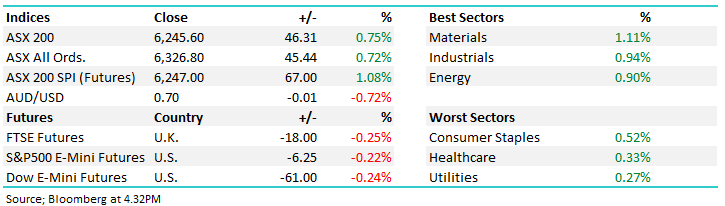

The Aussie Dollar was sold off again today, down by more than 0.5% from this time yesterday.

Australian Dollar Chart

Overall today, the ASX 200 rose by 46 points or +0.75% to 6245. Dow Futures are currently trading down -57pts / -0.23%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Myer (MYR) +10.98%; a true dog of the market over recent years, Myer shareholders have had little to cheer about over the last few years but today they did get some relief after the department store’s first half result today. Sales may have slipped, but at just a -2.8% for the half, it was much less than expected. Drilling down, online sales were the saviour here with the recent ramp up in website activity flowing through to sales. CEO John King is now looking to reduce floor space but not cut store numbers and seems to be making some headway with landlords in making this happen. Lease liabilities have long been an issue of Myer and investors will welcome the efforts to reduce this stress. The company also managed to post a decent profit of $38.4m for the half, a big turnaround from the $476m loss in the prior period.

Myer (MYR) Chart

Broker Moves; A recent sale of ours in Cochlear caught the eye of Citi Bank who increased their price target and upgraded to a buy. They noted the stock had dropped significantly from their result on the back of market share fears, however the analyst was not concerned with the trend saying the company operates in a division with high barriers to entry and early signs show strong uptake of the new Nucleus 7 product. We sold COH heading into the result on concerns the market would punish any signs of a slow down – and they did with the stock falling over 8% the next day. We tend to side with Citi here though – it’s a good business with great organic growth and no balance sheet concerns. A pullback to the recent lows below $170 would interest us.

Cochlear (COH) Chart

· Redflex Upgraded to Buy at CCZ Statton; PT A$0.74

· Auckland Airport Upgraded to Neutral at Forsyth Barr; PT NZ$7.30

· ANZ Bank Downgraded to Neutral at Citi; PT A$30

· Village Roadshow Upgraded to Outperform at Macquarie; PT A$3.80

· Rio Tinto Downgraded to Neutral at UBS

· Charter Hall Group Upgraded to Overweight at JPMorgan; PT A$9.75

· Domino’s Pizza Enterprises Raised to Buy at Goldman; PT A$50.50

· NIB Downgraded to Sell at Goldman; PT A$5.48

· Vicinity Centres Upgraded to Overweight at JPMorgan; PT A$2.80

· Cochlear Upgraded to Buy at Citi; PT $198

OUR CALLS

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.