ASX 200 closes just 25pts below all-time highs (HLS, CCP)

WHAT MATTERED TODAY

Reporting season is now upon us and this morning we had Credit Corp (CCP) out with full year results, the stock down -6.17% on the session highlighting the volatility that will likely play out over the coming month. Harry covers that result in more detail below, however from this Wednesday onwards (no major companies out tomorrow), I’ll be providing a quick take on reporting in a podcast each morning around 9.15am. The link will be included in the AM report each day (no podcast Monday’s) and will look at results as they drop, or the results expected for the day ahead. Below links to a quick promo.

**A new initiative this reporting season**

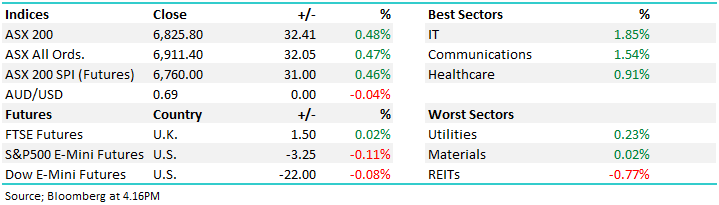

Another bullish day for stocks with the index closing at 6825 near the high of the session. The IT and Telco sectors were the strongest today, while the Real-Estate sector closed lower.

Overall, the ASX 200 added +32pts today or +0.48% to 6825. Dow Futures are trading down -22pts / -0.08%.

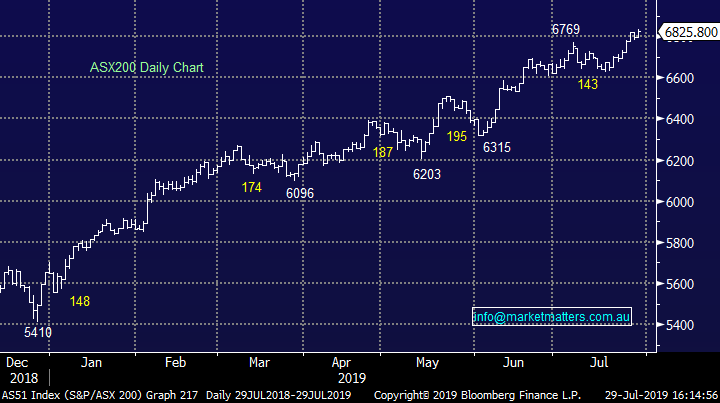

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Healius (HLS) +1.74%: Provided an operational update today reconfirming earnings expectations that are at the bottom of the previously guided range (underlying net profit of $93-$98m), but in-line with consensus expectations ($93.6) plus some management changes which included the departure of their very well regarded CFO, Mal Ashcroft and the CEO of their Pathology division Wes Lawrence - who had been with the company for 25 years.

This comes on the back of an AFR article last week which detailed around $30m worth of cost savings in the medical centre and pathology businesses. We held HLS for some time, looking for another bid from their Chinese suitor, which to date has proven elusive –we recently cut the position. Today’s announcement around earnings being at the lower end of prior guidance, plus the departure of two senior guys within the organisation provides some clarity in the near term but it speaks to the challenges being faced by the company. On 19x earnings the market is still pricing in a high chance for another takeover. All too hard for now.

Healius (HLS) Chart

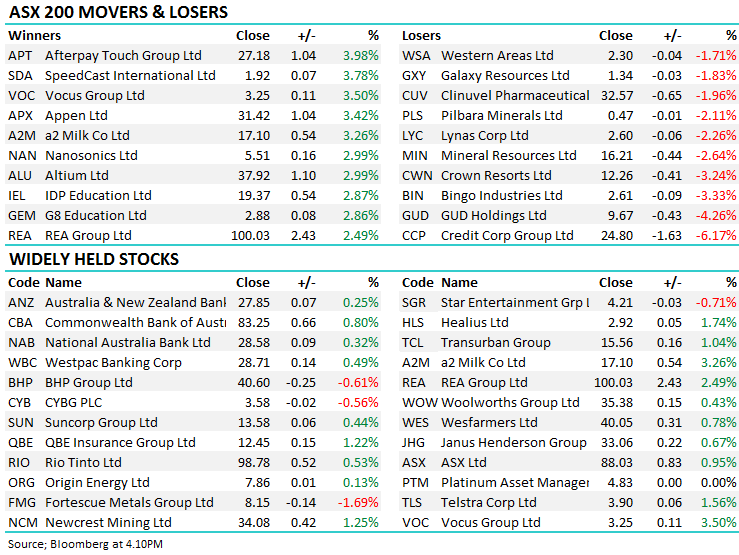

Credit Corp (CCP) -6.17%; the worst performer in the top 200 by some margin, Credit Corp slumped after announcing a full year profit that was in line with expectations but came with soft guidance. FY19 saw near record collections for the company, but there are signs appearing that the cycle is starting to peak. NPAT of $70.3m was up 9% on FY18, and came was marginally below expectations at $70.7m. The US has been the big driver for CCP in recent times. The company aims to have this segment equal the size of it’s Australian & New Zealand over the next few years.

The market’s issue with the result came with the guidance. CCP is looking for 10-12% growth at the NPAT line, which is around half the rate at which analysts were expecting, falling 10% short of the FY20 estimate of $83.5m. One for the traders, looks reasonable technically for a bounce to new highs.

Credit Corp (CCP) Chart

Broker moves;

- Bingo Industries Downgraded to Neutral at Goldman; PT A$2.80 -** Stock closed down -3.33% at $2.61

- ResMed GDRs Upgraded to Buy at Goldman; PT A$21.20

- ResMed Upgraded to Buy at UBS; PT $140

- GUD Holdings Downgraded to Neutral at Citi; PT A$11.02

- GUD Holdings Downgraded to Sell at UBS; PT A$9.50

- GUD Holdings Downgraded to Neutral at Macquarie; PT A$10.50

- NIB Downgraded to Underweight at Morgan Stanley; PT A$6

- Mineral Resources Downgraded to Hold at Morningstar

- Spark Infra Upgraded to Neutral at Credit Suisse; PT A$2.30

OUR CALLS

No changes today

Major Movers Today – Telco’s were well bid today, Vocus +3.5% and TLS +1.56% now at $3.90

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence