Macquarie taps the market for $1 billion (APX, APT, ABC, OZL, BAL)

WHAT MATTERED TODAY

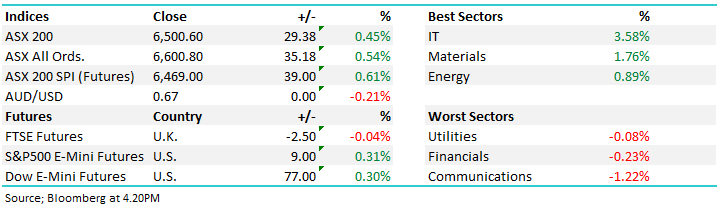

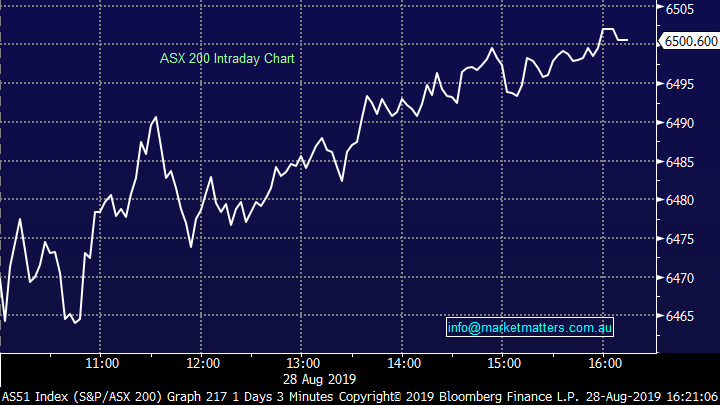

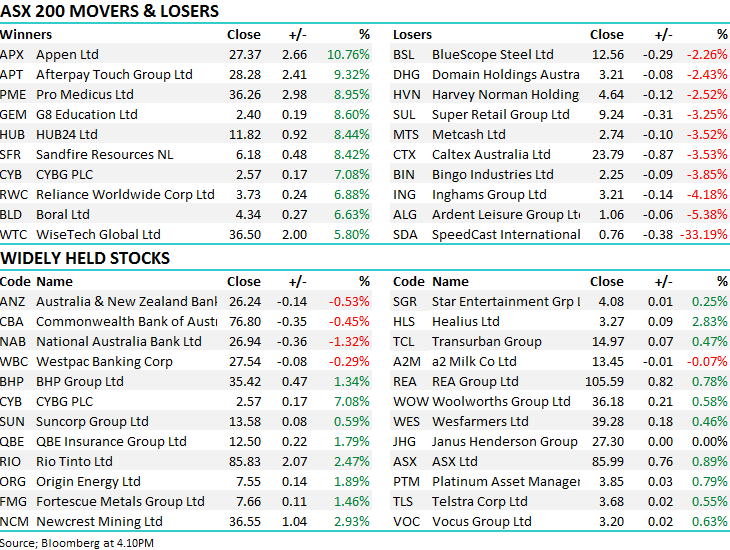

A good session for local stocks today with buyers getting back into the groove with the ‘risk on’ sectors doing best.IT stocks once again top of the charts following a good result from Afterpay (APT) + we’ve seen strong buying in the likes of Appen +10.76% ahead of their result tomorrow – more on that below. Material stocks were also strong today led by Rio Tinto (RIO) +2.47% & Oz Minerals (OZL) which put on an impressive +5.72%. Communications were down, however TLS trading ex-dividend the main cause.

Macquarie (MQG) / Trading Halt was out this morning announcing a surprise $1bn capital raise through an institutional placement and share purchase plan (SPP), the bulk of the funds used for an increase in regulatory capital. It’s a big placement, about 2.5% of the company which sapped some liquidity from the market this morning, especially from the banks. They also re-confirmed full year guidance for their FY20 result to be slightly down on FY19, no surprises there. The placement price was originally reported at $118, a 4.46% discount to yesterday’s close however due to demand, they covered it at $120, a discount of -2.84%.

Overall, the ASX 200 added +29pts today or +0.45% to 6500. Dow Futures are now trading up +77pts /+0.30%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks today: The table below looks at the share price performance of those companies that reported today. A quieter day on the reporting front only a handful of companies out with results…More tomorrow.

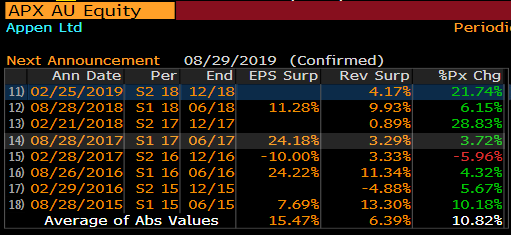

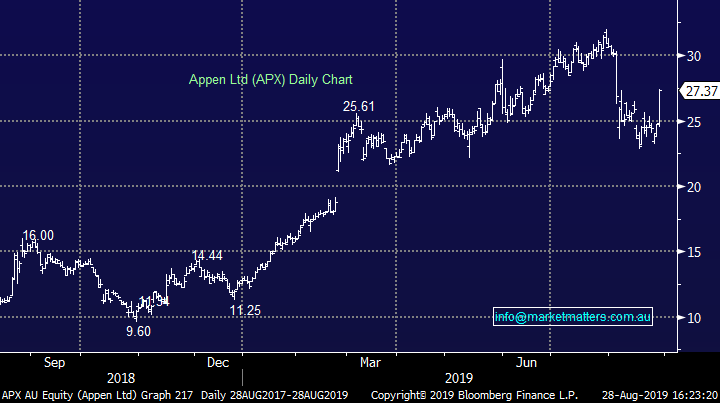

Reporting tomorrow: A big end to the reporting season tomorrow with some interesting companies out with results. Ausdrill (ASL), Appen (APX), Independence Group (IGO), Link (LNK), Ramsay Healthcare (RHC) & Woolworths (WOW) out with results. Appen (APX) was up +10.76% today ahead of their numbers tomorrow pricing in a beat to expectations....the reason is obvious when looking below. The average SP change on the day they report is +10.82% based on an average revenue beat of +6.39% & Earnings Per Share (EPS) surprise of +15.47%. Clearly some of that being built in today - they’ll need to deliver.

APX price changes on day of the result…

Source; Bloomberg

Appen (APX) Chart

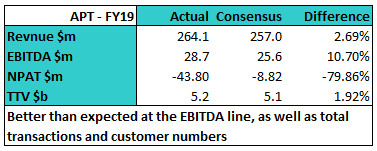

Afterpay (APT) +9.32%; the BNPL market darling took a while to get going today but buyers slowly emerged to send the stock strongly higher as the session went on. The full year report out this morning was another cracking result for Afterpay which has been adding an impressive 12,000+ customers a day on average, taking the total transaction volume more than double FY18 at $5.2b. The push into the UK and the US is going to plan, with the bulk of new merchant partners being added overseas.

From a financials perspective, Afterpay saw its loss blow out in the year, however the market has little concern here for now as the company continues to invest heavily in its global expansion plans. Co-founder Nick Molnar flagged pans to increase the maximum purchases sizes available to customers in time for Christmas trading potentially adding another boost to Afterpay’s growth.

Another standout result for Afterpay, but it is yet to spin a profit. Technical resistance around $29 is being tested again.

Afterpay (APT) Chart

Adelaide Brighton (ABC) +0.96%; Adelaide Brighton (ABC) released FY19 results (which were due tomorrow), however no surprises here given they released updated guidance at the end of July expecting full year underlying NPAT, excluding property to be in the range of $120 - $130m. As discussed in an update yesterday, we are looking to cut this position however reasonable buying yesterday and again from the lows today has us holding fire for now, looking to cut into further strength if it prevails.

Adelaide Brighton (ABC) Chart

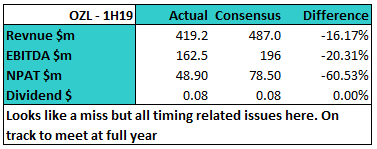

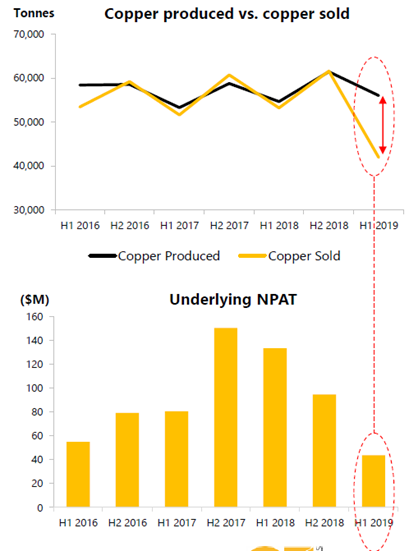

Oz Minerals (OZL) +5.72%; On first glance Oz looked a long way behind at the half year result today, posting NPAT of just $48.9m compared to full year expectations at $185.7m however the stock managed to rally on a decent look through to the 2nd half. Production, as had already been released, was in line for the half, however there was a sizable uncharacteristic difference between copper produced and sold. The company noted that this excess production, and the bulk of 2nd half production, has been committed which will bridge the gap to full year expectations. Gold production, as well as cost guidance remained unchanged and this was enough for the market to support the stock today.

A good chart here in the presentation pack which helps to explain the numbers missing expectations above…production was good, just a lag in sales + also worth noting, OZL typically have a 40/60 second half skew.

Oz Minerals (OZL) Chart

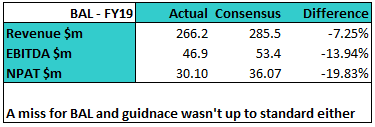

Bellamys (BAL) -1.37%; the infant formula brand managed to claw its way back from some savage selling in the morning which sent the stock down -14.5% at its worst. The company missed expectation’s across the board, blaming lower birth rate in China and increasing competition for the miss. The company’s guidance is chasing 10-15% revenue growth, on a similar EBITDA margin. Based on these numbers, guidance is an 12% miss at revenue and a 32% miss at the EBITDA line. The company also pushed its medium term revenue target of $500m out passed FY21 – the market didn’t believe this was possible anyways with this target priced in for FY23 currently. Unlike Appen, Bellamys is known for missing at results, which probably explains why he stock held up so well given the poor performance.

Bellamys (BAL) Chart

Broker moves;

- NZME Upgraded to Neutral at Jarden Securities; PT NZ$0.50

- Boral Upgraded to Buy at UBS; PT A$5.20

- Wesfarmers Upgraded to Neutral at UBS; PT A$37

- Inghams Upgraded to Neutral at Citi; PT A$3.40

- Inghams Upgraded to Neutral at Evans & Partners; PT A$3.42

- Caltex Australia Downgraded to Neutral at Macquarie; PT A$24.78

- Caltex Australia Upgraded to Overweight at JPMorgan; PT A$27

- Caltex Australia Cut to Neutral at Credit Suisse; PT A$26.85

- Sandfire Raised to Outperform at Macquarie; Price Target A$6.70

- Sandfire Upgraded to Buy at Bell Potter; PT A$6.47

- Sandfire Upgraded to Outperform at Credit Suisse; PT A$6.75

- SG Fleet Downgraded to Neutral at Macquarie; PT A$2.92

- SpeedCast Downgraded to Hold at Canaccord; PT A$1.31

- G8 Education Upgraded to Hold at Wilsons; PT A$2.37

- G8 Education Cut to Equal-weight at Morgan Stanley; PT A$2.50

- Qantas Downgraded to Sell at Morningstar

- Austin Engineering Raised to Buy at Argonaut Securities

- Opthea Rated New Buy at Goldman; PT A$4.90

- SRG Global Ltd Upgraded to Buy at Argonaut Securities; PT A$0.55

- Shaver Shop Upgraded to Buy at Shaw and Partners; PT A$0.75

OUR CALLS

No amendments today….we’ve held off selling ORE + ABC at this stage while we haven’t yet trimmed Costa Group (CGC) which we alluded to. CGC put on +5% today while Emeco (EHL) also had a decent session adding +5%.

We’re wanting to increase exposure in both the Overseas Equities & ETF portfolio’s, however patience remains our preferred course of action – boring I know.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.