Goldman’s’ downgrades Afterpay (APT)

WHAT MATTERED TODAY

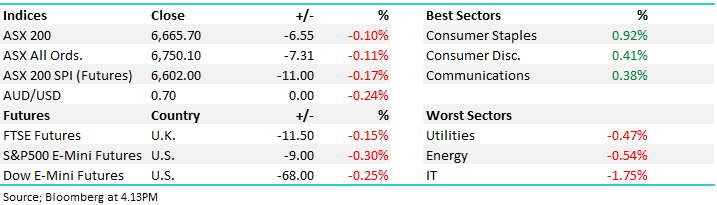

A begrudging sell-off played out today where the market looked weak at times before recovering late in the session to close only marginally lower. A ~40 point range on the ASX 200 closing +25pts from the daily lows set around lunchtime. There was an obvious bid-tone into today’s weakness which is not surprising with the amount of cash still on the sidelines earnings next to nothing.

Around the region, Asian markets were lower, somewhere between 0.20% & 0.70% while US Futures had a more volatile period during our time zone – settling down around ~0.30% at our close.

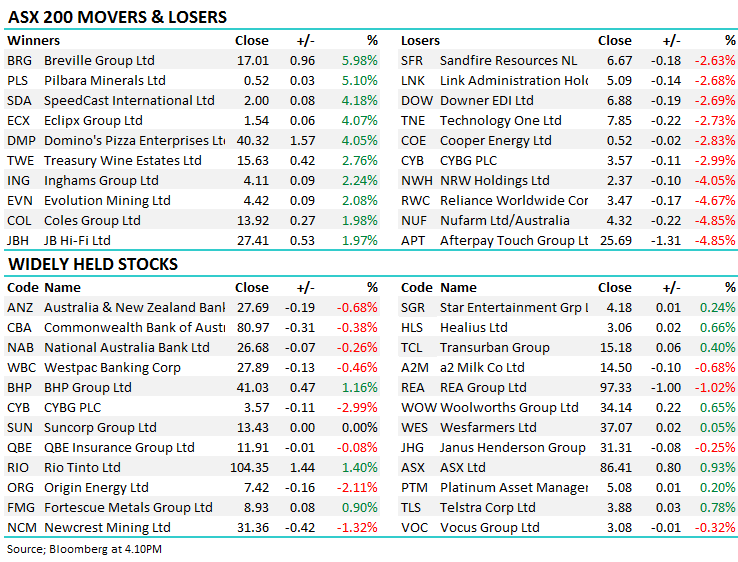

At the sector level, consumer stocks were well bid today, both staples and discretionary while a downgrade by Goldmans’ on Afterpay dragged the IT names lower. More on that below.

Overall, the ASX 200 fell -6pts today or -0.10% to 6665. Dow Futures are trading down -68pts / -0.25%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Afterpay (APT) -4.85%: Goldman Sachs moved APT down to a hold today, and the stock got hit -4.85% as a result. With only 1 other hold out of the 8 brokers that cover the market darling, GS is sticking its neck out a little here They increased their PT marginally, but they struggled to come up with a reasonable risk vs reward scenario to keep the buy on the stock - which closed less than 1% below the new PT overnight. They think the horse may have bolted.

The analyst downgraded FY19 revenue by 7% just a few weeks out from the result, and expects the company to swing back into an EPS loss for the year. Revenue for the next two years was also revised lower by 2-6% a piece. To us, the valuation does look full however even if AfterPay miss at the result, I would expect to see a rally in the share price if they can talk up progress in international markets. We are bearish APT at current prices.

Afterpay (APT) Chart

Broker moves; Macquarie were active today around a few areas talking about ‘hidden growth’ stocks then went onto name mainly offshore earners & resources including Fortescue, CSL, Aristocrat

Leisure, Oil Search. Not sure what these stocks have been hiding behind – a glass door maybe!

They also turned more positive on A2 Milk after June de-rating on China’s plan while they cooled on Treasury Wine’s.

- Afterpay Downgraded to Neutral at Goldman; PT A$27.15

- Alumina Downgraded to Underperform at Macquarie; PT A$2

- Commonwealth Bank Downgraded to Sell at Citi

- Evolution Downgraded to Neutral at Macquarie; PT A$4.30

- Fortescue Upgraded to Buy at Renaissance Capital; PT A$9.90

- Galaxy Resources Cut to Underperform at Macquarie; PT A$1.20

- Gold Road Upgraded to Outperform at Macquarie; PT A$1.40

- Northern Star Downgraded to Neutral at Macquarie; PT A$11.60

- Orocobre Raised to Outperform at Macquarie; Price Target A$3.30

- Regis Resources Downgraded to Neutral at Macquarie; PT A$5.70

- Sandfire Downgraded to Neutral at Macquarie; PT A$7.10

- Saracen Mineral Downgraded to Neutral at Macquarie; PT A$3.80

- South32 Downgraded to Underperform at Macquarie

- St Barbara Upgraded to Neutral at Macquarie; PT A$3.10

OUR CALLS

No new calls today, we’re looking to ‘tweak’ the income portfolio tomorrow.

Major Movers Today – Domino's (DMP) caught my eye today as an aggressive technical buy.

Have a great night

James the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.