Is now the time to snap up tech stocks? (FMG, APT, AAPL US, ALU, MP1, WTC)

The ASX200 sold off in tandem with a plunging US futures market during Thursdays trading session, the local -1.2% decline wasn’t too bad considering the S&P500 futures were down ~2% when are market closed, plus they had already previously endured a relatively tough session following the Feds statement. My initial read through of the Fed expecting rates to be fixed around zero for 3-years has proved off point as it didn’t excite investors who obviously are used to being very spoilt by the US central bank. The negative interpretation appears to be created by a couple of issues:

1 – There was nothing “new” in the Feds comments and the market wanted yet more dovish noises. Its still waiting on a stimulus package but ahead of Novembers election it now looks to have become a pipedream.

2 – The Feds remain uncertain around the future recovery from COVID-19, it’s a science issue hence I don’t see how they could be more optimistic but when you’re used to a drip feed of good news there’s always plenty of room for disappointment.

Perhaps the real issue is investors remain too long US stocks after their tremendous post March recovery and the washout which has been filtering down from the high flying tech space is still unfolding – remember we cancelled our buying in the NASDAQ ETF (QQQ) because things “felt a little wrong”.

However Fed Chair Mr. Powell stated that the Fed is “strongly committed” to achieving the monetary policy goals of maximum employment and price stability as outlined by Congress, and emphasized that “the fiscal support has been essential in the good progress we see now” and that “more fiscal support is likely to be needed.” – I’m not sure how much clearer the Fed could have been that asset support isn’t going away anytime soon.

MM remains bullish the ASX200 short-term.

ASX200 Index Chart

Yesterday we discussed our cautious outlook in the short-term for resources and especially iron ore, on cue the market thrashed Fortescue (FMG) sending the miner down over 6%, already a 17.5% pullback in under 4-weeks. Just like with US tech investors are finding it easy to lock in some profits on the top performers of 2020. Recently MM has sold RIO Tinto (RIO) around $103 and yesterday we trimmed our BHP Group (BHP) position back from 9% to 6% hence we have flexibility to buy FMG if it remains under pressure.

MM is keen on FMG ~$15, another 7% lower.

Fortescue Metals Group (FMG) Chart

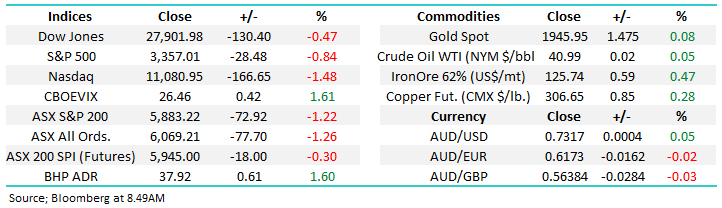

Recently MM has been flagging potential pullback targets for Afterpay (APT) after its stellar advance and there’s no change to our thinking, we like the risk / reward for this BNPL stock around the mid $60’s region.

MM likes APT around $65.

NB BNPL is the acronym for buy now pay later.

Afterpay Ltd (APT) Chart

Overseas Indices & markets

Financial markets are intertwined like a jigsaw and at present when investors become optimistic on the US economy they buy $US, sell bonds (yields up) which sends commodities down and in today’s market fuelled by stimulus stocks come along for the ride. We continue to believe that the $US will suffer another leg lower which MM believes will provide an excellent opportunity to take some profits in certain sections of the Australian market.

MM remains bearish the $US into Christmas.

$US Index Chart

Overnight US tech again fell but we feel its late recovery after making a fresh weekly low was very encouraging i.e. MM believes the NASDAQ is now “looking for a low”. Microsoft (MSFT US) for example recouped almost 60% of its losses by the close. As subscribers know we saw nothing in the Feds statement of major concern and of course September into October from a seasonal perspective does regularly produce a great buying opportunity.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

Three Australian tech stocks catching our eye.

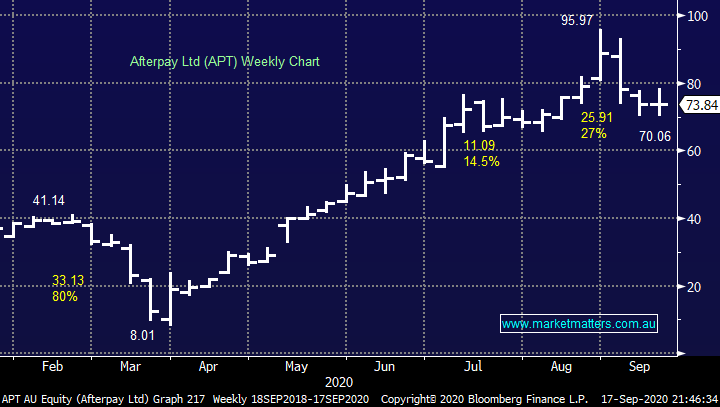

As we alluded to earlier MM is switching bullish after the NASDAQ’s 12% pullback, importantly this US index is dominated by quality stocks who make huge profits and are sitting on large cash piles. The main dichotomy in today’s zero interest rate world is how to value them but from a pure business perspective we like them into the current weakness. Heavyweight Apple has actually underperformed tumbling over 21% but we should remember that the stock rallied way too hard after its stock split, no value was added to the business!!

MM likes Apple around $US110.

Apple Inc (AAPL US) Chart

The local IT Sector has tracked its US equivalent fairly closely hence after its recent pullback which happily hasn’t been as deep as the US we feel is time to “check for opportunities” - the main reason we’ve outperformed the NASDAQ is the absence of heavyweight Apple from our index.

MM likes the risk / reward for local tech today.

ASX200 IT Sector Chart

As I mentioned above today, I have looked at 3 of these stocks that have most caught my attention – not including APT which we touched on earlier. Also, we’ve deliberately not covered stocks MM has looked at recently in an effort to avoid repetition.

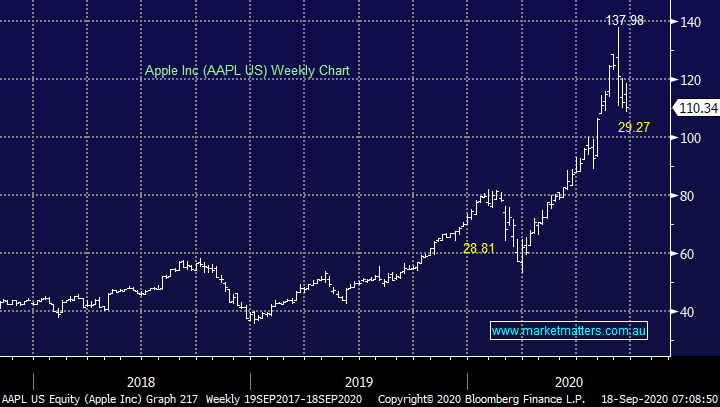

1 Altium (ALU) $34.02

Software business ALU focuses on systems for 3D printing circuit boards (PCB’s) putting it well and truly in a growing sector which sit in the middle of the $US2 trillion electronics industry. The company may have fallen short of market expectations when it delivered US revenue of $US189m for FY20 but it was still a solid effort which showed promise moving forward. An estimated P/E for 2021 of 60x makes it expensive on traditional matrices but investors should look at their 5-year plan which is exciting.

ALU has corrected 13% and we believe it’s now well positioned to make an assault on fresh all-time highs.

MM is bullish ALU around $34.

Altium (ALU) Chart

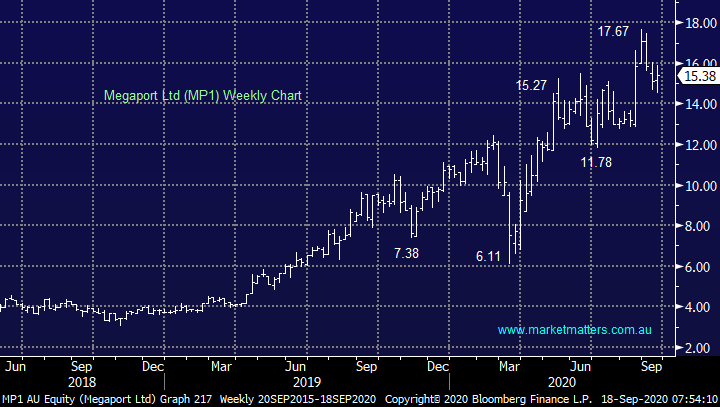

2 Megaport Ltd (MP1) $15.38

MP1 is a provider of elasticity connectivity and network services to over 300 centres globally. In August the company produced another great result, the “network as a service” provider delivered a 66% increase in revenue to $58m while recurring revenue increased ~10%. We believe the company is well positioned for ongoing strong growth as demand for its services increases in-line with the cloud computing boom.

MM believes this is a great company/story with the hardest facet previously being the risk / reward after the stock broke out to new highs however now after a 13% correction we can simply advocate buying now with stops under $14.50 – a 6% loss is always manageable and blue sky does beckon.

MM likes MP1 at today’s levels.

Megaport Ltd (MP1) Chart

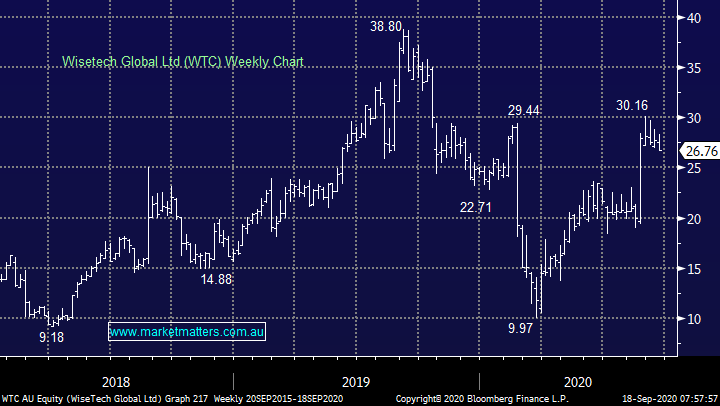

3 Wisetech Global Ltd (WTC) $26.76

Cloud- based software solutions business WTC has experienced a extremely volatile ride over the last 18-months but stability is returning to the stock and business. In mid-August the company revealed FY20 results which catapulted the stock up 30%, there’s mothing like low expectations to help send a stock higher. The business produced revenue up 23% and the relatively small pullback in September illustrates fund managers are now accumulating the stock.

MM likes with stops below $23, i.e. around 15% risk.

Wisetech Global Ltd (WTC) Chart

Conclusion

MM likes the 3 stocks looked at today in order of MP1, WTC and ALU but there is no major difference between the 3.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.