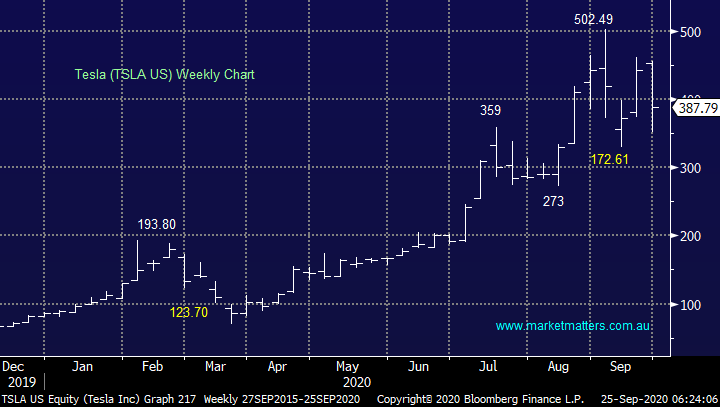

Teslas “Battery Day” was both interesting & insightful for investors (NCM, TSLA US)

The ASX200 again fell afoul of a weak US market on Thursday after the Fed gave investors an economic reality check but importantly not a change in policy direction. If anything, we felt it was confirmation that more stimulus is required and will eventually be forthcoming although there’s a little bit of politics to be resolved first. Earlier this week we had much lauded Westpac economist Bill Evans predict the RBA will cut interest rates to 0.1% next month and now the Fed Chair has made it clear he believes more stimulus is required for the COVID ravaged US economy to get back on its feet. We have 2 takeout’s which might make it sound like were looking at equities through rose colour glasses but remember only a few weeks ago MM did say the most likely short-term path for stocks was a 5-10% correction.

1 – The RBA have implied strongly they will use further monetary stimulus if / when required to further support the Australian economy, the post JobKeeper period is clearly the initial hurdle.

2 – The Fed have said the US economy needs its next “fix” of budgetary stimulus which also by definition implies they will unleash further QE if / when required.

MM continues to believe bond yields are “looking for a low” but 40-year old bear markets don’t just roll over and die, it could easily take 1-2 years before we see Australian 10-years back at 2% - great news for equity valuations.

Australian 10-year Bond Yields Chart

The local index remains range bound between 5700 and 6200, we are net bullish at current levels but many a thought has been wasted attempting to guess when the ASX200 will break its almost 4-month old trading range, at MM we will just let the tape do the talking while remaining focused on the aggressive stock / sector rotation unfolding beneath the hood.

MM remains bullish the ASX200 short-term.

ASX200 Index Chart

In yesterday’s report we considered tweaking our banking exposure lower to increase our position in Newcrest Mining (NCM), or another gold stock. However the manner in which the Banking Sector absorbed Westpac’s (WBC) enormous fine from AUSTRAC yesterday made us feel there was now more upside for the sector with the bad news out in the open hence we may look to finance any purchase through cash although we are cognisant of our almost “all-in” stance around current levels.

MM is bullish NCM at current levels.

Newcrest Mining (NCM) Chart

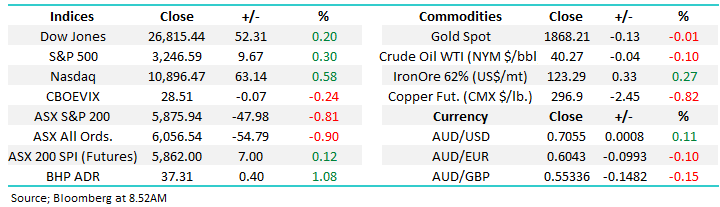

Overseas Indices & markets

Overnight US stocks closed marginally higher in a “choppy session” which makes us comfortable with our view that stocks are looking for a low after the S&P500 has corrected -10.6%. The earlier downside momentum has slowly been abating and a period of market accumulation above the 3200 area is our preferred scenario.

MM still believes that US stocks are “looking for a low” as markets head into October but we do anticipate ongoing high levels of volatility in Q4 which is no great surprise with Novembers election starting to form a cloud of uncertainty on the horizon.

US S&P500 Index Chart

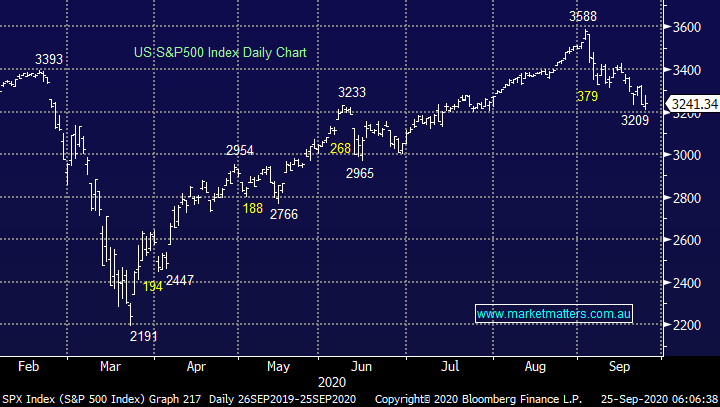

Previous comments from the Fed have given the $US a leg up into its targeted 94-94.5 resistance area, if we are correct the recent gains should fairly soon be reversed which implies a couple of important factors for stocks:

1 – Precious metals and other commodities should be close to rallying strongly – yesterday MM averaged our Silver position via the (ETPMAG) which should at least bounce strongly this morning.

2 – A weak $US has largely been supportive of US equities which coincides with our bullish outlook into October.

MM remains bearish the $US into Christmas.

$US Index Chart

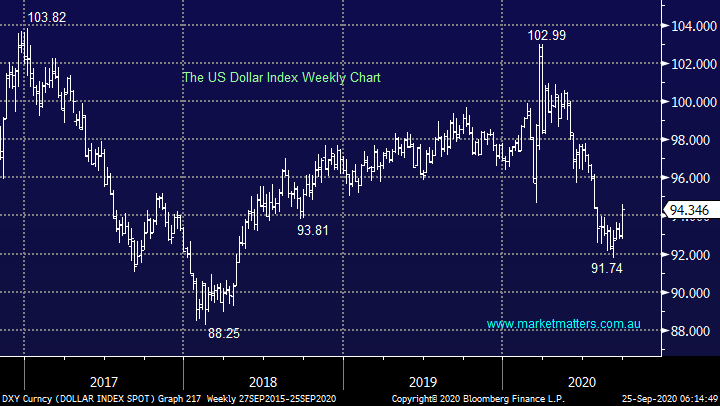

Elon Musk & Teslas “Battery Day” from a stock’s perspective.

Tesla is a regular topic of conversation whether it’s with regard to cars, battery power, its skyrocketing share price / valuation or just interesting “futuristic stuff” in general. This has been another classic example that investors should be prepared to both avoid sectors / stocks when they get too hot and also being prepared to take at least some profit in such scenarios. I think we can add to Tesla to the likes of the ASX’s BNPL sector and Fortescue (FMG) both of which have corrected over 20% in rapid fashion. We’re certainly guilty of not taking profit in our Z1P position when it was on offer.

The technical picture suggests the optimum entry into Tesla from a risk / reward perspective is around the $US300 area but we’re bullish equities from current levels so it’s tempting right here, right now!

MM is keen on TSLA under $US400 as an aggressive “tech play”.

Tesla (TSLA US) Chart

Moving onto the focal point of today’s report – Tesla’s insightful Battery Day which was held earlier this week. No great surprise that they believe that there are 3 parts to the future of energy - Sustainable energy generation, energy storage and electric vehicles and Tesla intends to play a meaningful role in all 3 although of course there will be numerous opportunities across the spectrum for other companies.

The company’s Annual Battery day was titled “accelerating to sustainable energy” from which 3 observations were made by one of our analysts at Shaw who reviewed the day:

1 – There hasn’t been any significant change in approach to battery technology or commodity inputs at the cathode.

Today’s Battery Day was being hyped as the silver bullet for battery technology however throughout the presentation, the company highlighted the level of complexity to incrementally improve battery cost and performance. The company proposed a complex five-step vertically integrated approach which looking at the share price reaction of TSLA disappointed many. There was no breakthrough to eliminate cobalt from the cathode (yet)!

2 – Tesla is attacking the energy transition problem in 5 vertically integrated steps – cell design, cell factory, anode, cathode and vehicle integration.

The main point which caught my attention here was the attempt to use silicon instead of graphite, makes sense as it’s literally everywhere! Also, nickel is moving to the fore as Tesla have told global mining companies “there’s a requirement for more nickel investment” – a great longer term read through for Western Areas (WSA) and Independence Group (IGO).

Interestingly the company is considering a 3-tiered approach of batteries for different applications:

(1) – Iron based batteries for small range batteries and stationary storage potentially in all of our homes.

(2) – Nickel & manganese for intermediate range where ~65% will be nickel.

(3) – High nickel content for long range such as trucks. Tesla is working on high nickel cathode development but at this stage has not quite overcome the technical challenges of a no cobalt battery. (they don’t like cobalt given it mainly comes from the Congo, however cobalt is important to stabilise batteries).

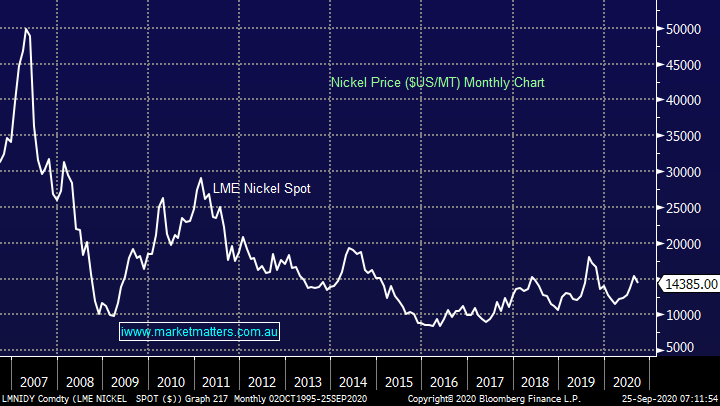

The nickel price remains well below its GFC levels and it certainly hasn’t got all caught up in the hype of electric vehicles (EV’s) and battery power as lithium did before it came crashing down to earth as production / development was incentive by high prices.

MM is keen on nickel & resources moving forward.

Nickel ($US/MT) Chart

While we are on the “cold subject” of lithium its interesting to see that local player Orocobre (ORE) has failed to embrace the more global recovery in the sector although a recent capital raise clearly didn’t help. For the aggressive believers in lithium we feel ORE has at least 30% upside from current levels but its not one for us at this stage.

Global lithium ETF v Orocobre (ORE) Chart

3 – The timing of the energy transition is going to be over 30-years.

Teslas reiterating the scale of the electrification challenge for the globe is immense, as we said previously logic didn’t help its shares on the day - it will take a long time for the world to electrify with global battery cell production capacity the key bottleneck in the transition. The company believes we need 20-25 years of battery manufacturing to completely transition the world to renewables. The read-through is Tesla expects the energy transition will take 30+ years to play out, comprised of 5-10 years to add battery infrastructure and become cost competitive, and 20+ years of steady-state manufacturing.

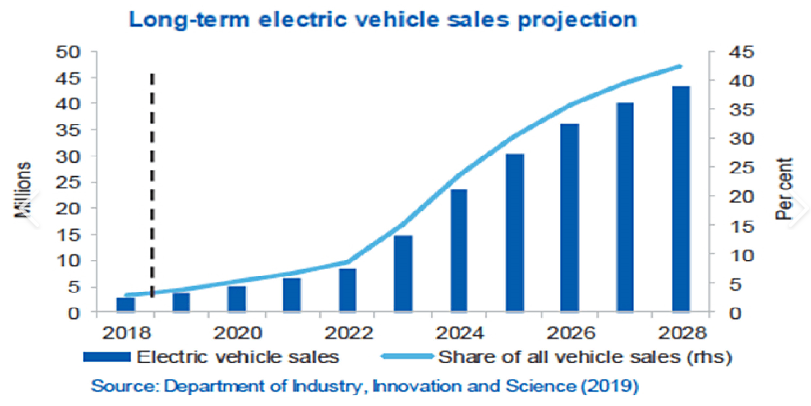

I would imagine very sobering numbers to many readers who thought the current acceleration in Teslas on the road would see an almost complete transition in around 5-years, I know it was my initial feel. To quantify1 – Tesla believes it will take around 15-years for all vehicles to become electric once the battery manufacturing infrastructure is complete.

2 – They also believe it’s a 20-25-year process to replace fossil fuels and make the global electric grid 100% renewable.

However, we must be mindful that Elon Musk is both a visionary and an optimist, however car sales look set to explode in 2-3 years as affordability looks set to create massive demand. If China continues to embrace EV’s at their current rate and affordability does improve in the next few years he may just be bang on the money.

EV sales projection this decade Chart

Conclusion

No changes to our view on energy but it does reinforce our belief in the reflation trade over the coming years.

1 – MM remains bullish the energy space given the amount of re-investment required to keep pace with long-term oil and gas demand hence our position in Beach Petroleum (BPT) & BHP Group (BHP) in the Growth Portfolio.

2 – MM is also positive stocks exposed to the long-term battery metal and electrification thematic such as Western Areas (WSA), Independence Group (IGO) and OZL Minerals (OZL).

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.