NAB cuts its dividend (NAB, WOW, ASL, WES, KDR)

WHAT MATTERED TODAY

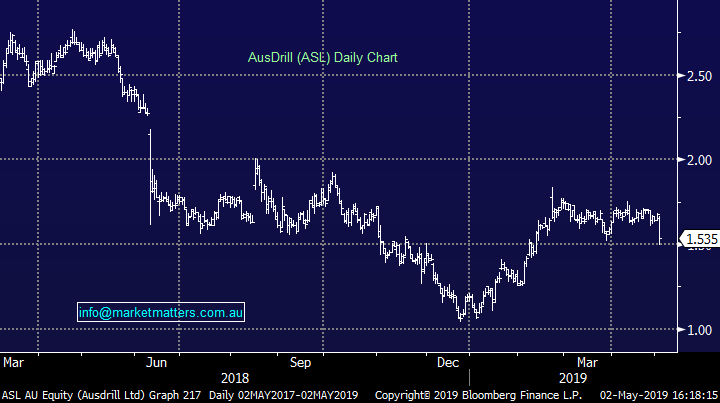

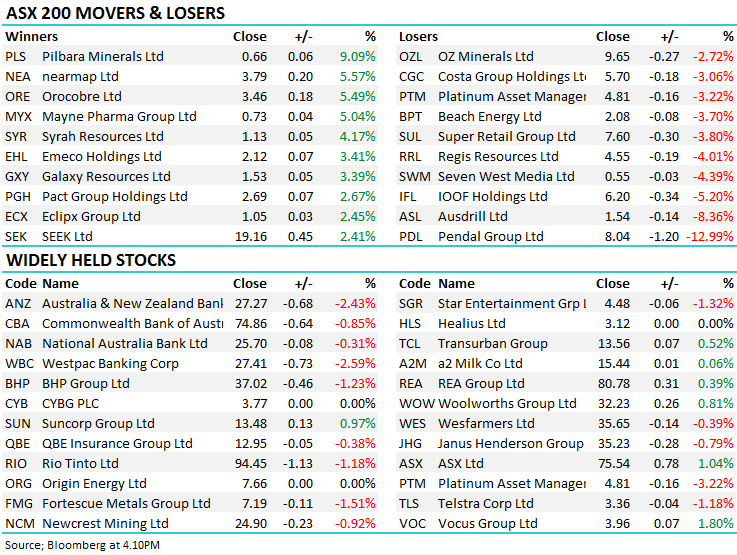

Stocks fell today with the financials leading the decline – ANZ the worst of the banks after a litany of downgrades filtered through post yesterday’s result. The first reaction yesterday to BUY the stock was clearly wrong and sellers took hold today, while NAB was a relative performer after they released 1H19 results – more on that below.

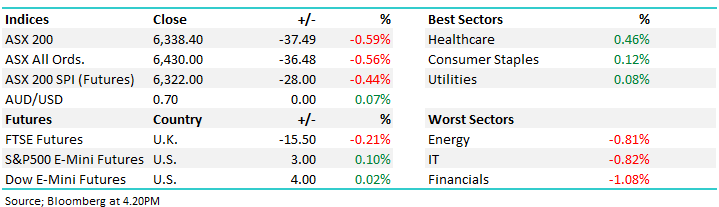

Overall today, the ASX 200 lost -37 points or -0.59% to 6338. Dow Futures are trading up +23pts / +0.08%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Macquarie Conference – wound up today ahead of Macquarie (MQG) themselves reporting results tomorrow. As we said yesterday, fewer big moves emanating from the event this year,, however one of note today was Seek (SEK) which downgraded guidance a few days ago but talked a bullish story during their presentation today. Broken out technically

Seek (SEK) Chart

Stocks that presented at the conference today and their moves...

NAB -0.31% $25.70 - NAB reported cash profit of $2954M for 1H19 which was close to expected with earnings per share (EPS) of $1.07 which was inline and included additional remediation costs, the dividend was 83cps, below expectations however, unlike ANZ yesterday, NAB reported home loan growth in Australia. It was only 2% from 30/9/18 to 31/3/19 but it was better than the 1% decline reported by ANZ. Business loan growth was 4% in the past 6 months and total loan growth was 3% - a passable result in a tough operating environment. Net interest margins were weak. NAB’s total revenue and expense growth were similar at 1.4% and 1.7% respectively from 1H18 to 1H19 while the bad debt charge increased as did 90 day past due housing loans. They increased from $2.2B at 30/9/18 to $2.7B at 31/3/19. The dividend was cut to a more sustainable 83 cps.

While the dividend will no doubt get the headlines on the news tonight, the underlying result is more important and we actually think an aggressive re-rate of the dividend could be a positive for the business moving forward. At 83c on $1.07 of earnings, that’s a 77% payout ratio, however the $1.07 also includes remediation costs which are not ongoing, so payout drops further in time. We recently write about NABs likely dividend cut here

NAB outperformed the sector today on a weak market closing down -0.31% versus ANZ –2.43%, CBA-0.85% & WBC –2.59%. Westpac reports 1H19 earnings on Monday

NAB Chart

Woolies (WOW) +0.81% - released a cracking sales number today with food sales growth of 4.2% versus market expectations of 3.0% to 3.5%. Liquor did well too adding 5.9%. They clearly have the wood on COL at the moment and WOW’s doing a good job to justify a premium PE multiple of 23x versus Coles on 19x, however both operators (WOW/COL) have sent a very clear message to the market, warning about a litany of challenging headwinds.

Wesfarmers (WES) -0.39% bids for Kidman Resources (KDR) +44.96% – WES has well and truly shown its hand towards the EV space, this morning lobbing a bid for the Lithium developer at a 47% premium to yesterday's closing price. Kidmans plans to back the $1.90 per share offer as are KDR’s major shareholders. Here's what WES said about Lithium this morning on the conference call; "Over the course of the last two years, we identified lithium as an interesting sector that will not only benefit from the growing global uptake of electric vehicles, but is also an area where Wesfarmers' capabilities are uniquely positioned to take advantage of the opportunity in this space,"

The move comes on the heels of WES’s bid for rare earths miner Lynas, although that bid seems to have more significant hurdles to actually become a reality. While the deal is obviously good in the short term for shareholders, Lithium prices are low, KDR has a great asset and clearly WES sees it. Kidman was trading above the $1.90 bid price this time last year. Others in the sector did well today, Pilbara Minerals (PLS) +9.09% and Altura Mining (AJM) added +9.09% (uncanny moves)

Kidman Resources (KDR) Chart

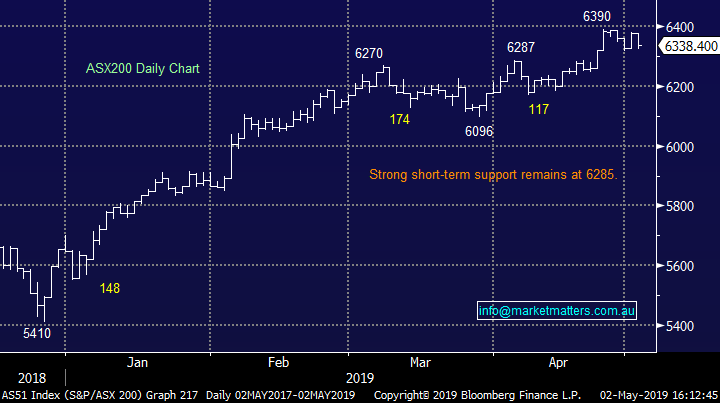

Ausdril (ASL) –8.36% hit today on no new news that I could see. There was an update a few days ago about the potential for a new note issue in the US (raising debt) however that has not been finalised. Need to dig deeper on today’s decline.

Ausdrill (ASL) Chart

Earnings: Resmed (RMD) –0.54% – down marginally today ahead of their Q3 earnings which will be released after the US close tonight (tomorrow morning our time). Adjusted eps expected to come in at 85c on revenue of $657 million – look for gross margins at 59%.

Janus Henderson (JHG) –0.79% – will report 1Q results tonight in the States with the market expecting 1Q adjusted eps of 59c on revenue of $522.3 million. Assets under management should come in somewhere around $352 billion.

Resmed (RMD) Chart

Broker moves: ANZ in focus with a litany of downgrades...

· Scentre Group Downgraded to Neutral at UBS; PT A$3.74

· Chorus Downgraded to Neutral at UBS; PT NZ$5.90

· Regis Resources Upgraded to Hold at Deutsche Bank

· SkyCity Entertainment Cut to Neutral at Evans and Partners

· A2 Milk Co Downgraded to Sell at Morningstar

· ANZ Bank Downgraded to Neutral at JPMorgan; PT A$29.50

· ANZ Bank Cut to Hold at Morgans Financial; Price Target A$29

· ANZ Bank Downgraded to Neutral at Goldman; PT A$28.62

· ANZ Bank Downgraded to Underperform at Credit Suisse; PT A$26.55

· BHP Group PLC Downgraded to Neutral at Citi

· Sandfire Upgraded to Hold at Bell Potter; Price Target A$7.10

· Redbubble Downgraded to Neutral at Goldman; PT A$1

OUR CALLS

We up weighted Emeco (EHL) and Costa Group (CGC) today in the Growth Portfolio

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.