Markets down most since January 2 (PMV, MEA)

WHAT MATTERED TODAY

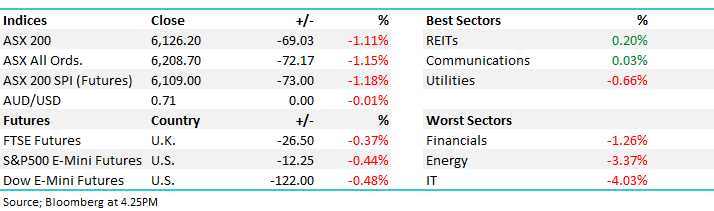

The market pulled back sharply today booking its worst performance since the first trading day of the calendar year following the weak lead from overseas on Friday night, growth concerns in a number of regions coming back into focus and overshadowing expectations of lower interest rates for longer. Talk around the desk today focussed on the strong rise in the market despite no real earnings growth – typical of analysts to highlight a negative influence on a down day! P/E expansion thanks to lower interest rates can only last for so long and the market, being the fickle beast that it often is may just start to focus on that ‘risk factor’ and sell stocks lower.

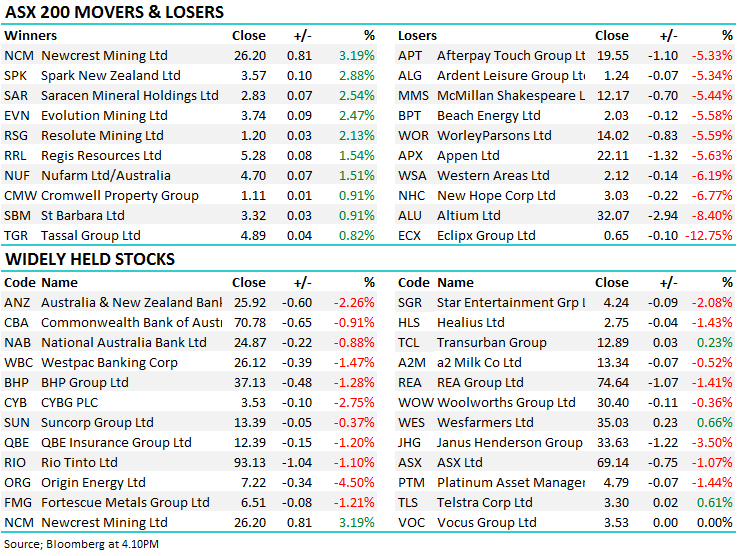

Those sectors that have been hottest recently felt the brunt of today’s selling, the IT stocks the main casualty with the likes of Appen (APX) down -5.63%, Afterpay (APT) off -5.33% while Altium (ALU) dropped -8.40% even Xero (XRO) fell by -3.44%. When hot money leaves hot sectors it can do so with some force. Then again, they did better than poor old McGrath (MEA) who snuck through an earnings downgrade just before 5pm on Friday afternoon – surely not a good look from an organisation that we (although fewer of us lately) trust to sell our biggest asset – Harry covers in more depth below.

Looking around the grounds today it was actually interesting to see banks bid up from their early lows, ditto for some of the large cap miners like BHP, RIO and FMG while the defensive Real-Estate and Utility stocks did okay as did the Gold stocks. As we suggested this morning, $10bn worth of dividends are set to hit investors' back pockets this week alone. This is a major contributor to March / Aprils usual strength in the local market with the average gain during this period over the last 10-years greater than 3%.

US Futures were trading lower though out our time zone - down around 0.50% even through Donald Trump has escaped any criminal charges from Mueller's probe into the President. Here’s was Mr Trump had to say… "After a long look, after a long investigation, after so many people have been so badly hurt, after not looking at the other side, where a lot of bad things happened, a lot of horrible things happened, a lot of very bad things happened for our country, it was just announced there was no collusion with Russia."

Overall today, the ASX 200 lost -69points or -1.11% to 6126. Dow Futures are trading down -114pts / -0.44%

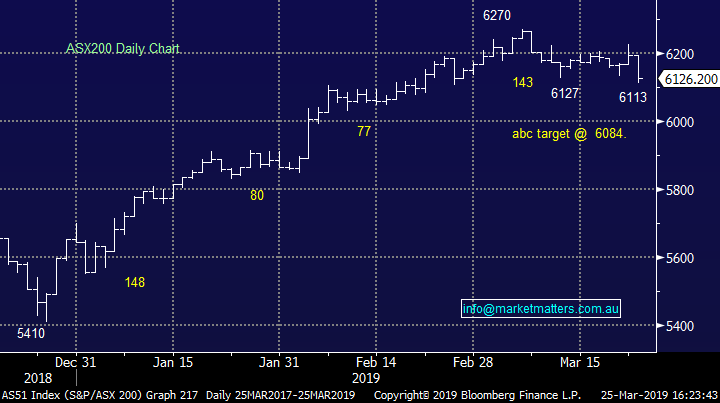

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Not a lot of stock specific news out today of note however there was some big moves at the stock level flowing on from news last week.

Premier Investments (PMV) – 3.66%, down as the market becomes increasingly concerned about their overseas growth prospects through Smiggle. Citi for instance estimated that 1H19 sales fell by 2% in Australia and 7% in the UK, with bricks and mortar LFL sales falling by 6% in Australia and double digits in the UK. It seems Smiggle are now targeting wholesale and online channel expansion which does suggest that they’re struggling through their normal outlets. While Smiggle has been a big driver of growth in periods gone by, this result saw the other more traditional brands do better. Ultimately, last week’s result was a good one in a tough environment however it may take the market some time to digest the changing strategy in Smiggle.

Premier Investments (PMV) Chart

McGrath Ltd (MEA) -7.69%, Ouch!!! tumbled to record lows again this morning, while setting a record low close this afternoon since listing at $2.10 back in late 2015. The stock has never traded higher than the offer price, being stuck in a downtrend since it debuted on the ASX.

Today’s hit follows a trading update the company tried to sneak past the market, posting it near 5pm on a Friday afternoon. The note to the market detailed the impact that falling house prices are continuing to have on the stock – the same reason it blamed for the loss of $2.5m at the underlying EBITDA line when they posted half year results in February.

That EBITDA loss almost doubled in the first 2 months of this year, with the company saying that as at 28 February it had generated -$4.5m EBITDA for the eight months to Feb 28. So with 4 months left, the trend shows no signs of turning for McGrath – seasonally this half is weaker than the first and a federal election still to come will subdue volumes for the rest of the year. At this rate, MEA should post a full year EBITDA loss of over $6m.

Geoff Lucas, the CEO made the following comments RE the housing market…“The significant reduction in transaction volumes in the real estate sector has continued, however we are seeing signs that sellers are now more prepared to meet the market and interest rates continue to be at historic lows”

The company is now languishing with a market cap of just $43m. Down from around ~$350m at listing.

McGrath (MEA) Chart

Broker Moves:

· Altium Downgraded to Hold at Bell Potter; PT A$37.50

· St Barbara Upgraded to Buy at Goldman; PT A$3.90

· St Barbara Upgraded to Sector Perform at RBC; PT A$3.75

· St Barbara Upgraded to Neutral at Credit Suisse; PT A$3.30

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.