RBA snubs weak inflation & sits tight for 33rd straight meeting (FMG, GNC)

WHAT MATTERED TODAY

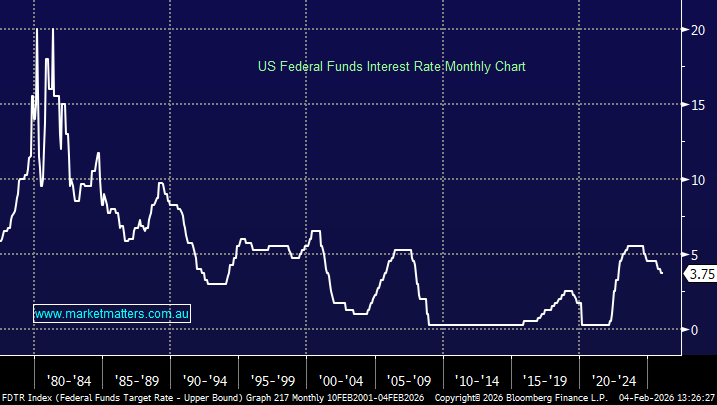

After 32 months of inaction by the RBA they stayed true to form today, and did nothing for the 33rd time deciding to put more weight behind strength in the employment market than the horrible inflation print we saw at the end of April. More economists than not thought a cut would happen and rightly so with headline inflation last quarter pretty close to zero, and with annual inflation pushing toward 1%. Remember, the RBA targets 2-3% inflation through the cycle and that number has been elusive for the current RBA Governor to date.

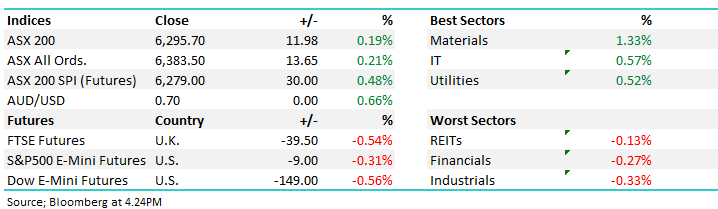

The AUD rallied on the news while the market sold off. We were actually enjoying a solid day before the decision with the mkt up ~50pts and looking strong, but alas, they held firm at 1.50% and the mkt dropped 30 points pretty quickly.

Aussie Dollar Intra Day Chart

Here’s the take from Shane Oliver… Our expectation was that the RBA would cut at this meeting particularly given the weak March quarter inflation outcome. But given the timing of the election and the RBA’s focus on the jobs market it was a close call and in the event while the RBA has yet again lowered its growth and inflation forecasts it has opted to leave rates on hold for the time being.

Unfortunately we won’t really know whether the RBA has moved to an easing bias until the Minutes are released for this meeting in two weeks time because in recent times it has expressed its bias either in the minutes or in speeches. However, in a dovish twist it noted at the end of its post meeting statement that it recognises “that there was still spare capacity in the economy and that a further improvement in the labour market was likely to be needed for inflation to be consistent with the target.” This continues the RBA’s focus on the labour market and implies that in the absence of a further improvement in the labour market inflation won’t head back to target. Which in turn would be consistent with rate cuts.

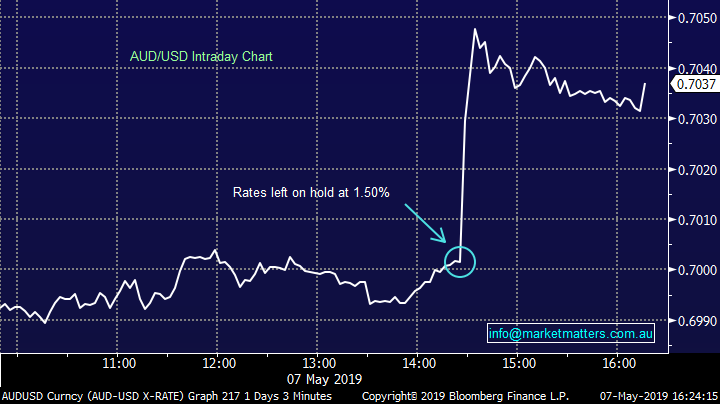

Overall today, the ASX 200 added +12 points or +0.19% to 6295. Dow Futures are trading down -37pts / -0.13%.

Worth noting that US Futures have been down much more during our time zone – about 150pts on the DOW however after our mkt closed, reports emerged that China’s chief negotiator is heading to the US and that has seen futures mkts moving. All very opaque and news driven mkt this week ensuring a heap of volatility. Aussie SPI Futures are now +31pts at 6281

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

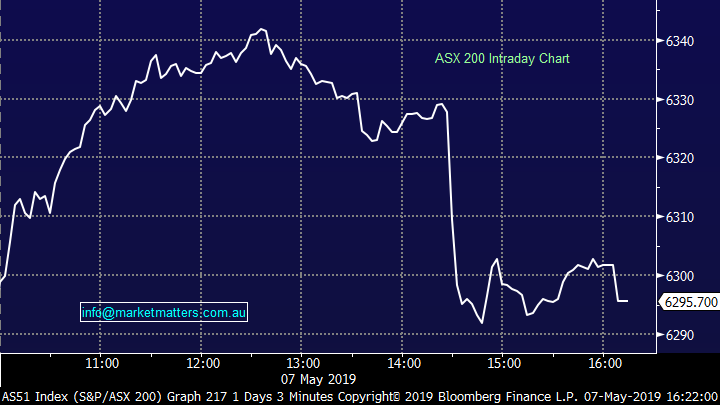

Iron Ore - the plot thickens after Vale informs the market overnight that it was summoned based on the monocratic decision by the Minas Gerais Court of suspending the effects of the ruling by the Lower Public Treasury Court of Belo, that had authorized the resumption of activities at the Laranjeiras tailings dam and the Brucutu mine. Consequently, wet processing operations at Brucutu werestoppedfollowing the above mentioned TJMG decision. Clear as mud however the key takeaway being that less iron Ore supply likely = bullish for Iron Ore prices.

Here’s the quick run-down of supply outages (tks Rocky)

Long term supply outages - Córrego de Feijão mine impacted by tailings dam spill ... potentially out of action for 3-4 years ... ~40mt

Near term supply outages

· Australian – Recent cyclone impacts to BHP, RIO and FMG ~25mt

· Brazil – Closures ruled by Brazil courts which will likely reopen. These include the Brucutu mine (30mt) which is the subject of this latest announcement) and another 13mtpa operation. So all up temporary outages are ~43mtpa.

· Total FY19 outages - ~110-120m

Key take out - price pressures not going away...and trading Iron Ore stocks makes sense.

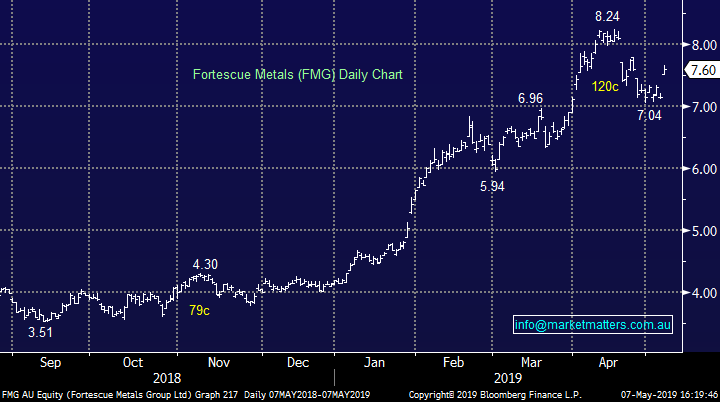

Fortescue Metals Chart

Stocks moving – we saw more pain today in the mining contractor space as the smell surrounding Cimic (CIM) continues to waft through the sector + they are risk on / risk off type stocks and the overall mkt volatility this week hasn’t helped. Emeco (EHL) -1.81% and Ausdrill (ASL) – 2.46% felt some pain. On the flipside, good moves in Bingo (BIN) +4.55% as people starting to realise it looks like an opportunity to buy cheap growth, Costa Group (CGC) +2.43% bouncing back from yesterday’s decline while the tech names were also bought – Afterpay (APT) +3.49% closing at an all-time high of $28.46 & WiseTech (WTC) +4.86% to $23.07, however it was Fortescue (FMG) that topped the boards adding +6.29% on the day to close at $7.60 on the above mentioned news.

Graincorp (GNC) – 6.96% hit hard after the final nail was put in the takeover coffin from suitors Long Term Asset Partners Pty Ltd although the deal looked dead for a while. The stock was trading around $8.80 yesterday against a bid price of $10.42 implying a lot was going wrong under the hood – today the stock closed at $8.15…becoming officially the hardest stock in the southern hemisphere to take over.

Graincorp (GNC) Chart

Broker moves:

· A2 Milk Co Upgraded to Hold at Morningstar

· Mineral Resources Upgraded to Buy at Morningstar

· Westpac ADRs Downgraded to Sell at CLSA

· Hub24 Downgraded to Sell at Citi; PT A$13.35

· GrainCorp Downgraded to Reduce at Morgans Financial; PT A$7.90

OUR CALLS

No trades today – FMG shot out of the blocks and never looked back.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.