Markets flat – Challenger downgrades (CGF)

WHAT MATTERED TODAY

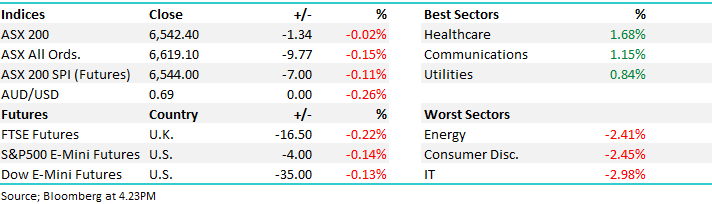

The market chopped around for the session today before closing flat - the ASX200 traded as much as +20 points higher and -10 points lower than the previous close. It was up on employment data, hitting the intraday high shortly after the 11.30AM print but was trading near the lows an hour later.

The employment data was mixed, with unemployment steady at 5.2% and slightly off the expectations of 5.1%. There were 42k jobs created, more than double expectations however much of the difference can be attributed to the election which employs a few thousand over the weeks surrounding the date. Finally the participation rate climbed up to 66% - a new all-time high above last month’s 65.9% and explains the stubbornness in the unemployment rate.

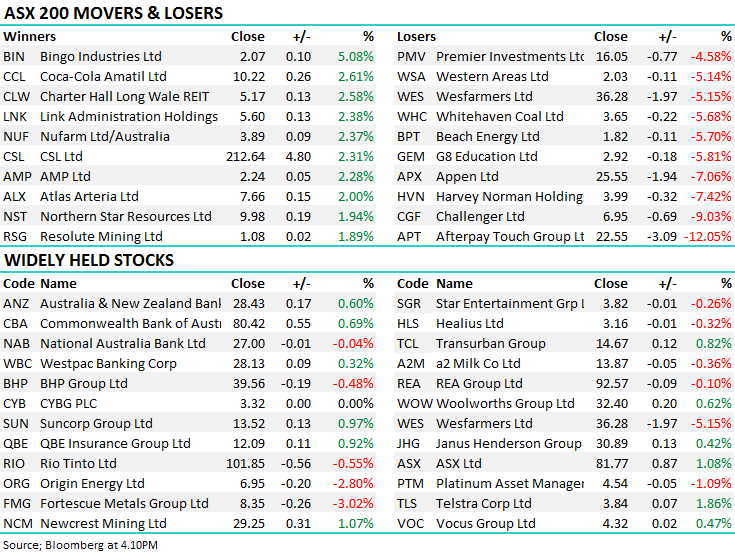

Underlying the miniscule index move were some bigger twists at a stock level. AfterPay (APT) was the worst off, falling -12% thanks to an AUSTRAC investigation into money laundering. Wesfarmers (WES) was also lower, off -5.15%, on news Target will miss sales targets again. The discount department store has been a thorn in the side but was showing signs of some recovery recently until today’s announcement – a soft 2H to blame as comparable sales have fallen 2.3% for the five months to may.

Stockland (SGP) was also punished, off -2.24%, following delays in their Mt Atkinson project, longer settlements and also a move higher in default rates – now above 5% for the current quarter. The biggest concern was that the company revised sales guidance lower on residential lots after reconfirming just 2 weeks ago. Challenger (CGF) also downgraded – a little more detail on this below.

Overall today, the ASX 200 fell -1 point or -0.02% to 6542. Dow Futures are trading down -35pts / -0.13%.

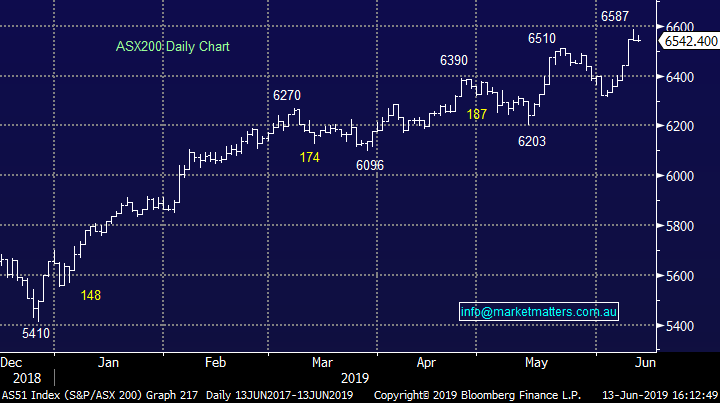

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Today I sat down with Steve Jacobs, Chairman of BTG Pactual. BTG is a Brazilian based investment bank & asset management company managing over $55bn in assets. Steve is also on the board of EFG International, and has recently become the Chair of Shaw & Partners.

Steve is an incredibly well regarded international investor and it was great to get his insights about global trends. EFG have recently become the major shareholder in Shaw & Partners and as a consequence, now has an interest in Market Matters. EFG have more than 200 analysts globally and that resource will become invaluable to MM and our subscribers as we roll out international portfolio’s in the not too distant future.

Steve & I discussed trade, Trump, Europe, the positive outlook for Australia and more in a quick 12 min video. Click here. I also had a chat today with Rupert Lowe, who is a member of the BREXIT party in the UK and was recently elected into the European Parliament. Rupert set out the reasons why BREXIT should (& will happen). We’ll share that video in the coming days.

Challenger (CGF) -9.03%; hosted an Investor Day, normally reserved for talking up performance however Challenger’s came with a guidance revision of “the lower end of previous guidance” for normalized net profit of $545m to $565m. The company also started talking down FY20 before the end of the current financial year which really concerned investors today. The downgrade relates in part to poor investment returns across the business. Just last week the Funds Management chief was moved on, an ominous sign ahead of an investor day. On top of this, the shift to selling more annuity products has created a longer term earnings model, it has also forced Challenger to change its investment mix, moving down the risk curve in more conservative but less lucrative investments.

The forecast for next year was based on lower equity returns, product and marketing, lower rates and a lower return on equity. Challenger are now targeting an ROE of RBA + 14%, down from a flat 18% target which Challenger had fallen short of over the past few years. Not a place we want to be at the moment, and won’t be helped by lower interest rates and higher costs within the business.

Challenger (CGF) Chart

Broker moves: BIN popped +5.1% to close at $2.07 on a broker upgrade. BIN have a site visit on the 26th June which is the next potential catalyst. We own BIN in the Growth Portfolio

· SCA Property Downgraded to Sell at Moelis & Company; PT A$2.45

· Cleanaway Reinstated Neutral at Evans and Partners; PT A$2.27

· Bingo Industries Rated New Positive at Evans and Partners

· Village Roadshow Downgraded to Neutral at Macquarie; PT A$3.10

· Kogan Rated New Sector Perform at RBC; PT A$5.30

· G8 Education Downgraded to Hold at Morningstar

· Western Areas Reinstated at Goldman With Sell; PT A$1.80

· Independence Group Reinstated at Goldman With Neutral; PT A$4.60

· Michael Hill Downgraded to Hold at Morgans Financial; PT A$0.60

· City Chic Collective Ltd Rated New Buy at Bell Potter; PT A$2.15

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.