Vocus tipped to raise capital – company denies it (VOC, AAC, HUB, ECX)

WHAT MATTERED TODAY

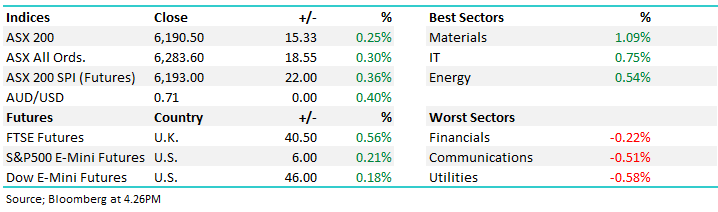

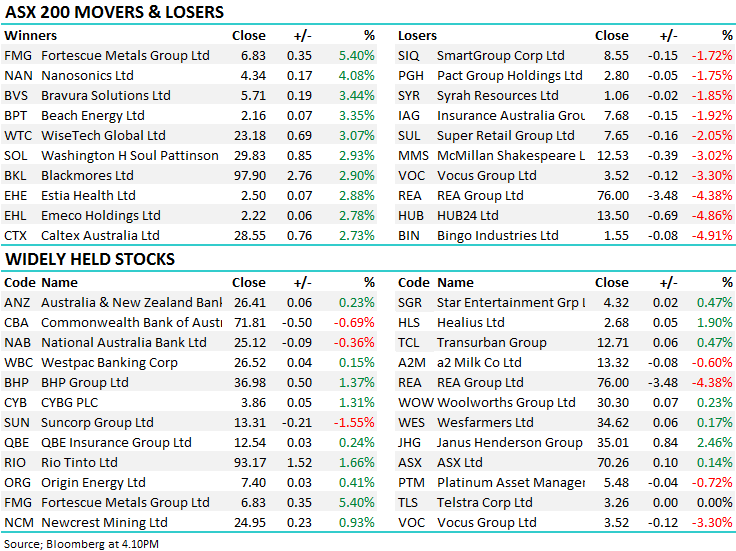

Not a lot to get excited about today with the market ebbing and flowing throughout the session to end the day marginally higher. US Futures were flat during our time zone, Asia was higher but not substantially so. There was a big seller of our market from midday for about an hour – which corresponds with Hong Kong coming online – about $800m worth of futures contracts traded and it was obviously seller led – that put pressure on stocks with the ASX dropping ~32points in short order, only to see a recovery play out for the rest of the day.

Overall today, the ASX 200 added +15 points or +0.25% to 6190. Dow Futures are currently flat

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

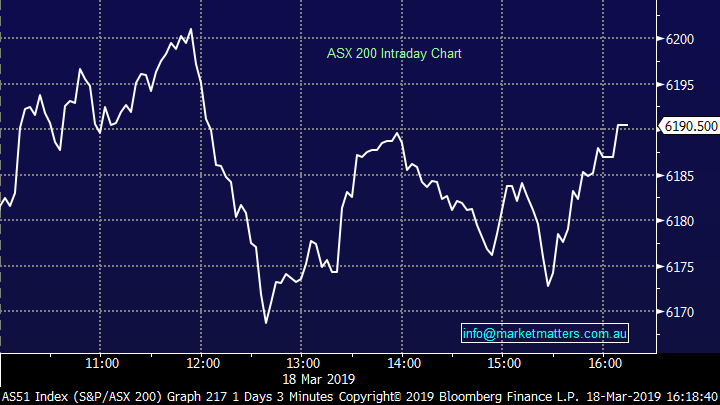

HUB 24 (HUB) -4.86% - down today after Director Ian Lister sold 275k shares at $14.05 a pop. HUB had been strong of late after the inclusion in the ASX 200 was announced on the 8th March, and was effective at open this morning. We also saw Pinnacle Investment Management (PNI) added to the 200, while Infigen Energy (IFN) & Automotive Holdings (AHG) was removed.

HUB 24 (HUB) Chart

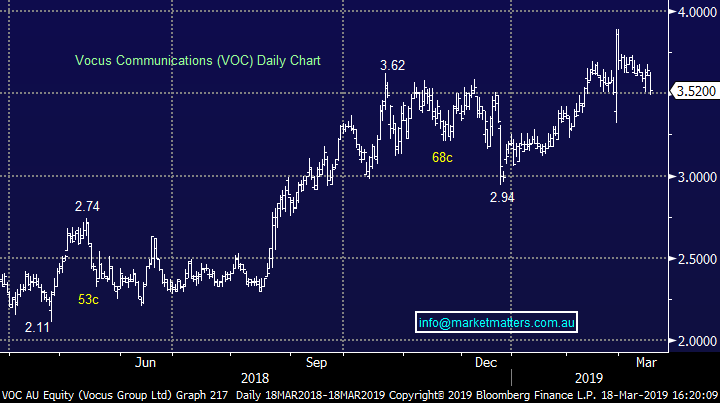

News in the AFR this morning that Vocus Communication (VOC) -3.3% was about to press the button on an equity raise was hosed down by the company – with the Telco saying....Vocus Group Limited (“Vocus”, ASX: VOC) notes press speculation this morning regarding a potential equity raising. Vocus refinanced its debt facility in June 2018 and as stated in the Interim Results presentation on 27 February 2019, net debt peaked during H1 FY19 after funding the Australia Singapore Cable. The Board and management remain comfortable with Vocus’ debt position. There is no current intention to raise additional equity.

It makes sense to raise cash up here – it would take pressure off the balance sheet however the company seems adamant that it’s not the case…although you what they say, where there’s smoke….

Vocus Communications (VOC) Chart

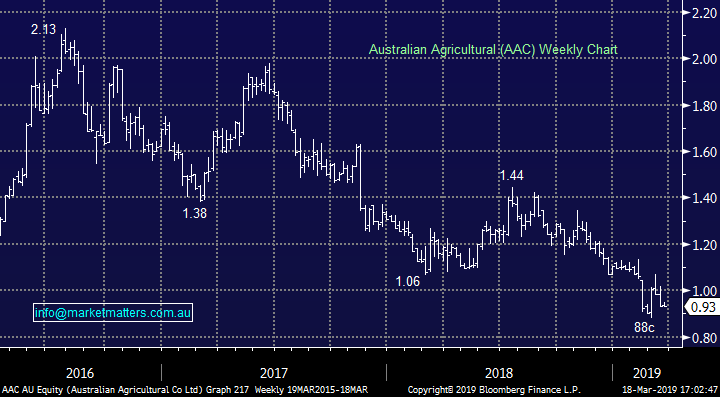

In other news doing the rounds this AM, Australian Agricultural (AAC) – flat- is also tipped to raise capital with expectations mounting that the country’s largest pastoral company will probably announce an equity raising while delivering its results in May (AFR). We spoke about AAC recently and a raise could potentially give us the opportunity in the 80’c region. Today the stock closed at 93c.

3 Australian Agricultural Company (AAC) $1

AAC is an integrated cattle and beef producer which runs the countries largest head of wagyu cattle – its all the rage in Sydney but obviously not enough impact on the companies bottom line in tough drought & flooding times. Ironically it’s now the Queensland floods that have hammered the companies share price to levels not seen since 2003, it’s a tough business when the weather has such a huge impact on profitability and one clearly only worth buying at the correct price.

Following the damage to its QLD livestock and infrastructure the company is undoubtedly going through touch economic and importantly social times, to put things in perspective this was a once in a century flood – don’t underestimate our farmers, they are a very tough breed who will fight back!

Importantly last month the company said ““The current operating conditions are not expected to affect the company’s ability to fulfil supply obligations or the rollout of its branded beef strategy, which continues to be a key focus. While we are still assessing the impact of this tragic situation, our balance sheet and financial position remains strong.” Definitely encouraging words in tough times. I have to be conscious of not voting with my heart on this one as I deeply feel for our farmers:

MM likes the risk reward of accumulating AAC between 80 and 88c i.e. no hurry yet.

Unfortunately AAC has prohibitive volume issues for MM only turning over $1m yesterday, we certainly need to be buying a wall of selling with this one and any position will be small

Australian Agricultural Company (AAC) Chart

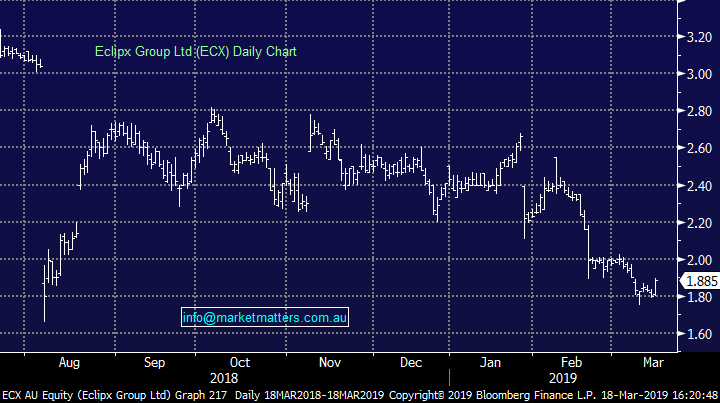

Eclipse (ECX) – in trading halt - is about to release a trading update to the market and this sniffs of a downgrade to me. We held ECX in the income portfolio for some time – cut it for a loss but at higher levels and the stock has been on a slide since – down around 30% since January. It’s certainly cheap however conditions have been weak on the back of weak confidence – not many looking to upgrade the car after reading the doom and gloom in weekend newspapers. Rivals McMillan Shakespeare (MMS) and SG Fleet are also down around 25% in the past couple of months. Back on Wednesday of after they release the news.

Eclipse (ASX:ECX)

Broker Moves:

· Central Petroleum Rated New Add at Morgans Financial; PT A$0.21

· Qantas Resumed at Macquarie With Outperform; PT A$6.25

· SCA Property Downgraded to Sell at Morningstar

· Stockland Downgraded to Hold at Morningstar

· Ruralco Downgraded to Hold at Morgans Financial; PT A$4.40

· Elders Upgraded to Hold at Morgans Financial; PT A$6.30

· Elders Upgraded to Buy at Bell Potter; PT A$6.70

**Elders upgrade interesting although it didn’t help the stock today – ended down smalls at $5.96**

OUR CALLS

We bought Emeco (EHL) & Healius (HLS) in the Growth Portfolio today while we also trimmed NAB.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.