Buyers re-emerge as Iron Ore continues to run (RIO, ILU, QBE, ALL)

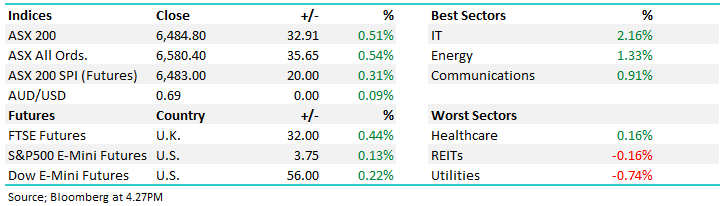

WHAT MATTERED TODAY

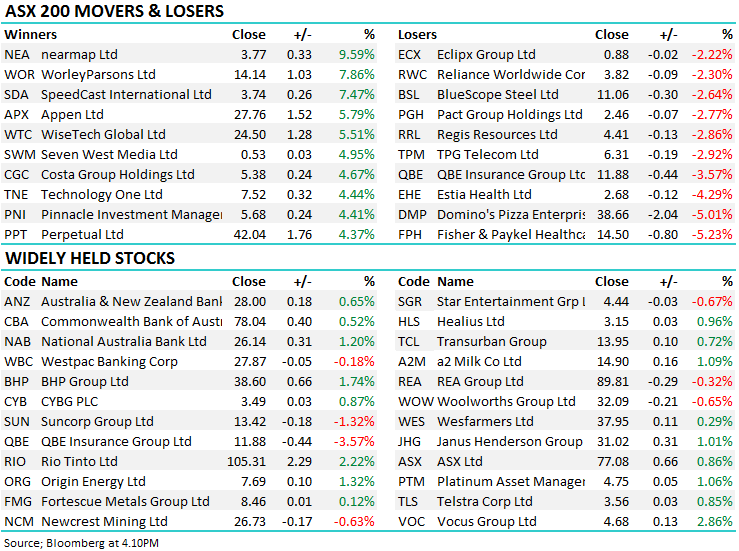

With no overseas lead to key off this morning, local stocks were muted from the outset however continued strength in the Iron Ore price and reasonable buying through Asia + US futures that ticked higher during our time zone meant more buyers than sellers emerged. The IT stocks saw most attention thanks to strong moves in both Nearmap (NEA) and Xero (XRO) on bullish broker notes plus Appen (APX), Wisetech (WTC) & Technology One (TNE) did well, while the defensive utilities and real-estate sectors saw some profit taking after recent strength.

An overall quiet day on the desk and across the market more generally as the market awaits the next volatility event - shouldn’t be too long!

Overall today, the ASX 200 added +32 points or +0.51% to 6484. Dow Futures are trading up +56pts / +0.22%.

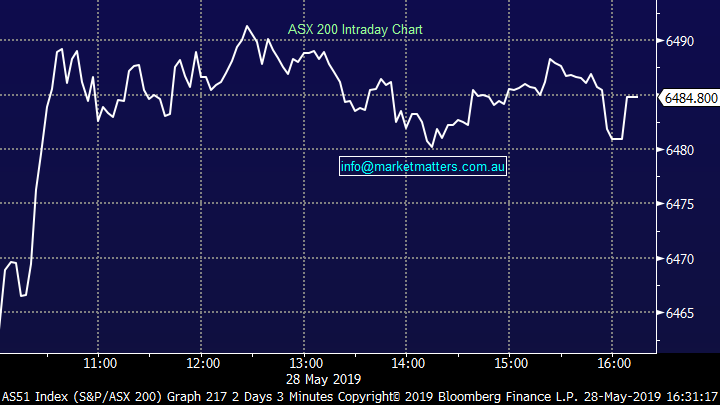

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Iron Ore stocks; the three main iron ore names - BHP, Rio & Fortescue - all traded higher today as the price of the commodity holds strongly about the $US 100 mark. Analysts continue to grapple with forecasting post the Vale outage resulting in begrudging upgrades from the bulge brackets. Today Goldman’s flinched, moving their price expectations into the triple figures citing solid steel production, falling stock piles and a lack of production capacity around to plug the gap left by Vale with the analyst expecting supply to be significantly impacted through 2020.

The new price deck forced the bank to upgrade Rio Tinto (RIO) +2.22%, which traded up to new decade long highs today in an early spike to $107.99. Goldman’s is not the only bank talking up the longevity of higher prices however street expectations still remain well below current spot prices. We own BHP in the Growth Portfolio, and RIO in the Income Portfolio.

Rio Tinto (RIO) Chart

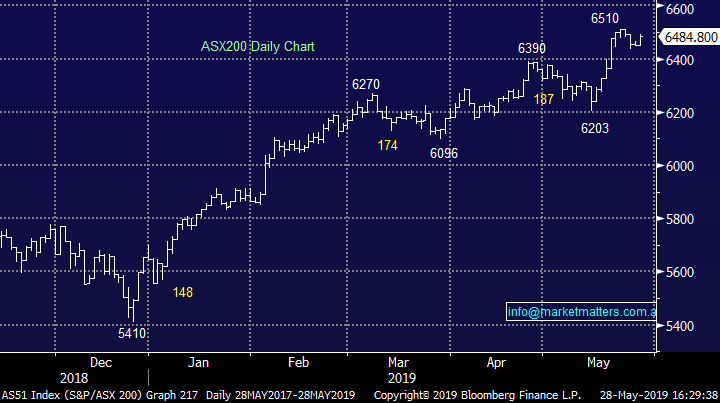

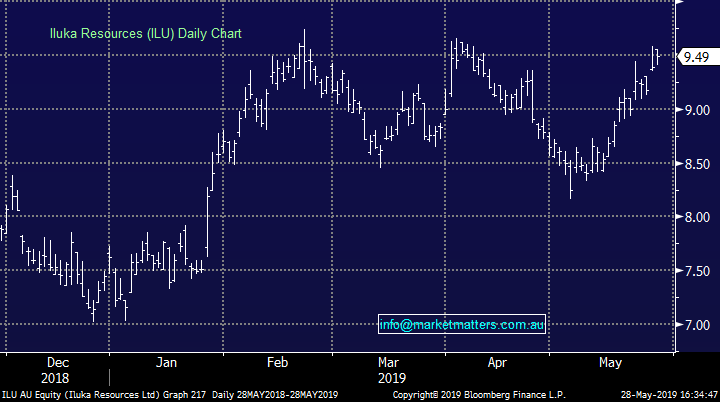

Iluka (ILU) +1.06% is a recent buy in the MM Growth Portfolio at $8.55 and today the stock closed at $9.49. Interesting to seePerpetual become substantial (again) in an old favourite of theirs. Perpetual has had a multi decade relationship with Iluka – and its predecessors, however has been off the register for some time. ILU share price has been weak at the back end of last year, however the operational backdrop has improved plus ILU would be a net beneficiary of any trade war resolution. We remain bullish ILU and view Perpetual’s move as a positive.

Iluka (ILU) Chart

Aristocrat Leisure (ALL) +1.57%: It’s been a strong week for the gaming company after they reported a stronger than expected 1H19 earnings result that allayed some circling market fears that projected growth was an unattainable ambition. The market was bullish on ALL, had been for some time however it was clear that some were questioning their thesis.

Of the 15 analysts covering the stock (on Bloomberg) there are 10 buys and 5 holds without a sell to be seen. Such bullish expectations can often lead to disappointment however ALL delivered and we’ve seen a number of upgrades flowing from last week’s result. Deutsche Bank has become the most bullish with a $42 price target while we’ve also seen upgrades from JP Morgan ($34.25 PT), Macquarie ($31.00 PT) & Wilsons ($32.15 PT). We own Aristocrat (ALL) in the Growth Portfolio and we expect ALL to re-test recent highs around ~$33

Aristocrat Leisure (ALL) Chart

Broker moves:

QBE –3.57% was hit hard today which is fitting post our update on the insurance stocks this morning (click here). Today’s move was blamed on a MQG downgrade from outperform back to neutral, or in other words, from buy to hold. PT now $12.90 from $13.20. As we suggested this morning, QBE will be interesting again at lower levels however bond yields are too much of a headwind currently.

QBE Insurance (QBE) Chart

Xero (XRO) +1.45% was also in focus but on the upside today after it copped an upgrade out of Morgan Stanley despite the stock trading just shy of all-time highs. The accountancy software has a great deal of upside in its small business platform expansion according to the analyst, whilst continuing to show growth in the offshore arm. At the full year result announced just a fortnight ago, the small business platform saw revenue growth of over 120%, 4 times that of the rest of the accountancy business.

- Vocus Upgraded to Neutral at UBS; PT A$4.60

- Vocus Upgraded to Neutral at Macquarie; PT A$4.70

- QBE Insurance Downgraded to Neutral at Macquarie; PT A$12.90

- Bluescope Downgraded to Underperform at Macquarie; PT A$10.15

- Domino’s Pizza Enterprises Cut to Equal-weight at Morgan Stanley

- F&P Healthcare Downgraded to Sell at Goldman

- F&P Healthcare Upgraded to Hold at Morningstar

- Reject Shop Downgraded to Sell at Goldman; PT A$1.55

- Nearmap Rated New Buy at Citi; PT A$4.26

- Rio Tinto Upgraded to Buy at Goldman; PT A$108.40

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.