Earnings seasons sparks volatility – with more likely (GMA, ORI, BIN, ABC)

WHAT MATTERED TODAY

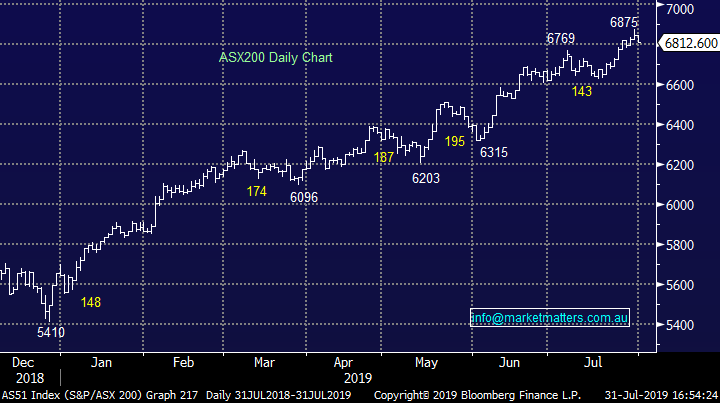

The first sign of selling today across the market with the ASX200 rejecting all-time highs and pulling back to close on the session lows. The shadow was cast by building materials company Adelaide Brighton (ABC) which had a painful 23% downgrade to earnings, finishing the day down 18%. That dragged down other related stocks and we saw the continuation of yesterdays “risk off tone”.

Gold stocks were again well bid today which has been the case for the entire month of July and with volatility now increasing “under the hood” into Augusts reporting season MM is still comfortable holding relatively high cash levels in our Growth Portfolio. For the month of July, all sectors finished up with the ASX 200 adding +2.93%. The more defensive areas of the Australian market gained did best, consumer staples up +9.72%, Health up +5.92% while the growth areas, Energy & Materials lagged.

As I said this morning, August is going to be a very busy month, reporting season and the APEX Postie ride. For those tracking our fundraising efforts, we’ve now raised $27,714 , a huge thankyou to all who have generously donated. For those that would still like to contribute, click here I’ll be providing updates throughout the ride.

Today was the first of our direct from the desk recordings specifically focussed on reporting. I also provided a quick update this afternoon – click the image below. Happy to hear feedback on this from subscribers.

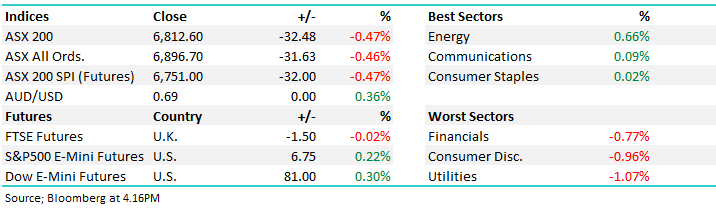

Overall, the ASX 200 lost -32pts today or -0.47% to 6812. Dow Futures are trading up 81pts / 0.30%.

ASX 200 Chart – grinded lower into the close

ASX 200 Chart

CATCHING OUR EYE;

Economic Data: On the economic front today, Chinese manufacturing data was a touch stronger than expected while domestic inflation was roughly inline. The AUD finished the session slightly higher.

Source: Bloomberg

Volatility begins to bubble: Some big moves across the market today as reporting seasons heats up. On the negative side, the downgrade from Adelaide Brighton (ABC) cast a shadow over most stocks with exposure to residential construction. ABC the worst down -18.06%, more on that below, however we also saw CSR off by -6.28%, Boral (BLD) down -8.02% and Bingo Industries (BIN) down another 3.98%.

Overnight big cement producer Heidelberg Cement reported and while their numbers were fine overall, they did call out weakness in Australian cement demand due to delayed infrastructure projects and softness in residential construction. Adding more ammunition to the housing bears was the reported collapse today of one of the country's biggest private developers - Ralan Group who have appointed Grant Thornton as voluntary administrators.

The AFR writes Ralan Group's pipeline of projects includes the $1.4 billion four-tower Ruby project on the Gold Coast with 1600 apartments and another big project in Arncliffe in Sydney's southern suburbs. While the exact reasons behind the collapse of Ralan are not yet clear, The Australian Financial Review reported in November that some buyers of apartments in its Ruby project had run into funding problems following a decline in valuation of up to 30 per cent for some apartments.

Bingo (BIN) Chart – stock back to $2.40 support. We still see risk ahead of their 21st August results.

Genworth (GMA) +14.92%: A stock we hold in the Income Portfolio rallied strongly today after reporting 1H19 results this morning. Overall written premiums were down substantially which was no surprise and the lower written premiums mean more excess capital available for share buy-backs along with special dividends. To that end, GMA this morning announced a big 21.9cps special dividend (unfranked) in addition to their 9cps fully franked ordinary dividend. This takes total yield for the 12 months to over 15% inclusive of franking credits. With 6% / 25m shares short sold in GMA, we could see short covering play out from here.

MM remains bullish GMA for income.

Genworth (GMA) Chart

Orica +3.41%: The explosives business has rallied hard for a second day, taking the 2 day move to +6.4% following an optimistic investor day. ORI were talking up the fruits of their technology investments over the last few years and that’s got the market excited. Technically, the stock has broken out and momentum is strong.

MM remains bullish targeting new highs ~$23.

Orica (ORI) Chart

Adelaide Brighton (ABC) – 18.06%: This morning building materials company Adelaide Brighton (ABC) downgraded full year profit expectations by around 23% relative to market expectations. ABC are a December year end, and they now think that underlying net profit after tax will be in the range of $120-130m. Market expectations were for $164m implying a 23% downgrade to the mid-point of new guidance range. They say this is a consequence of a softening residential housing market along with competitive pressures in QLD and SA. They also said no dividend will be paid for the first half which is prudent. On the new guidance the stock is now trading on around 18x which is expensive. With no yield, it’s hard to get excited about ABC and for that reason we’re not adding to our relatively small 3% holding in the Growth Portfolio, although we’re not cutting it either at this point.

MM is now neutral ABC, retaining our small 3% position for now.

Adelaide Brighton (ABC) Chart

Broker moves;

- Auckland Airport Cut to Neutral at Citi; Price Target NZ$9.40

- Auckland Airport Cut to Underweight at Morgan Stanley

- Resolute Mining Downgraded to Sell at Baillieu Ltd; PT A$1.53

- Resolute Mining Downgraded to Neutral at Goldman; PT A$1.70

- Resolute Mining Cut to Hold at Canaccord; Price Target A$1.90

- Premier Investments Cut to Neutral at Macquarie; PT A$17.20

- Northern Star Downgraded to Underperform at Macquarie; PT A$11

- Northern Star Downgraded to Hold at Canaccord; PT A$11.90

- AGL Energy Downgraded to Underperform at Macquarie; PT A$19.50

- Redbubble Upgraded to Buy at Canaccord; PT A$2

- Redbubble Upgraded to Hold at Morgans Financial; PT A$1.51

- CSL Downgraded to Sell at Morningstar

- Ramelius Upgraded to Outperform at RBC; PT A$1.10

- CYBG GDRs Downgraded to Hold at Bell Potter; PT A$3.90

- Flight Centre Downgraded to Neutral at JPMorgan; PT A$50 – stock hit on the back of this downgrade

- Silver Lake Downgraded to Sector Perform at RBC; PT A$1

- Suncorp Downgraded to Hold at Bell Potter; Price Target A$14.50

OUR CALLS

We are holding fire for now on overseas positons. Apple (APPL US) reported strong quarterly numbers overnight and should open up around 3% higher this evening.

Major Movers Today – CYB hit hard after reporting weak earnings overnight, Nickel stocks down as well. CYB results review available here

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.