Market grinds higher on final day of reporting (APX, NXT, WOW)

WHAT MATTERED TODAY

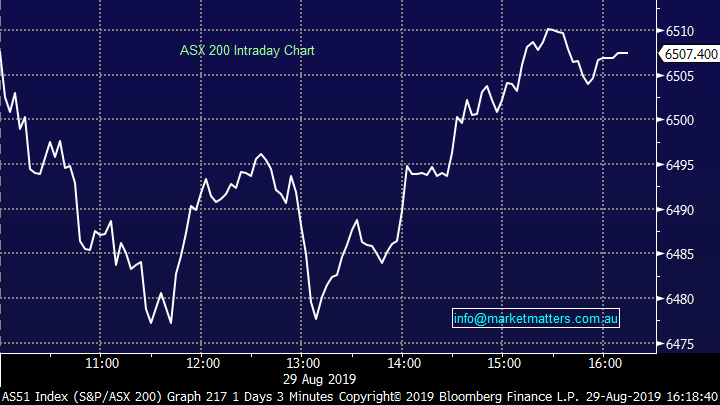

Today marks the final day of the local reporting season and it’s been a challenging one for investors. Beats have been slightly ahead of misses on FY19 numbers however outlook statements have been weak prompting substantially more downgrades to expectations for the year ahead. Offsetting to some degree has been the continued slide in bond yields, both in Australia and globally – today local yields are once again plumbing new lows courtesy of another contraction in business investment for the June quarter which printed -0.5% - its second successive quarter of negative growth in Australian CAPEX. The AUD traded down to 67.23c

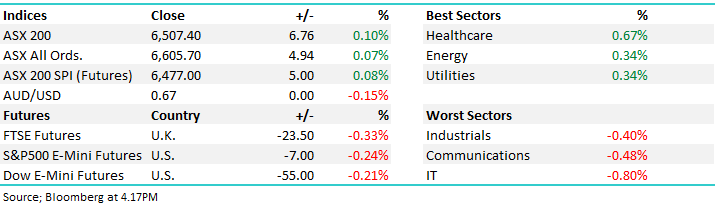

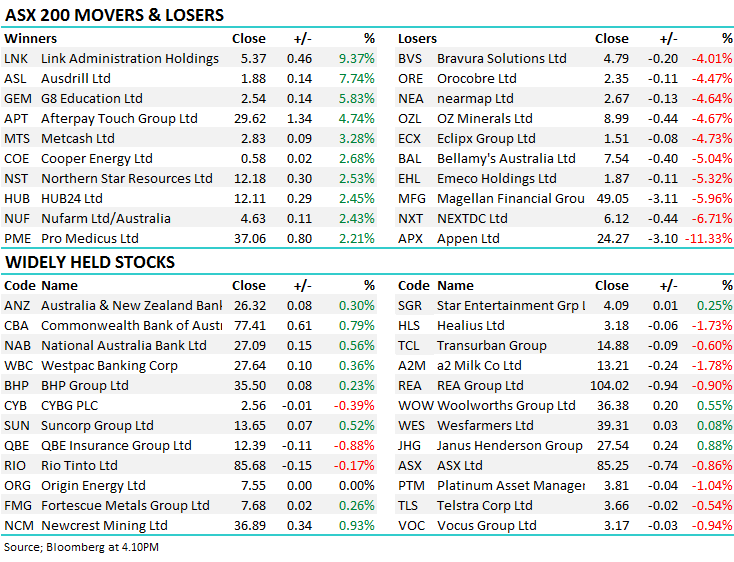

On the market today, the ASX 200 was weaker early before a good recovery from around 1pm onwards – the index closed near session highs, the Healthcare sector was strong followed by Energy for a second consecutive day while the It stocks were dragged lower by Appen – more on that below.

Overall, the ASX 200 added +6pts today or +0.10% to 6507, a fairly muted session although it was +32pts from the session lows. Dow Futures are trading down -43pts /-0.17%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks today: The table below looks at the share price performance of those companies that reported today. The final day of reporting now wrapped up.

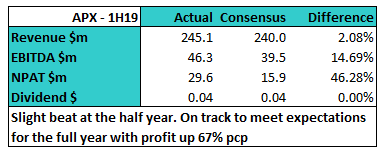

Appen (APX) -11.33%: We touched on this yesterday RE the markets positioning ahead of their result this morning. A stock that generally beats today met expectations, however it’s a good lesson in how the mkt was positioned ahead of the result. A +10% rally yesterday saw a raft of profit taking this morning, the stock higher on open before sellers took to it, closing 19% from the days early high of $29.98 – shows how market positioning plays a big part. The result was actually strong, met expectations with guidance upgraded to be at the top end of the prior guided range, however it wasn’t an upgrade, and the market was positioned for one.

Appen (APX) Chart

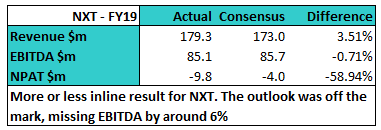

NextDC (NXT) -6.71%; the data centre operator posted a reasonable full year result today, marginally missing at the EBITDA line however the stock was sold off given the guidance at $100m-$105m in FY20, a 6% miss to consensus. Revenue was up 15% for the year, dropping down to a 13% EBITDA rise. The company continues to invest in growth with plenty of capital on the balance sheet supporting this. Demand for data centres continues to build momentum and we think the outlook is conservative at this early stage. We like NXT sub $6.

NextDC (NXT) Chart

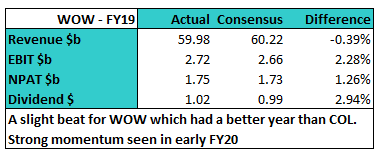

Woolworths (WOW) +0.55%; had the ascendency over Coles this year, and it showed in the full year result. Woolies beat at the full year, and commentary suggests that the momentum has continued for the first few weeks of FY20. LFL sales in the second half at 3.6% was better than expected with many in the market pricing in the Coles Little Shop round 2 benefit - earnings drag from Big W was also less than many anticipated with the discount department store doing ~7% LFL sales which is a positive and now showing a path to positive earnings.

The stock up smalls today, however given its run of late it did well to post a gain. We aren’t keen on WOW as the competition in the supermarket space is set to pick up, although concede we’ve missed the rally to date.

Woolworths (WOW) Chart

Broker moves;

· Perseus Downgraded to Neutral at Citi; PT A$0.90

· F&P Healthcare Upgraded to Neutral at Macquarie; PT NZ$16.61

· Nanosonics Downgraded to Sell at Wilsons; PT A$3.87

· Ainsworth Game Upgraded to Hold at Wilsons; PT A$0.79

· Sandfire Downgraded to Hold at Morningstar

· Healius Downgraded to Hold at Morningstar

· OZ Minerals Upgraded to Neutral at Credit Suisse; PT A$9.50

· Virgin Australia Cut to Underperform at Credit Suisse; PT A$0.1

· Macquarie Group Upgraded to Overweight at JPMorgan; PT A$133

· National Storage REIT Cut to Neutral at JPMorgan; PT A$1.85

· James Hardie GDRs Rated New Underperform at RBC; PT A$19

· Wesfarmers Downgraded to Sell at Shaw and Partners; PT A$34

· Aveo Downgraded to Neutral at JPMorgan; Price Target A$2.15

· CML Group Downgraded to Hold at Blue Ocean; PT A$0.45

OUR CALLS

No changes today – we’re still in a holding pattern for our overseas portfolio while we remain close to exiting a few of the underperformers in the Growth Portfolio.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.