ASX drifts back from highs (COL, HLS, SFR)

WHAT MATTERED TODAY

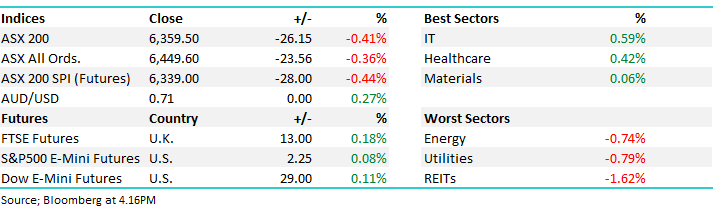

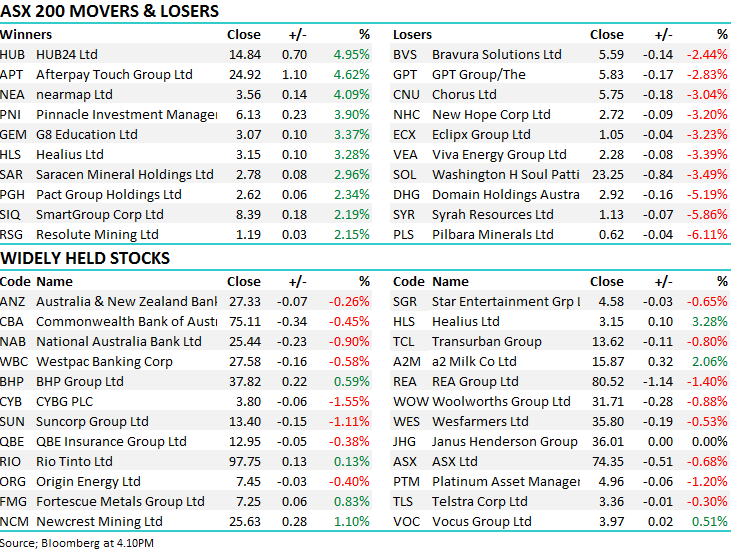

The ASX drifted marginally lower today, pulling back from recent highs but not aggressively so. Most Asian markets were higher while US futures were pretty flat during our time zone. Interesting to see the yield sensitive REITS pullback today which fits our commentary in the AM report today – the sector off by -1.62 % as the yield trade shows signs of cooling. The traffic this morning was heavier in Sydney, school back this week and the Eater festivities now wrapped up for another year, market volumes should go back to normal.

The Macquarie Conference starts tomorrow – more on that below, however suffice to say a lot of company news out over the next 3 days – most of which will be market moving.

Overall today, the ASX 200 fell by-26 points or -0.41% to 6359. Dow Futures are trading up +34pts / 0.12%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Macquarie Conference starts tomorrow – We saw Flight Centre (FLT) -0.03% kick off confession season last week – a typically tricky period where some companies need to ‘confess’ weaker than expected performance and realign market expectations with what’s happening on the ground – FLT the first to do so and they were whacked 12% for their troubles. This week the biggest equities conference in the land kicks off hosted by Macquarie with about 100 odd companies presenting. The timing of the event is perfect for companies to update guidance and release outlook statements given it’s between the Feb & August reporting periods, which is why it’s traditionally a market moving event. It kicks off tomorrow and lasts for 3 days with nearly all companies of note presenting at some stage.

Companies we’re most interested in tomorrow include; NCM, CSL, FMG, MPL (to get a read through on NHF), APT, WTC, CGC (guidance key on this one especially), NUF, EHL & ELD

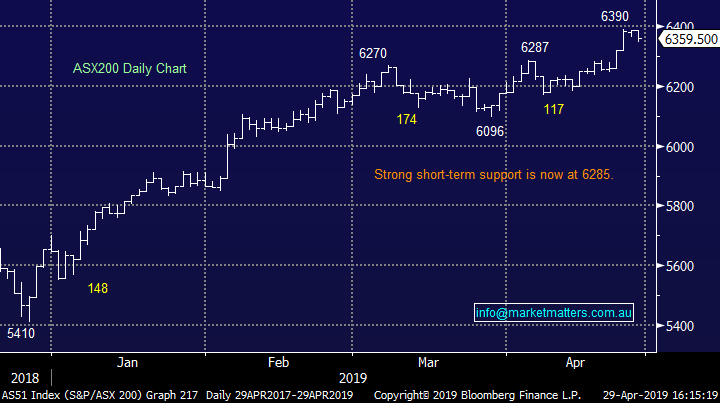

Healius (HLS) +3.28% - Up today on the back of a Credit Suisse note with the broker effectively falling on their sword and upgrading the stock to neutral and putting on a $3.10 price target, up from $2.35. The upgrade underpinned by corporate appeal they say, claiming HLS is worth $3.80 if broken up. A similar thesis we’ve held for a while insofar as there is value in the assets that are underperforming currently.

Healius (HLS) Chart

Coles (COL) +0.32% : 3Q sales numbers out today which were largely inline with expectations, but they pointed to “moderating growth” for Supermarkets into 4Q19. Woolies is out on Thursday with their sales numbers which will serve as a comparison. It’s hard to get too excited about either here with a confluence of headwinds which Coles alluded to again today, including retail increasingly challenging, lack of promos (like Little Shop) stunting growth, COL market share losses in NSW (drought), rise of meal delivery and convenience options, higher input costs in Fresh, fuel volumes weak, etc. Not the rosiest of pictures.

Coles (COL) Chart

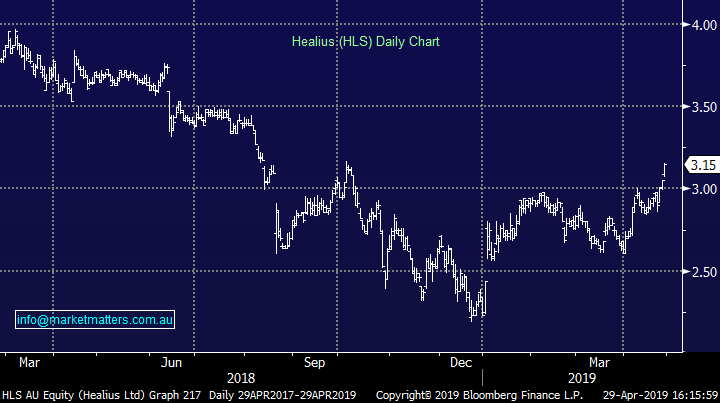

Sandfire (SFR) +0.70% On first pass the numbers looked pretty good and guidance hike (FY19) confirms a good June Quarter is likely as well. SFR has struggled of late however operationally at least. Now starting to do some good things.

Sandfire (SFR) Chart

Broker moves:

· Carsales.com Downgraded to Hold at Morningstar

· Flight Centre Upgraded to Hold at Morningstar

· Healius Upgraded to Neutral at Credit Suisse; PT A$3.10

OUR CALLS

No moves today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.