Westpac calls RBA cash rate to 0.5% by February (Z1P, ILU, RRL)

WHAT MATTERED TODAY

The market traded to a new 10 year high today buoyed by the prospect of lower interest rates as forecast by Westpac’s well regarded Chief Economist Bill Evans. He brought forward his forecast for the next cut to October from November -- saying by then the labor market will have deteriorated sufficiently from Reserve Bank estimates to prompt a move. He added another cut in February that would bring the cash rate to 0.5%.

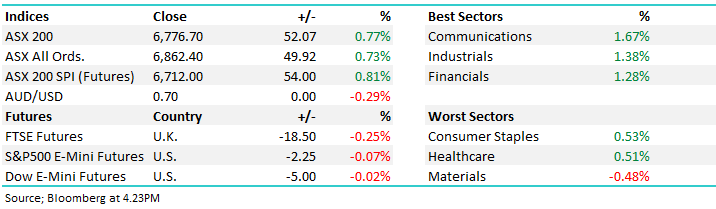

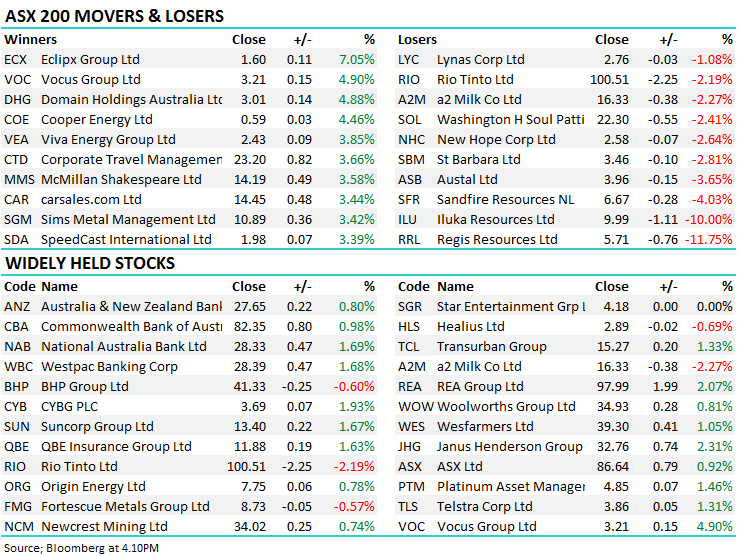

That was very supportive of the yield trade again today – the Telco’s led the charge however it was the financials led by Westpac & NAB that really caught my eye. NAB + 1.69% to close at $28.33 while WBC rallied 1.68% to close at $28.39. On the flipside, Iron Ore took a hit in China, Futures were trading down around 4% at our close however they were down more mid-afternoon. UBS was also out with a downbeat assessment saying Iron Ore will be $80 by year end…RIO closed down 2.19% at $100.50 & FMG lost 0.57% to $8.73.

Overall, the ASX 200 added +52pts today or +0.77% to 6776. Dow Futures are trading flat.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

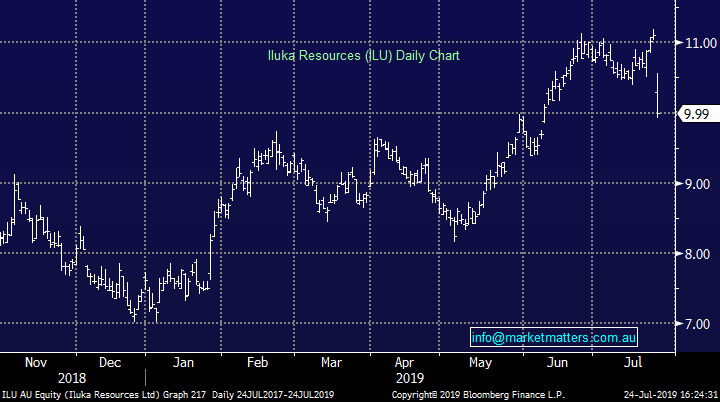

Iluka (ILU) -10%; the mineral sands miner slumped today on the company’s 2nd quarter production report which had investors worried about a soft half year report. Production across the bulk of the commodities came in well below last year’s level at the half year, with total mineral sands falling more than 20% yoy. Sales were even lower with the company struggling to move Zircon in particular, blaming “trade and geopolitical tensions.” Sales fell almost 25% for the half. Revenue managed a little better, with rising prices offsetting much of the fall in sales with revenue per tonne jumping more than 20% across the zircon & rutile products. Revenue still lagged 10% on the 1st half of 2018.

Iluka was on a bit of a run – and Market Matters was a beneficiary of part of the rally from January lows, taking a 20+% profit only a few weeks ago – carried higher by an improving market. Today’s report shows that better prices can only do so much. They were probably lucky to only be down 10% today, however we can also see why investors are somewhat supporting the stock given the tailwinds from the demand side. It hasn’t quite fallen back into buy territory for us, and given our general cautious market view we aren’t close to pulling the trigger here. MM likes ILU closer to $9.50

Iluka (ILU) Chart

Zip Co (Z1P) +9.12%: Reporting a strong quarterly update this morning and the stock rallied hard….The company now seems well on track to do $130m in revenues in FY20 which is up from $84m this year. A large step change and big growth for what is now a materially large alternative finance player in Australia, with a long growth runway.

Z1P Co (Z1P) Chart

Broker moves; Analysts were far from impressed with Regis Resources (RRL) 4th quarter update that hit yesterday morning. Four analysts dropped their rating, and more cut their target price on the gold miner despite what was at first look a decent report. The outlook statements worried the market, and the stock tracked lower in yesterday’s session after opening strongly higher. Regis is looking for a similar gold output but expects operational costs to rise at least 10%, squeezing margins. Not a great outcome, but Regis could head higher if gold continues the rally

- Austal Downgraded to Neutral at Citi; PT Set to A$4.04

- Regis Resources Downgraded to Sell at UBS; PT A$4.85

- Regis Resources Cut to Underperform at Macquarie; PT A$5.10

- Regis Resources Cut to Hold at Argonaut Securities; PT A$5.94

- Regis Resources Downgraded to Sell at Canaccord; PT A$4.70

- Transurban Reinstated at JPMorgan With Overweight; PT A$16.75

- Gold Road Cut to Sector Perform at RBC; Price Target A$1.20

- Senex Cut to Neutral at Credit Suisse; Price Target A$0.37

OUR CALLS

We’re sitting tight for now locally.

**Internationally**

Netflix (NFLX) $US307.30: MM will sell its NFLX either at $US315 or on stop below $US300.

MM is looking to exit NFLX.

Netflix (NFLX US) Chart

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence