Some of the ‘dogs’ starting to run (PMV, SGM)

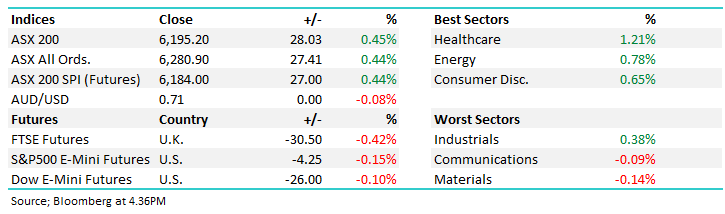

WHAT MATTERED TODAY

The market took its bullish que from the US overnight with stocks having a belated response to the Feds dovish commentary on Thursday – the Dow put on +216 points feeding into a bullish open in Australia and the market went on with – up until lunchtime at least. On the ASX 200, a break of 6200 saw short covering / new money come in with some decent buying of stocks, particularly some of the beaten down (dog) names rallied well – the index was strong into a lunchtime high of 6227, however that was as good as it got. Sellers then took the market by the scruff of the neck and pushed it back down below the 6200 handle. A weak close at6195 was 32 points below the intra–day high which is a more bearish than bullish day even though the market closed up.

US Futures were trading marginally lower during our time zone while Asian market were also fairly soft.

Overall today, the index closed up +28pts or +0.45% to 6195. Dow Futures are trading down -40 points / -0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

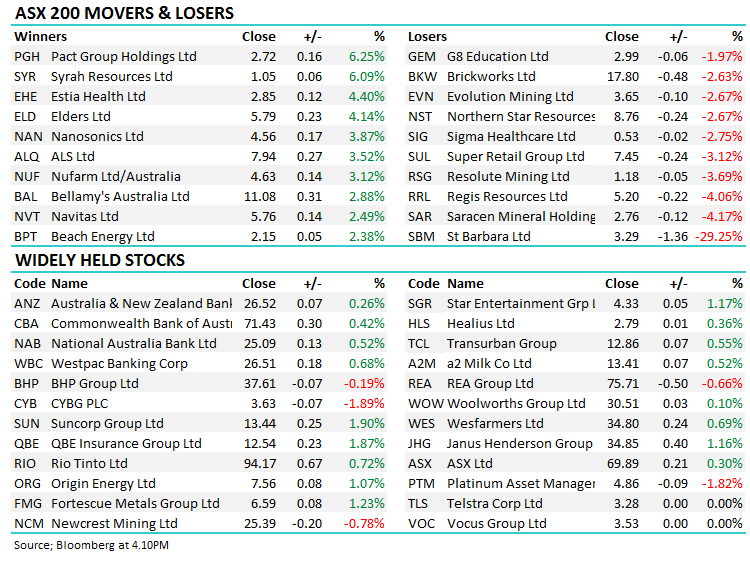

While the market was higher today, it was the recent laggards leading the charge with the likes of Syrah (SYR) +6.85%, Pact group (PGH) +6.25% which we added to this am in the MM Portfolio, Estia Health (EHE) continued to run up 4% and even Elders (ELD) +3.6% and Nufarm (NUF) +2.9% copped some buying. That sort of buying can be typical of a tired market – the index rallying on macro factors but stocks that offer ‘perceived’ value seeing most attention i.e. the leaders are expensive so focus on the laggards.

Sectors this week;

Stocks this week;

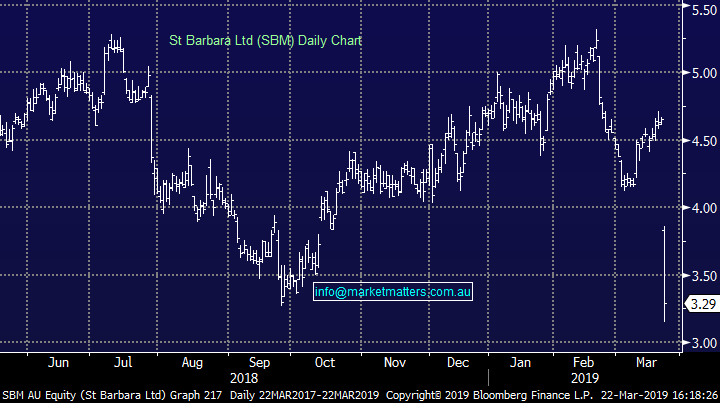

St Barbara (SBM) –29.25%, hit hard today after a downgrade to the current year’s production expectations, as well as a hit to any mine life extensions the market was hoping for to the Gwalia mine which is already 123 years old. St Barbara had been looking at ways to add years to the aging mine that in its current state would survive until the early 2030s, however today’s announcement all but ends the prospects of any extension to the 12 more years of production at Australia’s deepest mine. Add to this they also need to invest $100m into ventilation so that trucking the 1.1m tonnes of ore out each year can continue. For now, production will be limited until the additional ventilation is added, as such the miner was forced to downgrade expectations this year by 10,000 ounces to 235,000 to 240,000 ounces of gold. So production is slipping and capex will increase until eventually mining at Gwalia comes to an end – not a great story and the market dealt with it accordingly.

St Barbara (SBM) Chart

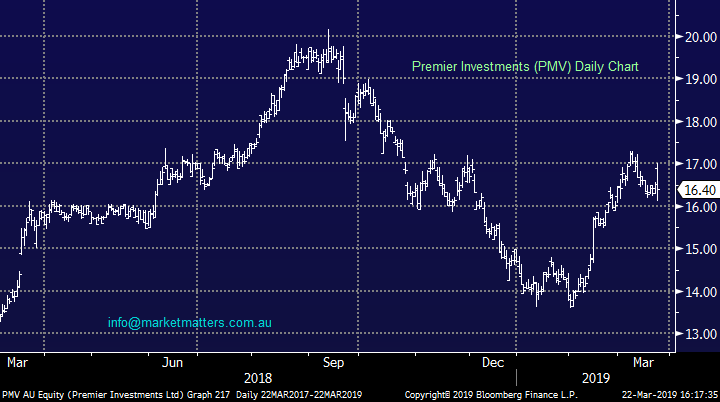

Premier Investments (PMV) -0.61%, was up early but that strength was sold into after they delivered what appeared to be a very strong set of numbers across most brands. The owner of Just Jeans, Jay Jays, Jacqui E, Portmans and Dotti chains along with the growth engine Smiggle, delivered both total sales growth and like-for-like growth during the period on all brands – so why the weakness in the stock? The market seems to be fixated with Smiggle which saw comparable sales growth of 4.8% in the first half, which was below expectations.

Premier Investments (PMV) Chart

Broker Moves;

· Shine Corporate Reinstated Buy at Moelis & Company; PT A$0.89

· Sigma Healthcare Downgraded to Sell at UBS; PT A$0.45

· Brickworks Cut to Hold at Deutsche Bank; PT Set to A$18.60

· Perpetual Upgraded to Hold at Morningstar

· ERM Power Downgraded to Hold at Morgans Financial; PT A$1.90

OUR CALLS

We added 2% to Pact Group (PGH) today however volume was fairly scarce around the ~$2.62 region early on. We’’ll continue to update our views for those that did not get set.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.