A sluggish start to the week, banks fail to ignite the ASX (PDL, ILU)

WHAT MATTERED TODAY

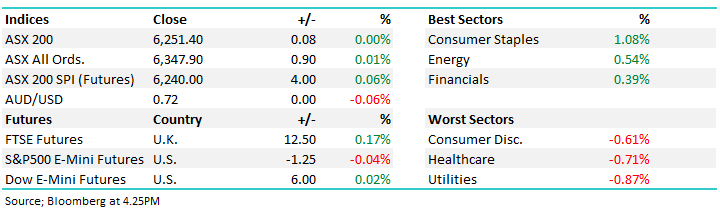

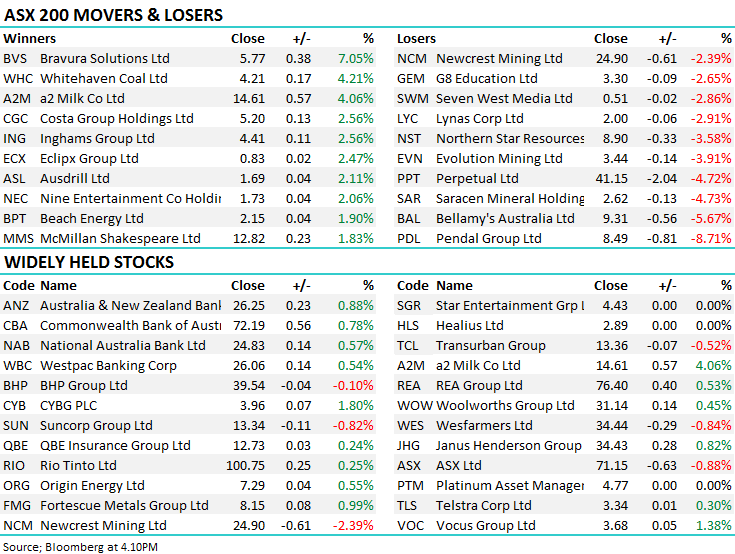

The ASX 200 was in two minds throughout the trading day, twice trading a small margin above par but ultimately failed to make any headway in either direction to close flat on the session. There was a noticeable lack of volume across much of the market today, contributing to the lack of movement today. Expect this to be a theme over the next fortnight with the two shortened trading weeks as a result of Easter and ANZAC day. We expect the campaign trail for the federal election as well as quarterly reporting season both in the US and for Australian miners and fund managers will be the focus of investors for now. We discuss two quarterly updates below.

Banks continued the upward momentum seen on Friday, the energy names pushed higher on M&A activity in the US as well as an oil bounce and consumer staples also saw some broad based buying. On the other side of the ledger was the bond proxy utilities, while healthcare was dragged by sector heavyweight CSL.

Overall today, the ASX 200 ended flat at 6251. Dow Futures are trading marginally higher, up +6pts / 0.02%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

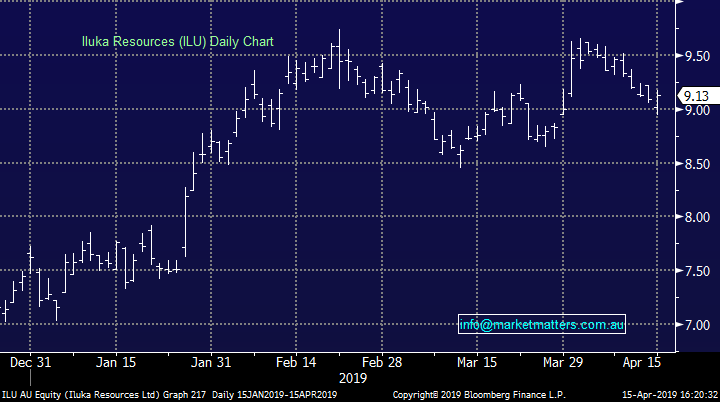

Iluka (ILU), +0.44%, traded marginally higher on the day after posting their March quarter production report pre-market. The report was a huge slip quarter on quarter, however this stemmed from well flagged maintenance which the company was due to take out. The company said demand remains solid across the book, particularly with their mineral sands product which saw a reasonable draw down on inventories in the quarter to cover the subdued level of supply. ILU looks reasonably cheap at these levels, and also has a (small) iron leverage through royalties with BHP. One to watch

Iluka (ILU) Chart

Pendal Group (PDL), -8.71%, continued the sell off from Friday, although with plenty more vigour today as is seemed the market seemed to catch on to some skeletons in closet from the FUM update the company released Friday morning. FUM might have seen a 9.5% uplift from the previous quarter, with the bulk of it driven by market performance (+$2.8b) and along with net flows of +$1.2b. the bulk of the flows however were into lower margin cash and fixed income products. Pendal has had a good three months of performance on a stock level, rising over 20% to recent highs set early in April – it seems the market had priced in a lot of the recovery in FUM with the rising market and has now been disappointed with net flows. The old BT is also battling the changing financial advice landscape with a large portion of its FUM stemming from bank aligned advisors, particularly its affiliation with WBC helping drive flows into high margin products – Westpac are also likely to redeem a large chunk of funds when they come up for renewal this month. Not one we like at these levels.

Pendal (PDL) Chart

Broker Moves:

· Perpetual Downgraded to Sell at Morningstar

· Dexus Upgraded to Neutral at JPMorgan; PT A$13

· Tabcorp Rated New Neutral at Evans and Partners; PT A$5

· OZ Minerals Cut to Hold at Argonaut Securities; PT A$10.60

OUR CALLS

No changes to either portfolio today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.