China stimulus working its magic (WOW, FMG, RIO, CCP)

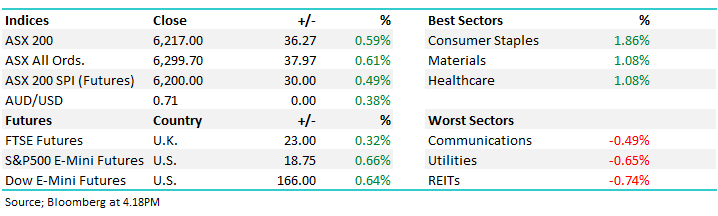

WHAT MATTERED TODAY

The local market ran with the positive lead out of the US and Europe on Friday night, combining with some better than expected China PMI data to send the index over 6200. The unofficial number out over the weekend was better than expected, then official, or Caixin PMI once again shown its resilience after each dip below the even 50 mark – after spending 3 months below the level, just missing out last month, today it smashed expectations at 50.1 by printing 50.8. today’s official print actually coincided with some profit taking this afternoon, with the market drifting into the close.

Around the groups the REITs took a bit of a hit as investors moved up the risk curve. We also saw a slight expansion in yields which lowers the attractiveness of the sector. Consumer Staples rallied the most thanks to a big buy back from Woolworths which was launched today – we discuss more in depth below.

Overall today, the ASX 200 added +36 points or +0.59% to 6176. Dow Futures are trading up 166pts / +0.64%

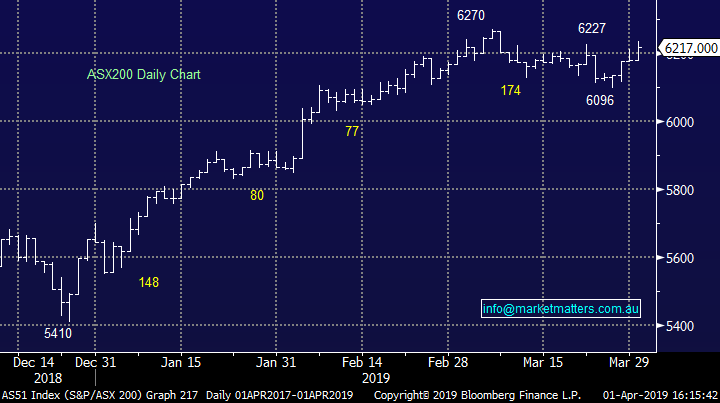

ASX 200 Chart

ASX 200 Chart

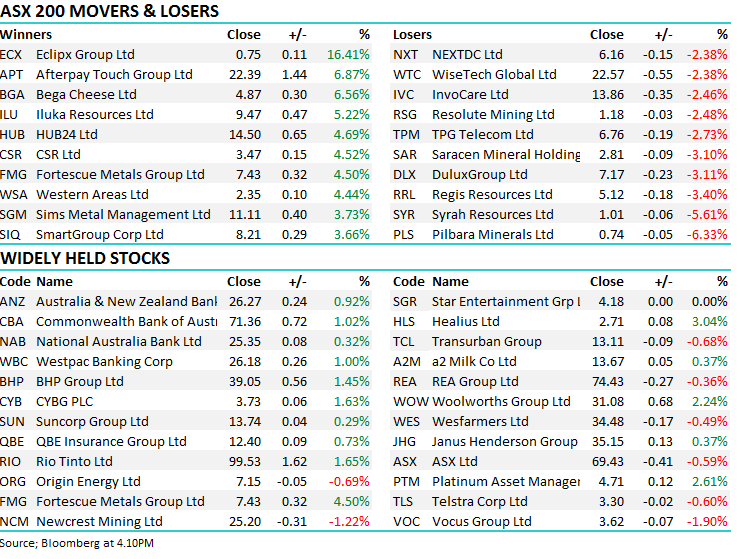

CATCHING OUR EYE;

Iron ore names received another boost today as the red dirt traded higher over the weekend. Rio Tinto (RIO), +1.65%, disclosed the extent of outages caused by last week’s cyclone, signalling they expect iron ore shipments to come in at the lower end of previous guidance of 338m to 350m tonnes. This equates to around a 14mt impasse from the fire at the facility in January combined with the cyclone. Fortescue (FMG), +4.5%, hit a new post-GFC high once again today thanks to the iron ore move. It came within a whisker of $7.50 before some profit taking saw the stock slip.

Rio Tinto (RIO) Chart

Credit Corp (CCP), unchanged today as it remained in a trading halt for the session. The debt collection company has announced it is launching a capital raise for around $110m to accelerate its debt buying plans this year while also maintaining balance sheet flexibility by reducing gearing to ~20%. The deal will be done at $20.45, ~7% discount to the last traded price on Friday. We spoke about Credit Corp recently, saying the business continues to operate strongly and we weren’t overly concerned about the Chairman selling a $700k parcel of shares and maintain that view.

Credit Corp (CCP) Chart

Woolworths (WOW), +2.24%, shares rallied today after a delayed start on some mixed news out to the market. The supermarket has successfully sold its petrol business to UK petrol retailer EG Group for $1.7b as was flagged late last year. The petrol business contributed $84m to the groups EBIT in the first half, around 5.5% of Woolworth’s total. The company has always maintained the proceeds would return to shareholders and today that promise was kept as Woolworths launched an off market buyback. The company stated that a number of options were considered, but specifically noted the ability to release a portion of its large franking credit balance through the off market buyback as key in its decision, particularly ahead of the likely incumbent Labor party’s franking cash rebate attack.

Along with the petrol sale and buyback announcement, Woolworth’s also published the review into its discount department store Big W in which it identified 30 stores for closure over the next three years. Big W has been a thorn in the side of WOW. Big W has recently seen LFL sales do well, adding 6% in the 3rd quarter, however they have struggled to convert that into earnings and the business is expected to post a loss for FY19 of between $80-100m compared to a FY18 loss of $110m. To put it in perspective, 30 of over 180 stores will be closed in the period, as well as 2 distribution centres. We remain negative Woolworths expecting competition and inflation to punish margins.

Woolworths (WOW) Chart

Broker Moves:

· Southern Cross Media Rated New Buy at Canaccord; PT A$1.36

· Eclipx Reinstated at UBS With Buy; PT A$1

· DuluxGroup Rated New Underweight at Morgan Stanley; PT A$6.50

· South32 Downgraded to Market Perform at BMO

OUR CALLS

No changes today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.