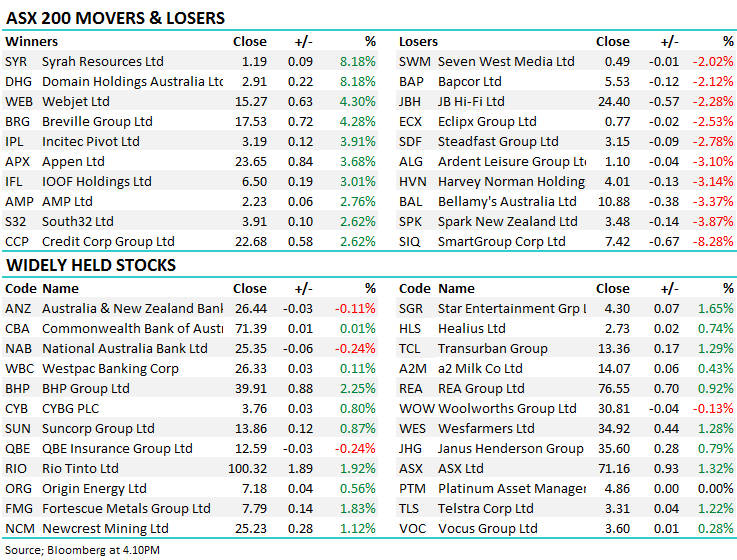

Miners lead the ASX higher (SIQ, ECX, MMS)

WHAT MATTERED TODAY

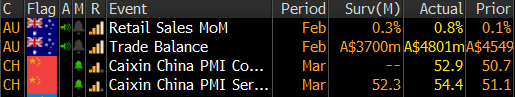

The local market threatened to fade the rally once again today, but instead some bidders in the afternoon managed to fight off any chance of another intraday slump and sent the index to levels not seen since September last year. It was the resource names seeing the most love again today – Rio Tinto (RIO) cracked and this time held the $100 mark, BHP only a whisker away from $40 – as iron ore continues to receive the most news flow.

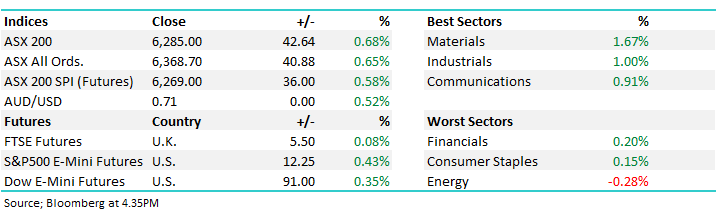

Today, Chinese PMI’s were strong and the Iron Ore price put on another ~2% from the morning close. Iron Ore is now up more than 50% since November – massive moves clearly.

Data Today

Locally, retail sales were better than expected while the trade balance was also fairly strong.

Last night’s budget seemed to be in focus today despite Labor likely to take the next election. Two areas we see as getting bipartisan support would be healthcare & infrastructure – these two areas are prioritised at nearly every budget, seen as easy vote getters. Healthcare names tended to do well today, while the infrastructure leveraged plays were mixed although the three big contractors, DOW, CIM & LLC all finished higher.

Overall today, the ASX 200 added +42 points or +0.68% to 6285. Dow Futures are trading up 91pts / +0.35%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

From a share price perspective, a few names caught my eye today – BHP front and centre with the miner now featuring in a number of our afternoon notes – today it locked in a high of $39.91 – just shy of the $40 handle. At MM we’re always keen to give kudos where it’s due and todays price action made me think of a video that James Gerrish did with Shaw’s Resource Analyst, Peter O’Connor back in September 2017. At the time, BHP was trading in the mid $20’s and Peter articulated a through the cycle target of above $40. Worth a retrospective look! Good call Rocky…

Video – James Gerrish & Peter O’Connor talk BHP back in Sep 2017 - click Here to view

Retailers were also a focus area today with a lot of SP volatility under the hood. JB Hi-Fi (JBH) traded in a big range, opening down, recovering but experiencing significant momentum on both sides of the ledger intra-day. The stock closed down -2.28% which was around 3% off its low. Harvey Norman (HVN) also has a volatile session down -3.14% pulling back from near 2018 highs. A couple of exerts interesting from NABs Online Retail Sales Index out today…

NAB Online Retail Sales Index contracted -3.4% in February on a month-on-month, seasonally adjusted basis. This is its worst growth rate in the series history. With the effect of the November sales events now passed, it appears that broader weakness in retail is flowing through to online.

While transaction volumes are growing, the average spend in each transaction appears to be falling. We estimate that in the 12 months to February, Australians spent $28.92 billion on online retail, a level that is equivalent to around 9.0% of the traditional bricks and mortar retail sector

Harvey Norman (HVN) Chart

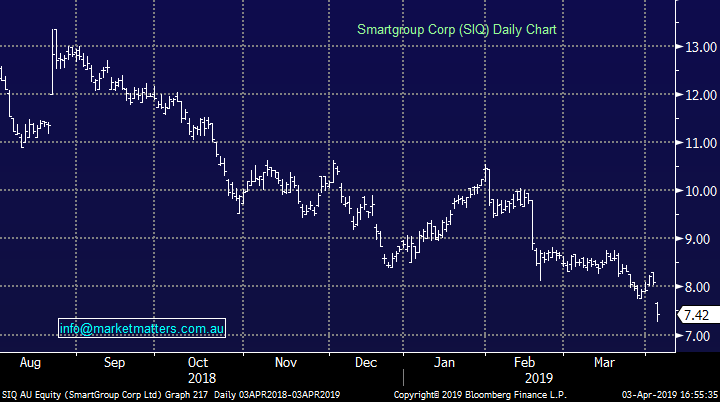

Smartgroup (SIQ), -8.28%, took a hit today a day after announcing a special dividend and trading higher. The company which runs outsourced administration announced that the CEO had sold a total of 1.1m shares for ‘personal reasons,’ priced at $7.60 after market yesterday, ~6% below yesterday’s close price. The CEO still holds around 3m shares, so it’s not a total departure from the registry however the market never likes an internal seller.

Smartgroup Corporation (SIQ) Chart

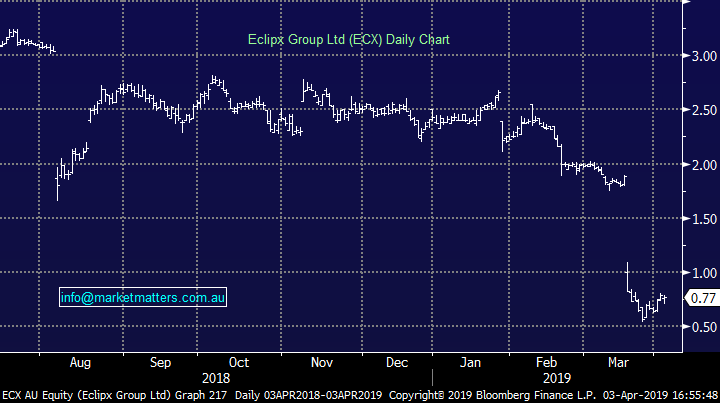

Eclipx (ECX), -3.8%, one we have spoken a bit about recently, struggled again after formalising the end of takeover talks with McMillan Shakespeare (MMS), -1.24%. The market assumed this was likely the case, however the announcement also detailed that Eclipx would make an $8m payment to McMillan “for costs… incurred to date in connection with the SIA (Scheme of Implementation).” It seems McMillan held Eclipx to ransom here, with the payment equal to 1.8c/ECX share according to the company. Not one we are interested in.

Eclipx (ECX) Chart

Broker Moves:

· Independence Group Upgraded to Neutral at Macquarie; PT A$4.90

· Air NZ Upgraded to Buy at UBS; PT NZ$2.90

· Transurban Downgraded to Neutral at Goldman; PT A$13.11

· Woolworths Group Cut to Hold at Deutsche Bank; PT Set to A$31

· Credit Corp Raised to Positive at Evans and Partners; PT A$22.55

· Nine Entertainment Downgraded to Hold at Morningstar

· Beach Energy Downgraded to Sell at Morningstar

· Coles Group Downgraded to Hold at Morningstar

· Bellamy’s Downgraded to Equal-weight at Morgan Stanley; PT A$10

OUR CALLS

We added Sims Metals Management (SGM) to the Growth Portfolio today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.